The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

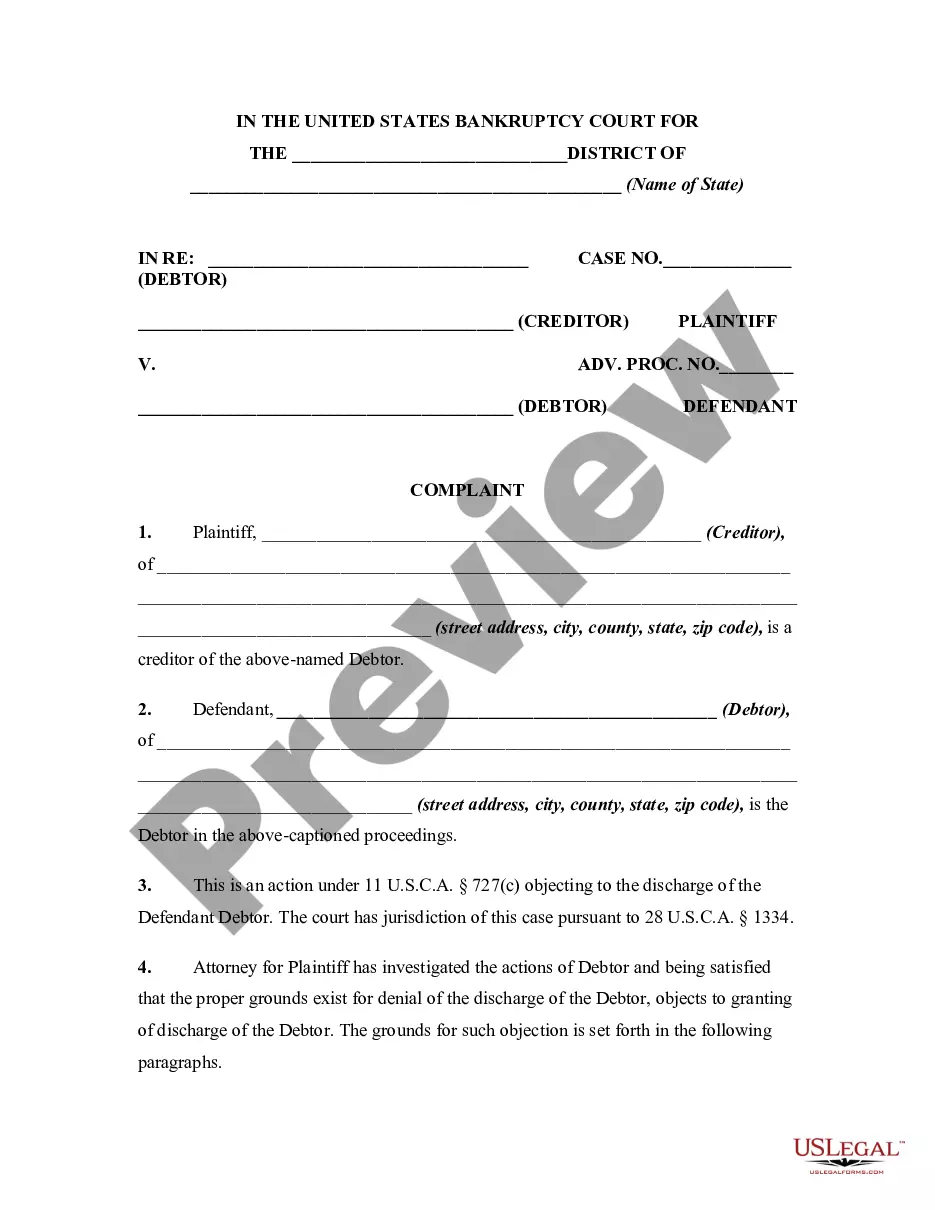

Nebraska Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property Within One Year Preceding

Description

How to fill out Complaint Objecting To Discharge In Bankruptcy Proceeding For Transfer, Removal, Destruction, Or Concealment Of Property Within One Year Preceding?

Are you currently in the place that you need papers for either organization or individual uses nearly every day time? There are plenty of lawful papers themes available on the net, but finding ones you can trust is not effortless. US Legal Forms delivers thousands of type themes, such as the Nebraska Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property, which are written to satisfy federal and state specifications.

Should you be previously acquainted with US Legal Forms internet site and have a free account, merely log in. Following that, you may down load the Nebraska Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property design.

Should you not come with an bank account and need to begin using US Legal Forms, abide by these steps:

- Obtain the type you require and ensure it is to the proper area/state.

- Utilize the Review option to examine the shape.

- Browse the explanation to ensure that you have chosen the right type.

- If the type is not what you are searching for, make use of the Look for area to obtain the type that fits your needs and specifications.

- Whenever you get the proper type, click Purchase now.

- Choose the prices strategy you desire, submit the desired info to create your account, and purchase the transaction utilizing your PayPal or bank card.

- Decide on a hassle-free paper file format and down load your backup.

Locate all of the papers themes you have bought in the My Forms food selection. You can obtain a additional backup of Nebraska Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property anytime, if needed. Just select the needed type to down load or print the papers design.

Use US Legal Forms, the most extensive variety of lawful varieties, to save time and prevent mistakes. The assistance delivers expertly created lawful papers themes which can be used for an array of uses. Make a free account on US Legal Forms and begin generating your daily life a little easier.

Form popularity

FAQ

In fact, the federal courts (which handle bankruptcy cases) list 19 different types of debt that are not eligible for discharge. 2 The most common ones are child support, alimony payments, and debts for willful and malicious injuries to a person or property.

Debts not discharged include debts for alimony and child support, certain taxes, debts for certain educational benefit overpayments or loans made or guaranteed by a governmental unit, debts for willful and malicious injury by the debtor to another entity or to the property of another entity, debts for death or personal ...

Filing for Chapter 7 bankruptcy eliminates credit card debt, medical bills and unsecured loans; however, there are some debts that cannot be discharged. Those debts include child support, spousal support obligations, student loans, judgments for damages resulting from drunk driving accidents, and most unpaid taxes.

Chapter 7 Bankruptcy Doesn't Clear All Debts Mortgages, car loans, and other "secured" debts if you keep the property. ... Recent income taxes, support obligations, and other "priority" debt. ... Debts incurred by fraud or criminal acts. ... Student loans.

If a debt arose from the debtor's intentional wrongdoing, the creditor can object to discharging it. This might involve damages related to a drunk driving accident, for example, or costs caused by intentional damage to an apartment or other property.

Key Takeaways. Types of debt that cannot be discharged in bankruptcy include alimony, child support, and certain unpaid taxes. Other types of debt that cannot be alleviated in bankruptcy include debts for willful and malicious injury to another person or property.

The burden then shifts to the debtor to object to the claim. The debtor must introduce evidence to rebut the claim's presumptive validity. If the debtor carries its burden, the creditor has the ultimate burden of proving the amount and validity of the claim by a preponderance of the evidence.

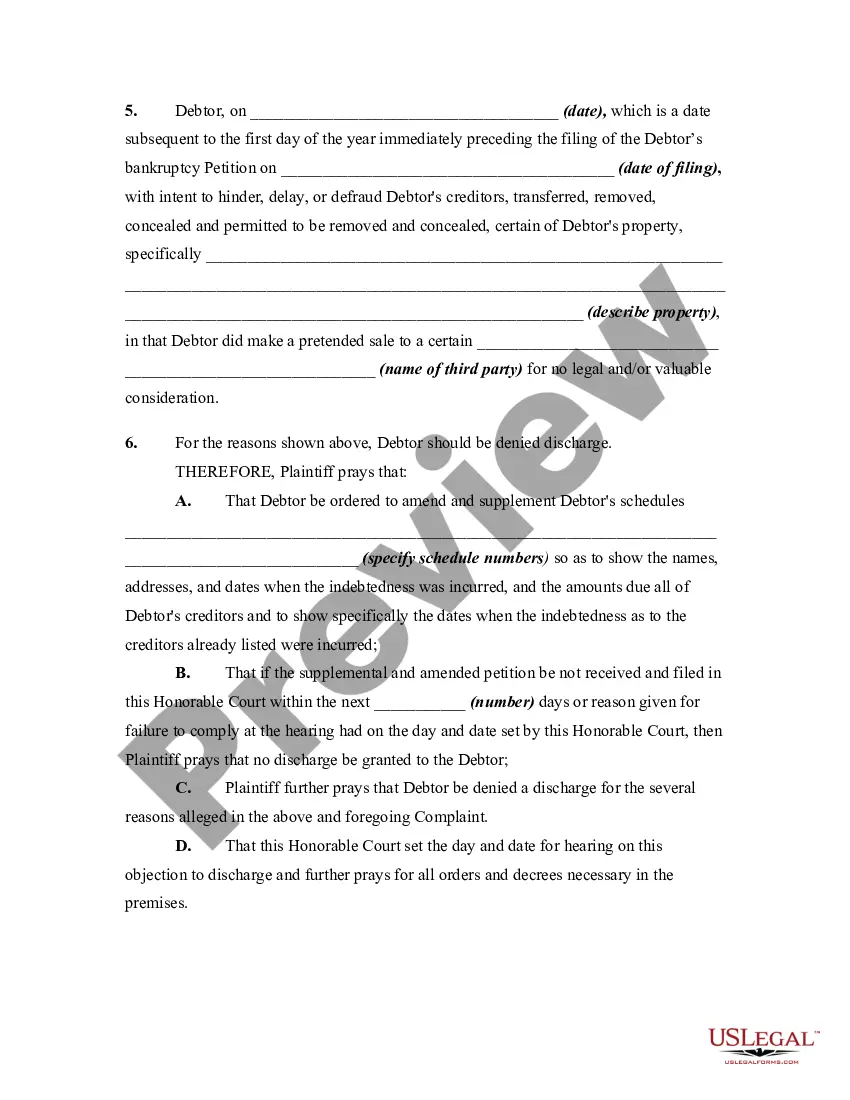

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...