A Nebraska Buy Sell or Stock Purchase Agreement Covering Common Stock in a Closely Held Corporation with Option to Fund Purchase through Life Insurance is a legal contract that outlines the terms and conditions for the purchase and sale of shares of common stock in a closely held corporation located in Nebraska. This agreement includes a provision for funding the purchase through life insurance proceeds. Keywords: 1. Nebraska: This refers to the location of the closely held corporation and indicates that the agreement follows the laws and regulations of Nebraska. 2. Buy Sell Agreement: This refers to an agreement that governs the buyout of a shareholder's interest in a corporation. 3. Stock Purchase Agreement: This indicates that the agreement covers the purchase and sale of shares of common stock. 4. Common Stock: This refers to the type of stock being purchased and sold, typically representing ownership in the corporation. 5. Closely Held Corporation: This describes a corporation with a limited number of shareholders, often including close family members or a small group of individuals. 6. Option to Fund Purchase: This indicates that the agreement provides the option to finance the stock purchase using a specific method, which in this case is through life insurance. 7. Life Insurance: This refers to a contract between an individual and an insurance company, where the individual pays regular premiums in exchange for a death benefit that would be paid out to the named beneficiaries upon the individual's death. Different types of Nebraska Buy Sell or Stock Purchase Agreements Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance may include variations in terms and specific provisions based on the desires and needs of the parties involved. These variations might include different methods of determining the purchase price of the stock (e.g., agreed-upon value, book value, or independent appraisal), different terms for funding the purchase (e.g., through installment payments or a lump-sum payment), and different triggers for the agreement to take effect (e.g., death, disability, or retirement).

Nebraska Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance

Description

How to fill out Nebraska Buy Sell Or Stock Purchase Agreement Covering Common Stock In Closely Held Corporation With Option To Fund Purchase Through Life Insurance?

Are you presently in a place that you need paperwork for possibly enterprise or specific reasons virtually every day time? There are plenty of legal document templates available online, but finding versions you can rely is not straightforward. US Legal Forms delivers a large number of kind templates, much like the Nebraska Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance, which can be created in order to meet state and federal demands.

In case you are previously knowledgeable about US Legal Forms web site and have a free account, just log in. Afterward, you can download the Nebraska Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance design.

Unless you come with an profile and want to begin using US Legal Forms, follow these steps:

- Get the kind you want and make sure it is for your proper area/area.

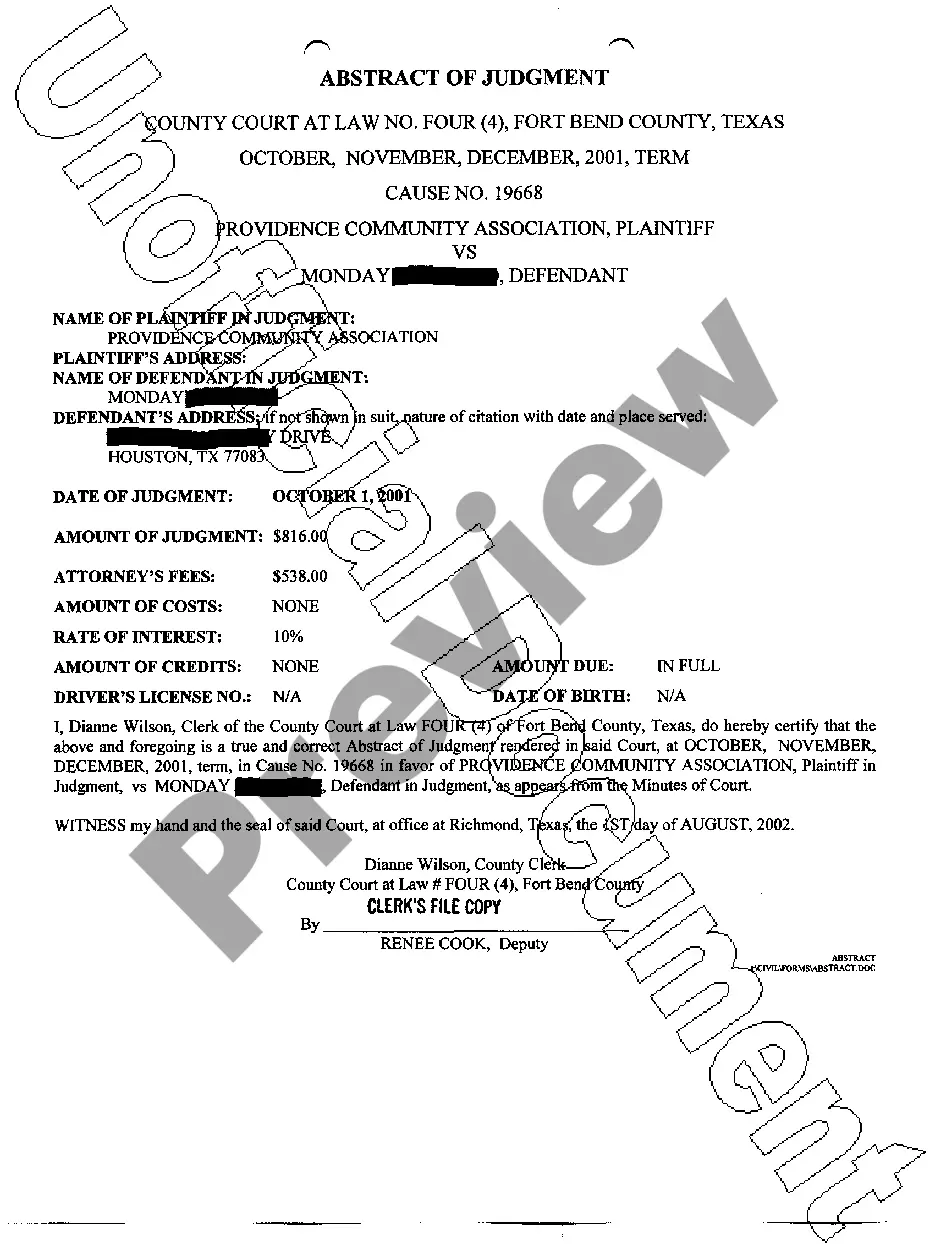

- Use the Preview button to analyze the shape.

- Browse the description to ensure that you have selected the correct kind.

- In case the kind is not what you`re searching for, take advantage of the Research field to get the kind that meets your needs and demands.

- If you get the proper kind, just click Acquire now.

- Choose the prices program you want, submit the specified info to produce your money, and buy an order utilizing your PayPal or bank card.

- Select a convenient paper structure and download your duplicate.

Get each of the document templates you may have purchased in the My Forms menus. You can get a additional duplicate of Nebraska Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance anytime, if possible. Just click the needed kind to download or print the document design.

Use US Legal Forms, probably the most comprehensive assortment of legal kinds, to save time as well as avoid faults. The support delivers expertly created legal document templates that you can use for an array of reasons. Create a free account on US Legal Forms and initiate generating your life a little easier.