Nebraska Triple Net Commercial Lease Agreement: A Comprehensive Overview of Real Estate Rental Terms and Types In the realm of real estate rentals, a Nebraska Triple Net Commercial Lease Agreement is a legal contract that outlines the terms and conditions under which a tenant leases a commercial property from a landlord or property owner. This type of agreement is referred to as "triple net" because it requires the tenant to bear the financial responsibility for three main expenses: property taxes, insurance, and maintenance costs. Let's delve into the various aspects and types of Nebraska Triple Net Commercial Lease Agreements. 1. Definition and Key Elements: A Nebraska Triple Net Commercial Lease Agreement is a highly detailed document, providing a comprehensive framework for the landlord-tenant relationship. It typically outlines the following key elements: — Lease Term: Specifies the duration of the lease, including the start and end dates. — Rent and Payments: Defines the amount of rent, frequency of payment, and accepted payment methods. — NNN Expenses: Describes the three main expenses covered by the tenant, namely property taxes, insurance premiums, and maintenance costs. — Property Condition: Outlines the tenant's obligations for maintaining the property, including repair and upkeep responsibilities. — Insurance Coverage: Details the minimum insurance requirements for the tenant, like liability or property insurance. — Assignment/Subleasing: Addresses the circumstances and conditions under which the tenant may assign or sublease the property to another party. — Alterations and Improvements: Specifies the tenant's rights and permissions regarding any alterations or improvements made to the property. — Default and Termination: Outlines the repercussions for both parties in the event of a breach of the agreement's terms. — Governing Laws: Identifies the applicable laws and regulations governing the lease agreement in the state of Nebraska. 2. Types of Nebraska Triple Net Commercial Lease Agreements: a. Single Net Lease: While not considered a true triple net lease, a single net lease still requires the tenant to pay one of the three expenses mentioned above, typically property taxes. The landlord retains responsibility for the other two (insurance and maintenance costs). b. Double Net Lease: Similar to a single net lease, a double net lease demands that the tenant cover two of the three expenses, commonly property taxes and insurance premiums. The landlord remains responsible for maintenance costs. c. Triple Net Lease: The most common type, a triple net lease places the burden of all three expenses (property taxes, insurance, and maintenance costs) squarely on the tenant's shoulders. This arrangement usually leads to a lower base rent but may result in substantial financial obligations for the tenant. d. Absolute Triple Net Lease: In an absolute triple net lease, the tenant is responsible for virtually all aspects, including structural repairs and replacements. This comprehensive lease shifts almost all financial and maintenance obligations to the tenant, often preferred by commercial real estate investors seeking minimal physical involvement. Conclusion: A Nebraska Triple Net Commercial Lease Agreement establishes the terms and obligations for both parties involved in a commercial real estate rental. By understanding the different types of triple net leases, including single net, double net, triple net, and absolute triple net leases, landlords and tenants can customize the agreement to meet their specific needs and protect their interests. Whether you're a landlord or a tenant entering into a Nebraska Triple Net Commercial Lease Agreement, it is crucial to consult with a real estate attorney to ensure a thorough understanding of the contractual terms and compliance with Nebraska state laws.

Nebraska Triple Net Commercial Lease Agreement - Real Estate Rental

Description

How to fill out Nebraska Triple Net Commercial Lease Agreement - Real Estate Rental?

It is possible to spend several hours on the web attempting to find the legitimate papers format that meets the federal and state specifications you want. US Legal Forms offers 1000s of legitimate forms which can be examined by experts. You can easily down load or produce the Nebraska Triple Net Commercial Lease Agreement - Real Estate Rental from my assistance.

If you have a US Legal Forms bank account, it is possible to log in and click the Download switch. Next, it is possible to comprehensive, edit, produce, or sign the Nebraska Triple Net Commercial Lease Agreement - Real Estate Rental. Each and every legitimate papers format you get is yours for a long time. To have an additional duplicate of the obtained develop, proceed to the My Forms tab and click the related switch.

If you use the US Legal Forms web site for the first time, stick to the straightforward guidelines under:

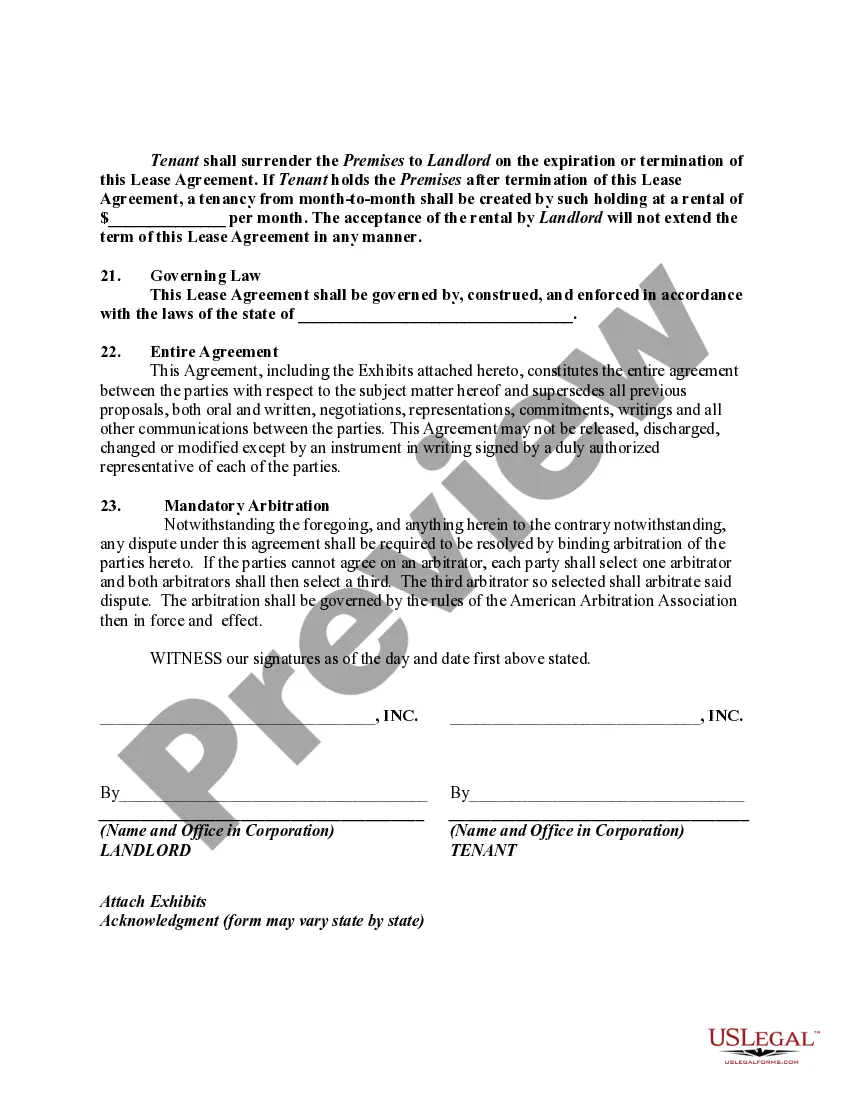

- Very first, make sure that you have selected the best papers format for that county/town of your choosing. See the develop description to make sure you have chosen the right develop. If offered, take advantage of the Review switch to search from the papers format too.

- In order to get an additional edition from the develop, take advantage of the Search discipline to find the format that fits your needs and specifications.

- Once you have identified the format you would like, just click Acquire now to proceed.

- Find the prices program you would like, type in your references, and register for a free account on US Legal Forms.

- Comprehensive the transaction. You should use your charge card or PayPal bank account to purchase the legitimate develop.

- Find the format from the papers and down load it to your product.

- Make changes to your papers if required. It is possible to comprehensive, edit and sign and produce Nebraska Triple Net Commercial Lease Agreement - Real Estate Rental.

Download and produce 1000s of papers templates making use of the US Legal Forms web site, which offers the largest assortment of legitimate forms. Use skilled and state-distinct templates to handle your company or person requirements.