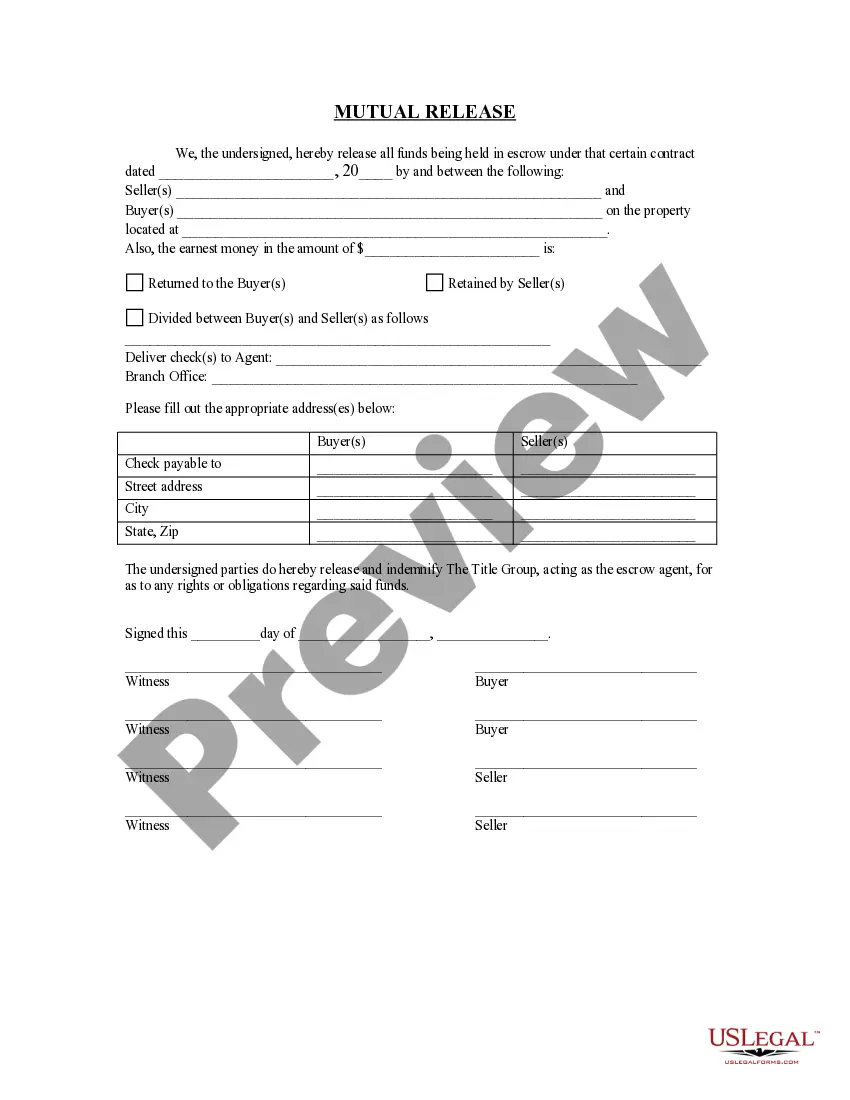

This form is a simple Escrow Release, by which the parties to a transaction having previously hired an escrow agent to perform certain tasks release the agent from service following the completion of tasks and satisfaction of escrow agreement. Adapt to fit your circumstances.

Nebraska Escrow Release

Instant download

Description

How to fill out Escrow Release?

Selecting the appropriate legal document format can be quite challenging.

Certainly, there are numerous templates accessible online, but how can you discover the legal form you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Nebraska Escrow Release, that can cater to both business and personal needs.

You can review the form using the Review button and examine the form description to confirm it is suitable for you.

- All templates are reviewed by professionals and comply with state and federal regulations.

- If you are currently registered, Log In to your account and click the Acquire button to obtain the Nebraska Escrow Release.

- Use your account to browse through the legal documents you have previously purchased.

- Visit the My documents tab in your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple steps.

- First, ensure that you have selected the correct form for your city/area.