Nebraska Contract of Employment between Church and Organist

Description

How to fill out Contract Of Employment Between Church And Organist?

Are you currently in a scenario where you need documents for either business or personal purposes almost every day.

There is a wide range of legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers numerous form templates, including the Nebraska Contract of Employment between Church and Organist, designed to comply with federal and state regulations.

Once you find the appropriate form, click Get now.

Choose the pricing plan you prefer, fill in the necessary information to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Nebraska Contract of Employment between Church and Organist template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Select the form you need and make sure it’s for the correct city/state.

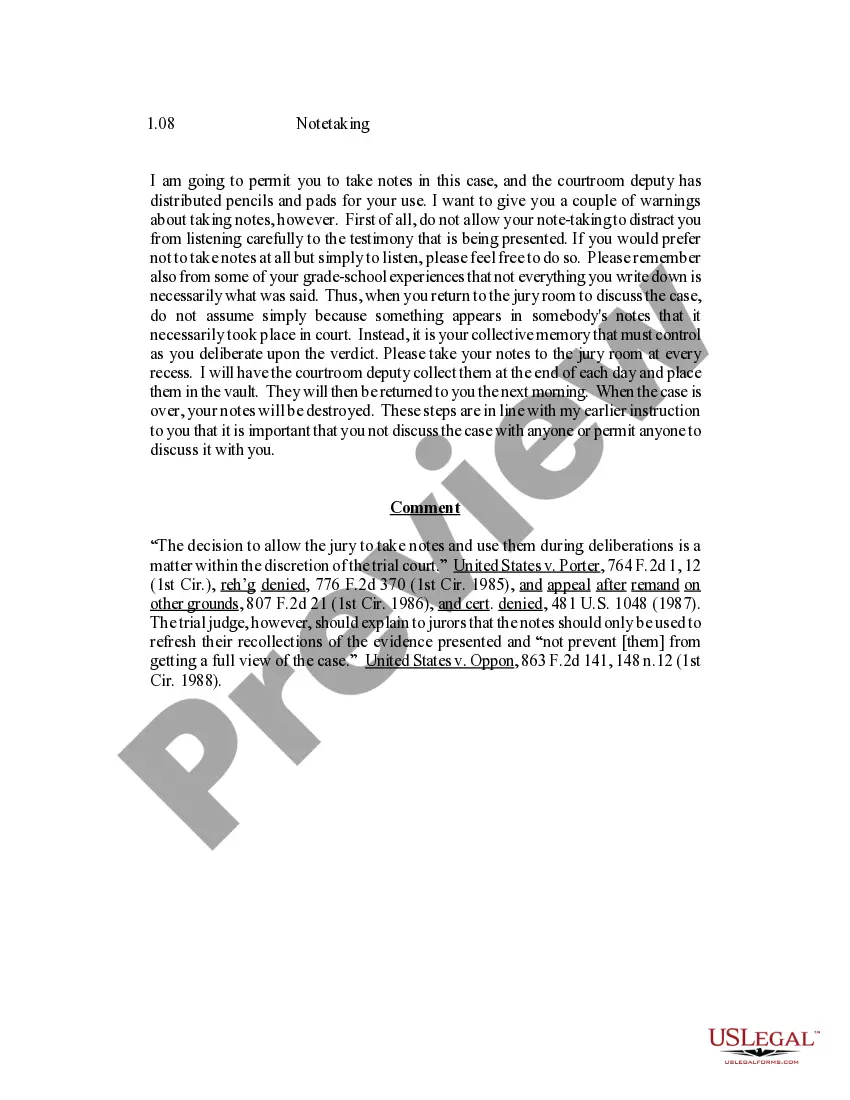

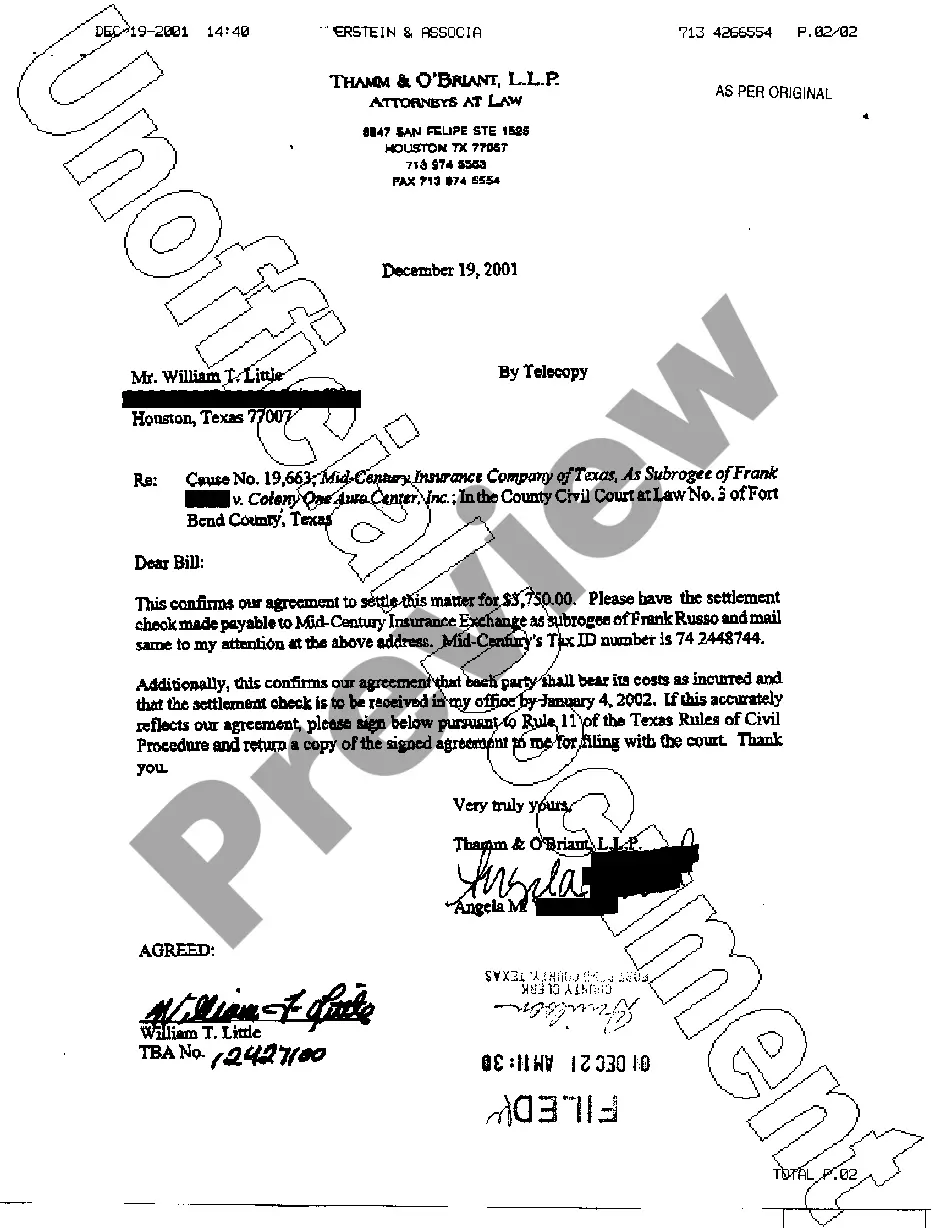

- Use the Preview button to examine the document.

- Read the description to confirm that you have chosen the correct form.

- If the form is not what you’re looking for, use the Lookup section to find the document that suits your needs and requirements.

Form popularity

FAQ

In most cases, church musicians do not pass the test of being an independent contractor because of the control that the employer exercises over the musician's work. In two Private Letter Rulings, the IRS has maintained that church organists and choir directors are employees, not independent contractors.

Yes. If a church is paying you for providing music during worship services or other events, you have income that should be reported on your tax return. If the church provides a Form W-2, treat the earnings as wages from any other type of work.

Occasionally churches or synagogues will hire musicians as independent contractors instead of employees. According to the IRS, workers are generally considered employees if they: Must comply with the employer's instructions about the work. Receive training from or at the direction of the employer.

Many musicians in our ranks continue to be treated as independent contractors by employers, even though it is clear that an employer-employee relationship exists. There is a name for this practiceit is called illegal worker misclassification, and it is affecting a variety of industries in our country.

Generally, you're an employee if the church or organization you perform services for has the legal right to control both what you do and how you do it, even if you have considerable discretion and freedom of action.

Like independent contractors, musicians provide their own tools. Further, freelance musicians retain some control over their work schedule, are paid on a 1099 and are highly skilled. Thus, the region found that these musicians were more like independent contractors than employees.

After clarifying that references to 'the organist' should include all musicians and music directors in similar positions, it states that the majority of organists are employees.

Many musicians in our ranks continue to be treated as independent contractors by employers, even though it is clear that an employer-employee relationship exists. There is a name for this practiceit is called illegal worker misclassification, and it is affecting a variety of industries in our country.

A Music Recording Contract should include the following:Recording company details (name, contact info)Artist details (group name, names of each artist, contact info)Production details, e.g. studio address, recording session dates, control over song selections on the recording, and control over album title.More items...