Nebraska Minutes of Meeting of the Directors regarding Bank Loan

Description

How to fill out Minutes Of Meeting Of The Directors Regarding Bank Loan?

If you want to comprehensive, download, or print out legitimate document layouts, use US Legal Forms, the most important assortment of legitimate kinds, which can be found online. Make use of the site`s basic and convenient look for to find the paperwork you require. Numerous layouts for business and individual reasons are sorted by categories and suggests, or search phrases. Use US Legal Forms to find the Nebraska Minutes of Meeting of the Directors regarding Bank Loan with a couple of clicks.

Should you be already a US Legal Forms customer, log in for your account and then click the Down load option to have the Nebraska Minutes of Meeting of the Directors regarding Bank Loan. You can also access kinds you formerly saved in the My Forms tab of the account.

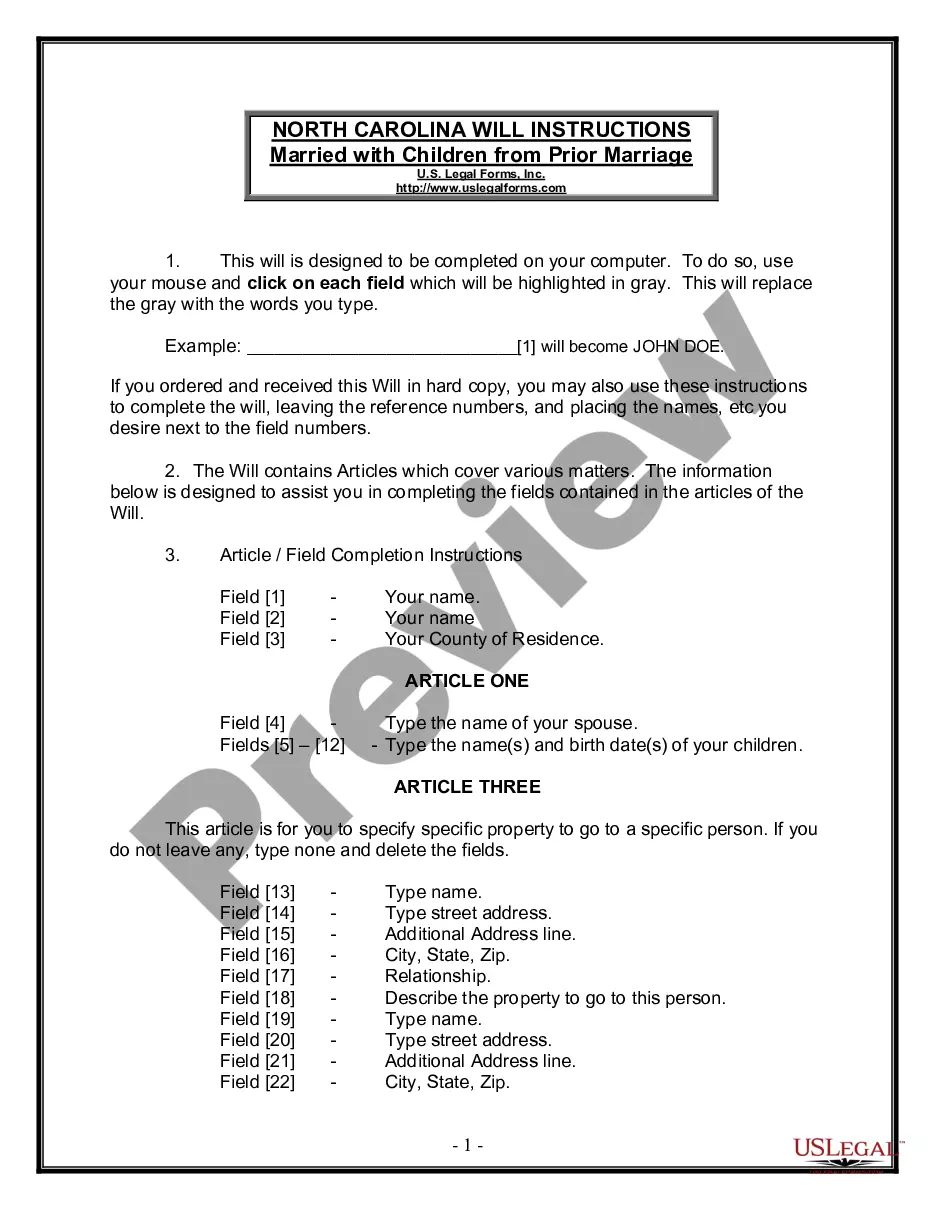

If you use US Legal Forms initially, follow the instructions listed below:

- Step 1. Be sure you have selected the form for the right metropolis/country.

- Step 2. Make use of the Review option to look through the form`s content material. Do not overlook to read the description.

- Step 3. Should you be not happy using the kind, use the Lookup industry near the top of the screen to get other types in the legitimate kind format.

- Step 4. Once you have discovered the form you require, click the Acquire now option. Choose the prices program you prefer and add your qualifications to register for an account.

- Step 5. Approach the purchase. You can use your charge card or PayPal account to complete the purchase.

- Step 6. Find the structure in the legitimate kind and download it on the system.

- Step 7. Complete, modify and print out or signal the Nebraska Minutes of Meeting of the Directors regarding Bank Loan.

Every legitimate document format you buy is the one you have eternally. You might have acces to each kind you saved in your acccount. Select the My Forms section and decide on a kind to print out or download once again.

Be competitive and download, and print out the Nebraska Minutes of Meeting of the Directors regarding Bank Loan with US Legal Forms. There are many skilled and express-particular kinds you can use to your business or individual demands.

Form popularity

FAQ

Resolution Loan means any loan or other arrangement under which the Recapitalisation Fund lends or contributes funds to the Resolution Fund, and which is made using Financial Assistance provided to the Recapitalisation Fund (whether directly from ESM or indirectly via the Beneficiary Member State), for the purposes of ...

A corporate resolution that authorizes borrowing on a line of credit is often referred to a borrowing resolution. This resolution indicates that the members (LLC) or Board of Directors (Corporation) have held a meeting and conducted a vote allowing the company to borrow a specific loan amount.

Financial institutions help keep capitalist economies running by matching people who need funds with those who can lend or invest it. They offer a wide range of business operations within the financial services sector including banks, credit unions, insurance companies, and brokerage firms.

The Board will review and approve (a) the Bank's strategic goals and objectives, as proposed by management, and use those goals and objectives, among other criteria, to evaluate the Bank's performance, (b) the Bank's annual budget, and monitor the Bank's performance against the budget, and (c) on an on-going basis, ...

A board resolution is a document that formalises important decisions made by the board of directors and the actions relating to them. It is legally binding and functions as a compliance record to provide evidence of decisions made by the board regarding pivotal company matters.

When you create a resolution to open a bank account, you need to include the following information: The legal name of the corporation. The name of the bank where the account will be created. The state where the business is formed. Information about the directors/members.

The banking resolution document is drafted and adopted by a company's members or Board of Directors to define the relationship, responsibilities and privileges that the members or directors maintain with respect to the company's banking needs.