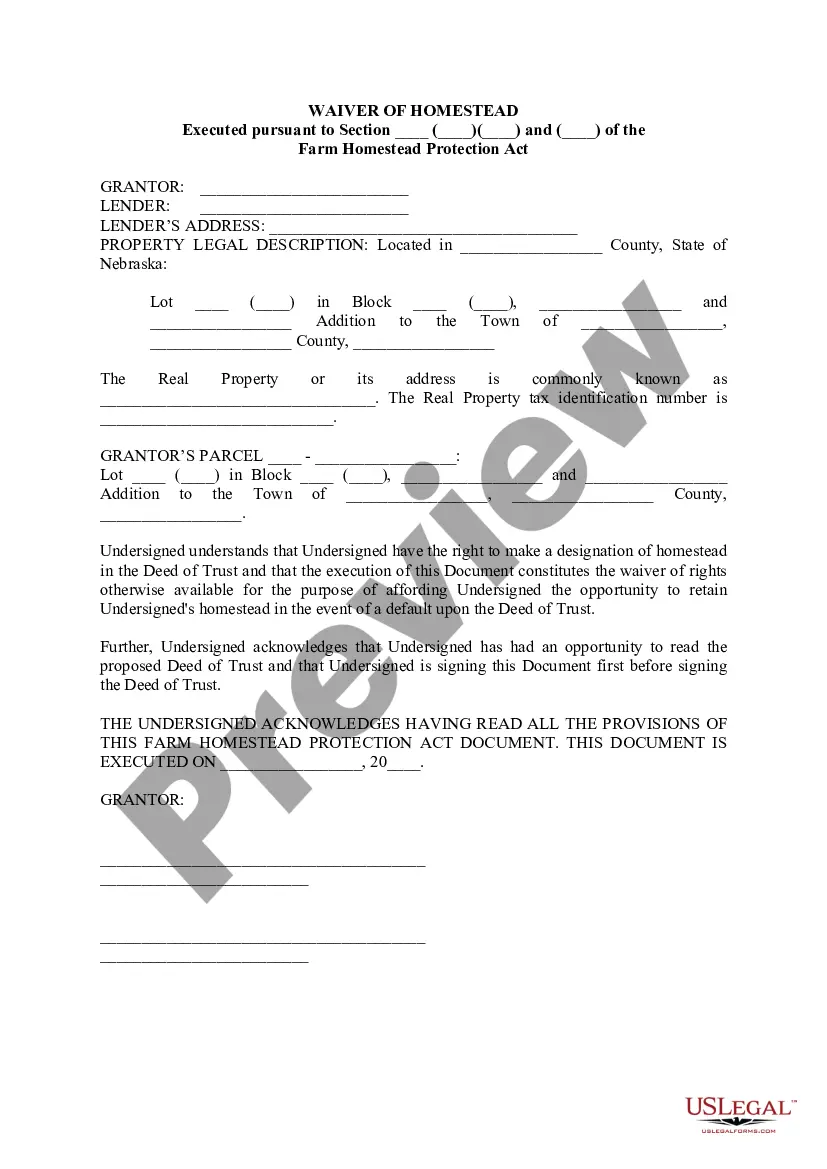

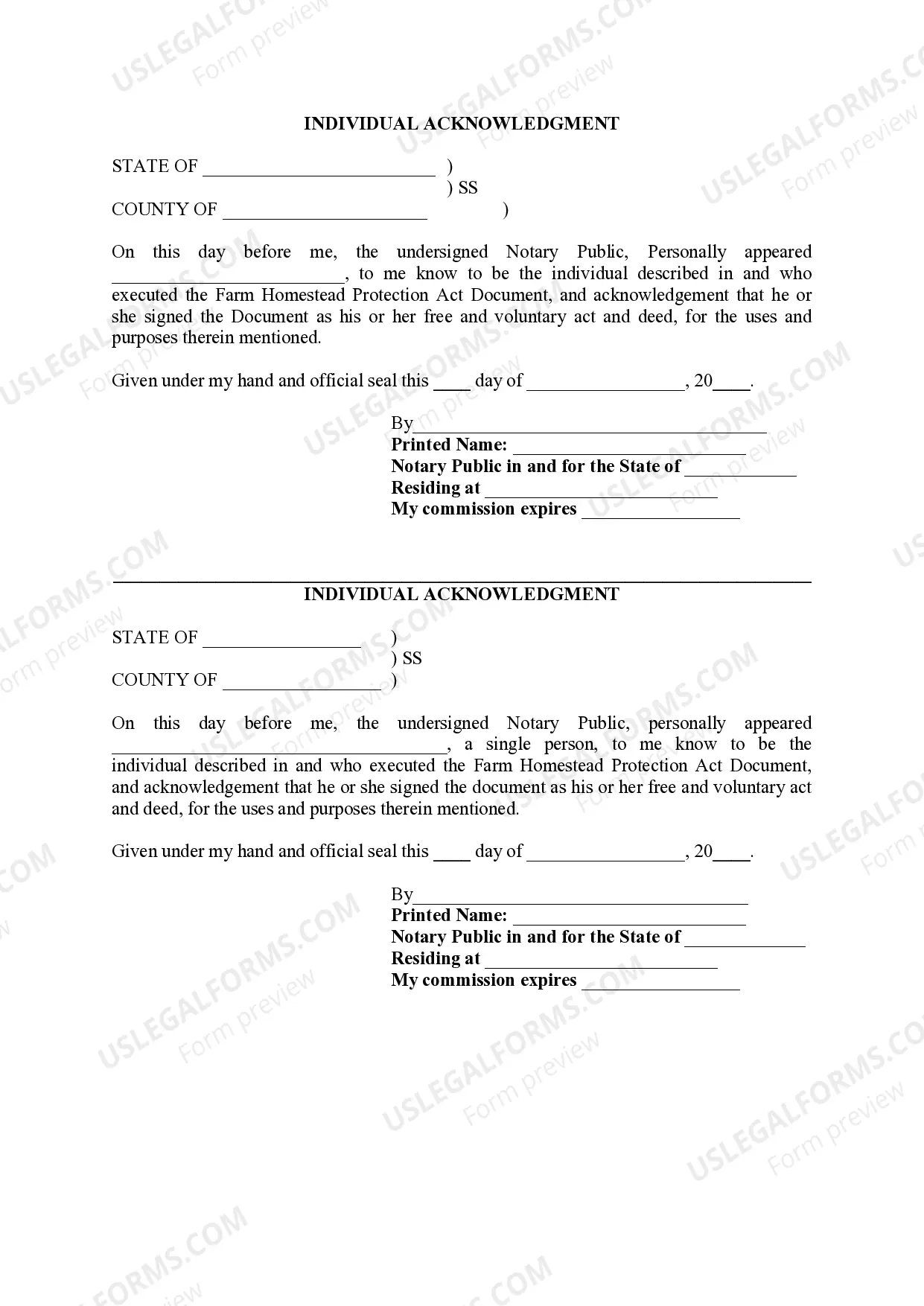

Nebraska Waiver of Homestead pursuant to Farm Homestead Protection Act

Description

How to fill out Nebraska Waiver Of Homestead Pursuant To Farm Homestead Protection Act?

Avoid pricey attorneys and find the Nebraska Waiver of Homestead pursuant to Farm Homestead Protection Act you need at a affordable price on the US Legal Forms site. Use our simple groups function to look for and download legal and tax forms. Go through their descriptions and preview them before downloading. In addition, US Legal Forms provides customers with step-by-step tips on how to download and fill out every form.

US Legal Forms customers simply must log in and download the particular form they need to their My Forms tab. Those, who have not obtained a subscription yet must stick to the guidelines below:

- Ensure the Nebraska Waiver of Homestead pursuant to Farm Homestead Protection Act is eligible for use where you live.

- If available, read the description and make use of the Preview option before downloading the templates.

- If you’re confident the template is right for you, click on Buy Now.

- In case the form is wrong, use the search engine to find the right one.

- Next, create your account and choose a subscription plan.

- Pay out by card or PayPal.

- Choose to download the document in PDF or DOCX.

- Click Download and find your form in the My Forms tab. Feel free to save the form to the gadget or print it out.

Right after downloading, you may fill out the Nebraska Waiver of Homestead pursuant to Farm Homestead Protection Act manually or an editing software. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

A valid Florida driver's license. Either a valid voter's registration or a Declaration of Domicile, reflecting the homeowner's Florida address. At least one of your automobiles must be registered in Florida.

Filing for the Homestead Exemption can be done online. Homeowners may claim up to a $50,000 exemption on their primary residence. The first $25,000 of this exemption applies to all taxing authorities.

Homestead Exemption: Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of up to $50,000. The first $25,000 applies to all property taxes.

How do I check to see if my Homestead has been filed and the status off it. You will need to contact your local County office for this information. Your Homestead is filed with you local County office. You file a homestead exemption with your county tax assessor and it reduces the amount of property tax you have to pay

In Nebraska, a homestead exemption is available to the following groups of persons: 2022 Persons over the age of 65; 2022 Qualified disabled individuals; or 2022 Qualified disabled veterans and their widow(er)s. Some categories are subject to household income limitations and residence valuation requirements.

The Homestead Act, enacted during the Civil War in 1862, provided that any adult citizen, or intended citizen, who had never borne arms against the U.S. government could claim 160 acres of surveyed government land. Claimants were required to improve the plot by building a dwelling and cultivating the land.

Do I Need to File Every Year? Not necessarily. Your Florida homestead exemption automatically renews every year as long as your residency status and the property title stay the same. Florida homeowners are required to inform their local property appraiser of any change in ownership or use of the property.

Homestead exemption provides a tax exemption up to $50,000 for persons who are permanent residents of the State of Florida, who hold legal or equitable title to the real property, and who occupy the property as their permanent residence. The first $25,000 applies to all property taxes, including school district taxes.

2756 The maximum exempt value of the homestead is the greater of $40,000 or 100% of the county average assessed value of a single family residential property in the county. In this case, the maximum exempt amount is $75,000 ($75,000 x 100% = $75,000, which is greater than $40,000).