Nebraska Corporate Resolution for SBA Loan

Description

How to fill out Corporate Resolution For SBA Loan?

You might spend hours online looking for the authentic format that meets the federal and state regulations you need.

US Legal Forms offers thousands of authentic templates that are reviewed by experts.

You can easily download or print the Nebraska Corporate Resolution for SBA Loan from my service.

First, make sure that you have selected the correct format for the area/city of your preference. Review the form description to confirm you have picked the right one. If available, use the Preview option to view the format as well. If you wish to find another version of the form, use the Search section to locate the format that suits your needs and preferences. Once you have found the format you want, click Purchase now to proceed. Select the pricing plan you wish, input your details, and register for an account on US Legal Forms. Complete the purchase. You may use your credit card or PayPal account to pay for the authentic form. Choose the format of the file and download it to your device. Make edits to your document if necessary. You can complete, modify, sign, and print the Nebraska Corporate Resolution for SBA Loan. Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of authentic formats. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can sign in and click the Download button.

- After that, you can complete, modify, print, or sign the Nebraska Corporate Resolution for SBA Loan.

- Each authentic format you acquire is yours permanently.

- To obtain another copy of the downloaded form, go to the My documents section and click the associated option.

- If you’re using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

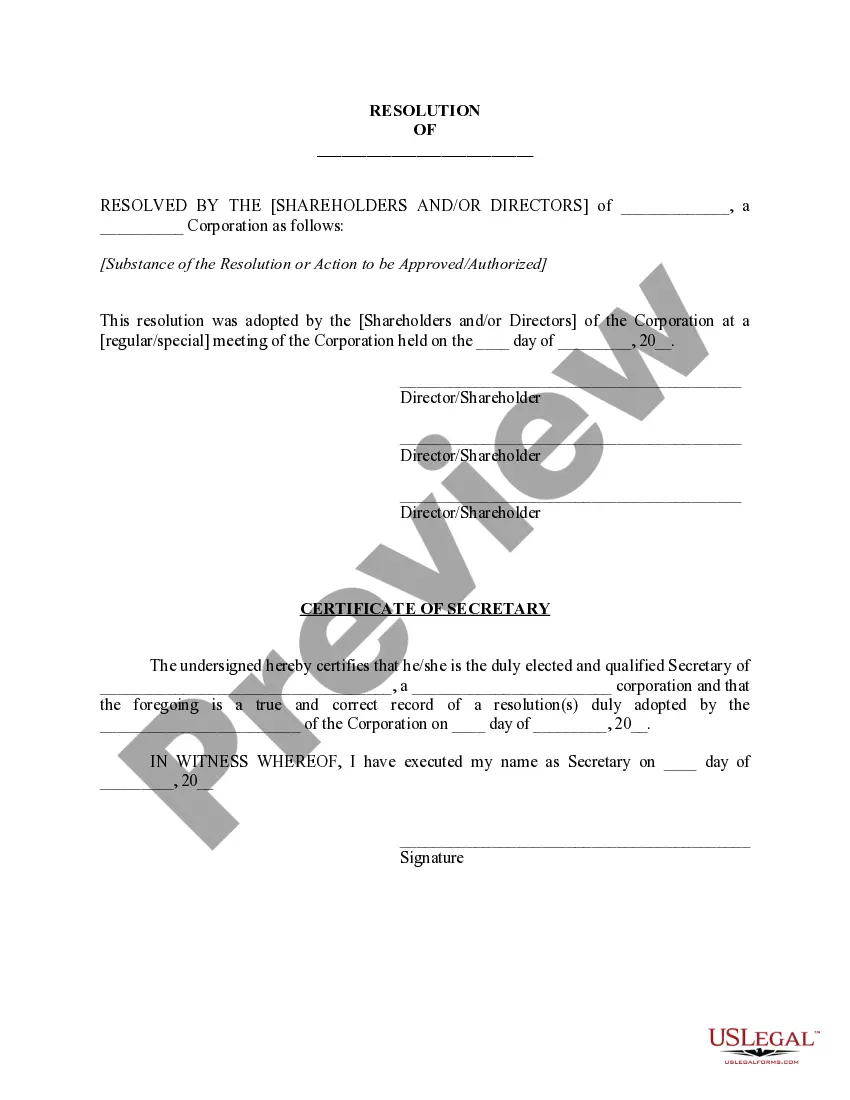

A corporate resolution is a document that formally records the important binding decisions into which a company enters. These decisions are made by such stakeholders as the corporation's managers, directors, officers or owners.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

A board resolution, also sometimes called a corporate resolution, is a formal document that makes a statement about an issue that is so important that the board wants to have a record of it. A resolution is a document stands as a record if compliance comes in to question.

Issuing corporate resolutions is one way for corporations to demonstrate independence and avoid piercing the veil. In fact, all states require C-corporations and S-corporations to issue corporate resolutions to document important board of director decisions.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

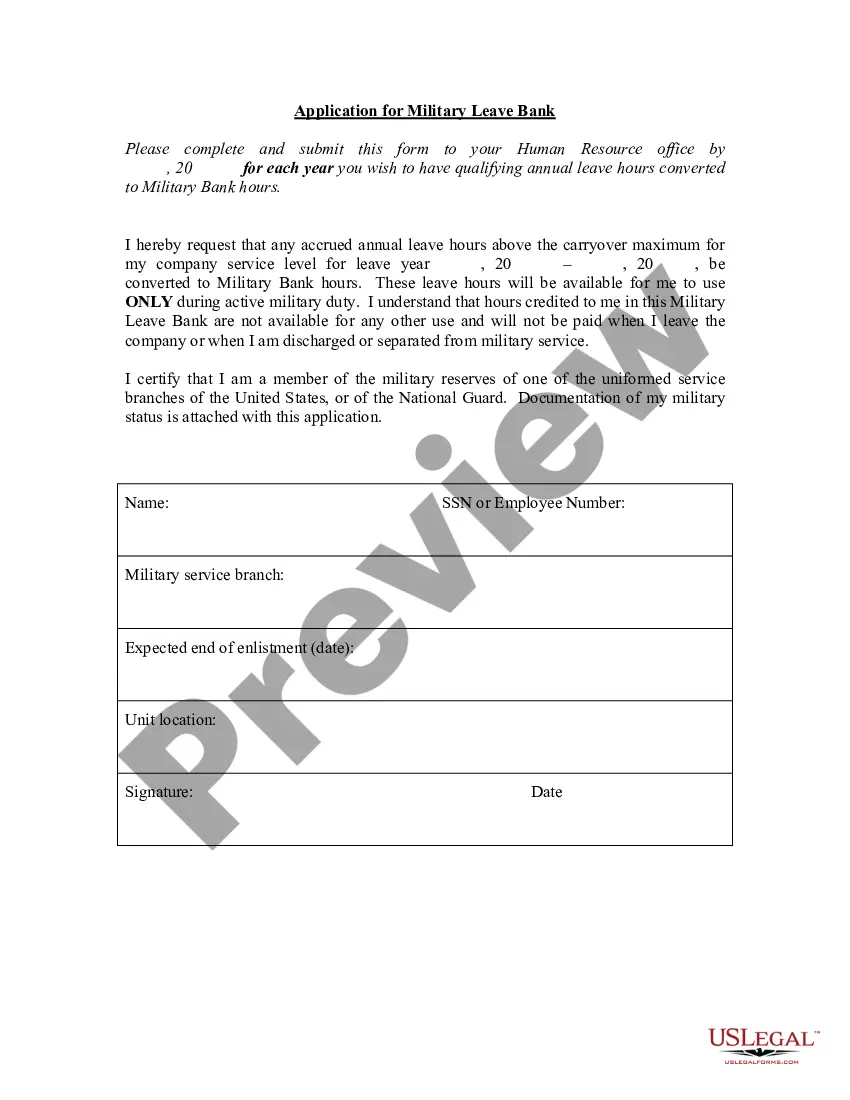

What is the resolution of the board of directors SBA?Organization name.Minimum and maximum loan amounts.These officers' names, titles, and signatures.When and where the Resolution took place.That meeting's exact date.Signature of the secretary attesting to the genuineness of signatures and names provided by officers.18-Aug-2021

By way of example, corporate resolutions are typically required in order for a company to open bank accounts, execute contracts, lease equipment or facilities, and many more situations where the corporation's ownership or directors must be in agreement in order to transact business.

A resolution might outline the officers that are authorized to act (trade, assign, transfer or hedge securities and other assets) on behalf of the corporation. The resolution would outline who is authorized to open a bank account, withdraw money, and write checks.

A corporate resolution is typically found in the board meeting minutes, although its form and structure can vary.

The resolution of board of directors is the convenient form that satisfies this requirement. The completed form signifies that the board of directors is aware of the fact that the finances are requested, of the exact sum, and has authorized the organization indicated in the document to receive funds.