By-laws describe the agreed rules governing the operations of the Professional Corporation.

Sample Bylaws for a Nebraska Professional Corporation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

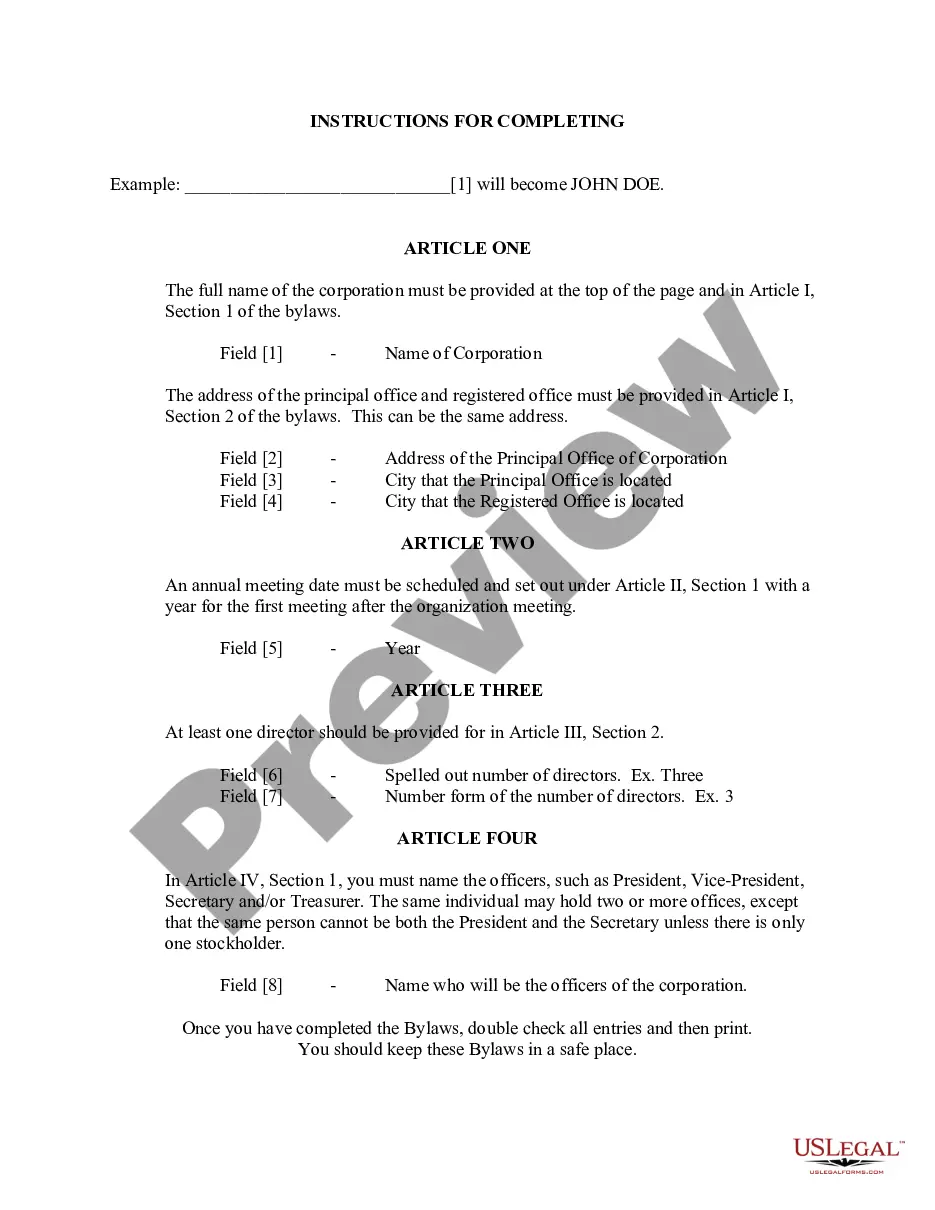

How to fill out Sample Bylaws For A Nebraska Professional Corporation?

Avoid costly lawyers and find the Sample Bylaws for a Nebraska Professional Corporation you want at a reasonable price on the US Legal Forms website. Use our simple groups functionality to find and download legal and tax documents. Go through their descriptions and preview them well before downloading. Moreover, US Legal Forms provides users with step-by-step instructions on how to download and fill out each and every template.

US Legal Forms subscribers basically need to log in and obtain the particular form they need to their My Forms tab. Those, who have not obtained a subscription yet need to stick to the tips below:

- Make sure the Sample Bylaws for a Nebraska Professional Corporation is eligible for use where you live.

- If available, look through the description and make use of the Preview option well before downloading the sample.

- If you are confident the document suits you, click Buy Now.

- If the template is wrong, use the search field to find the right one.

- Next, create your account and select a subscription plan.

- Pay out by card or PayPal.

- Select obtain the form in PDF or DOCX.

- Click on Download and find your template in the My Forms tab. Feel free to save the template to the device or print it out.

After downloading, you are able to complete the Sample Bylaws for a Nebraska Professional Corporation manually or an editing software program. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

Similarly, corporations (S corps and C corps) are not legally required by any state to have an operating agreement, but experts advise owners of these businesses to create and execute their version of an operating agreement, called bylaws.

An S Corporation is required by state law to adopt bylaws that govern the corporation's internal management and the rights of the shareholders.

Taxes. Corporations must file their annual tax returns. Securities. Corporations must issue stock as their security laws and articles of incorporation mandate. Bookkeeping. Board meetings. Meeting minutes. State registration. Licensing.

Minimum number. Corporations must have one or more directors. Residence requirements. Nebraska does not have a provision specifying where directors must reside. Age requirements. Inclusion in the Articles of Incorporation.

The California professional corporation bylaws were created to provide services in professions that require a state license in order to practice.The bylaws may be for either a C corporation or an S corporation.

A limited liability company (LLC) is not required to have bylaws. Bylaws, which are only relevant to businesses structured as corporations, include rules and regulations that govern a corporation's internal management.Alternatively, LLCs create operating agreements to provide a framework for their businesses.

To form your own corporation, you must take these essential steps.File formal paperwork, usually called "articles of incorporation," and pay a filing fee that ranges from $100 to $800, depending on the state where you incorporate. Create corporate bylaws, which lay out the operating rules for your corporation.

A professional corporation is a variation of the corporate form available to entrepreneurs who provide professional servicessuch as doctors, lawyers, accountants, consultants, and architects.In a professional corporation, the owners perform services for the business as employees.

A professional corporation is a variation of the corporate form available to entrepreneurs who provide professional servicessuch as doctors, lawyers, accountants, consultants, and architects.In a professional corporation, the owners perform services for the business as employees.