The Nebraska Assumption Agreement of Loan Payments is a legal document that outlines the process by which a borrower transfers their loan payment responsibility to another individual or entity. This agreement is commonly used in real estate transactions where a current homeowner wants to transfer their mortgage loan to a new buyer. The Nebraska Assumption Agreement of Loan Payments serves as a legally binding contract that details the terms and conditions of the assumption. It typically includes the original loan details, such as the loan amount, interest rate, repayment terms, and any applicable fees. This agreement outlines the responsibilities and obligations of both the original borrower (also known as the "assumed" or "mortgagor") and the new borrower (also known as the "assumed" or "mortgagee"). The assumed agrees to take on the loan payments and fulfill all obligations under the original loan terms. The mortgagor, on the other hand, provides their consent to the transfer and may be released from any further liability for the loan. It is important to note that an assumption agreement does not release the original borrower from their legal obligations unless the lender explicitly releases them from liability. The new borrower assumes all responsibilities for the loan, including payment of the remaining balance, interest, and any applicable fees. This agreement is subject to the lender's approval, and they may require certain qualifications and creditworthiness from the potential new borrower. In Nebraska, there are various types of Assumption Agreement of Loan Payments, such as: 1. Simple Assumption: In this type of assumption, the new borrower assumes the loan payment obligations without any changes to the original loan terms. The interest rate, repayment period, and other conditions remain the same. 2. Assumption with Novation: This type of assumption agreement involves replacing the original loan contract with a new one. The new borrower negotiates new loan terms, such as interest rate and repayment terms, with the lender. 3. Qualified Assumption: A qualified assumption occurs when the new borrower meets specific qualifications set by the lender. These qualifications may include creditworthiness, income stability, and other criteria set by the lender. Whether you are a potential new borrower or an original borrower considering an assumption agreement, it is crucial to thoroughly review the terms and conditions outlined in the document. Consulting with a legal professional specializing in real estate law is highly recommended ensuring all legal requirements are met, and both parties are adequately protected. In conclusion, the Nebraska Assumption Agreement of Loan Payments is a vital document facilitating the transfer of loan payment responsibilities from one individual to another. It protects the interests of both the original borrower and the new borrower, setting out the terms and conditions of the assumption. Various types of assumption agreements exist, including simple assumption, assumption with novation, and qualified assumption. Seek legal counsel to navigate the complexities of this agreement and ensure a smooth and lawful process.

Nebraska Assumption Agreement of Loan Payments

Description

How to fill out Nebraska Assumption Agreement Of Loan Payments?

Finding the right legitimate document design can be quite a have difficulties. Obviously, there are a variety of themes available on the net, but how can you get the legitimate type you will need? Utilize the US Legal Forms web site. The support gives thousands of themes, for example the Nebraska Assumption Agreement of Loan Payments, which can be used for enterprise and private requirements. Every one of the kinds are examined by experts and meet up with state and federal specifications.

In case you are presently signed up, log in to the profile and click on the Download switch to have the Nebraska Assumption Agreement of Loan Payments. Utilize your profile to check throughout the legitimate kinds you might have acquired previously. Visit the My Forms tab of the profile and get yet another duplicate of the document you will need.

In case you are a fresh consumer of US Legal Forms, allow me to share straightforward recommendations so that you can adhere to:

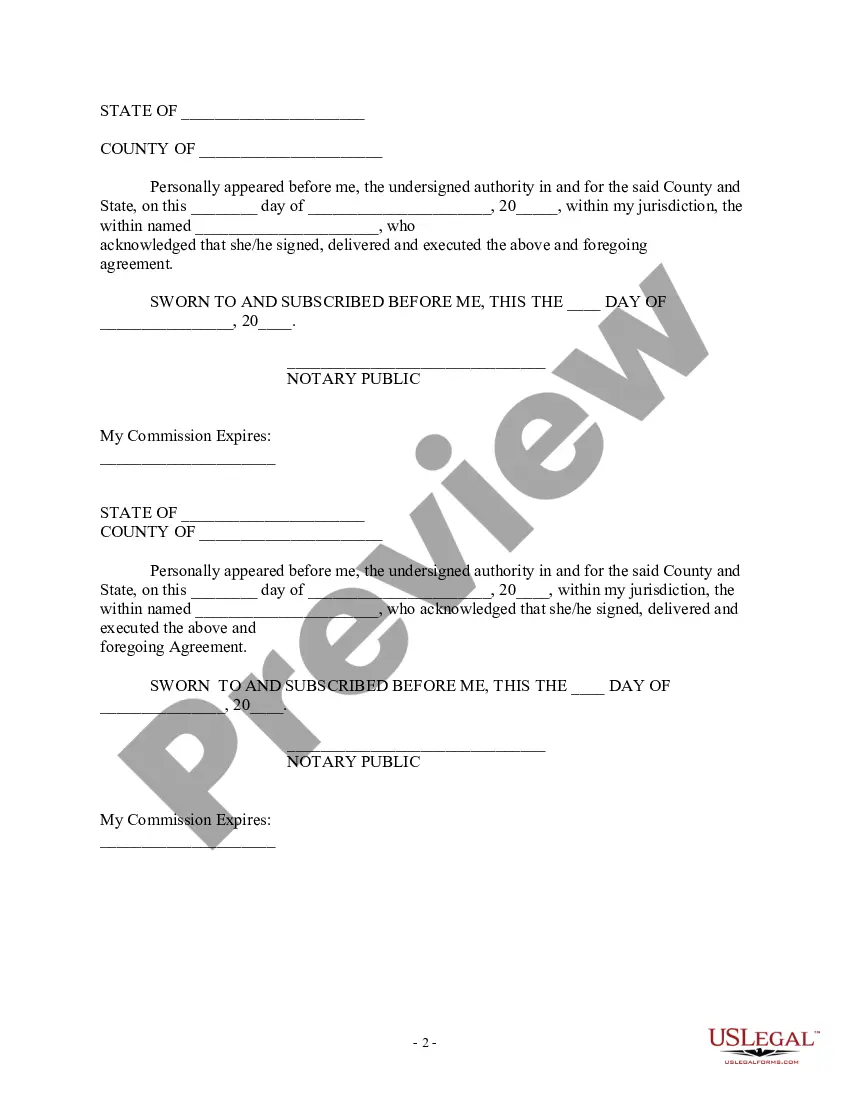

- Initially, ensure you have chosen the correct type for the metropolis/county. You can check out the form while using Review switch and study the form information to make sure it will be the best for you.

- In the event the type is not going to meet up with your preferences, use the Seach field to discover the correct type.

- When you are certain that the form would work, click on the Buy now switch to have the type.

- Opt for the prices program you would like and type in the necessary details. Make your profile and pay for the order making use of your PayPal profile or Visa or Mastercard.

- Select the document file format and down load the legitimate document design to the product.

- Full, modify and printing and sign the obtained Nebraska Assumption Agreement of Loan Payments.

US Legal Forms will be the greatest catalogue of legitimate kinds where you can see a variety of document themes. Utilize the service to down load expertly-made papers that adhere to express specifications.