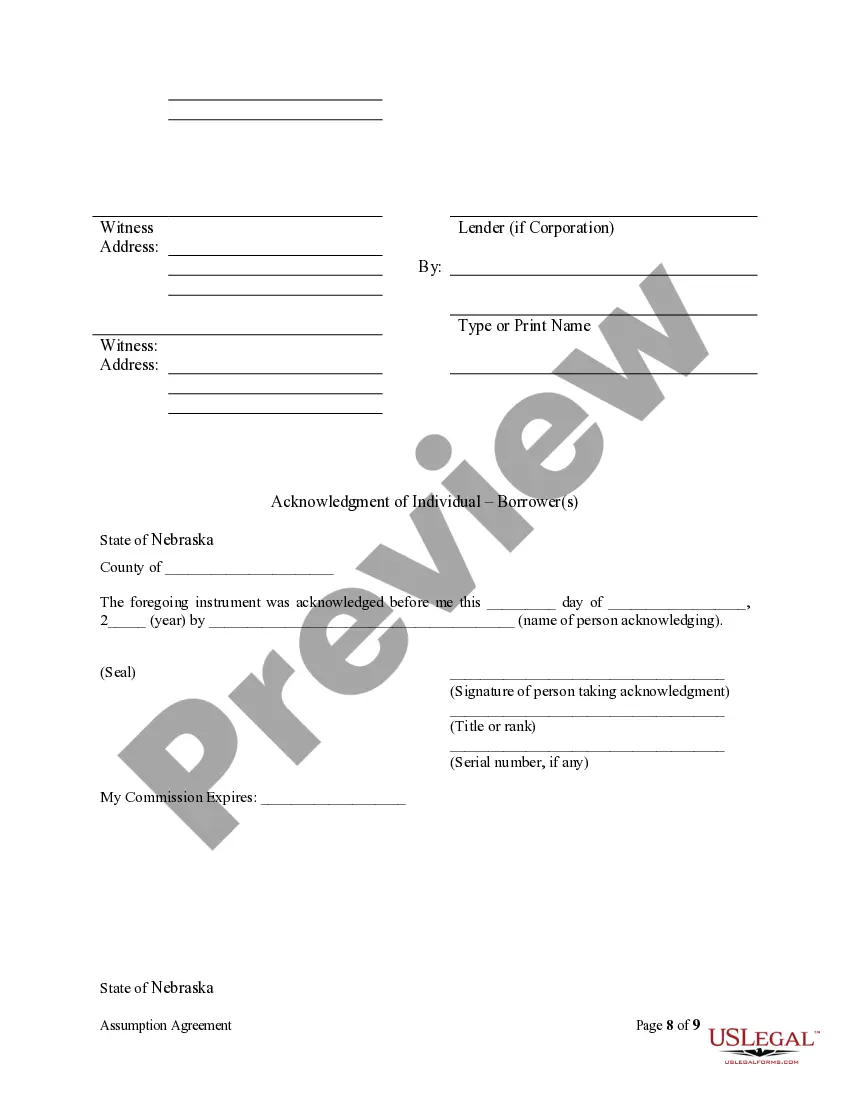

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Nebraska Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out Nebraska Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

Avoid pricey lawyers and find the Nebraska Assumption Agreement of Deed of Trust and Release of Original Mortgagors you need at a reasonable price on the US Legal Forms site. Use our simple categories functionality to look for and obtain legal and tax documents. Go through their descriptions and preview them before downloading. In addition, US Legal Forms provides customers with step-by-step instructions on how to obtain and complete every form.

US Legal Forms subscribers just must log in and get the specific form they need to their My Forms tab. Those, who have not got a subscription yet should stick to the guidelines listed below:

- Ensure the Nebraska Assumption Agreement of Deed of Trust and Release of Original Mortgagors is eligible for use in your state.

- If available, read the description and use the Preview option well before downloading the templates.

- If you are sure the template fits your needs, click Buy Now.

- In case the template is wrong, use the search engine to find the right one.

- Next, create your account and choose a subscription plan.

- Pay by card or PayPal.

- Select download the form in PDF or DOCX.

- Just click Download and find your form in the My Forms tab. Feel free to save the form to your gadget or print it out.

After downloading, you can fill out the Nebraska Assumption Agreement of Deed of Trust and Release of Original Mortgagors manually or by using an editing software. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

Keep in mind that the average loan assumption takes anywhere from 45-90 days to complete. The more issues there are with underwriting, the longer you'll have to wait to finalize your agreement.

An assumable mortgage allows a buyer to take over the seller's mortgage. Once the assumption is complete, you take over the payments on a monthly basis, and the person you assume the loan from is released from further liability. If you assume someone's mortgage, you're agreeing to take on their debt.

A deed of assumption of trustees and conveyance, incorporating resignation, to add new trustees to a Scottish trust and to effect the resignation of one of the existing trustees at the same time, where there is more than one existing trustee and all of the existing trustees are party to the deed.

An assumable mortgage allows a buyer to take over the seller's mortgage. Once the assumption is complete, you take over the payments on a monthly basis, and the person you assume the loan from is released from further liability. If you assume someone's mortgage, you're agreeing to take on their debt.

The contractual agreement for repaying the property loan includes the interest that the borrower has to pay per month in addition to the principal repayments to the lender.Therefore, an assumable mortgage during this period is likely to have a lower interest rate reflecting the current state of the economy.

A deed is a written document that evidences the legal transfer of ownership of real estate.A deed of assumption is a single deed that includes both the language of a general warranty or other deed along with the acknowledgement that the buyer is taking over the mortgage on the property.

You will need a minimum credit score of 580 to 620, depending on individual lender guidelines. Your household income cannot exceed 115% of the average median income for the area. Your debt ratios should not exceed 29% for your housing expenses and 41% for your total monthly expenses.

Having an assumable loan might give a seller a marketing edge, particularly if mortgage rates have risen since the seller got the loan. For a buyer, assuming a mortgage can save thousands of dollars in interest payments and closing costs but it could require making a big down payment.

An assumption clause is a provision in a mortgage contract that allows the seller of a home to pass responsibility for the existing mortgage to the buyer of the property. In other words, the new homeowner assumes the existing mortgage.