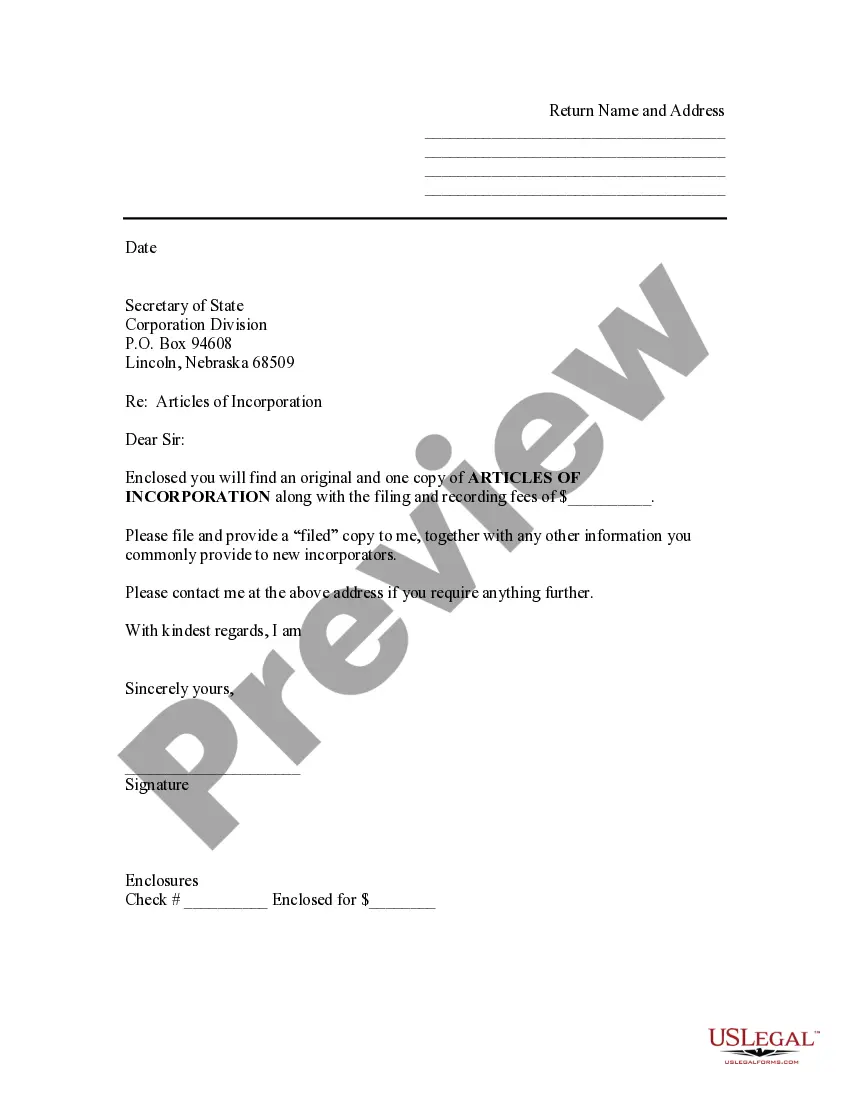

Use this sample letter as a cover sheet to accompany the Articles of Incorporation for filing with the Secretary of State's Office.

Nebraska Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation

Description

How to fill out Nebraska Sample Transmittal Letter To Secretary Of State's Office To File Articles Of Incorporation?

Avoid pricey lawyers and find the Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation - Nebraska you need at a affordable price on the US Legal Forms website. Use our simple groups function to search for and obtain legal and tax files. Read their descriptions and preview them prior to downloading. Additionally, US Legal Forms provides users with step-by-step tips on how to obtain and complete each template.

US Legal Forms clients simply need to log in and obtain the specific form they need to their My Forms tab. Those, who have not got a subscription yet need to follow the guidelines below:

- Ensure the Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation - Nebraska is eligible for use in your state.

- If available, read the description and use the Preview option just before downloading the templates.

- If you are sure the template is right for you, click on Buy Now.

- In case the template is wrong, use the search field to find the right one.

- Next, create your account and choose a subscription plan.

- Pay out by credit card or PayPal.

- Choose to obtain the form in PDF or DOCX.

- Simply click Download and find your form in the My Forms tab. Feel free to save the template to your device or print it out.

Right after downloading, you may complete the Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation - Nebraska manually or with the help of an editing software. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

Under Domestic Organizations, select Domestic Profit Corporation. Enter your name and email address. Complete the Oklahoma Certificate of Incorporation. Submit and pay the filing fee.

To start an LLC in Oklahoma you will need to file the Articles of Organization with the Oklahoma Secretary of State, which costs $100. You can apply online, by mail, or in-person. The Articles of Organization is the legal document that officially creates your Oklahoma Limited Liability Company.

Step 1: Get Your Articles of Organization Forms. You can download and mail in your Ohio Articles of Organization, OR you can create an account and file online. Step 2: Fill Out the Articles of Organization. Step 3: File the Articles of Organization.

Step 1: Create a Name For Your Nebraska Corporation. When naming your Nebraska Corporation, you will need to: Step 2: Choose a Nebraska Registered Agent. Step 3: Choose Your Nebraska Corporation's Initial Directors. Step 4: File the Articles of Incorporation.

For now, all business and UCC filings must be submitted online at OhioBusinessCentral.gov. Records filings such as Apostille requests and Minister License applications and other documents that you are unable to submit online may be mailed to 22 N. Fourth Street, Columbus, Ohio 43215 or submitted in person.

If you want to structure your business as a corporation, one of the first formal steps you'll need to take is to file a special document with a particular state office. In most states, the document is known as the articles of incorporation, and in most states it needs to be filed with the Secretary of State.

LLCs are not corporations and do not use articles of incorporation. Instead, LLCs form by filing articles of organization.

STEP 1: Name your Nebraska LLC. STEP 2: Choose a Nebraska Registered Agent. STEP 3: File the Nebraska LLC Certificate of Organization. STEP 4: Complete Nebraska LLC Publication Requirements. STEP 5: Create a Nebraska LLC Operating Agreement.

Articles of Organization are generally used for LLC formation, while Articles of Incorporation are the type of documents that you need to form a C Corporation or S Corporation. But the general concept remains the same you need to file these articles upfront as part of starting your business as a legal entity.