Nebraska Agreement to Assign Lease to Incorporate Forming Corporation: The Nebraska Agreement to Assign Lease to Incorporate Forming Corporation is a legally binding document that outlines the terms and conditions of assigning a lease agreement to the incorporates of a new corporation in the state of Nebraska. This agreement is crucial for individuals who wish to transfer an existing lease to a newly formed corporation. When forming a corporation in Nebraska, incorporates often need to secure suitable office or commercial space for their business operations. In certain cases, it may be more advantageous to assign an existing lease rather than entering into a new lease agreement. This agreement serves as a legal instrument that facilitates the transfer of lease rights and responsibilities to the corporation. It ensures that all parties involved, including the landlord, the original tenant, and the incorporates, are protected and have a clear understanding of their obligations. The Nebraska Agreement to Assign Lease to Incorporate Forming Corporation typically includes the following key elements: 1. Parties Involved: The agreement identifies the parties entering into the assignment, including the original tenant, the incorporates, and the landlord. 2. Lease Details: It provides a comprehensive description of the original lease, such as the address of the leased premises, lease term, rental amount, and any special provisions or restrictions. 3. Assignment Terms: This section outlines the specific terms and conditions of the assignment. It typically includes details about the effective date of the assignment, the corporation's assumption of the original tenant's rights and obligations, and any conditions precedent for the assignment's validity. 4. Release and Indemnification: The agreement may contain provisions that release the original tenant from any liabilities or obligations arising after the assignment, making the corporation solely responsible. In addition, it may include an indemnification clause to protect the original tenant from potential claims or damages related to the assigned lease. 5. Landlord Consent: To ensure the assignment's legality, the agreement usually stipulates that the landlord's written consent is required for the assignment to take effect. This provision offers a level of assurance to all parties involved in the transaction. Different Types of Nebraska Agreement to Assign Lease to Incorporate Forming Corporation: Although the core elements of the Agreement to Assign Lease to Incorporate Forming Corporation are consistent, various versions or variations of this agreement may exist due to specific circumstances or individual preferences. These might include: 1. Short-term Lease Assignment: In some cases, corporations only require a short-term assignment, which allows them to utilize the leased premises for a specified period without assuming the entire lease agreement's remaining term. 2. Assignment with Transfer of Ownership: This type of agreement not only assigns the lease but also involves the transfer of ownership of the original tenant's business to the new corporation. It may include additional provisions related to the purchase price, assets, and liabilities of the business being transferred. 3. Assignment with Modifications: This version of the agreement enables the parties to modify certain terms of the original lease during the assignment process. Modifications might include changes to rental amounts, lease duration, or other lease provisions to better align with the new corporation's needs. It is essential to consult with legal professionals or experienced business attorneys to ensure that the Nebraska Agreement to Assign Lease to Incorporate Forming Corporation meets all necessary legal requirements and adequately protects the interests of the parties involved.

Nebraska Agreement to Assign Lease to Incorporators Forming Corporation

Description

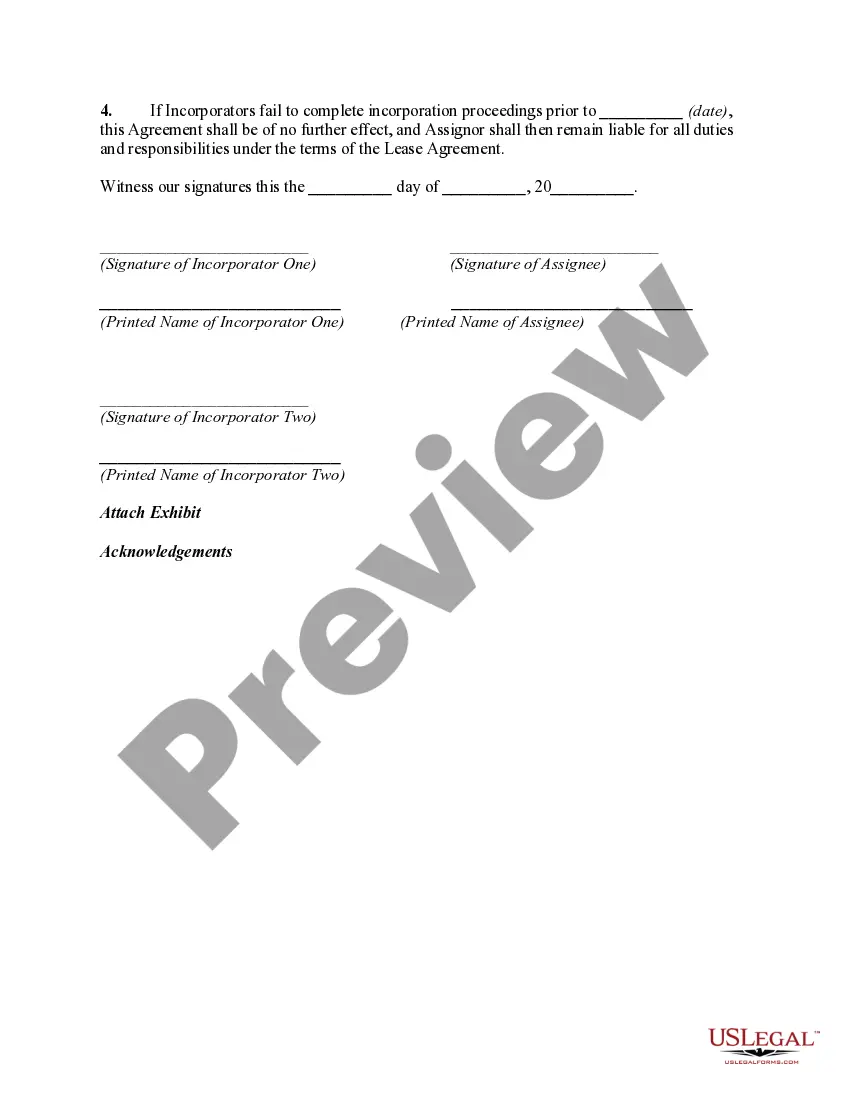

How to fill out Agreement To Assign Lease To Incorporators Forming Corporation?

Are you currently in a position where you require documents for either business or personal purposes almost every day.

There are numerous valid document templates accessible online, but locating ones you can trust isn't easy.

US Legal Forms offers a vast collection of form templates, such as the Nebraska Agreement to Assign Lease to Incorporators Forming Corporation, designed to comply with state and federal regulations.

Once you find the appropriate form, click Buy now.

Choose the pricing plan you want, complete the requested information to create your account, and process the payment using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Nebraska Agreement to Assign Lease to Incorporators Forming Corporation template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and make sure it is for the correct region/county.

- Use the Review button to evaluate the form.

- Check the summary to ensure you've selected the right form.

- If the form isn't what you need, use the Lookup field to find the form that matches your requirements.

Form popularity

FAQ

Assigning a commercial lease requires reviewing the terms of the original lease contract to ensure assignment is permitted. You must typically obtain consent from the landlord before proceeding with the assignment. Utilizing the Nebraska Agreement to Assign Lease to Incorporators Forming Corporation can streamline this process, ensuring that all legal requirements are met and providing a solid foundation for your assignment agreement.

Setting up an S Corp in Nebraska involves forming a regular corporation first, then filing Form 2553 with the IRS to elect S Corporation status. You will need to ensure that you meet the eligibility requirements, such as having the right number and type of shareholders. Utilizing the Nebraska Agreement to Assign Lease to Incorporators Forming Corporation can be advantageous as it provides structure and clarity in your business operations, including lease assignments.

To start a corporation in Nebraska, you need to choose a name, appoint a registered agent, and file your Articles of Incorporation with the Secretary of State. After obtaining your incorporation documents, you should create corporate bylaws and hold your first organizational meeting. Additionally, you might consider utilizing the Nebraska Agreement to Assign Lease to Incorporators Forming Corporation to assist in the initial setup and lease management for your new entity.

Yes, Nebraska does allow composite returns for certain taxpayers. This is particularly beneficial for non-resident shareholders of S Corporations. They can opt to file a composite return rather than individual returns, simplifying the process. Using the Nebraska Agreement to Assign Lease to Incorporators Forming Corporation can help corporate entities manage their tax obligations efficiently.

To write a business proposal for a lease, begin with a clear introduction that states your intent to lease the property. Highlight what makes your business plan viable, and specify your rental offer along with any proposed terms, including maintenance and upgrades. Reference the Nebraska Agreement to Assign Lease to Incorporators Forming Corporation to show that you understand the legalities of leasing in a corporate context. A thoughtful proposal fosters trust and opens the door for negotiations.

A commercial real estate proposal should clearly present your business proposition regarding a particular commercial property. Include essential information about the property, your intended use, and proposed lease terms. Incorporating elements of the Nebraska Agreement to Assign Lease to Incorporators Forming Corporation can add legal substance and demonstrate your commitment to adhering to proper leasing channels. Be sure to present your potential value to the property owner.

A lease proposal is a document that outlines the terms and conditions under which one party intends to lease property from another. It generally includes details about duration, rental rates, and obligations related to the property. In the context of the Nebraska Agreement to Assign Lease to Incorporators Forming Corporation, such proposals can facilitate smoother transitions through clear, agreed-upon terms for the lease assignment. Properly crafted lease proposals protect both parties and set a framework for cooperation.

Writing a business proposal for a contract involves several key steps. Start by outlining your objectives and the services or products you offer, highlighting how they align with the client's needs. Include details about the Nebraska Agreement to Assign Lease to Incorporators Forming Corporation, as this can showcase your expertise in legal documentation for business arrangements. Always remember to structure your proposal clearly and provide a summary that reinforces your intent.

To break your lease without penalty in Nebraska, look for valid reasons such as the landlord failing to meet health and safety codes or if you have a legally protected reason like being a victim of domestic violence. You can also reach out to your landlord for a mutual agreement to terminate the lease. If conditions allow, using the Nebraska Agreement to Assign Lease to Incorporators Forming Corporation may help you securely assign your lease, reducing potential penalties and providing peace of mind.

In Nebraska, you typically have a short window to back out of a lease after signing, often linked to the lease's specific terms. It’s crucial to review your lease, as many agreements do not allow any backing out after signing. However, certain situations might permit you to exercise your rights under the Nebraska Agreement to Assign Lease to Incorporators Forming Corporation, facilitating a lawful transfer of the lease if circumstances change swiftly.

More info

The Assignor hereby acknowledges and agrees that the following terms and conditions are the exclusive terms and conditions under which the assignee, to the extent provided in the Assignor's interest, leases and transfers title to any and all premises to the assignee. The following terms and conditions are subject to change at Holiday Casino Colorado limited liability company Assignor's sole discretion. By submitting a lease and/or deed assignment, the assign tenant agrees to the following terms: 1.