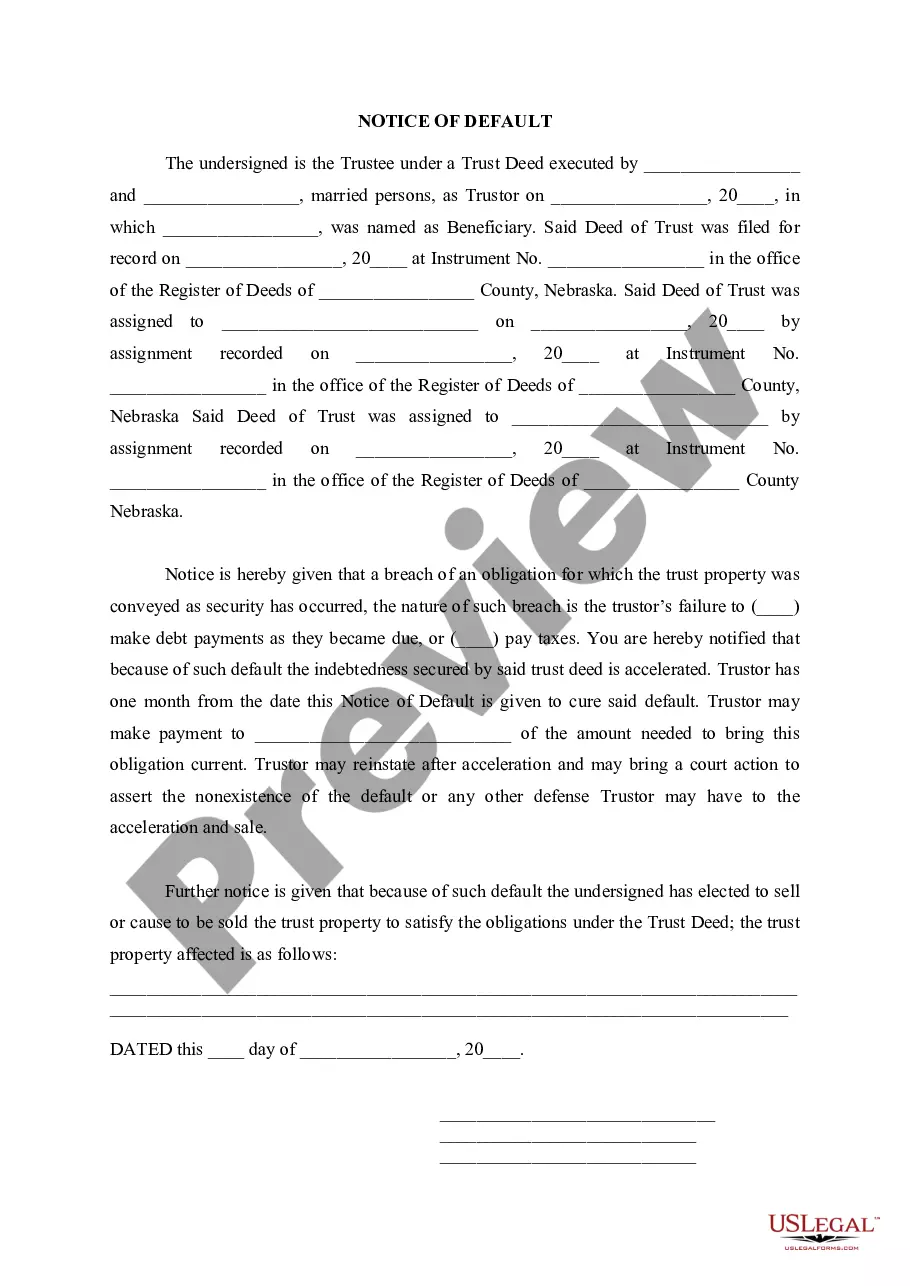

Nebraska Notice of Default

Description

How to fill out Nebraska Notice Of Default?

Avoid expensive attorneys and find the Nebraska Notice of Default you want at a reasonable price on the US Legal Forms site. Use our simple groups function to look for and obtain legal and tax forms. Read their descriptions and preview them prior to downloading. In addition, US Legal Forms enables users with step-by-step tips on how to download and fill out every single template.

US Legal Forms subscribers basically must log in and download the specific form they need to their My Forms tab. Those, who haven’t got a subscription yet should follow the guidelines listed below:

- Make sure the Nebraska Notice of Default is eligible for use where you live.

- If available, look through the description and make use of the Preview option prior to downloading the sample.

- If you are confident the template is right for you, click Buy Now.

- In case the template is wrong, use the search engine to find the right one.

- Next, create your account and select a subscription plan.

- Pay by card or PayPal.

- Select download the form in PDF or DOCX.

- Just click Download and find your form in the My Forms tab. Feel free to save the template to your gadget or print it out.

Right after downloading, you can fill out the Nebraska Notice of Default manually or with the help of an editing software. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

Currently, 22 states in the U.S. only allow banks to attempt judicial foreclosures, including Arkansas, Connecticut, Delaware, Florida, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Nebraska, New Jersey, New Mexico, New York, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, Vermont, Virginia, and

Foreclosures are usually nonjudicial in the following states: Alabama, Alaska, Arizona, Arkansas, California, Colorado, District of Columbia (sometimes), Georgia, Idaho, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Mexico (sometimes), North Carolina,

The Nebraska Trust Deeds Act is the statue that governs foreclosures in this state. Under this statue, foreclosure is a non-judicial remedy.Nebraska also has judicial foreclosures, which allows mortgages that serve as liens on real property to be foreclosed through the courts.

A notice of default is the first step to a bank or mortgage lender's foreclosure process.If the mortgage is not paid up to date, the lender will seize the home. A notice of default is also known as a reinstatement period, notice of public auction, or notice of foreclosure.

Essentially, a judicial foreclosure means that the lender goes to court to get a judgment to foreclose on your home, while a non-judicial foreclosure means that the lender does not need to go to court.

The notice of default doesn't affect your credit file, but when the account defaults this will be recorded.If the debt is regulated by the Consumer Credit Act, you must be sent a default notice warning letter and have time to act on it before the default is recorded on your credit file.