Nebraska Corporation — Consent by Shareholders refers to the legal process through which shareholders of a Nebraska corporation collectively grant their approval or consent to certain corporate actions or decisions. This consent is usually obtained to waive certain corporate formalities, such as the need for a formal shareholders' meeting or unanimous written consent. The process of obtaining consent by shareholders is governed by the Nebraska Business Corporation Act (NBCA) and the corporation's bylaws. It is essential for corporations to follow the specific requirements outlined by these laws and regulations to ensure the validity of the consent. There are two main types of consent by shareholders in Nebraska: 1. Consent by Shareholders' Meeting: This type of consent is obtained when a majority of the shareholders attend a formal meeting and vote in favor of a proposed action or decision. The meeting should be properly noticed, and the voting process should adhere to the statutory requirements. The shareholders' meeting can either be physical or virtual, depending on the corporation's bylaws and the specific circumstances. 2. Consent by Written Consent of Shareholders: This type of consent eliminates the need for a physical meeting and allows shareholders to provide their consent in writing. Nebraska's law requires unanimous written consent for certain actions, such as mergers, amendments to the articles of incorporation, or dissolution. However, for routine matters, only a majority or super majority consent may be required, as specified in the bylaws or the NBCA. Shareholders can submit their written consent in person, by mail, or electronically, as permitted by state laws and the corporation's governing documents. Both types of consent require proper documentation to record the shareholders' approval, which usually takes the form of resolutions or written consent agreements. These documents should clearly state the nature of the action or decision being consented to, the date of consent, and the names of the consenting shareholders. Additionally, the consent should be maintained in the corporation's records and made available for inspection by shareholders and regulatory authorities. Compliance with Nebraska Corporation — Consent by Shareholders is crucial to ensure that corporate actions comply with legal requirements, protect shareholder rights, and maintain the validity of the corporation's decisions. It is recommended that corporations consult legal professionals familiar with Nebraska corporate laws to correctly navigate this complex process and ensure compliance with all applicable regulations.

Nebraska Corporation - Consent by Shareholders

Description

How to fill out Nebraska Corporation - Consent By Shareholders?

Are you in a situation where you will require documents for potentially corporate or personal purposes nearly every business day? There are numerous legitimate document templates available online, but finding those you can trust isn’t straightforward.

US Legal Forms offers a plethora of form templates, such as the Nebraska Corporation - Consent by Shareholders, which are crafted to comply with both federal and state regulations.

If you are already familiar with the US Legal Forms site and possess an account, simply Log In. Then, you can acquire the Nebraska Corporation - Consent by Shareholders template.

Access all the document templates you have purchased in the My documents section. You can retrieve an additional copy of the Nebraska Corporation - Consent by Shareholders at any time if needed. Simply click the required form to download or print the document template.

Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid errors. The service offers professionally crafted legal document templates that can be utilized for a variety of purposes. Create an account on US Legal Forms and begin simplifying your life.

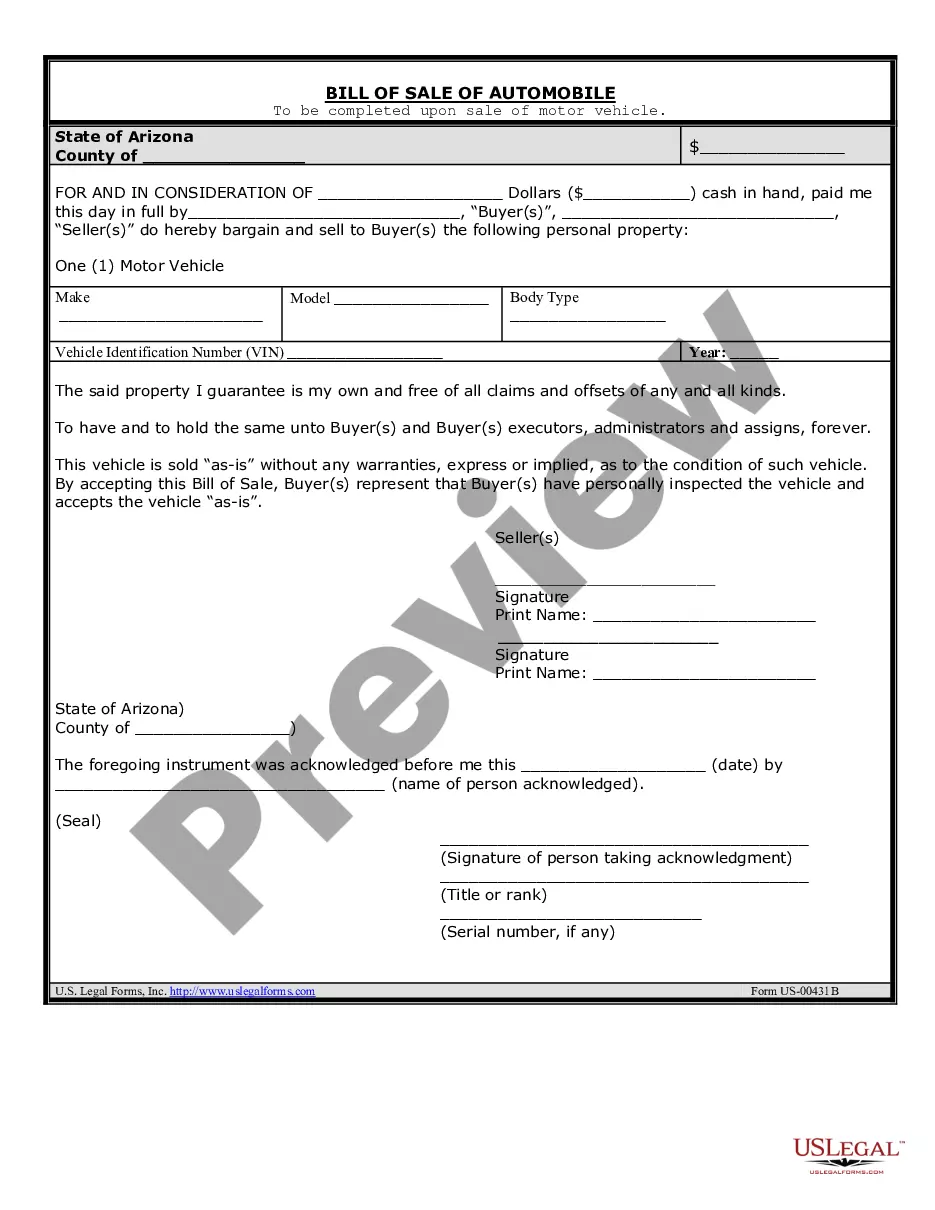

- Select the form you need and ensure it corresponds to the appropriate area/county.

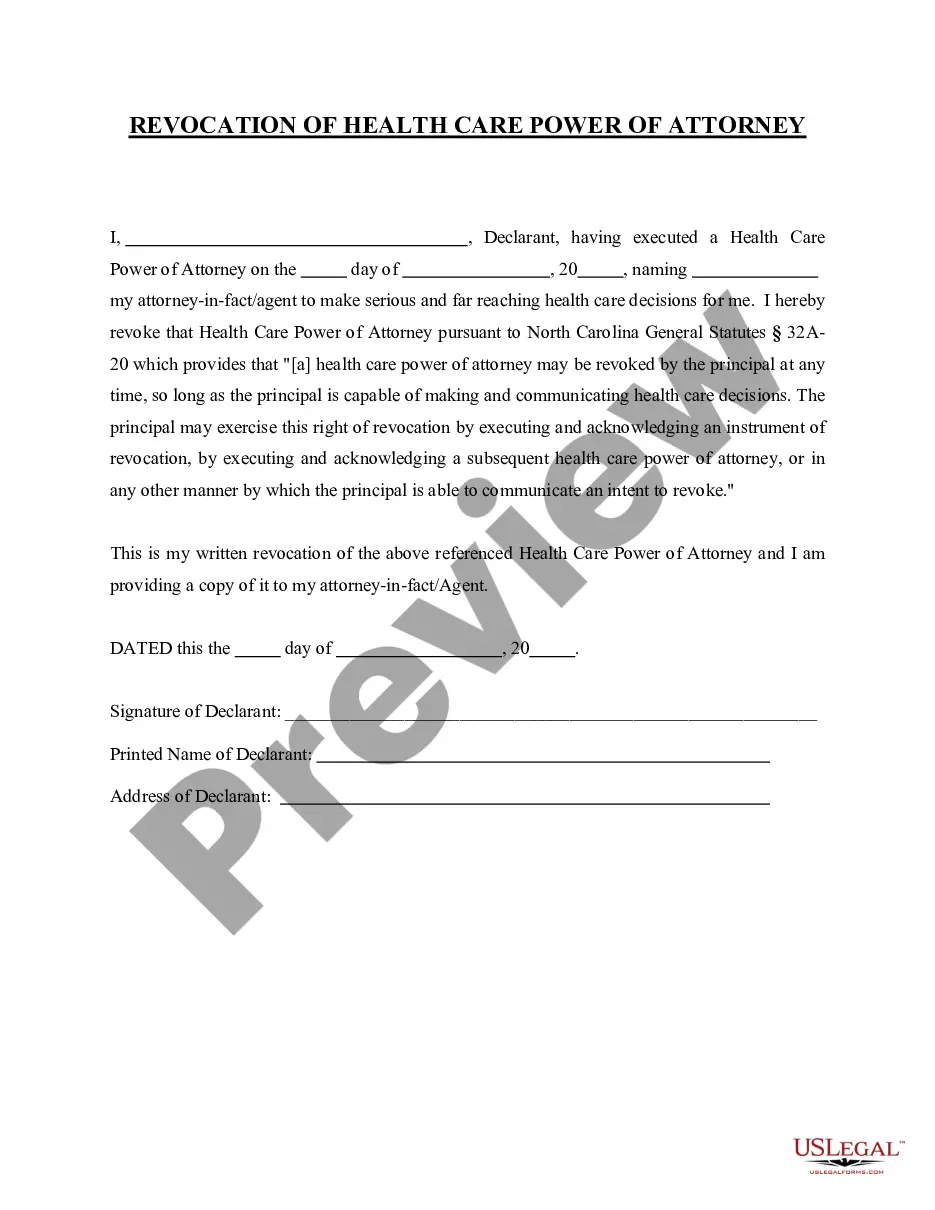

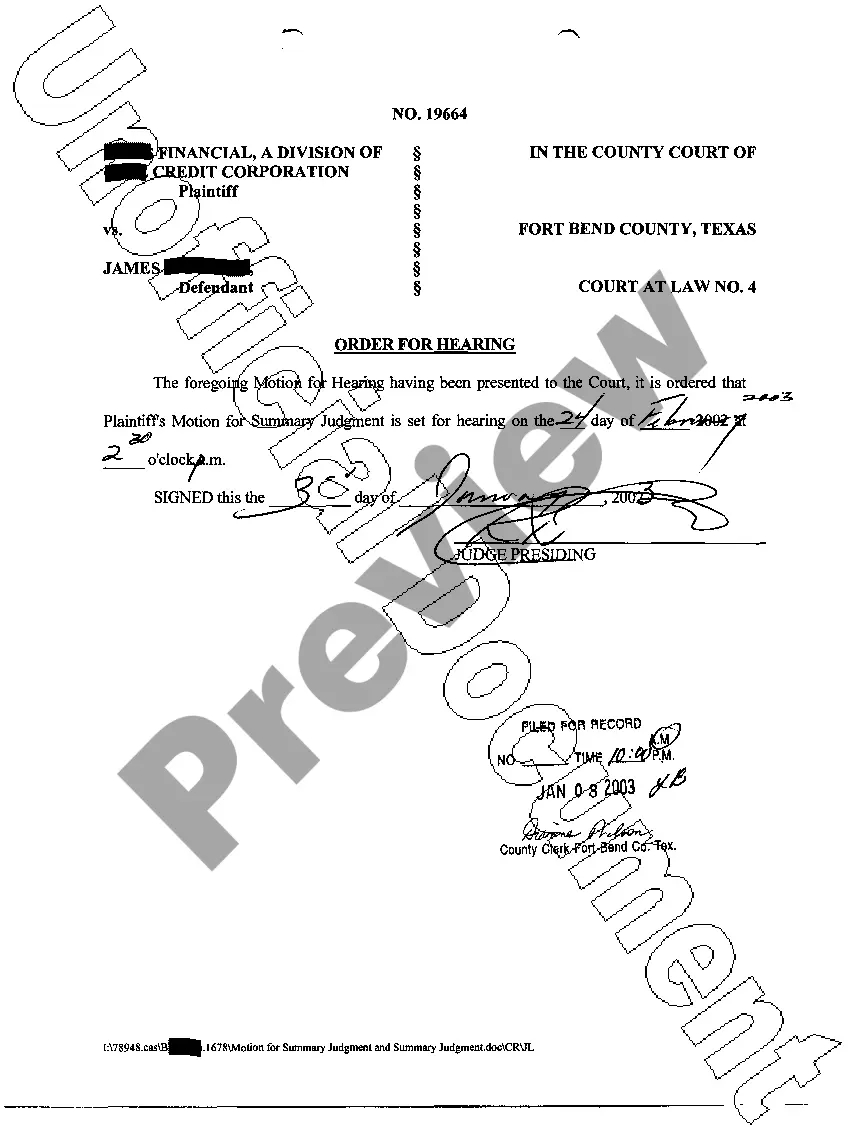

- Utilize the Review button to verify the form.

- Examine the description to ensure you have selected the correct form.

- If the form isn’t what you’re seeking, use the Lookup field to find the form that fits your requirements.

- Once you discover the correct form, click on Purchase now.

- Choose the pricing plan you prefer, complete the required information to create your account, and settle the payment using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

Steps to Becoming a Corporation: Everything You Need to KnowFirst Steps to Forming a Corporation: Choosing a Business Name and Company Directors.Important Documents.The Board of Directors Meeting and Issuing Stock.Last Steps.

South Dakota and Wyoming are the only states that levy neither a corporate income nor gross receipts tax.

Nebraska corporations must keep the following items with their corporate records at the principal business location:The Articles of Incorporation and any amendments.Bylaws.Minutes of director and shareholder meetings.A list of names and business addresses of current directors and officers.Most recent annual report.

The five main characteristics of a corporation are limited liability, shareholder ownership, double taxation, continuing lifespan and, in most cases, professional management.

There are only two rates of corporate income tax, 5.58% and 7.81%. The higher rate is for all corporate income greater than $50,000. The primary policy issue for Nebraska, and other states, is how the income of a multistate enterprise is allocated to Nebraska.

Nebraska's current regime has two corporate income tax rates: 5.58% on state taxable income up to $100,000 and 7.81% on state taxable income over $100,000.

Step 1: Name Your Corporation. Choosing a business name is the first step in starting a corporation.Step 2: Choose a Registered Agent. You must appoint a registered agent when you register your corporation with the state.Step 3: Hold an Organizational Meeting.Step 4: File the Formation Documents.Step 5: Get an EIN.

The life of a corporation begins upon the filing of articles of incorporation with the secretary of state's office....If you're looking into forming a corporation, here are the steps involved.Decide Where to Form Your Company.Choose a name.Choose a Board of Directors.Choose Officers.Designate a Registered Agent.

In order to become an S corporation, the corporation must submit Form 2553 Election by a Small Business Corporation signed by all the shareholders. See the Instructions for Form 2553PDF for all required information and to determine where to file the form.

Basic Steps to Forming a CorporationDecide Where to Form Your Company. You can incorporate in any of the 50 states.Choose a name. In general, the name of a corporation must end with "incorporated," "corporation," or an abbreviation of one of these.Choose a Board of Directors.Choose Officers.Designate a Registered Agent.

Interesting Questions

More info

MEANINGFUL CUSTOMER MANIPULATION CUSTOMER NUANCE MEANINGFUL MISC.