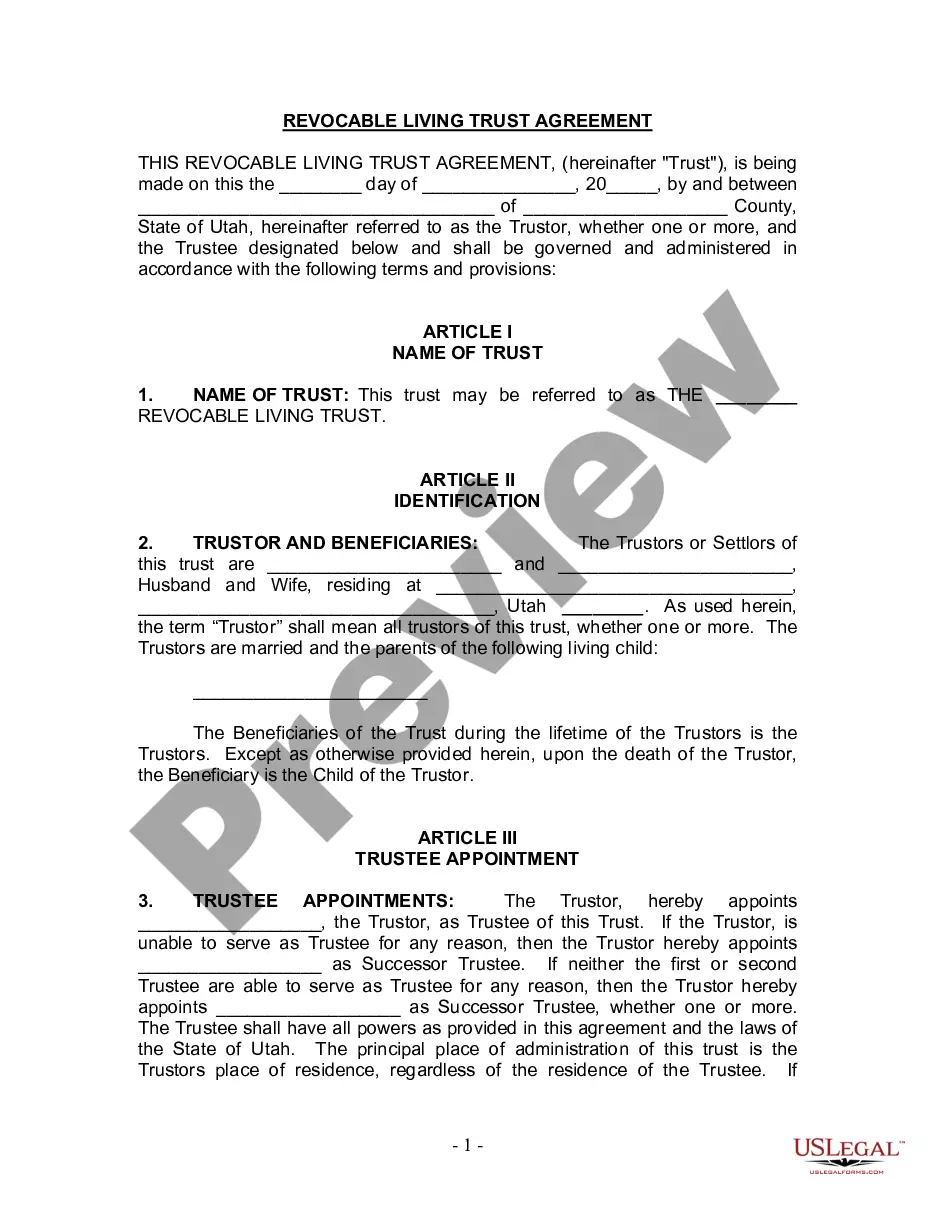

In today's tax system, estate and gift taxes may be levied every time assets change hands from one generation to the next. Dynasty trusts avoided those taxes by creating a second estate that could outlive most of the family members, and continue providing for future generations. Dynasty trusts are long-term trusts created specifically for descendants of all generations. Dynasty trusts can survive 21 years beyond the death of the last beneficiary alive when the trust was written.

Nebraska Irrevocable Generation Skipping or Dynasty Trust Agreement For Benefit of Trustor's Children and Grandchildren

Description

How to fill out Irrevocable Generation Skipping Or Dynasty Trust Agreement For Benefit Of Trustor's Children And Grandchildren?

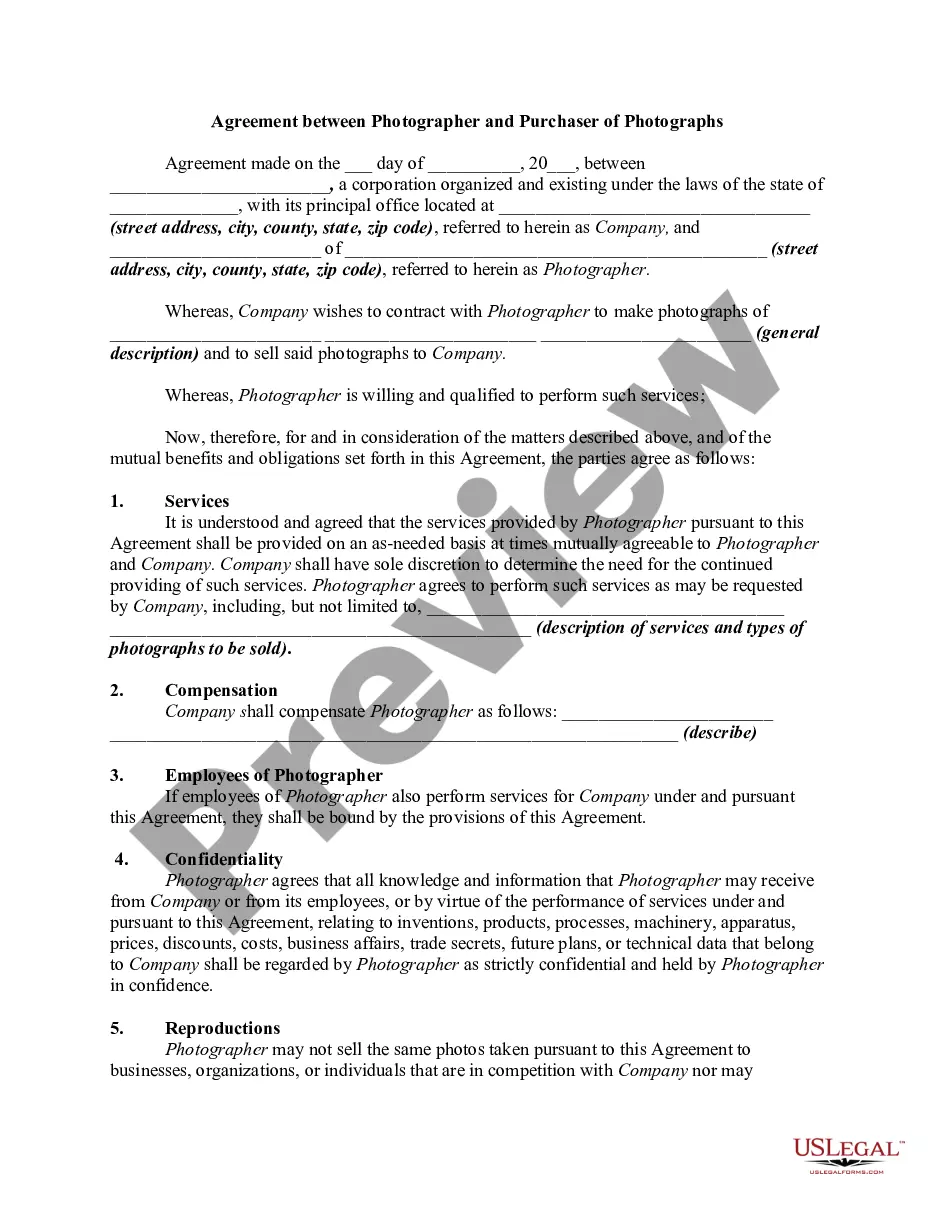

Locating the correct certified document template can be quite a challenge. It's clear that there are numerous templates accessible online, but how can you pinpoint the certified version you require.

Utilize the US Legal Forms website. This service provides a vast array of templates, such as the Nebraska Irrevocable Generation Skipping or Dynasty Trust Agreement For the Advantage of the Trustor's Children and Grandchildren, suitable for both business and personal needs.

All documents are reviewed by professionals and comply with state and federal regulations.

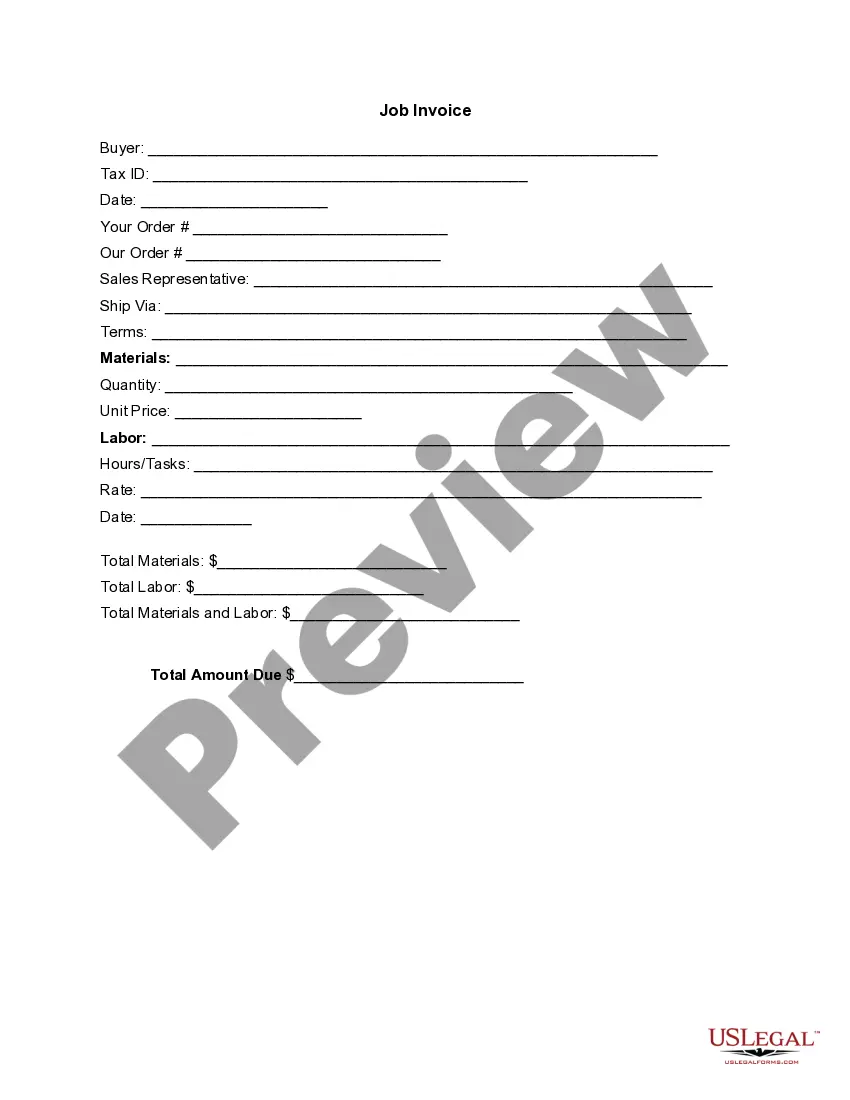

Once you are confident that the template is appropriate, click on the Get now button to obtain the template. Select your payment plan, input the required information, create your account, and make a payment using your PayPal account or credit card. Choose the document format and download the certified document template to your device. Complete, modify, print, and sign the acquired Nebraska Irrevocable Generation Skipping or Dynasty Trust Agreement For the Benefit of the Trustor's Children and Grandchildren. US Legal Forms is the largest collection of certified templates where you can explore various document designs. Take advantage of the service to obtain properly crafted documents that comply with state requirements.

- If you are already registered, sign in to your account and click the Acquire button to access the Nebraska Irrevocable Generation Skipping or Dynasty Trust Agreement For the Benefit of the Trustor's Children and Grandchildren.

- Use your account to review the certified templates you’ve previously purchased.

- Navigate to the My documents section of your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

- First, ensure you have selected the correct template for your city/state. You can view the template using the Review button and read the description to confirm it is suitable for you.

- If the template does not fulfill your needs, use the Search field to find the correct template.

Form popularity

FAQ

A dynasty trust is a special kind of trust that allows you to pass wealth on to your descendants. These trusts can allow a family to save on estate tax or transfer tax across generations while also protecting assets from a variety of situations.

A dynasty trust is a great option for families that are seeking to transfer wealth from generation to generation. If you have a sizable estate and wish to transfer wealth without triggering certain estate-planning taxes, a dynasty trust could be a great option. As a reminder, dynasty trusts are irrevocable.

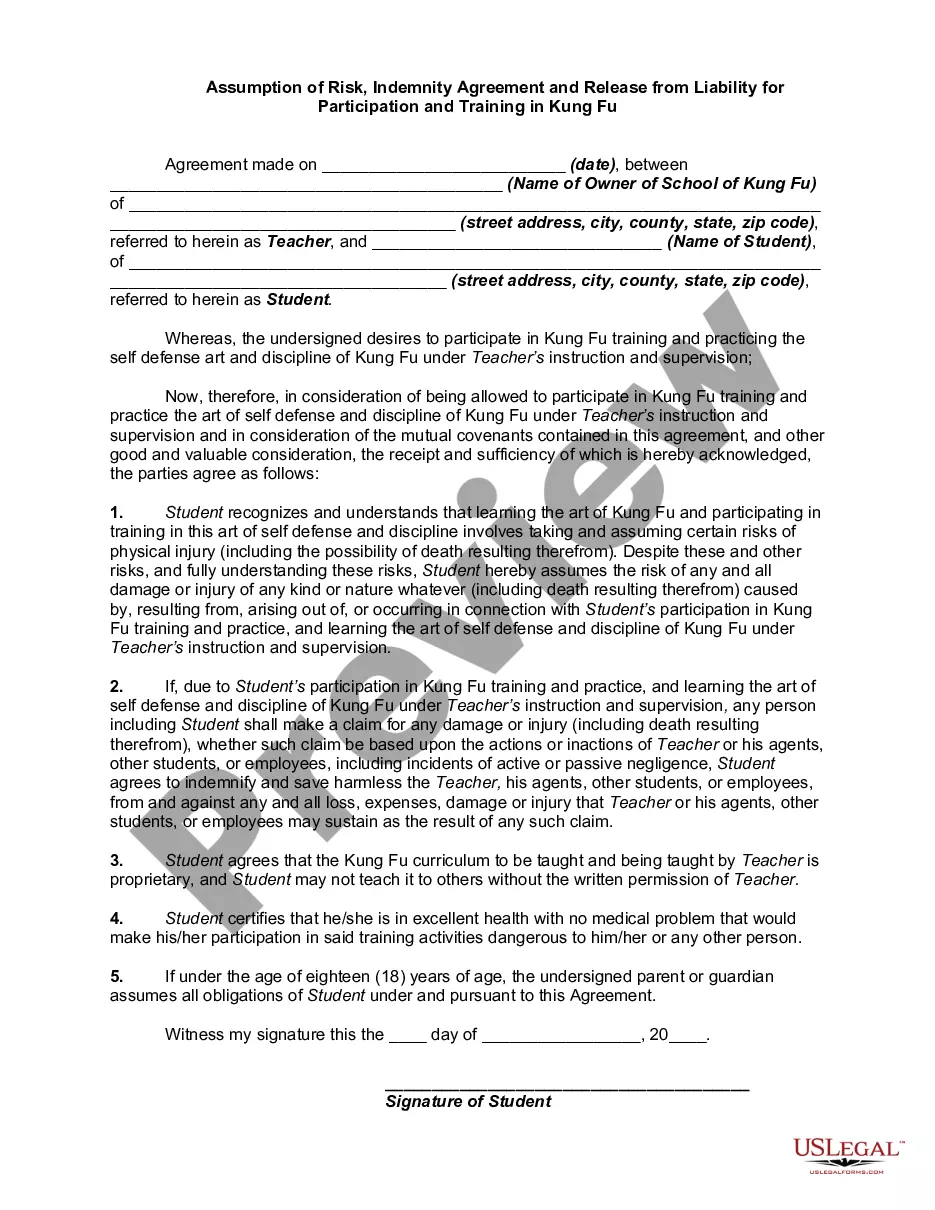

Skip Persons For termination purposes, skip person means a trust beneficiary who is either: A natural person assigned to a generation that is two or more generations below the settlor's generation, or. A trust that meets either of the following conditions: All interests in the trust are held by skip persons; or.

A generation-skipping trust is a type of trust that designates a grandchild, great-niece or great-nephew or any person who is at least 37 ½ years younger than the settlor as the beneficiary of the trust. The goal of a generation-skipping trust is to eliminate one round of estate tax.

A dynasty trust is a long-term trust created to pass wealth from generation to generation without incurring transfer taxessuch as the gift tax, estate tax, or generation-skipping transfer tax (GSTT)for as long as assets remain in the trust. The dynasty trust's defining characteristic is its duration.

A generation-skipping trust (GST) is a legally binding agreement in which assets are passed down to the grantor's grandchildrenor anyone at least 37½ years youngerbypassing the next generation of the grantor's children.

A generation-skipping trust is a type of trust that designates a grandchild, great-niece or great-nephew or any person who is at least 37 ½ years younger than the settlor as the beneficiary of the trust.

A generation skipping trust is an irrevocable trust. This type of trust cannot be changed or revoked.

A dynasty trust allows wealth to be available to each generation while never being reduced by transfer taxes. In 2020, the generation-skipping transfer tax exemption amount is $11,580,000 per person and is the same as the lifetime gift and estate tax exemption amount.

By passing over the grantor's children, the assets avoid the estate taxestaxes on an individual's property upon his or her deaththat would apply if the children directly inherited them. Generation-skipping trusts are effective wealth-preservation tools for individuals with significant assets and savings.