Nebraska Letter to Creditors Notifying Them of Identity Theft for New Accounts

Description

How to fill out Letter To Creditors Notifying Them Of Identity Theft For New Accounts?

Are you currently in a position that you need to have papers for possibly organization or specific uses almost every day? There are a variety of lawful document themes available on the net, but finding types you can rely on isn`t simple. US Legal Forms delivers 1000s of kind themes, just like the Nebraska Letter to Creditors Notifying Them of Identity Theft for New Accounts, that are created to fulfill state and federal requirements.

If you are previously knowledgeable about US Legal Forms web site and have a free account, just log in. Afterward, it is possible to download the Nebraska Letter to Creditors Notifying Them of Identity Theft for New Accounts format.

Should you not provide an account and need to begin to use US Legal Forms, follow these steps:

- Find the kind you will need and make sure it is for that appropriate metropolis/state.

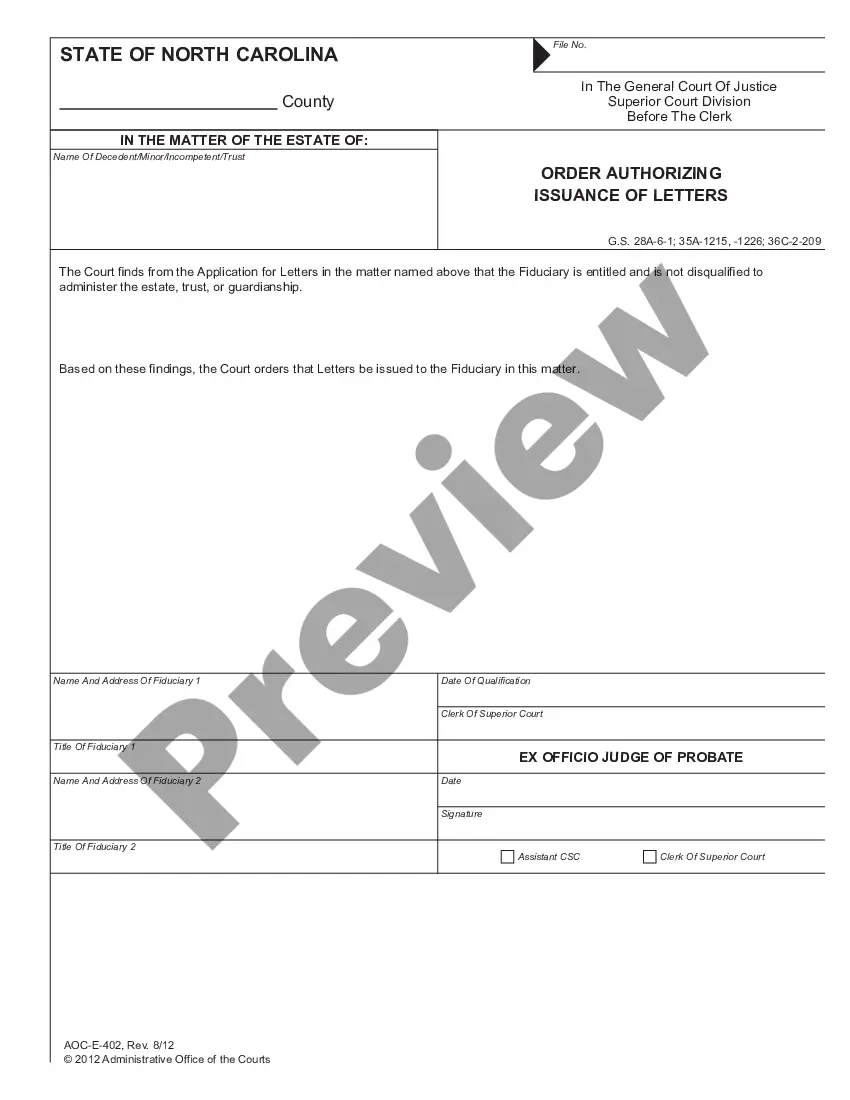

- Use the Preview button to analyze the form.

- Browse the description to ensure that you have selected the right kind.

- In case the kind isn`t what you`re seeking, take advantage of the Lookup field to get the kind that meets your requirements and requirements.

- If you find the appropriate kind, simply click Buy now.

- Opt for the rates strategy you would like, complete the desired info to generate your bank account, and pay for your order using your PayPal or charge card.

- Decide on a hassle-free paper file format and download your copy.

Discover every one of the document themes you have bought in the My Forms menus. You may get a further copy of Nebraska Letter to Creditors Notifying Them of Identity Theft for New Accounts whenever, if possible. Just select the necessary kind to download or print out the document format.

Use US Legal Forms, the most considerable variety of lawful forms, in order to save time as well as avoid mistakes. The assistance delivers skillfully manufactured lawful document themes that you can use for a variety of uses. Produce a free account on US Legal Forms and begin creating your way of life a little easier.

Form popularity

FAQ

28-640. Identity fraud; penalty; restitution. (b) Willfully and knowingly obtains, possesses, uses, sells or furnishes or attempts to obtain, possess, or furnish to another person for any purpose of deception a personal identification document. (2)(a) Identity fraud is a Class I misdemeanor.

28-639. Identity theft; penalty; restitution. (3)(a) Identity theft is a Class IIA felony if the credit, money, goods, services, or other thing of value that was gained or was attempted to be gained was five thousand dollars or more. Any second or subsequent conviction under this subdivision is a Class II felony.

Call the local police. The Nebraska Attorney General´s Office recommends that you inform local police as well as federal law enforcement through the Federal Trade Commission. You may need to file a police report to back up the validity of your identity theft claim to your credit card and banking companies.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

It is the unlawful violation of an individual's right to the protection of his/her privacy. This illegitimate acquisition of your information can be performed in a variety of ways. Most commonly, identity theft includes stealing, misrepresenting or hijacking the identity of another person or business.

The lowest level theft is a Class II Misdemeanor for when the value is $500 or less. The penalty range for a Class II Misdemeanor is 0 to 6 months imprisonment, and/or up to a $1,000 fine. The other level of theft is a Class I Misdemeanor, when the value is more than $500 but less than $1,500.

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.

The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.