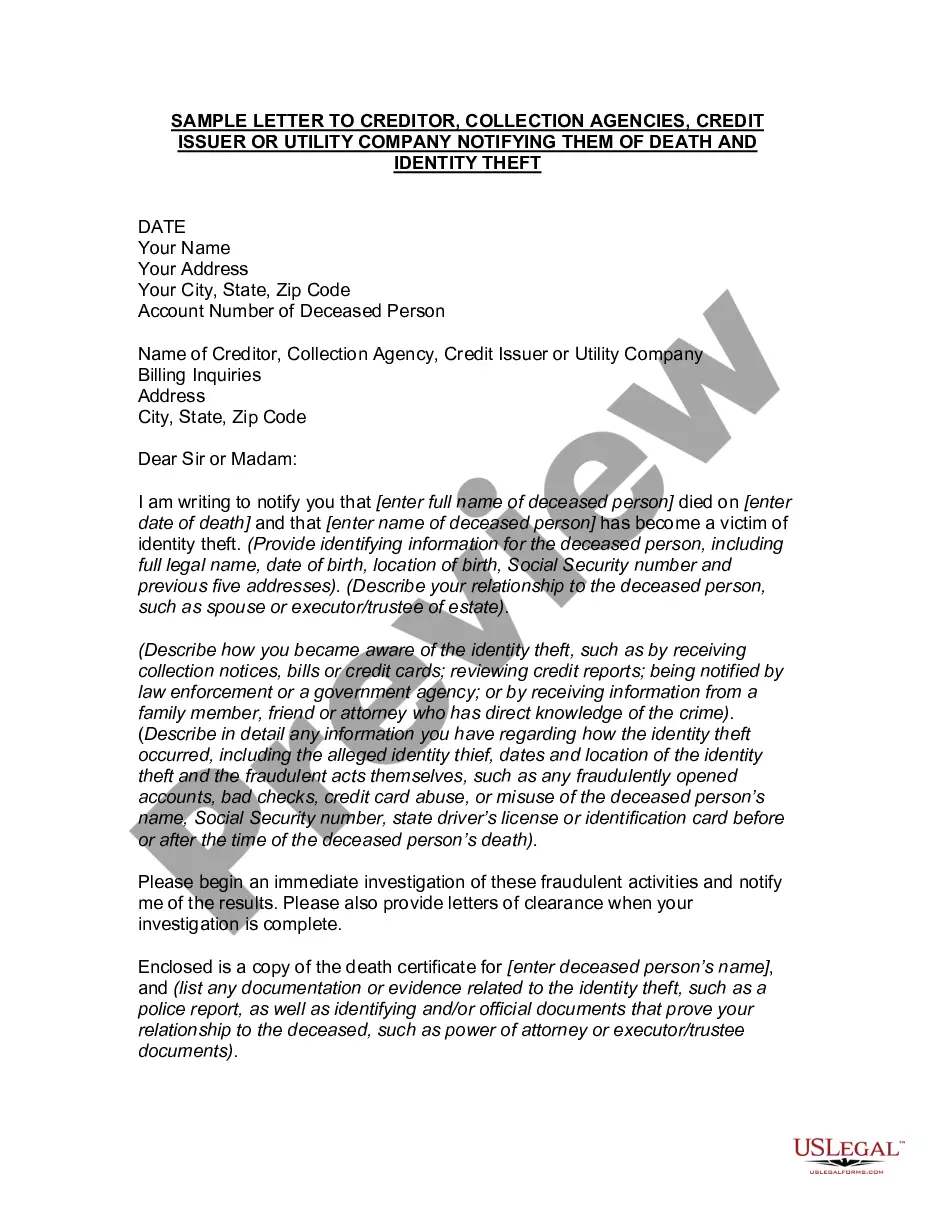

Title: Nebraska Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death — A Comprehensive Guide Introduction: In Nebraska, it is crucial to inform creditors, collection agencies, credit issuers, and utility companies about the death of a loved one. This ensures that the deceased individual's accounts are properly handled and prevents unintended liabilities for their family members. This guide provides a detailed description of how to craft a Nebraska letter notifying these entities of the situation, keeping in mind their distinct requirements. It also highlights different types of letters that may be used in specific circumstances. Keywords: Nebraska, letter, creditor, collection agencies, credit issuer, utility company, death, notifying, types. 1. Basic Components of a Nebraska Letter Notifying Creditor, Collection Agencies, Credit Issuer or Utility Company of Death: — Clear subject line: Clearly state the purpose of the letter, such as "Notice of Death" or "Deceased Account." — Deceased individual's information: Include their full name, date of death, and account number (if available). — Contact information: Provide your name, relationship to the deceased person, address, phone number, and email. — Proof of death: Enclose a certified copy of the death certificate or obituary notice. — Account details: Mention relevant account numbers, balances, outstanding debts, or other relevant details. — Request for account closure: Ask the recipient to close the deceased's accounts or transfer them to the appropriate person, such as an executor or beneficiary. — Deadline for response: Suggest a reasonable timeframe within which you expect a response or closure. — Enclosures: If applicable, attach any necessary supporting documents, such as a power of attorney or estate documentation. 2. Letters based on Individual Companies: a) Nebraska Letter to Creditor: — Financial institutions, credit card companies, or lenders should be notified to close accounts, end automatic payments, or conduct necessary transfers. b) Nebraska Letter to Collection Agencies: — Detail any outstanding debts and request that collection efforts cease, pending resolution by the deceased's estate. c) Nebraska Letter to Credit Issuers: — Alert credit bureaus about the death to avoid unauthorized use of the deceased's credit profile. Include official notifications such as Social Security Administration's death records. d) Nebraska Letter to Utility Companies: — Inform utility providers (electricity, water, gas, etc.) of the death to handle possible account changes, adjustments, or finalization of any pending balances. 3. Additional Nebraska Letters: a) Nebraska Letter to Executor or Personal Representative: — Acknowledge the executor/personal representative's authority and request their collaboration in dealing with the creditor, collection agencies, credit issuers, or utility companies. b) Nebraska Letter to Credit Reporting Agencies: — Notify major credit bureaus (Equifax, Experian, TransUnion) of the death to update credit records and prevent any future issues. c) Nebraska Letter Requesting Credit Report: — Ask credit bureaus to provide a complete credit report of the deceased individual, which helps assess and close all accounts properly. Conclusion: Effectively notifying creditors, collection agencies, credit issuers, and utility companies of a loved one's death is a crucial step in managing their affairs. By submitting a detailed Nebraska letter, correctly tailored to specific entities and complying with their requirements, you can ensure a smooth transition and protect the deceased's estate and family members from potential financial burdens. Keywords: Nebraska, letter, creditor, collection agencies, credit issuer, utility company, death, notifying, types.

Nebraska Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death

Description

How to fill out Nebraska Letter To Creditor, Collection Agencies, Credit Issuer Or Utility Company Notifying Them Of Death?

If you want to total, down load, or printing lawful document templates, use US Legal Forms, the biggest collection of lawful kinds, which can be found on the Internet. Take advantage of the site`s simple and hassle-free research to discover the paperwork you want. Different templates for enterprise and person reasons are categorized by classes and says, or search phrases. Use US Legal Forms to discover the Nebraska Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death in just a handful of mouse clicks.

Should you be presently a US Legal Forms customer, log in to your account and click the Download switch to find the Nebraska Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death. You can also entry kinds you earlier saved in the My Forms tab of the account.

If you use US Legal Forms for the first time, refer to the instructions below:

- Step 1. Ensure you have selected the form for that appropriate area/land.

- Step 2. Utilize the Review choice to look over the form`s articles. Don`t forget about to learn the explanation.

- Step 3. Should you be unsatisfied together with the develop, utilize the Research discipline on top of the display to find other versions of your lawful develop template.

- Step 4. Upon having found the form you want, click the Acquire now switch. Pick the rates strategy you like and put your credentials to register for the account.

- Step 5. Procedure the financial transaction. You may use your credit card or PayPal account to accomplish the financial transaction.

- Step 6. Pick the formatting of your lawful develop and down load it on your own system.

- Step 7. Comprehensive, edit and printing or sign the Nebraska Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death.

Each and every lawful document template you buy is your own property forever. You may have acces to each develop you saved inside your acccount. Click the My Forms area and choose a develop to printing or down load again.

Be competitive and down load, and printing the Nebraska Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death with US Legal Forms. There are millions of expert and express-specific kinds you can use for the enterprise or person needs.

Form popularity

FAQ

Unfortunately, ?(Detail Deceased's name) ?passed away on ?(Detail Date)?. I enclose a copy of their death certificate. They didn't leave behind any assets and there is no money to pay what they owe. Please consider writing off this debt because there is no prospect of you ever recovering any money towards it.

You can call the number on the back of the card and speak with a customer service representative about your situation. Note that the credit card companies may ask for an official copy of the death certificate and may also need the deceased's Social Security number.

How to Write a Death Announcement Full name of the deceased. State that they have died. Date and location of death. Funeral and/or memorial date, time, and location. Optional information, such as for donations.

The death announcement wording includes one paragraph announcing the decedent's full name, city and state where they died, and date of death. Often it also includes birth date and place, funeral arrangements or memorial details, and instructions for how to honor the deceased.

Write a letter to one of the nationwide credit reporting agencies. Whichever agency you contact ? TransUnion, Equifax or Experian ? will then notify the other two on your behalf. Along with a copy of the death certificate, please also include the following for the deceased: Legal name.

Basic Death Notification Procedures Always make death notification in person ? not by telephone. It is very important to provide the survivor with a human presence or ?presence of compassion? during an extremely stressful time. ... Arrange notification in person even if the survivor lives far away.

Our family is deeply saddened to inform you that Grandmother passed away in her sleep Wednesday night. As many of you know, she has been suffering from kidney failure for some time now. We are relieved that her passing was peaceful and painless.

It is with our deepest sorrow that we inform you of the death of our beloved husband and father (insert name). With great sadness, we announce the loss of our beloved father, (insert name). In loving memory of (insert name), we are saddened to announce their passing on (insert date).

Your loved ones or the executor of your will should notify creditors of your death as soon as possible. To do so, they'll need to send each creditor a copy of your death certificate. Creditors generally pause efforts to collect on unpaid debts while your estate is being settled.

Using the credit report as your guide, contact all banks and credit card companies at which the deceased had an open account and close those accounts as quickly as possible. You will need to provide a certified copy of the death certificate to close the account.