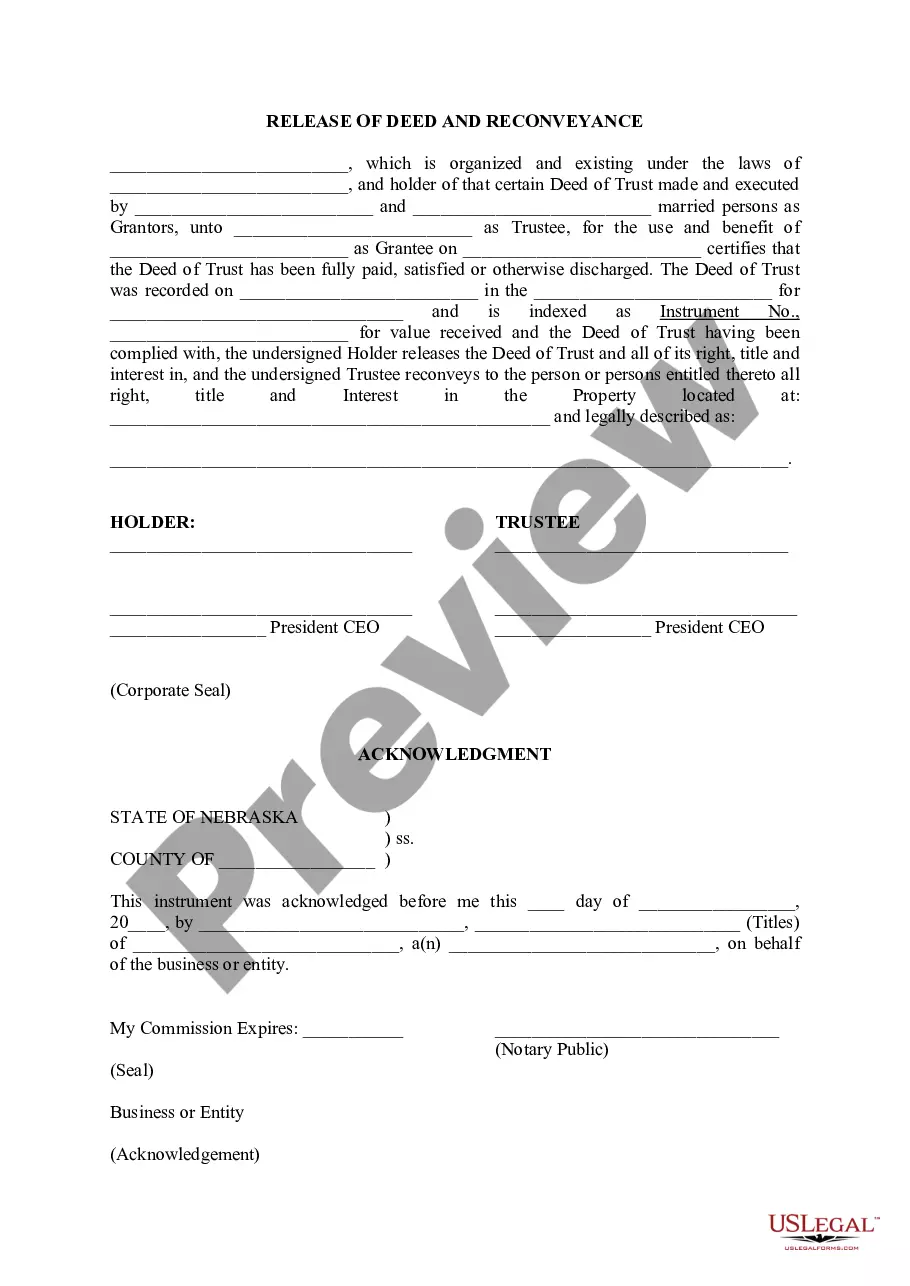

Nebraska Release of Deed and Reconveyance

Description

How to fill out Nebraska Release Of Deed And Reconveyance?

Avoid expensive attorneys and find the Nebraska Release of Deed and Reconveyance you want at a affordable price on the US Legal Forms site. Use our simple categories functionality to look for and download legal and tax forms. Read their descriptions and preview them just before downloading. Moreover, US Legal Forms provides users with step-by-step tips on how to download and fill out every single template.

US Legal Forms subscribers merely need to log in and obtain the particular document they need to their My Forms tab. Those, who have not got a subscription yet need to stick to the tips below:

- Make sure the Nebraska Release of Deed and Reconveyance is eligible for use in your state.

- If available, read the description and make use of the Preview option just before downloading the sample.

- If you are confident the document suits you, click on Buy Now.

- In case the form is incorrect, use the search field to find the right one.

- Next, create your account and choose a subscription plan.

- Pay out by card or PayPal.

- Choose to download the document in PDF or DOCX.

- Click on Download and find your form in the My Forms tab. Feel free to save the form to the gadget or print it out.

Right after downloading, you are able to fill out the Nebraska Release of Deed and Reconveyance by hand or with the help of an editing software. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Form popularity

FAQ

Only until the debt is paid off by the borrower can a deed of reconveyance then be used to clear the deed of trust from the title to the property. The document is signed by the trustee, whose signature must be notarized.

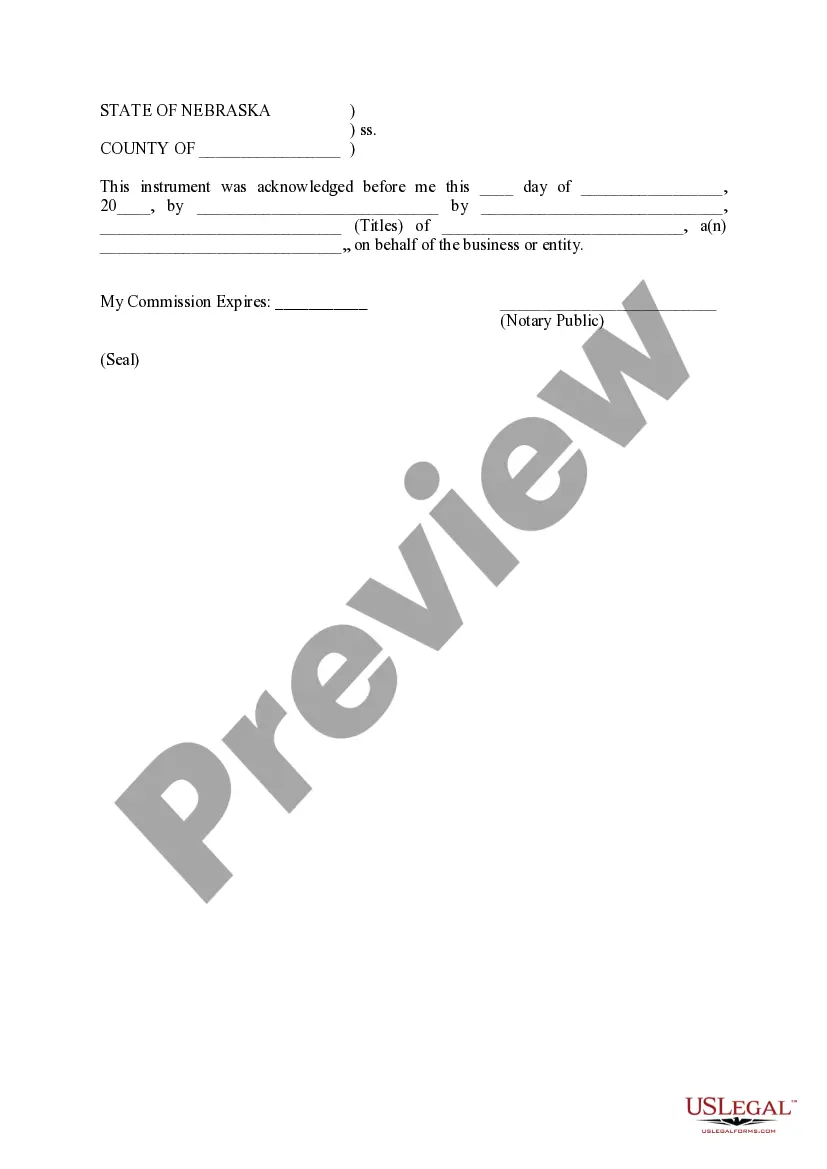

How do you file a Deed of Reconveyance? A Deed of Reconveyance should be filed with your local county recorder or recorder of deeds once it has been signed by a notary public (such as an attorney). Once the document has been filed, the debt that was registered to the property will be considered paid off.

A reconveyance is the official transfer of the property title after the mortgage has been paid in full. The processing time can vary based on the county in which the property is located and can take up to three months. You will need to contact your county for questions on their specific processing time.

A deed of release or release deed is a legal document that removes the claim of a person from an immovable property and transfers his/her share to the co-owner. The release deed procedure is executed in the sub-registrars office and both the parties are required to be present for signing it.

When you pay off your loan and you have a mortgage, the lender will send you or the local recorder of deeds or office that handles the filing of real estate documents a release of mortgage.On the other hand, when you have a trust deed or deed of trust, the lender files a release deed.

A deed of release literally releases the parties to a deal from previous obligations, such as payments under the term of a mortgage because the loan has been paid off. The lender holds the title to real property until the mortgage's terms have been satisfied when a deed of release is commonly entered into.

Is completed and signed by the trustee, whose signature must be notarized. Full Reconveyance form can be purchased at most office supply or stationery stores. Usually the trustee named on your Deed of Trust will also have forms available and will issue the Full Reconveyance.

Reconveyance is the transfer of a title to the borrower after a mortgage has been fully paid.

Complete the top area of the reconveyance deed. Enter the name of and address of the person who executed the deed of trust, the borrower or debtor. Refer to the original deed of trust for the name spelling. Complete the middle section, the trustee's name and address.