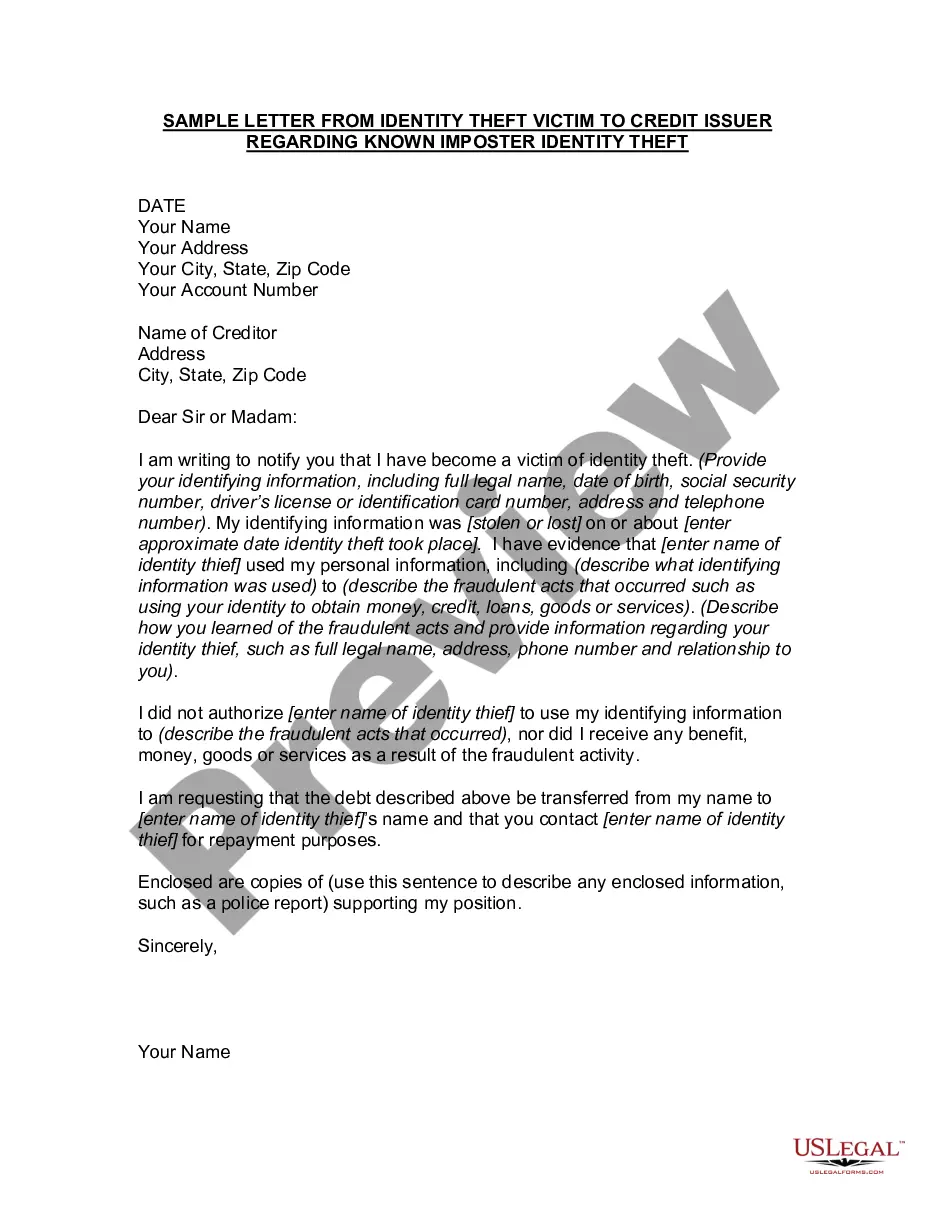

Nebraska is a state situated in the Midwestern region of the United States. Known for its vast prairies, the Platte River, and the Sand hills, Nebraska offers picturesque landscapes and a rich history. When it comes to identity theft, victims in Nebraska often face unique challenges that require special attention. In cases of known imposter identity theft, individuals are targeted by imposters who steal their personal information to fraudulently open credit accounts or conduct unauthorized transactions. To address this issue, victims of imposter identity theft in Nebraska often need to write a detailed letter to their credit issuer alerting them of the situation and requesting appropriate actions to be taken. The letter should include specific keywords to ensure it effectively communicates the victim's concerns and demands. Some relevant keywords to consider are: 1. Identity Theft Victim: Clearly state in the letter that you are an identity theft victim and specify the type of identity theft, such as known imposter identity theft. 2. Credit Issuer: Mention the name of the credit issuer, typically a bank or a credit card company, to ensure the letter reaches the appropriate recipient. 3. Imposter: Clearly describe the imposter who is using your identity, providing any relevant details you might know, such as their name, address, or aliases they might be using. 4. Unauthorized Accounts: State that the imposter has fraudulently opened accounts in your name without your consent, and provide any evidence or documentation you may have to support your claim. 5. Fraudulent Transactions: Detail any unauthorized transactions conducted by the imposter using your personal information and request an investigation into these activities. 6. Police Report: Mention if a police report has been filed and provide the relevant details, such as the report number and the agency where it was filed. This helps to substantiate your claim and demonstrates your proactive steps against the identity theft. 7. Freeze or Close Accounts: Request that the credit issuer freeze or close any fraudulent accounts opened by the imposter to prevent further unauthorized activity. 8. Fraud Alerts: Ask the credit issuer to place fraud alerts on your credit reports to provide an additional layer of protection and to be notified of any suspicious activity. 9. Documentation: Encourage the credit issuer to contact you for any additional information or documentation required to assist in resolving the identity theft case. Different types of Nebraska letters from identity theft victims to credit issuers regarding known imposter identity theft may vary based on the specific circumstances and details of each case. However, the main objective remains the same — to alert the credit issuer and request their assistance in rectifying the situation, recovering losses, and safeguarding the victim's credit profile.

Nebraska Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft

Description

How to fill out Nebraska Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft?

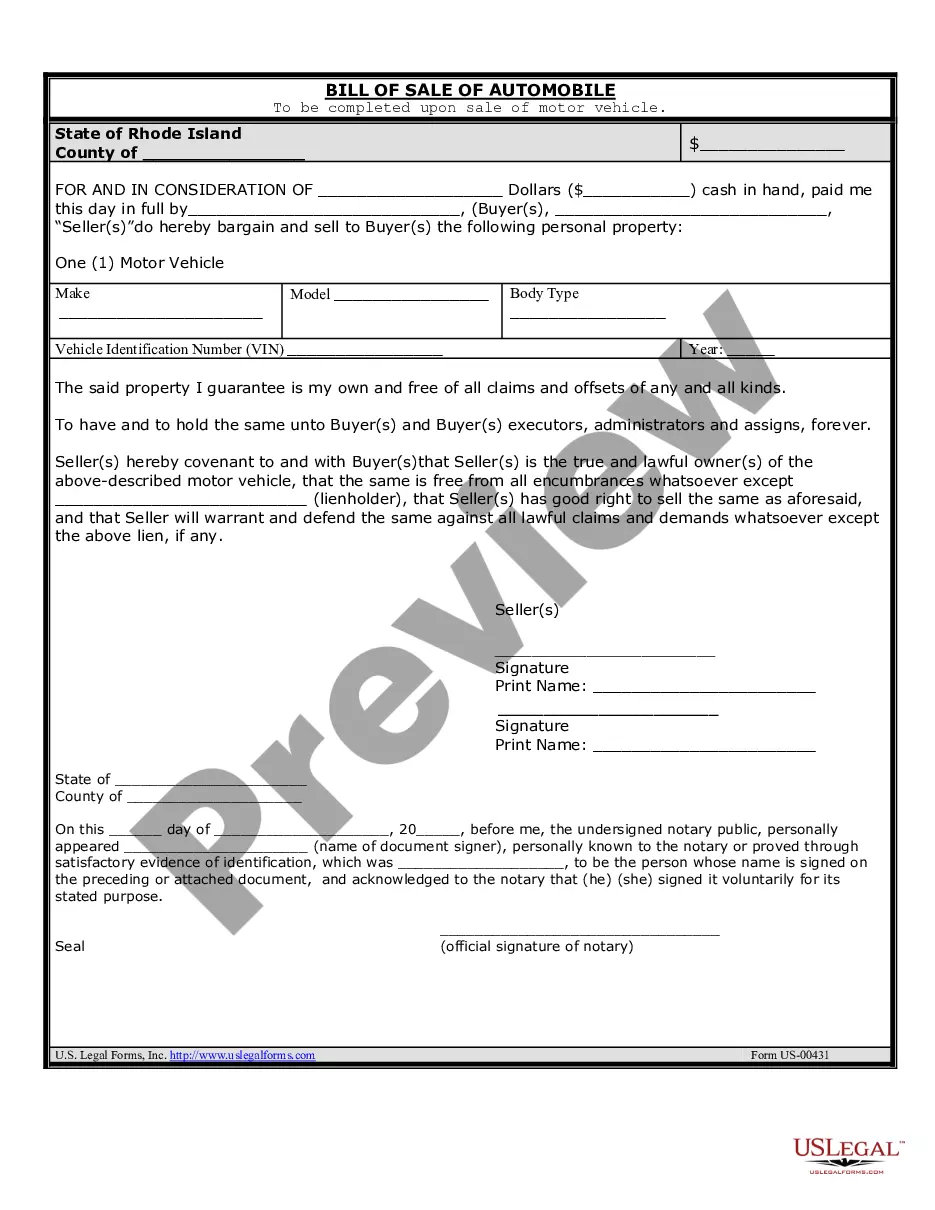

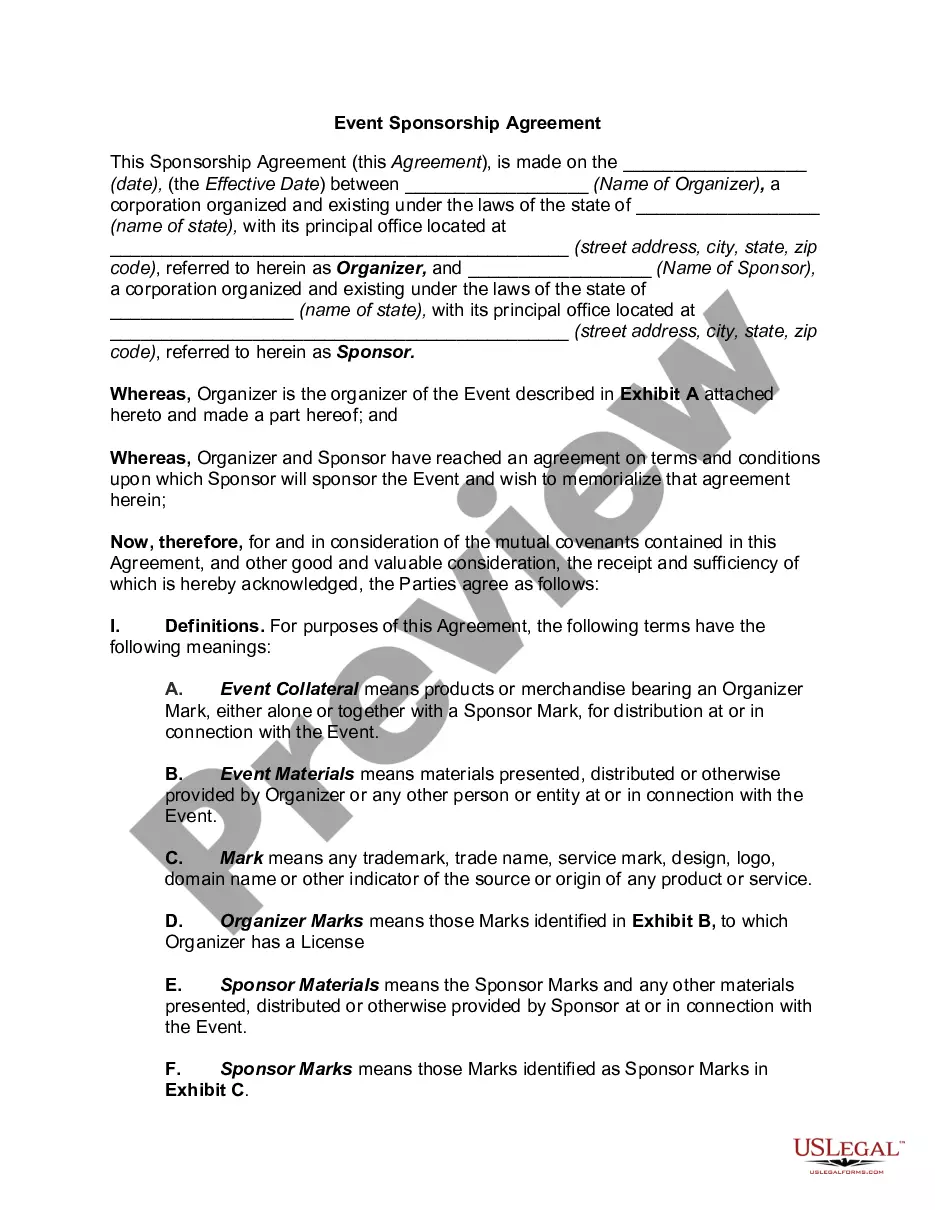

Have you been inside a placement where you require documents for both enterprise or individual reasons just about every working day? There are a lot of authorized document templates accessible on the Internet, but finding ones you can rely on isn`t straightforward. US Legal Forms gives thousands of develop templates, such as the Nebraska Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft, that are created to fulfill federal and state demands.

When you are previously knowledgeable about US Legal Forms web site and have a merchant account, basically log in. Afterward, you are able to down load the Nebraska Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft design.

Unless you have an bank account and need to start using US Legal Forms, adopt these measures:

- Get the develop you need and ensure it is to the proper city/county.

- Utilize the Review switch to analyze the form.

- Look at the explanation to actually have chosen the right develop.

- When the develop isn`t what you are searching for, use the Search field to get the develop that meets your requirements and demands.

- Whenever you get the proper develop, click Acquire now.

- Choose the rates program you want, submit the required information to make your bank account, and pay money for the transaction utilizing your PayPal or Visa or Mastercard.

- Choose a handy paper format and down load your version.

Locate all of the document templates you might have purchased in the My Forms menu. You may get a extra version of Nebraska Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft any time, if necessary. Just click the required develop to down load or printing the document design.

Use US Legal Forms, the most comprehensive selection of authorized types, in order to save time as well as stay away from faults. The services gives skillfully manufactured authorized document templates which you can use for an array of reasons. Produce a merchant account on US Legal Forms and commence making your daily life easier.

Form popularity

FAQ

If a person is convicted of identity theft, they may face fines, jail time, and a criminal record, as well as be required to compensate the victim for financial losses.

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.

28-639. Identity theft; penalty; restitution. (3)(a) Identity theft is a Class IIA felony if the credit, money, goods, services, or other thing of value that was gained or was attempted to be gained was five thousand dollars or more. Any second or subsequent conviction under this subdivision is a Class II felony.

Persons age 35 to 49 accounted for 24% of all U.S. residents age 16 or older, but they accounted for 29% of all victims of identity theft. About 51% of victims of identity theft lived in a household with an annual income of $75,000 or more, while accounting for 12% of U.S. residents age 16 or older.

A copy of your FTC Identity Theft Report. A government-issued ID with a photo. Proof of your address (mortgage statement, rental agreement, or utilities bill) Any other proof you have of the theft?bills, Internal Revenue Service (IRS) notices, etc.

If you believe information in your file results from identity theft, you have the right to ask that a consumer reporting agency block that information from your file. An identity thief may run up bills in your name and not pay them. Information about the unpaid bills may appear on your consumer report.

The Fair Credit Reporting Act (FCRA) spells out rights for victims of identity theft, as well as responsibilities for businesses. Identity theft victims are entitled to ask businesses for a copy of transaction records ? such as applications for credit ? relating to the theft of their identity.

Use the ID Theft Affidavit Creditors may ask you to fill out fraud affidavits. The Federal Trade Commission's ID Theft Affidavit is accepted by the credit bureaus and by most major creditors. Send copies of the completed form to creditors where the thief opened accounts in your name.