Nebraska Oil, Gas and Mineral Royalty Transfer is a legal process that allows owners of oil, gas, and mineral rights in Nebraska to sell their royalty interests to a third party for a lump sum payment. This transfer of royalty rights enables owners to monetize their future royalty streams and immediately access the cash value of their assets. Keywords: Nebraska, oil, gas, mineral, royalty transfer, lump sum payment, rights, monetize, cash value, assets. There are various types of Nebraska Oil, Gas and Mineral Royalty Transfers, which include: 1. Full Royalty Transfer: In this type, the owner sells their entire share of the royalty interest to a buyer. The buyer assumes all future responsibilities and entitlements related to the royalty, such as receiving income and bearing associated costs. 2. Partial Royalty Transfer: Owners can choose to sell only a portion of their royalty interest, retaining a percentage for themselves. This allows them to receive an immediate payment while still benefiting from future royalty income. 3. Term Royalty Transfer: This type involves transferring the royalty interest for a specific period of time. The owner agrees to sell their rights for a fixed duration, usually a set number of years, while the buyer gains the advantage of receiving royalty income during that period. 4. Perpetual Royalty Transfer: Unlike the term transfer, a perpetual royalty transfer involves selling the royalty interest indefinitely. Owners relinquish their entitlement to future royalty income permanently, but receive an upfront sum in return. 5. Multi-Property Royalty Transfer: This type of transfer allows owners with royalty interests in multiple properties to consolidate and sell those interests as a package. It simplifies the process by dealing with one buyer and receiving a lump sum payment for all properties collectively. 6. Overriding Royalty Interest (ORRIS) Transfer: An ORRIS is a royalty interest that is separate from the working interest that typically grants the right to explore and produce oil, gas, or minerals. Owners can transfer their ORRIS to a buyer, providing them a share of the royalties without any exploration or operational obligations. By engaging in Nebraska Oil, Gas and Mineral Royalty Transfers, owners gain immediate financial freedom and flexibility. Whether they prefer a complete or partial transfer, a term or perpetual arrangement, consolidating multiple properties, or selling their ORRIS, these transfer options allow for the conversion of royalty assets into a substantial lump sum payment.

Nebraska Oil, Gas and Mineral Royalty Transfer

Description

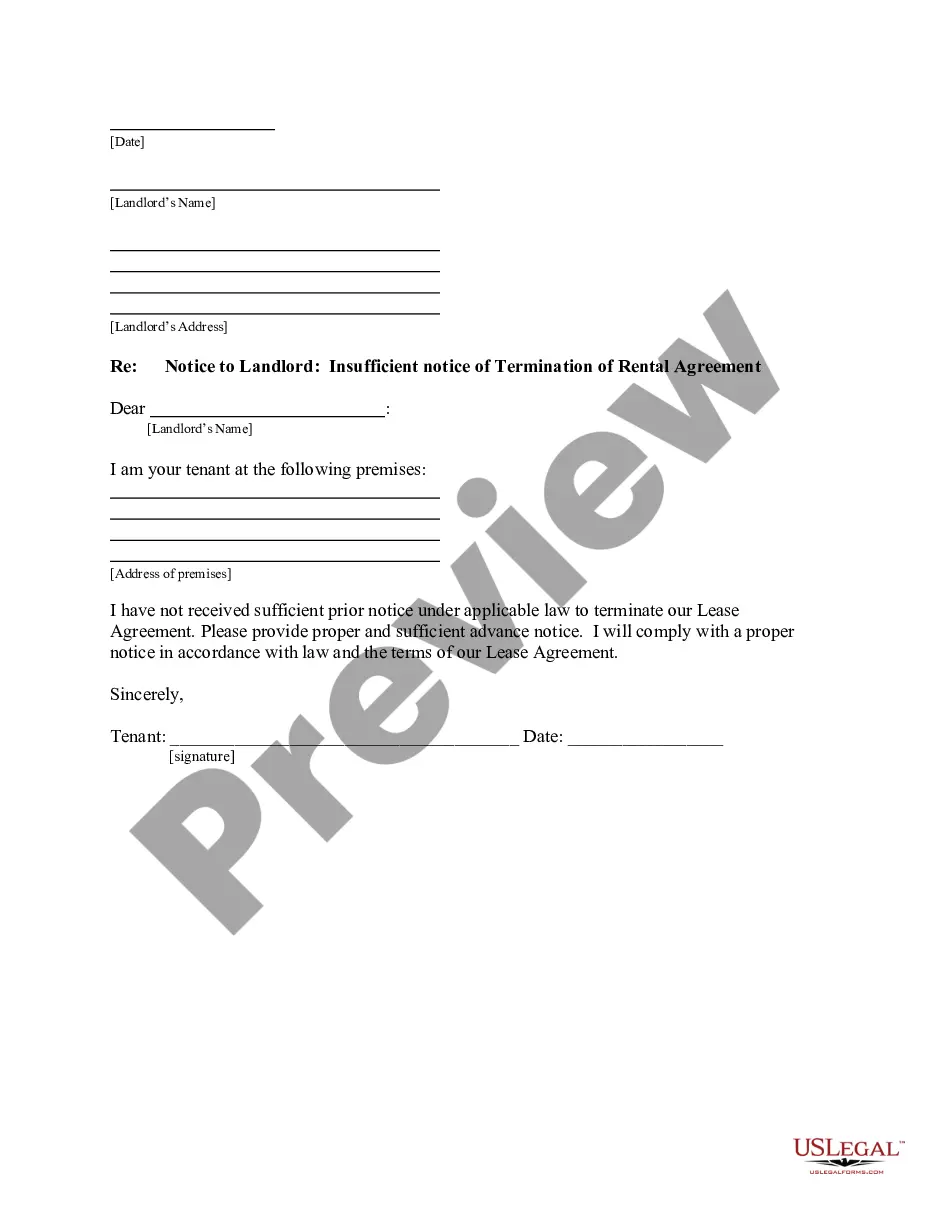

How to fill out Nebraska Oil, Gas And Mineral Royalty Transfer?

Discovering the right lawful papers design might be a struggle. Naturally, there are a lot of templates available on the net, but how will you discover the lawful kind you want? Take advantage of the US Legal Forms site. The support gives 1000s of templates, for example the Nebraska Oil, Gas and Mineral Royalty Transfer, which can be used for organization and personal demands. Every one of the kinds are examined by experts and meet federal and state specifications.

If you are presently signed up, log in to your bank account and then click the Down load button to get the Nebraska Oil, Gas and Mineral Royalty Transfer. Utilize your bank account to check throughout the lawful kinds you have ordered in the past. Visit the My Forms tab of the bank account and obtain an additional copy from the papers you want.

If you are a fresh end user of US Legal Forms, allow me to share simple instructions that you can comply with:

- Very first, ensure you have selected the appropriate kind to your metropolis/state. You are able to look over the form making use of the Preview button and study the form information to guarantee it will be the right one for you.

- If the kind does not meet your expectations, utilize the Seach industry to discover the correct kind.

- When you are positive that the form is suitable, go through the Buy now button to get the kind.

- Pick the prices prepare you desire and type in the necessary information and facts. Make your bank account and pay money for the order using your PayPal bank account or bank card.

- Pick the data file file format and obtain the lawful papers design to your gadget.

- Complete, revise and print and indicator the attained Nebraska Oil, Gas and Mineral Royalty Transfer.

US Legal Forms is definitely the biggest local library of lawful kinds where you will find a variety of papers templates. Take advantage of the service to obtain appropriately-produced documents that comply with state specifications.

Form popularity

FAQ

Currently, most of the producing mineral rights in Nebraska originate from the production of crude oil. There is very little production of natural gas in Nebraska.

There are 5 steps to remove a name from the property deed: Discuss property ownership interests. ... Access a copy of your title deed. ... Complete, review and sign the quitclaim or warranty form. ... Submit the quitclaim or warranty form. ... Request a certified copy of your quitclaim or warranty deed.

If you sign a mineral rights lease, then you are on your way to earning oil and gas royalties. As a mineral rights owner, you can receive royalty compensation. This is from the sale of crude oil, natural gas, and other valuable resources found on your property.

The most common way is through a will or estate plan. When the mineral rights owner dies, their heirs will become the new owners. Another way to transfer mineral rights is through a lease. If the mineral rights are leased to a third party, the new owner will need approval from the current lessee to claim them.

A defining feature of a Nebraska quitclaim deed is that it transfers real estate with no warranty of title. It transfers whatever interest the current owner holds in the real estate on the date of the deed. At the same time, the current owner does not promise that these rights are valid or free of defects.

Stat. §§ 76-3401-76-3423 (the ?Act?). The Act allows an individual to transfer property located in Nebraska to one or more beneficiaries effective at the transferor's death through the use of a special deed referred to as a ?Transfer on Death Deed.?

This Form 521 must be filed with the register of deeds when a deed, land contract, memorandum of contract, or a death certificate being recorded pursuant to a transfer on death deed is presented for recording. Note: An attachment may be added if additional space is needed for items 5, 6, and 20.

To complete the transfer, the deed must be recorded in the office of the Register of Deeds of the county where the property is located. All deeds also require a Form 521 - Real Estate Transfer Statement.