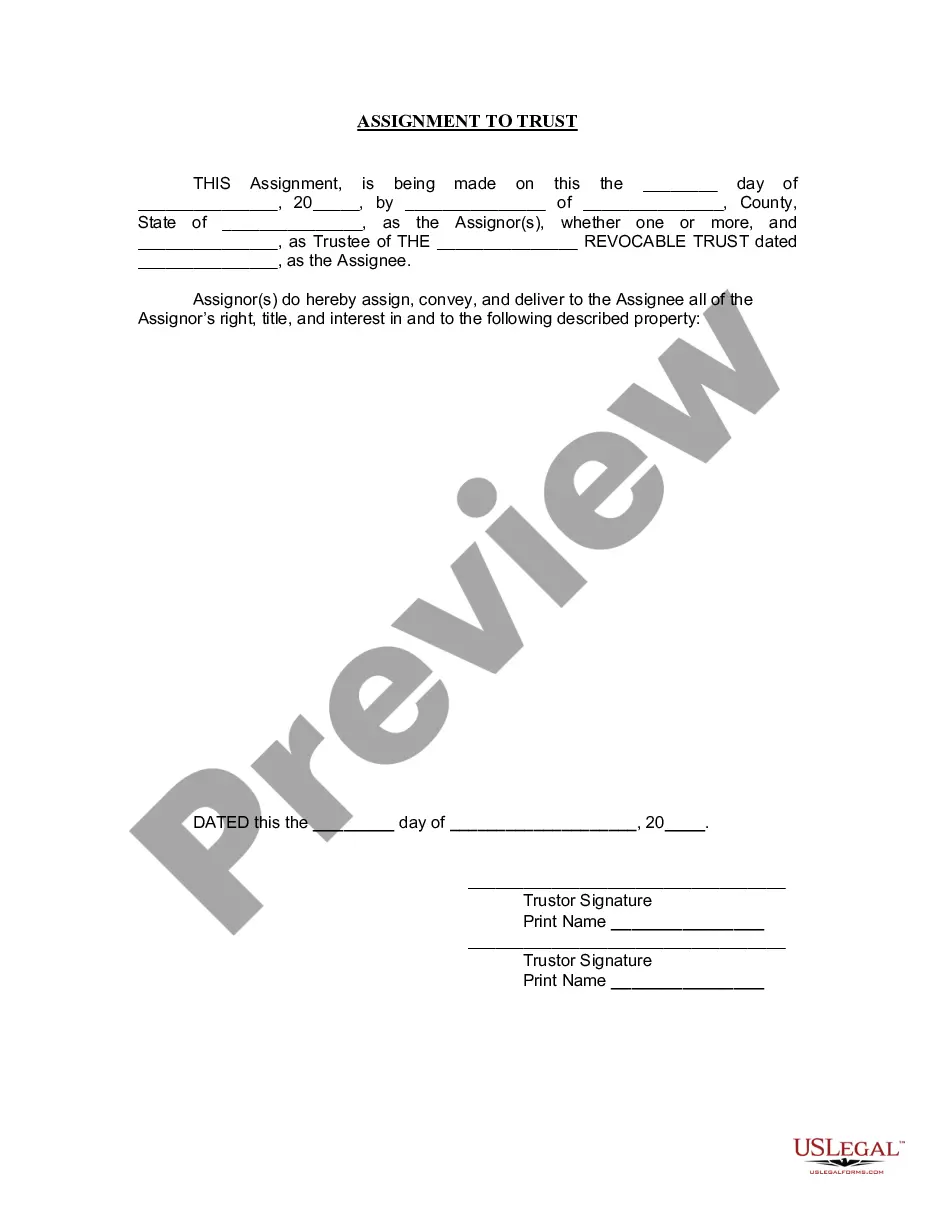

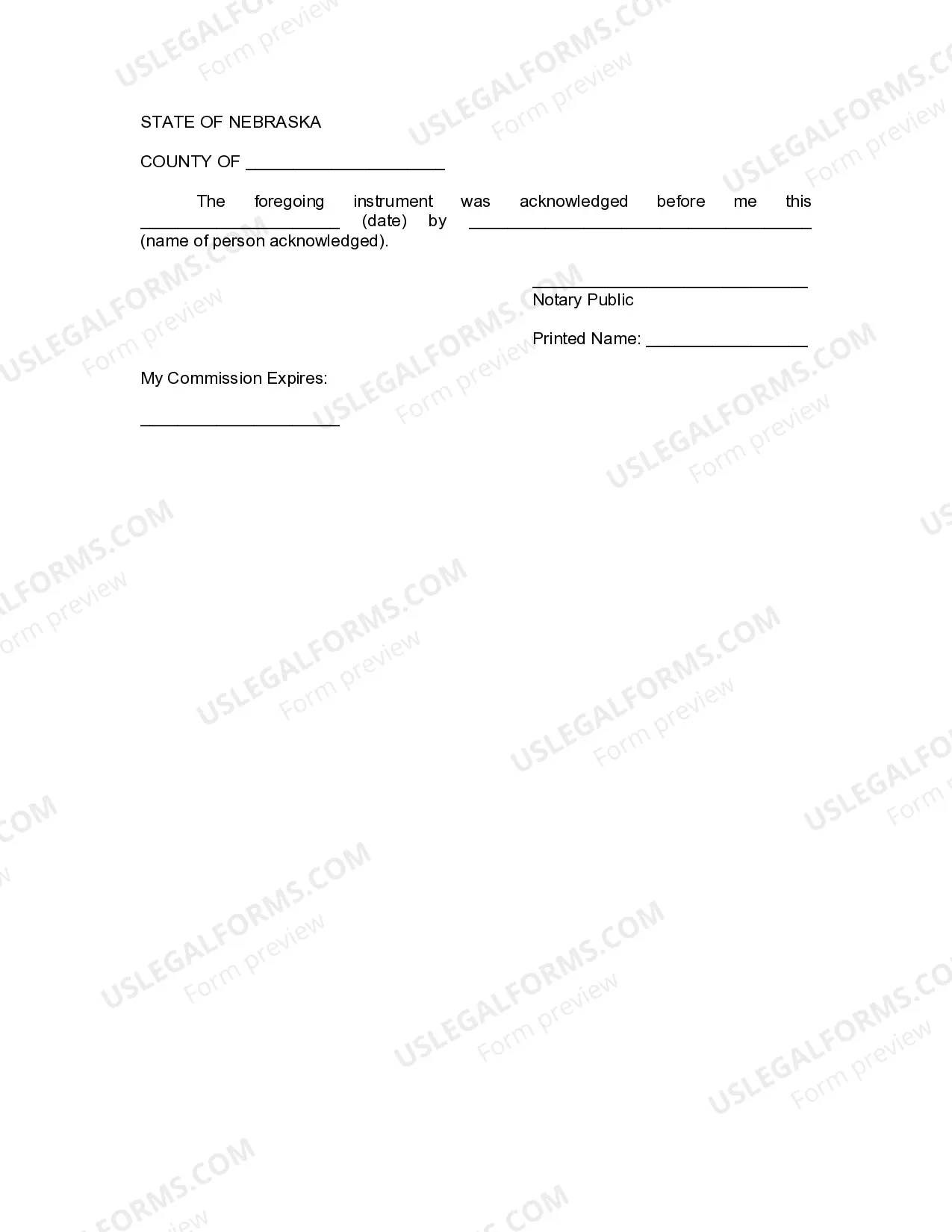

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Nebraska Assignment to Living Trust

Description

How to fill out Nebraska Assignment To Living Trust?

Avoid costly lawyers and find the Nebraska Assignment to Living Trust you want at a affordable price on the US Legal Forms site. Use our simple groups functionality to find and download legal and tax documents. Read their descriptions and preview them well before downloading. In addition, US Legal Forms enables users with step-by-step instructions on how to obtain and fill out every form.

US Legal Forms customers just have to log in and get the specific form they need to their My Forms tab. Those, who have not obtained a subscription yet should stick to the tips below:

- Make sure the Nebraska Assignment to Living Trust is eligible for use where you live.

- If available, look through the description and make use of the Preview option well before downloading the templates.

- If you’re confident the document is right for you, click Buy Now.

- If the form is incorrect, use the search field to find the right one.

- Next, create your account and select a subscription plan.

- Pay by credit card or PayPal.

- Select download the form in PDF or DOCX.

- Click on Download and find your template in the My Forms tab. Feel free to save the template to the gadget or print it out.

After downloading, you may fill out the Nebraska Assignment to Living Trust by hand or by using an editing software program. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

Expect to pay $1,000 for a simple trust, up to several thousand dollars. You may incur additional costs after the trust has been established if you transfer property in and out or otherwise move things around. However, the bulk of the cost will be setting it up initially.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them.You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.

Sure you can write your own revocable living trust.The discussion of your need for a revocable living trust is in another of my articles, but it is safe to say that if you own real property and have a significant estate (over about $50,000), then you could use a trust and it would help your loved ones.

A living trust is an important part of your estate plan. Most people can create a living trust without an attorney using software or an online service.

You should still have a durable power of attorney for finances.You may even want to empower your attorney-in-fact to transfer into your living trust any property that becomes yours after you become incapacitated. Only a durable power of attorney for finances can grant that authority.

Trusts Are Not Public Record. Most states require a last will and testament to be filed with the appropriate state court when the person dies. When this happens, the will becomes a public record for anyone to read. However, trusts aren't recorded.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

Open a bank account in the name of the trust. Close out any bank accounts the grantor established for the trust and put the proceeds into the new trust bank account. Cash in any life insurance policies that name the trust as beneficiary and put the proceeds into the trust bank account.