Title: Understanding the Nebraska Agreement for Sale of Goods, Equipment, and Related Software Introduction: The Nebraska Agreement for Sale of Goods, Equipment, and Related Software is a legally binding document that outlines the terms and conditions governing the sale of various goods, equipment, and software in the state of Nebraska. This agreement serves as a crucial framework for both buyers and sellers, ensuring a smooth transaction by defining the rights, responsibilities, and obligations of each party involved. In this article, we will delve into the intricacies of this agreement, exploring its purpose, key components, and various types if applicable. Key Components of the Nebraska Agreement for Sale of Goods, Equipment, and Related Software: 1. Parties Involved: The agreement will clearly identify the buyer(s) and the seller(s) participating in the transaction. It is important to accurately state the legal names, contact information, and official representatives of each party. 2. Description of Goods, Equipment, and Related Software: The agreement must provide a detailed description of the goods, equipment, and software being sold, including precise specifications, quantities, quality standards, and any relevant warranty information. 3. Terms of Sale: This section outlines the agreed-upon terms of the sale, including the purchase price, payment schedule, and any applicable taxes or fees. It may also include provisions for delivery, installation, and acceptance of the goods, equipment, or software. 4. Risk of Loss: This clause typically specifies when the risk of loss or damage to the goods, equipment, or software is transferred from the seller to the buyer. It may outline responsibilities for insurance coverage during transportation or storage. 5. Inspection and Acceptance: The agreement should include provisions regarding the buyer's right to inspect the goods, equipment, or software upon delivery and a timeframe for acceptance or rejection. Any defects or discrepancies should be clearly addressed, including mechanisms for resolution or compensation. 6. Intellectual Property Rights: If the agreement involves the sale of software or other intellectual property, it is important to address ownership rights, licenses, and restrictions on the use, reproduction, or distribution of the software. Different Types of Nebraska Agreements for Sale of Goods, Equipment, and Related Software: While the Nebraska Agreement for Sale of Goods, Equipment, and Related Software generally follows a similar structure, there may be various types catering to specific industries or circumstances. Some potential types could include: 1. Nebraska Agreement for Sale of Agricultural Goods and Equipment: This type of agreement focuses on the sale of agricultural products, machinery, or equipment, considering factors unique to the agriculture industry, such as harvesting seasons, crop yields, and specific equipment requirements. 2. Nebraska Agreement for Sale of Technology-Related Goods and Software: This agreement may cater to the sale of technology equipment, hardware, or specialized software, addressing distinct considerations related to the technology sector, such as compatibility, upgrades, or technical support. 3. Nebraska Agreement for Sale of Medical Equipment and Software: Specific to the healthcare industry, this agreement covers the sale of medical devices, machinery, or software, addressing regulatory compliance, safety standards, and specialized maintenance requirements. 4. Nebraska Agreement for Sale of Manufacturing Equipment and Software: Tailored for the manufacturing sector, this agreement governs the sale of production machinery, equipment, or software, with a focus on maintenance, warranties, and integration capabilities to meet manufacturing needs. Conclusion: The Nebraska Agreement for Sale of Goods, Equipment, and Related Software is essential for establishing a clear understanding and mutually beneficial relationship between buyers and sellers in Nebraska. By comprehensively addressing various aspects of the transaction, this agreement protects the interests of all parties involved. Understanding the specific type of agreement, if applicable, and consulting legal experts can further ensure compliance with industry-specific regulations and requirements.

Nebraska Agreement for Sale of Goods, Equipment and Related Software

Description

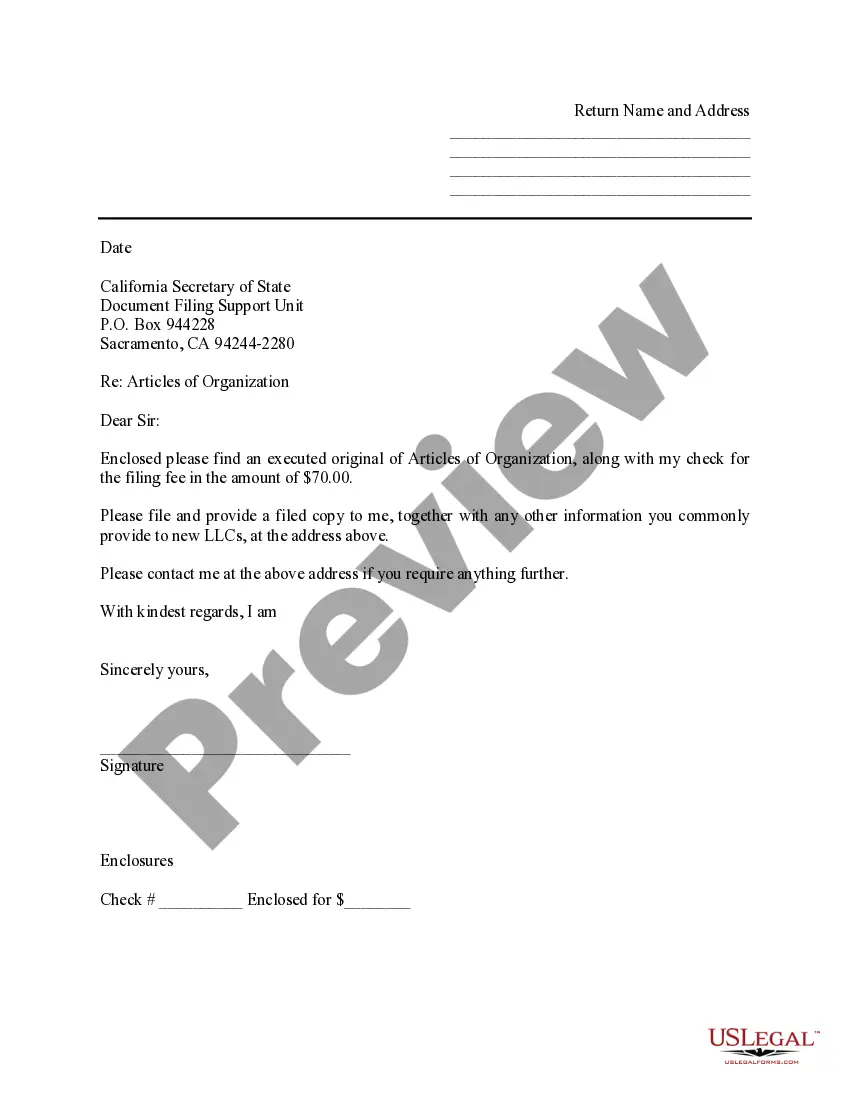

How to fill out Nebraska Agreement For Sale Of Goods, Equipment And Related Software?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a vast selection of legal document formats that you can obtain or print.

By utilizing the website, you can locate thousands of templates for business and personal use, organized by categories, states, or keywords. You can acquire the most recent versions of templates such as the Nebraska Agreement for Sale of Goods, Equipment, and Related Software within minutes.

If you have a subscription, Log In and obtain the Nebraska Agreement for Sale of Goods, Equipment, and Related Software from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded templates from the My documents tab in your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Fill, edit, and print the downloaded Nebraska Agreement for Sale of Goods, Equipment, and Related Software. Each template you added to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, just navigate to the My documents section and click on the form you desire. Access the Nebraska Agreement for Sale of Goods, Equipment, and Related Software with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and specifications.

- Ensure you have selected the appropriate template for your region/state.

- Click the Preview button to review the content of the form.

- Check the form description to confirm you have chosen the correct template.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, validate your choice by clicking the Acquire now button.

- Then, select the pricing plan you want and provide your information to register for an account.

Form popularity

FAQ

The taxability of Software as a Service (SaaS) in the USA varies by state. In some states, SaaS is treated as a taxable service, while in others, it may be considered a non-taxable service. Understanding the implications of SaaS within the realm of a Nebraska Agreement for Sale of Goods, Equipment and Related Software is important to ensure compliance and avoid unexpected tax liabilities.

In Nebraska, the taxation of IT services can be complex, as it varies depending on the specific service. Generally, personal services, such as programming, may not be taxable, while services leading to the sale of tangible goods can be. When entering into a Nebraska Agreement for Sale of Goods, Equipment and Related Software, it's vital to identify which IT services are involved to determine their tax liability.

Form 20 in Nebraska is utilized for the resale of tangible personal property or certain services by businesses. This form allows the purchaser to assert an exemption from sales tax on qualifying items. When dealing with the Nebraska Agreement for Sale of Goods, Equipment and Related Software, utilizing Form 20 can streamline transactions and ensure compliance with Nebraska tax laws.

In Nebraska, subscriptions can be taxable depending on the nature of the service provided. For example, subscriptions for tangible personal property usually incur sales tax, while certain digital services may not. When drafting a Nebraska Agreement for Sale of Goods, Equipment and Related Software, it’s essential to clarify any subscriptions included to ensure correct tax treatment.

Digital products are generally taxable in Nebraska, making it essential for businesses to understand their tax implications. This includes software and digital goods that can be downloaded or accessed online, which may relate to the Nebraska Agreement for Sale of Goods, Equipment and Related Software. Staying updated with the latest tax regulations is crucial for compliance. Always consult with a tax expert to ensure you are correctly applying the laws.

Service charges in Nebraska could be taxable, but it greatly depends on what the charges cover. If they are related to the sale of goods or tangible personal property, they may fall under the Nebraska Agreement for Sale of Goods, Equipment and Related Software and thus subject to sales tax. Ensure that you understand the specifics of the service you are providing. Consulting with professionals can help clarify your obligations.

Typically, consulting services are not taxable in Nebraska, as they do not involve the sale of tangible personal property. However, if the consulting service includes deliverables that constitute goods, it may fall under the Nebraska Agreement for Sale of Goods, Equipment and Related Software. Understanding the nature of your service is critical for compliance. If in doubt, seek guidance from a tax professional.

Service agreements in Nebraska might be subject to sales tax, depending on the specific service being offered. If a service involves the sale of goods alongside the service, it likely falls under the Nebraska Agreement for Sale of Goods, Equipment and Related Software. It’s essential to review the details of the service agreement to ensure compliance. Consulting with a tax expert can help clarify any uncertainties.

In Nebraska, the frequency of filing sales tax returns generally depends on the volume of sales. Most businesses are required to file monthly, while some smaller operations may qualify for quarterly or annual filings. Adhering to these requirements is crucial to avoid penalties. Consider utilizing the Nebraska Agreement for Sale of Goods, Equipment and Related Software to streamline your business transactions.

Software as a Service (SaaS) is generally subject to sales tax in Nebraska. This is because it is considered a service related to tangible personal property, making the Nebraska Agreement for Sale of Goods, Equipment and Related Software relevant. Therefore, companies providing SaaS offerings must carefully assess their tax obligations. For clarity, always seek advice from tax professionals familiar with Nebraska law.

Interesting Questions

More info

Sell and Buy is where goods would be bought and sold in a commercial transaction (like buying a bus ticket) Sell Good: goods are sold to buyers Sell Buy: goods are bought from producers or sellers in order to sell to buyers Where Sell Goods You Buy Goods is in a commercial location Sell Good: goods are sold in a commercial location The difference between Sell and Buy is where goods are sold How Sell and Buy Works The sale of goods is an agreement between parties for the exchange of goods, or with goods purchased. Goods are valued on a set basis, either on an individual basis or on an aggregated basis, to help you gauge the worth of the goods you are receiving. The value of the goods, in either a cash, commercial or fixed contract basis, is adjusted on a regular basis. Goods that you buy and sell could be goods that you receive in trade, goods you take, or goods that you buy for resale.