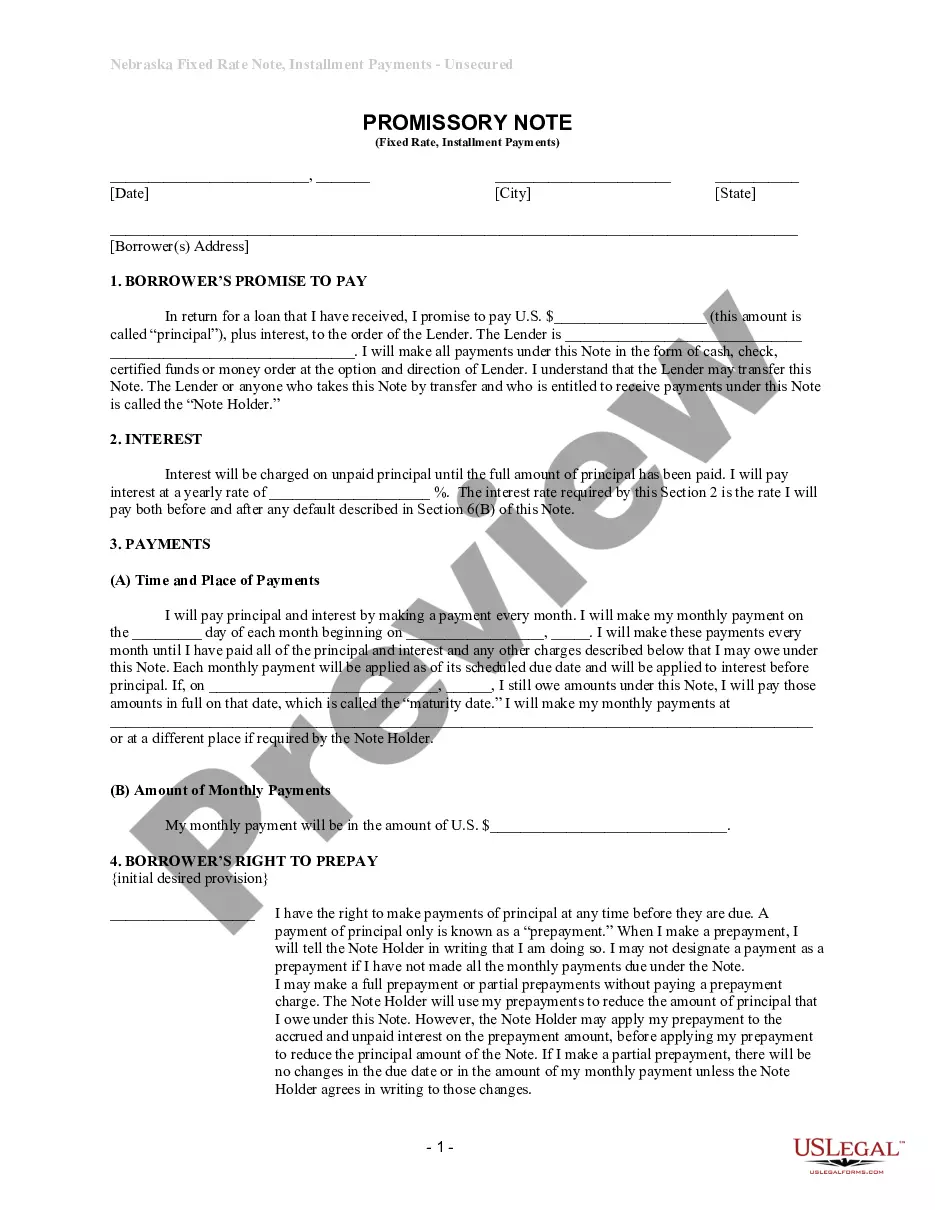

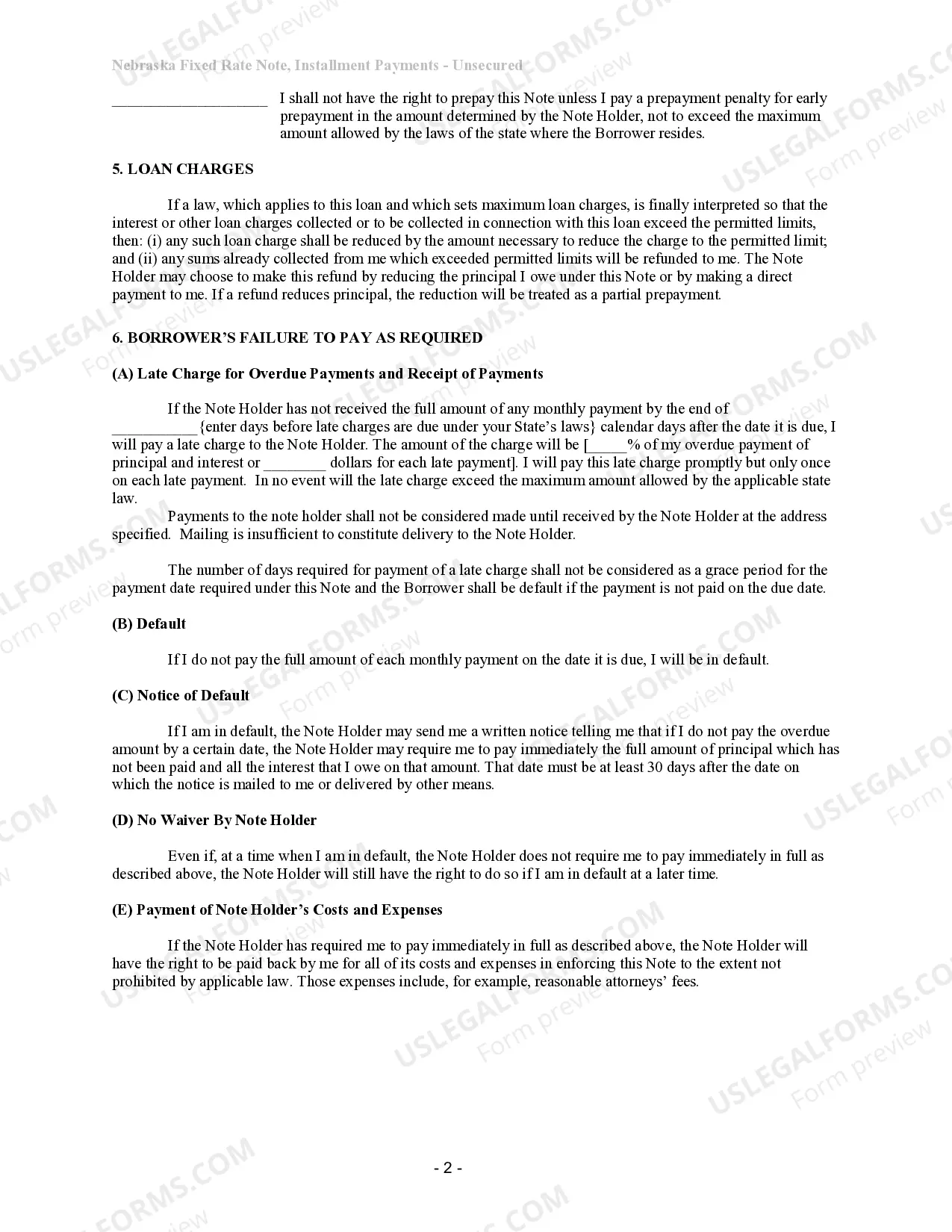

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Nebraska Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Nebraska Unsecured Installment Payment Promissory Note For Fixed Rate?

Avoid pricey attorneys and find the Nebraska Unsecured Installment Payment Promissory Note for Fixed Rate you want at a affordable price on the US Legal Forms website. Use our simple categories function to search for and obtain legal and tax forms. Go through their descriptions and preview them prior to downloading. Additionally, US Legal Forms enables customers with step-by-step tips on how to download and complete each and every form.

US Legal Forms subscribers simply must log in and get the specific form they need to their My Forms tab. Those, who haven’t obtained a subscription yet must stick to the tips below:

- Ensure the Nebraska Unsecured Installment Payment Promissory Note for Fixed Rate is eligible for use where you live.

- If available, read the description and make use of the Preview option well before downloading the sample.

- If you’re sure the template meets your needs, click on Buy Now.

- In case the form is incorrect, use the search field to get the right one.

- Next, create your account and select a subscription plan.

- Pay out by credit card or PayPal.

- Choose to download the form in PDF or DOCX.

- Click on Download and find your form in the My Forms tab. Feel free to save the form to the device or print it out.

Right after downloading, you may fill out the Nebraska Unsecured Installment Payment Promissory Note for Fixed Rate manually or with the help of an editing software program. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

Although this case relates to state securities law claims, in applying the Reves test and holding that the Notes are not securities, the court has ruled squarely in favor of the long-held view in the loan industry that loans are not securities.

Lenders, whether banks or individual sellers, typically require the persons who are borrowing money in order to finance the purchase of real estate to sign a "note" and a "security instrument." A note is a written, unconditional promise to pay a certain sum of money at a certain time or within a certain period of time.

A note is a debt security obligating repayment of a loan, at a predetermined interest rate, within a defined time frame.

Where a contract is in writing, generally, it must be signed by the party against whom the contract is being enforced.A party seeking to enforce an unsigned agreement may also have a claim for unjust enrichment or promissory estoppel.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.

In general, under the Securities Acts, promissory notes are defined as securities, but notes with a maturity of 9 months or less are not securities.The US Supreme Court in Reves recognizes that most notes are, in fact, not securities.

So, what's the difference between secured and unsecured promissory notes? It's actually quite simple. A secured note is any debt collateralized with real property like a first deed of trust or car title. Conversely, an unsecured note is any debt not secured by collateral (or uncollateralized).

Secured or unsecured? Generally, promissory notes are unsecured which means it is more like a formal IOU. However, lenders can request some security for the loan. For personal secured promissory notes, a house or car is often used as collateral.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.