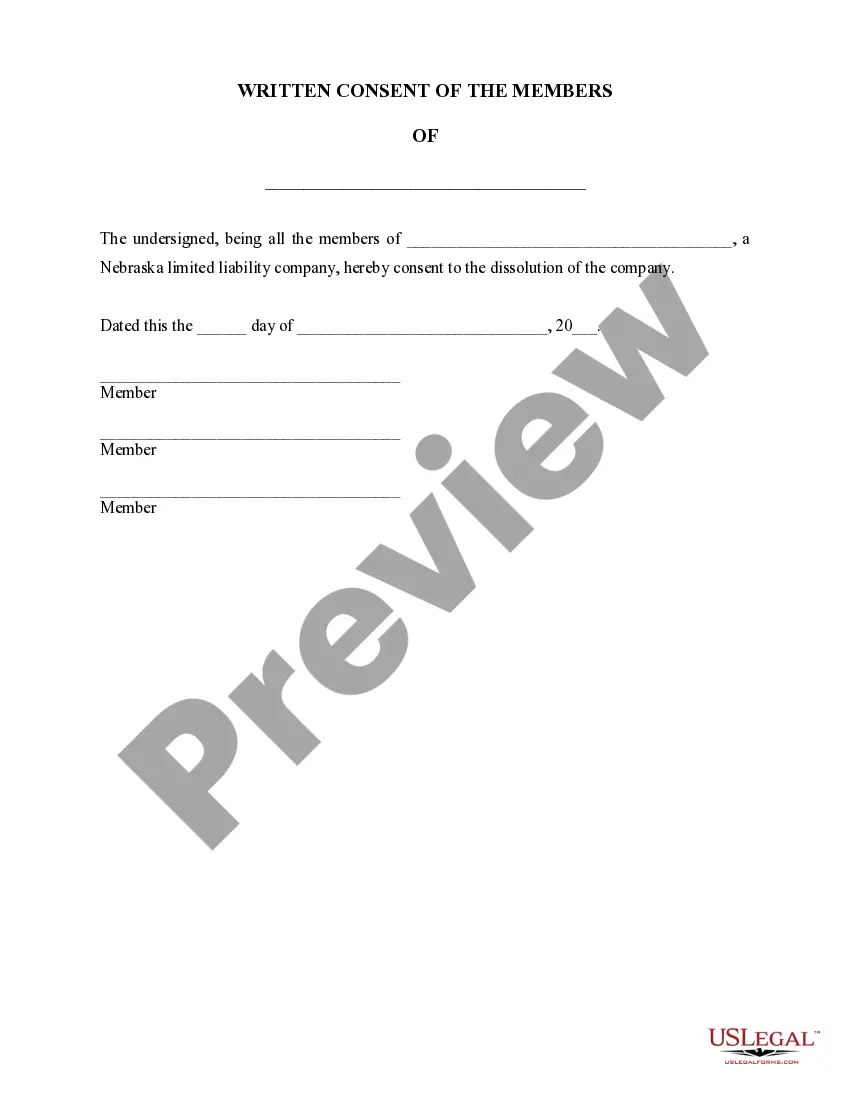

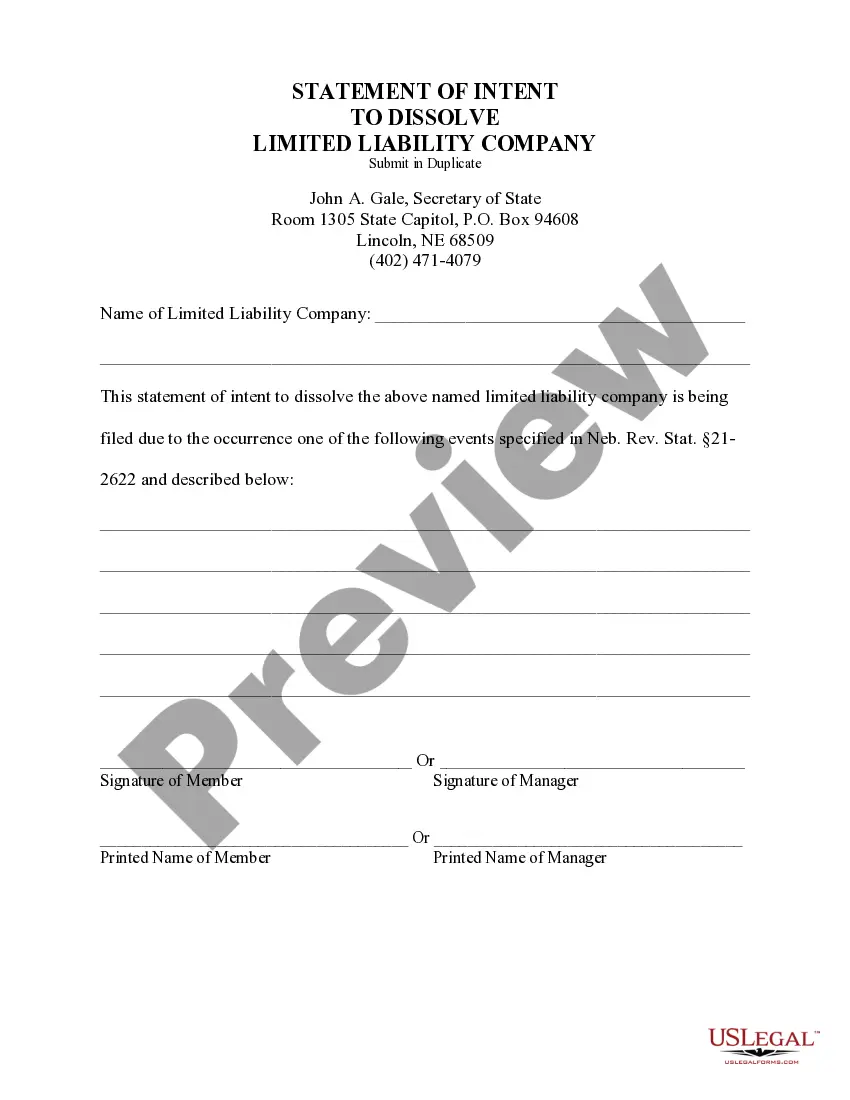

The dissolution package contains all forms to dissolve a LLC or PLLC in Nebraska, step by step instructions, addresses, transmittal letters, and other information.

Nebraska Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out Nebraska Dissolution Package To Dissolve Limited Liability Company LLC?

Avoid expensive attorneys and find the Nebraska Dissolution Package to Dissolve Limited Liability Company LLC you need at a affordable price on the US Legal Forms website. Use our simple categories function to search for and obtain legal and tax files. Read their descriptions and preview them before downloading. In addition, US Legal Forms enables customers with step-by-step instructions on how to download and complete each and every form.

US Legal Forms clients basically must log in and download the particular document they need to their My Forms tab. Those, who haven’t obtained a subscription yet must stick to the guidelines below:

- Ensure the Nebraska Dissolution Package to Dissolve Limited Liability Company LLC is eligible for use where you live.

- If available, look through the description and make use of the Preview option before downloading the sample.

- If you are sure the template suits you, click Buy Now.

- In case the template is incorrect, use the search engine to get the right one.

- Next, create your account and select a subscription plan.

- Pay by credit card or PayPal.

- Choose to download the form in PDF or DOCX.

- Click on Download and find your form in the My Forms tab. Feel free to save the template to the device or print it out.

Right after downloading, you can fill out the Nebraska Dissolution Package to Dissolve Limited Liability Company LLC manually or by using an editing software program. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

Hold a Members meeting and record a resolution to Dissolve the Nebraska LLC. File all required Biennial Reports with the Nebraska Secretary of State. Clear up any business debt. Pay all taxes and administrative fees owed by the Nebraska LLC.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office.

The Effect of Dissolution After you close your LLC in California, that LLC shall be canceled, and its powers, rights, and privileges shall end upon the filing of the Certificate of Cancellation. This means you can no longer conduct business using that LLC.

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.

Step 1: Corporation or LLC action. Step 2: Filing the Certificate of Dissolution with the state. Step 3: Filing federal, state, and local tax forms. Step 4: Notifying creditors your business is ending. Step 5: Settling creditors' claims.

Method 1: You can voluntarily dissolve your LLC. This requires a majority vote from all members or a certain percentage of votes as required per your operating agreement. With the required votes, you can move forward with the dissolution.