A trust is the legal relationship between one person, the trustee, having an equitable ownership or management of certain property and another person, the beneficiary, owning the legal title to that property. The beneficiary is entitled to the performance of certain duties and the exercise of certain powers by the trustee, which performance may be enforced by a court of equity. Most trusts are founded by the persons (called trustors, settlors and/or donors) who execute a written declaration of trust which establishes the trust and spells out the terms and conditions upon which it will be conducted. The declaration also names the original trustee or trustees, successor trustees or means to choose future trustees.

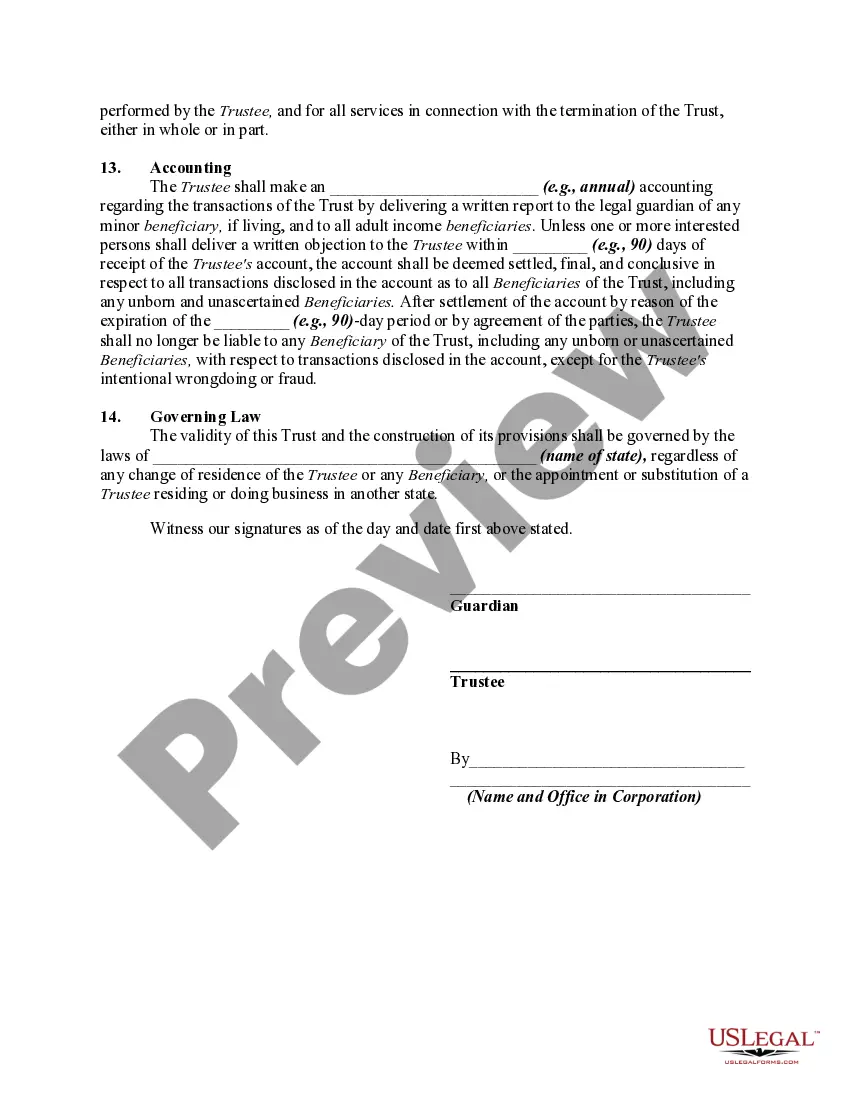

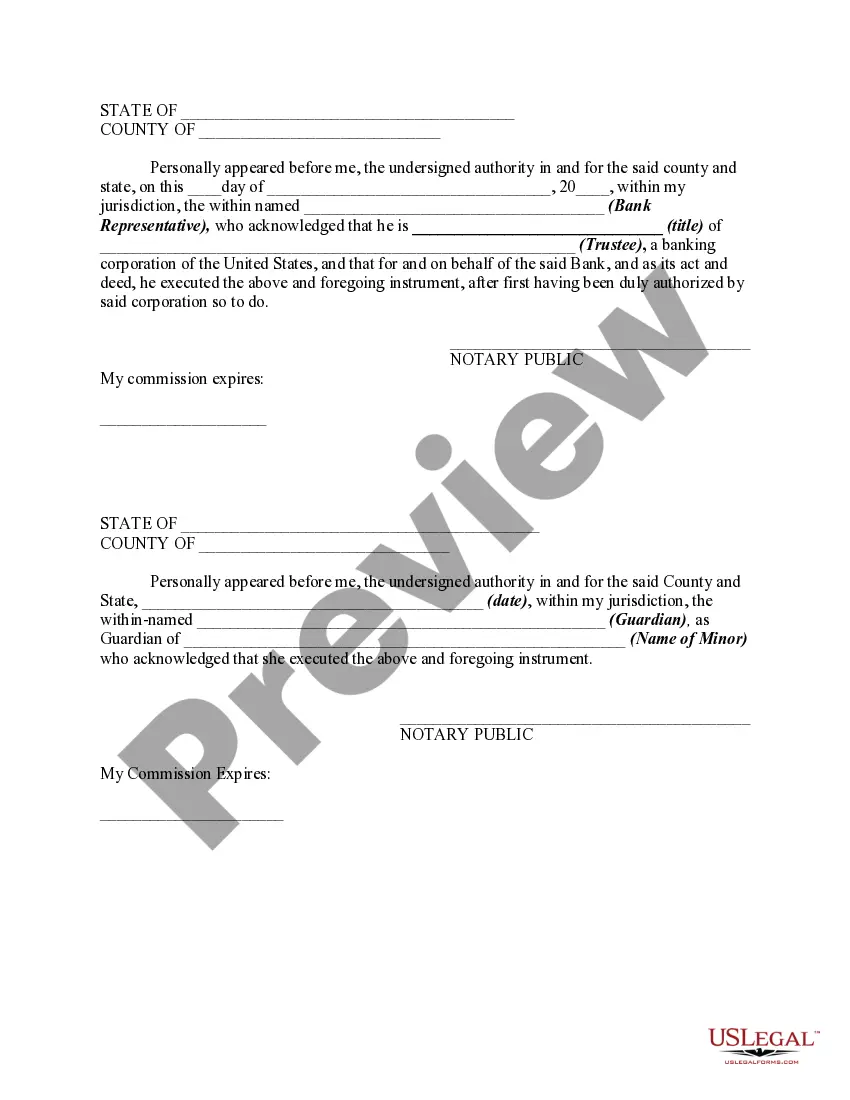

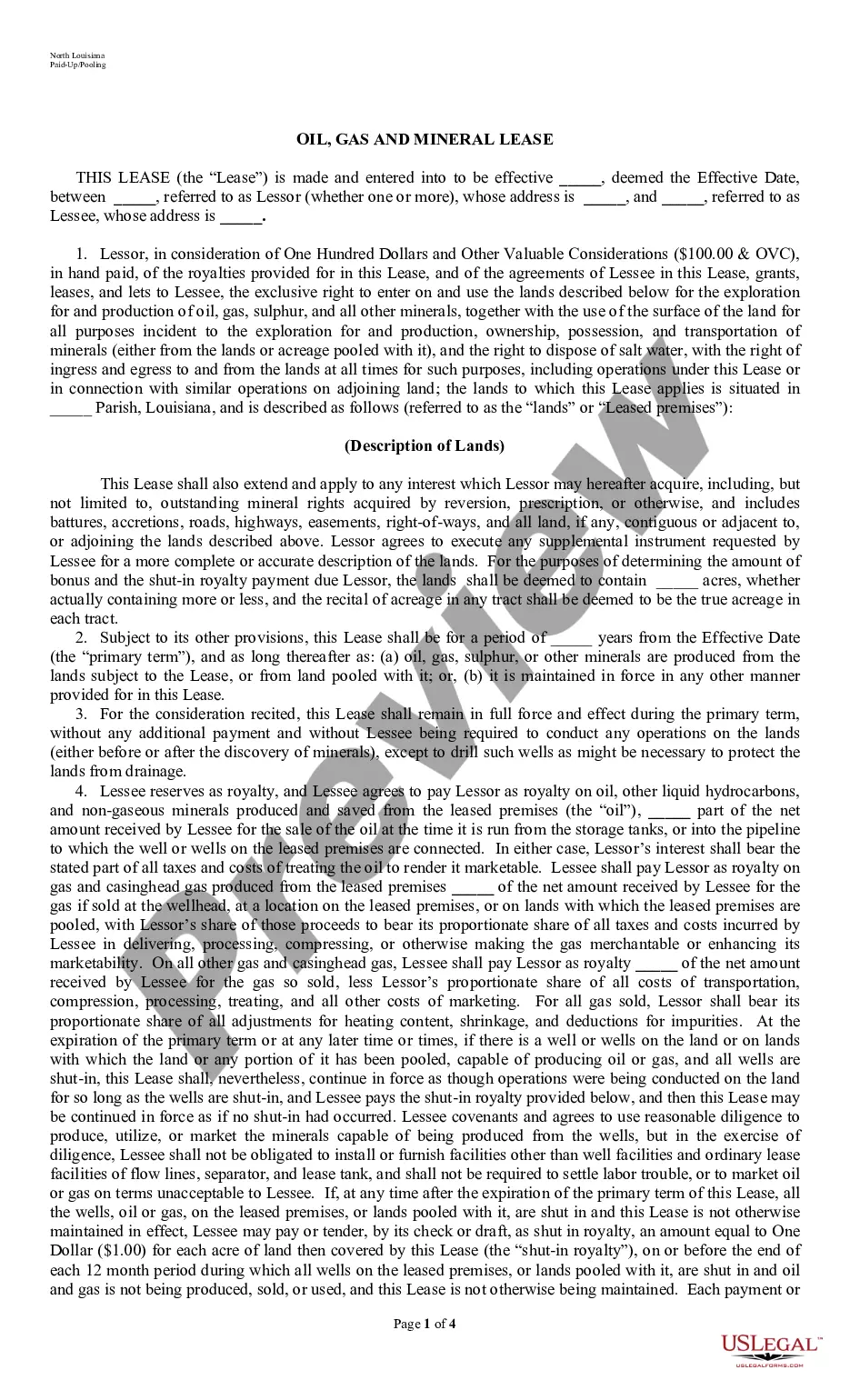

Nebraska Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor In Nebraska, when a minor is involved in a personal injury action and receives a settlement, it is important to establish a trust agreement to hold and manage the funds on behalf of the minor. This arrangement serves to safeguard the minor's interests and ensures that the funds are used for their benefit, which may include medical expenses, education, and other related costs. There are different types of trust agreements that can be used to hold funds for a minor resulting from the settlement of a personal injury action filed on their behalf. These agreements include: 1. Irrevocable Minors' Settlement Trust: This type of trust is established to hold and manage the settlement funds exclusively for the minor. The trust is irrevocable, meaning that once it is created, the terms cannot be altered or terminated without the court's approval. This protects the minor from any potential misuse or misappropriation of the funds. 2. Supplemental Needs Trust: If the minor has special needs or disabilities, a supplemental needs trust may be established. This type of trust allows the settlement funds to be used for the minor's benefit while still maintaining their eligibility for government benefits such as Medicaid or Supplemental Security Income (SSI). The trust is designed to supplement, not replace, the support provided by these programs. 3. Custodial Accounts: Another option is to establish custodial accounts, such as Uniform Gifts to Minors Act (UGA) or Uniform Transfers to Minors Act (TMA) accounts. These accounts are held by a custodian who manages the funds on behalf of the minor until they reach a certain age (typically 18 or 21). Once the minor reaches the age of majority, they gain full control over the funds. Regardless of the type of trust agreement chosen, there are several key provisions that should be included to ensure the minor's best interests are protected. These provisions may include guidelines for the use of funds, investment strategies, limitations on withdrawals, the appointment of a trustee or custodian, and the establishment of a termination date for the trust. In conclusion, a Nebraska Trust Agreement to Hold Funds for a Minor Resulting from the Settlement of a Personal Injury Action is a vital legal tool to safeguard a minor's settlement funds. By establishing the appropriate trust agreement based on the minor's circumstances, their future financial security and well-being can be effectively managed.