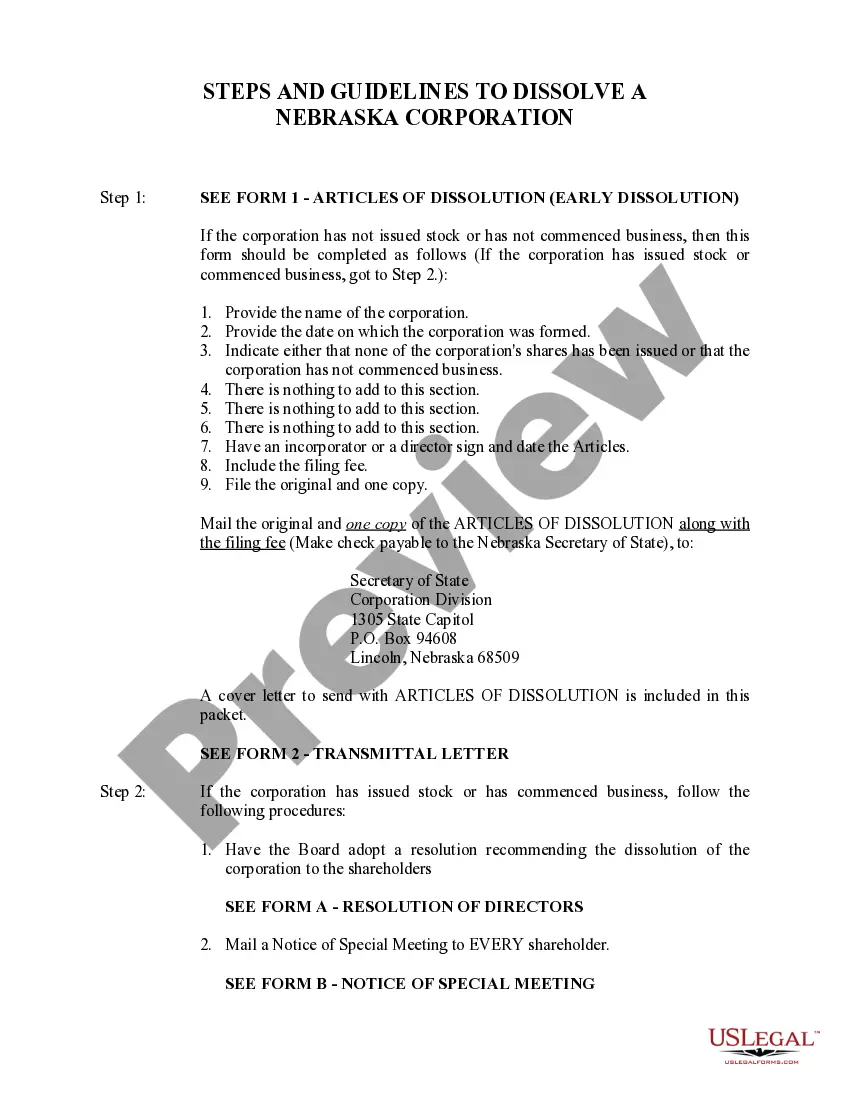

The dissolution of a corporation package contains all forms to dissolve a corporation in Nebraska, step by step instructions, addresses, transmittal letters, and other information.

Nebraska Dissolution Package to Dissolve Corporation

Description Nebraska Dissolve File

How to fill out Ne Dissolution Dissolve?

Avoid costly attorneys and find the Nebraska Dissolution Package to Dissolve Corporation you need at a affordable price on the US Legal Forms website. Use our simple groups functionality to look for and download legal and tax documents. Go through their descriptions and preview them just before downloading. In addition, US Legal Forms provides customers with step-by-step instructions on how to download and complete every single form.

US Legal Forms clients merely need to log in and obtain the particular form they need to their My Forms tab. Those, who have not obtained a subscription yet should stick to the guidelines below:

- Make sure the Nebraska Dissolution Package to Dissolve Corporation is eligible for use in your state.

- If available, look through the description and use the Preview option just before downloading the templates.

- If you’re sure the template meets your needs, click on Buy Now.

- In case the form is wrong, use the search field to get the right one.

- Next, create your account and choose a subscription plan.

- Pay out by credit card or PayPal.

- Choose to download the form in PDF or DOCX.

- Just click Download and find your form in the My Forms tab. Feel free to save the form to your gadget or print it out.

Right after downloading, it is possible to fill out the Nebraska Dissolution Package to Dissolve Corporation manually or with the help of an editing software program. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Nebraska Dissolution Corporation Form popularity

Articles Of Dissolution Nebraska Other Form Names

Ne Dissolve Corporation FAQ

If the company has ceased trading and is closed owing money and your debt is with that company then your liability ends with that company.

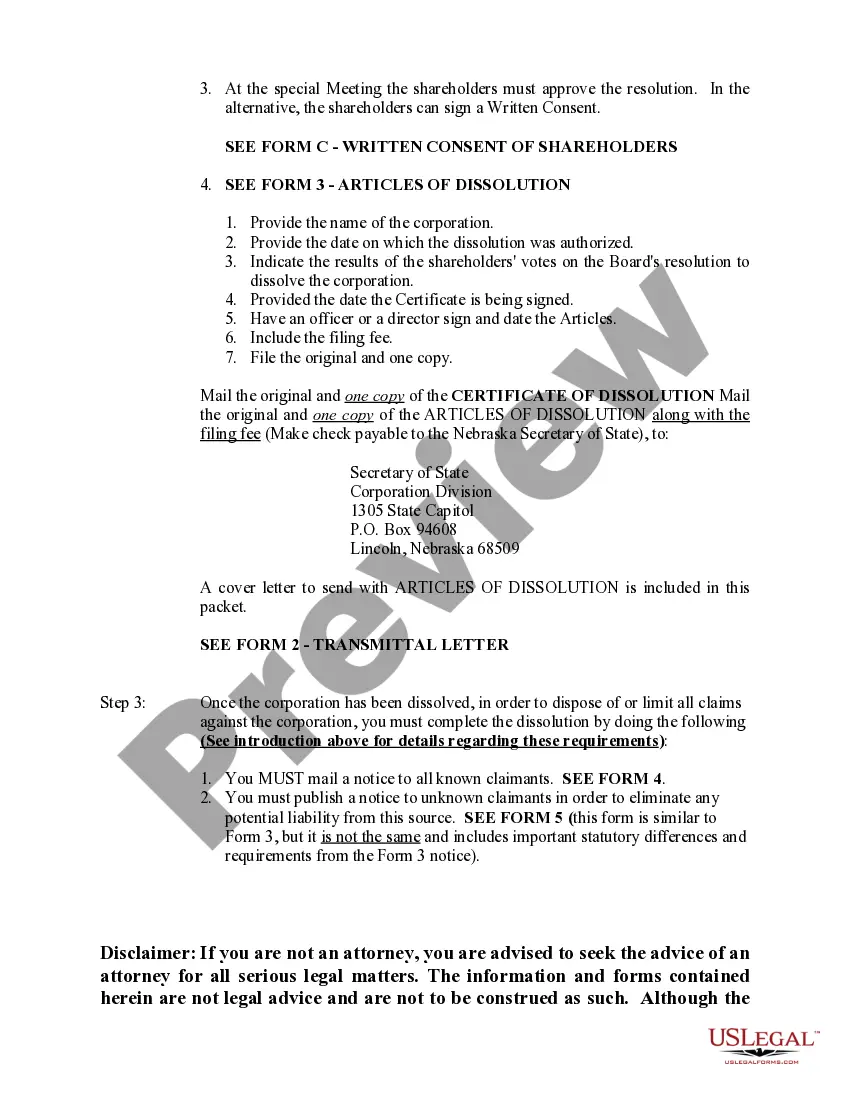

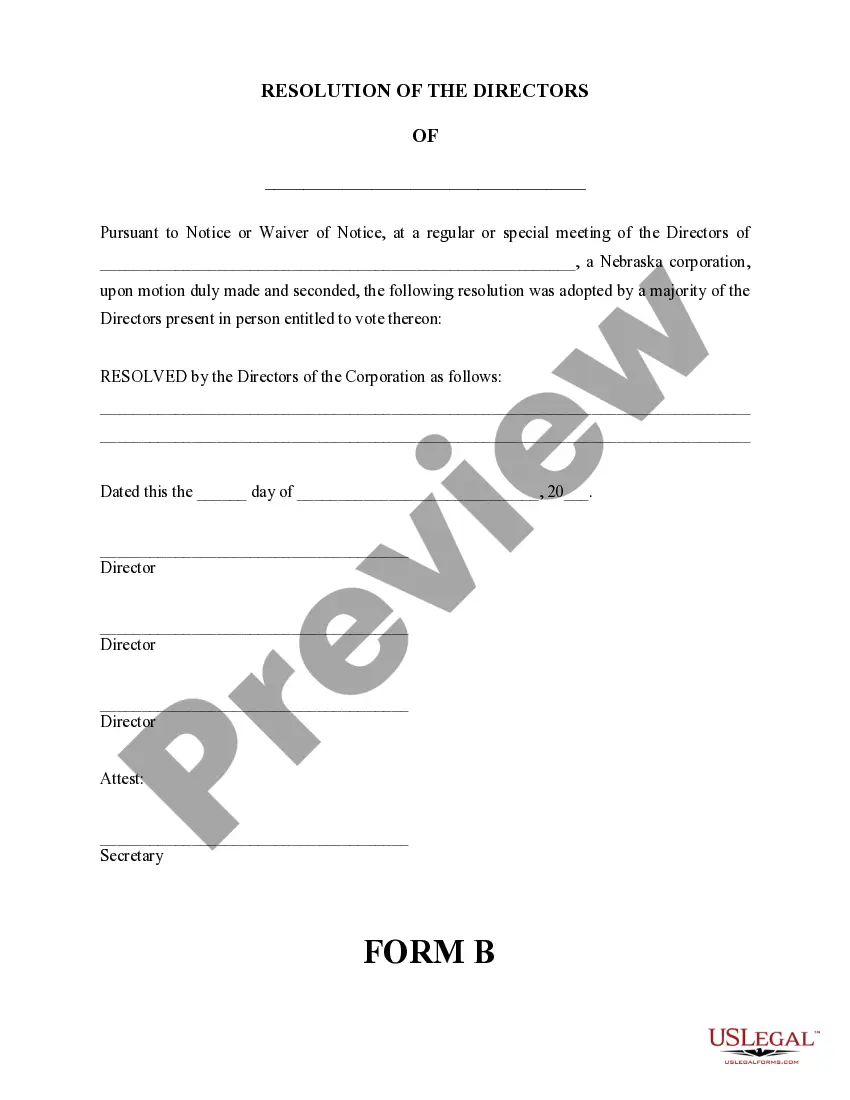

Hold a Directors meeting and record a resolution to Dissolve the Nebraska Corporation. Hold a Shareholder meeting to approve Dissolution of the Nebraska Corporation. File all required Biennial Reports with the Nebraska Secretary of State.

In legal terms, when a company is dissolved, it ceases to exist. It cannot still be trading - although a person may trade (misleadingly) using its name.

After a company is dissolved, it must liquidate its assets. Liquidation refers to the process of sale or auction of the company's non-cash assets.Assets used as security for loans must be given to the bank or creditor that extended the loan, or you must pay off the loan before selling such assets.

Definition. The ending of a corporation, either voluntarily by filing a notice of dissolution with the Secretary of State or as ordered by a court after a vote of the shareholders, or involuntarily through government action as a result of failure to pay taxes.

After dissolution, you cannot use the funds remaining in your business bank account for new business. LLC members no longer have the authority to conduct business or do anything that would indicate that the LLC is still active. Your bank account can cover only essential winding up affairs.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

When a corporation is dissolved, it no longer legally exists and, in most cases, its debts disappear as well. State laws usually give additional time beyond the dissolution for creditors to file suits for failure to pay any corporate debts or for the wrongful distribution of corporate assets.

Failing to dissolve the corporation allows third parties to continue to sue the corporation as if it is still in operation. A judgment might mean that shareholders use the money received from distributed assets when the corporation closed down to satisfy judgments against the corporation.