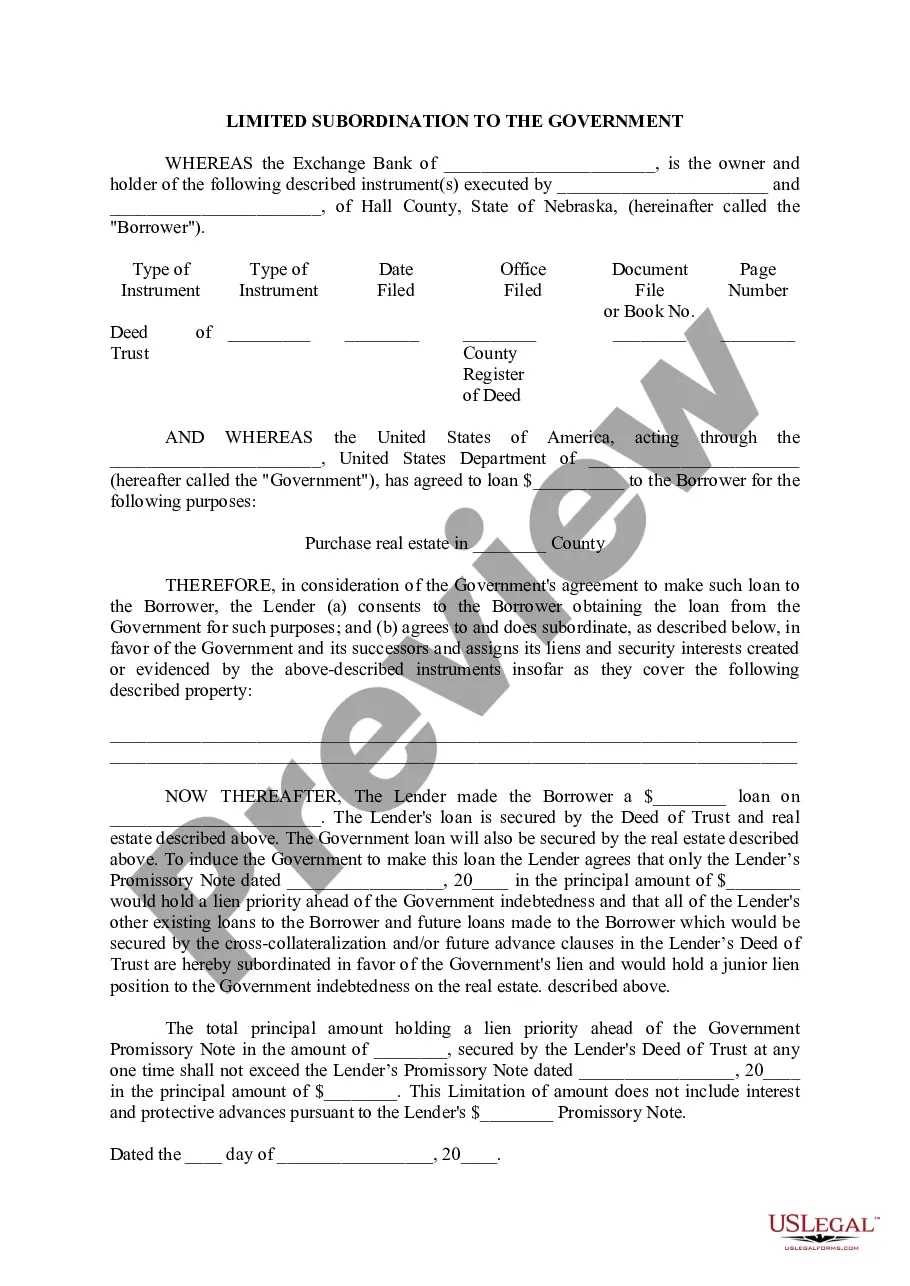

Nebraska Limited Subordination to the Government

Description

How to fill out Nebraska Limited Subordination To The Government?

Avoid pricey attorneys and find the Nebraska Limited Subordination to the Government you need at a reasonable price on the US Legal Forms site. Use our simple groups function to look for and obtain legal and tax documents. Read their descriptions and preview them just before downloading. Additionally, US Legal Forms provides users with step-by-step instructions on how to obtain and complete each and every template.

US Legal Forms clients simply must log in and download the particular document they need to their My Forms tab. Those, who have not got a subscription yet need to follow the guidelines below:

- Ensure the Nebraska Limited Subordination to the Government is eligible for use where you live.

- If available, look through the description and use the Preview option before downloading the templates.

- If you’re sure the template suits you, click on Buy Now.

- If the form is wrong, use the search engine to get the right one.

- Next, create your account and select a subscription plan.

- Pay by card or PayPal.

- Choose to obtain the document in PDF or DOCX.

- Click on Download and find your template in the My Forms tab. Feel free to save the form to the gadget or print it out.

Right after downloading, you may complete the Nebraska Limited Subordination to the Government manually or with the help of an editing software program. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Form popularity

FAQ

Subordination clauses in mortgages refer to the portion of your agreement with the mortgage company that says their lien takes precedence over any other liens you may have on your property.The primary lien on a house is usually a mortgage. However, it's also possible to have other liens.

A subordination agreement prioritizes collateralized debts, ranking one behind another for purposes of collecting repayment from a debtor in the event of foreclosure or bankruptcy. A second-in-line creditor collects only when and if the priority creditor has been fully paid.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit. Signing your agreement is a positive step forward in your refinancing journey.

Who Benefits from a Subordination Clause? A subordination clause is meant to protect the interests of the primary lender. A primary mortgage usually covers the cost of purchasing the home; however, if there is a secondary mortgage, the clause ensures that the primary lender retains the number one priority.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit.

A subordination agreement is a legal document that establishes one debt as ranking behind another in priority for collecting repayment from a debtor.

But as property values are going up and the demand for refinance isn't as much, it seems that the subordination process has gotten a little easier. Typically, it takes two to three weeks to get the resubordination paperwork through, and it is likely to set you back $200 to $300.

Subordinate Liens Being "subordinate" means they can be paid only after more senior liens are released. In other words, if the mortgage lender has the primary lien, that lender must be paid in full before any subordinate liens are paid.

- A subordination agreement is an agreement between two lien holders to modify the order of lien priority.