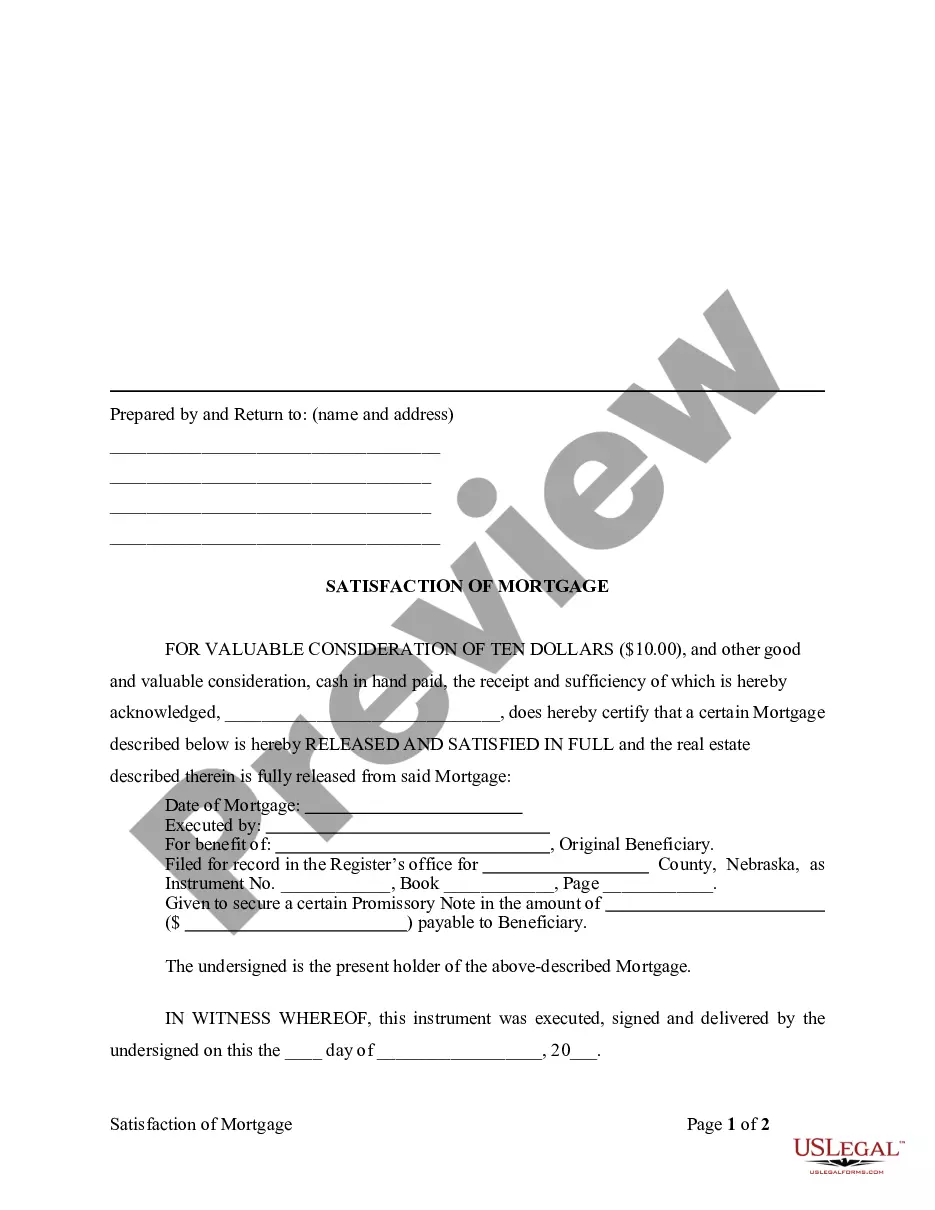

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Release of Mortgage - Corporation (Category: Mortgages and Deeds of Trust), can be used in the transfer process or related task. You can adapt the language to fit your circumstances. This form is available for download now in standard format(s).

Nebraska Release of Mortgage by Corporation

Description

How to fill out Nebraska Release Of Mortgage By Corporation?

Avoid pricey attorneys and find the Nebraska Release of Mortgage by Corporation you want at a affordable price on the US Legal Forms site. Use our simple categories functionality to search for and download legal and tax documents. Go through their descriptions and preview them well before downloading. In addition, US Legal Forms provides users with step-by-step tips on how to download and complete every single form.

US Legal Forms customers merely must log in and get the particular form they need to their My Forms tab. Those, who haven’t got a subscription yet must follow the tips below:

- Ensure the Nebraska Release of Mortgage by Corporation is eligible for use where you live.

- If available, look through the description and use the Preview option prior to downloading the sample.

- If you’re confident the document suits you, click on Buy Now.

- If the form is wrong, use the search engine to find the right one.

- Next, create your account and choose a subscription plan.

- Pay by credit card or PayPal.

- Select download the document in PDF or DOCX.

- Click on Download and find your template in the My Forms tab. Feel free to save the form to your gadget or print it out.

After downloading, it is possible to fill out the Nebraska Release of Mortgage by Corporation manually or an editing software. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Form popularity

FAQ

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

A reconveyance is the official transfer of the property title after the mortgage has been paid in full. The processing time can vary based on the county in which the property is located and can take up to three months. You will need to contact your county for questions on their specific processing time.

Reconveyance is the transfer of a title to the borrower after a mortgage has been fully paid.

A deed of reconveyance refers to a document that transfers the title of a property to the borrower from the bank or mortgage holder once a mortgage is paid off. It is used to clear the deed of trust from the title to the property.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

A mortgage holder issues a deed of reconveyance to indicate that the borrower has been released from the mortgage debt. The deed transfers the property title from the lender, also called the beneficiary, to the borrower. This document is most commonly used when a mortgage has been paid in full.

When a borrower prepays their mortgage or makes the final mortgage payment, a satisfaction of mortgage document must be prepared, signed, and filed by the financial institution in ownership of the mortgage. The satisfaction of mortgage document is created by a lending institution and their legal counsel.

Reconveyance Fee: When you refinance your mortgage, expect to pay a number of fees. A loan reconveyance fee is a typical charge when you refinance a mortgage.The overall fee covers the cost of removing your current lender's lien from your property title and have it be recorded at the County Recorder's office.

When you pay off your loan and you have a mortgage, the lender will send you or the local recorder of deeds or office that handles the filing of real estate documents a release of mortgage.On the other hand, when you have a trust deed or deed of trust, the lender files a release deed.