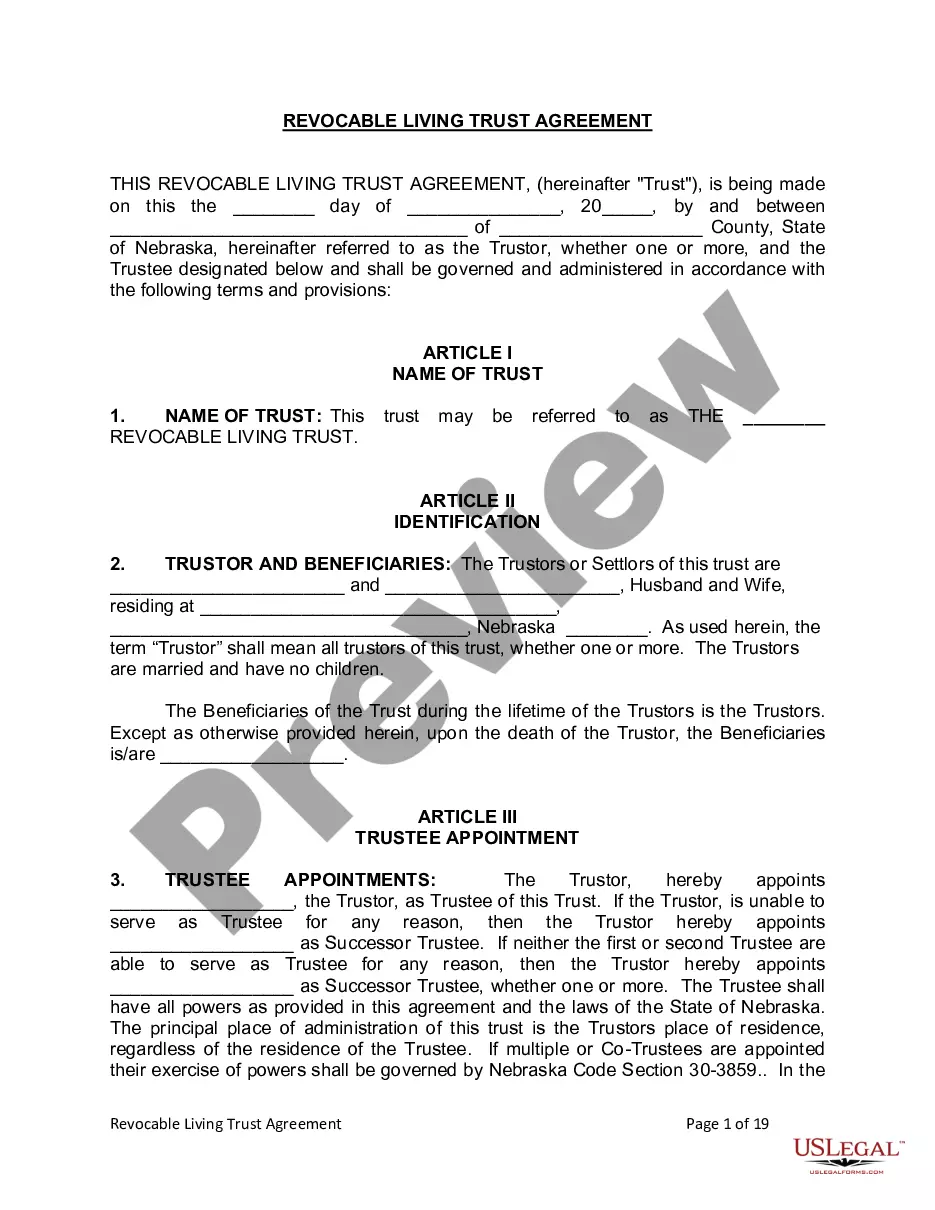

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Nebraska Living Trust for Husband and Wife with No Children

Description

How to fill out Nebraska Living Trust For Husband And Wife With No Children?

Avoid expensive lawyers and find the Nebraska Living Trust for Husband and Wife with No Children you need at a affordable price on the US Legal Forms site. Use our simple categories function to find and obtain legal and tax forms. Read their descriptions and preview them well before downloading. In addition, US Legal Forms provides users with step-by-step tips on how to obtain and fill out every template.

US Legal Forms customers basically need to log in and download the particular form they need to their My Forms tab. Those, who haven’t got a subscription yet must stick to the tips below:

- Make sure the Nebraska Living Trust for Husband and Wife with No Children is eligible for use where you live.

- If available, read the description and make use of the Preview option before downloading the sample.

- If you’re sure the document is right for you, click on Buy Now.

- If the template is wrong, use the search engine to get the right one.

- Next, create your account and select a subscription plan.

- Pay out by credit card or PayPal.

- Select obtain the form in PDF or DOCX.

- Just click Download and find your template in the My Forms tab. Feel free to save the template to your device or print it out.

Right after downloading, you can fill out the Nebraska Living Trust for Husband and Wife with No Children by hand or with the help of an editing software program. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

Community Property in California Inheritance LawsCalifornia is a community property state, which is a policy that only applies to spouses and domestic partners.The only property that doesn't become community property automatically are gifts and inheritances that one spouse receives.

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

Most married couples own most of their assets jointly. Assets owned jointly between husband and wife pass automatically to the survivor.This requires the will to be probated and an executor to be appointed in order to secure the assets. There are exceptions to the probate requirement for estates of $50,000 or less.

If one dies, the other partner will automatically inherit the whole of the money. Property and money that the surviving partner inherits does not count as part of the estate of the person who has died when it is being valued for the intestacy rules.

But to protect spouses from being disinherited, most of these states give a surviving spouse the right to claim one-third to one-half of the deceased spouse's estate, no matter what the will provides. (For other limitations on what a will can do, see What a Will Won't Do.)

If you die without a will in Nebraska, your children will receive an intestate share of your property.For children to inherit from you under the laws of intestacy, the state of Nebraska must consider them your children, legally. For many families, this is not a confusing issue.

If you and your spouse own your house jointly, the responsibility for the mortgage will pass to your surviving spouse. Your surviving spouse, who will now be the sole owner of the house, will also be responsible for the entire mortgage.

Property owned by the deceased husband alone: Any asset that is owned by the husband in his name alone becomes part of his estate. Intestacy: If a deceased husband had no will, then his estate passes by intestacy.and also no living parent, does the wife receive her husband's whole estate.

California is a community property state, which means that following the death of a spouse, the surviving spouse will have entitlement to one-half of the community property (i.e., property that was acquired over the course of the marriage, regardless of which spouse acquired it).