Are you in the placement in which you need paperwork for sometimes business or individual reasons almost every day time? There are a lot of lawful record web templates accessible on the Internet, but discovering types you can rely isn`t straightforward. US Legal Forms provides thousands of form web templates, much like the Nebraska Agreement By Heirs to Substitute New Note for Note of Decedent, that happen to be created in order to meet federal and state requirements.

In case you are presently knowledgeable about US Legal Forms site and have your account, just log in. After that, you can download the Nebraska Agreement By Heirs to Substitute New Note for Note of Decedent template.

If you do not have an accounts and wish to start using US Legal Forms, abide by these steps:

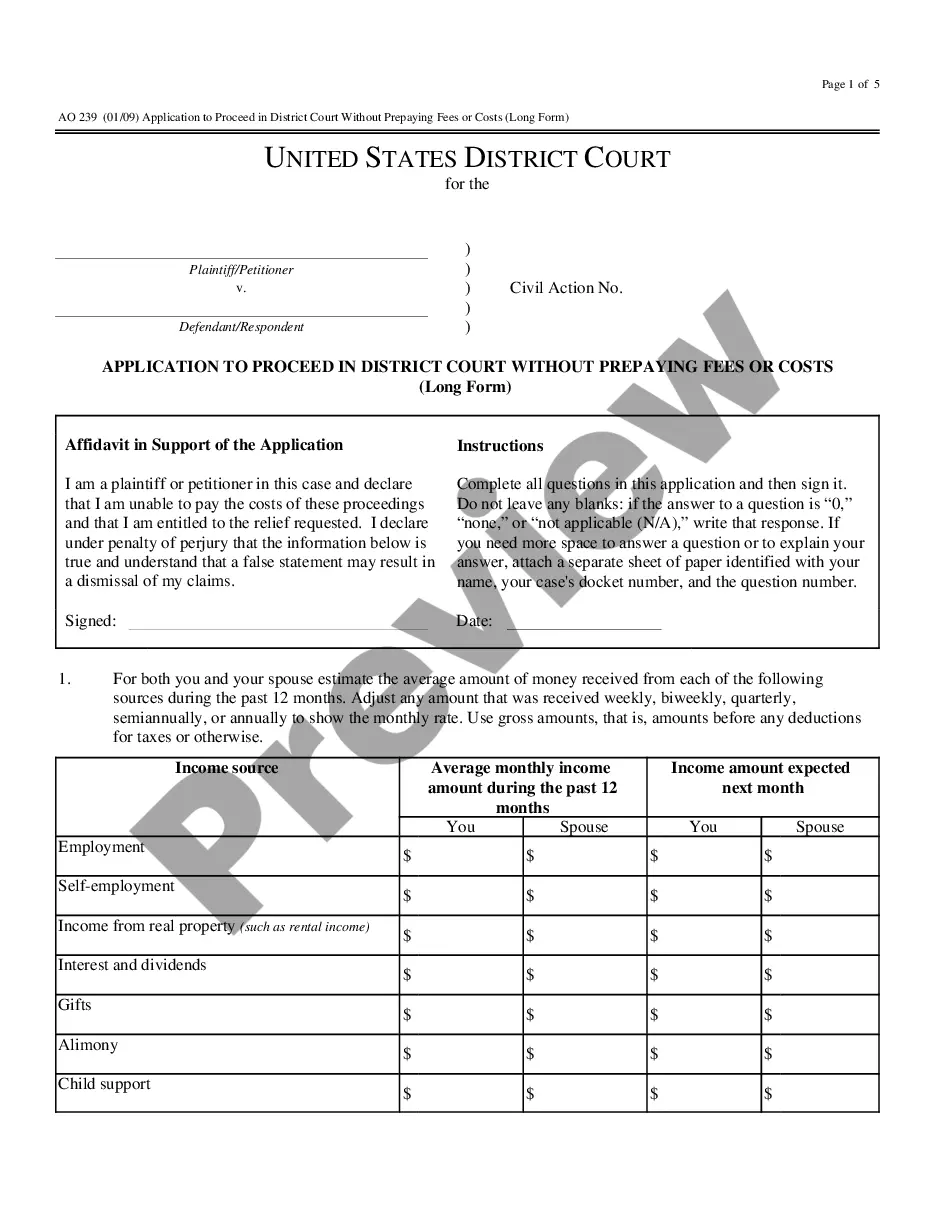

- Obtain the form you want and make sure it is for the proper town/state.

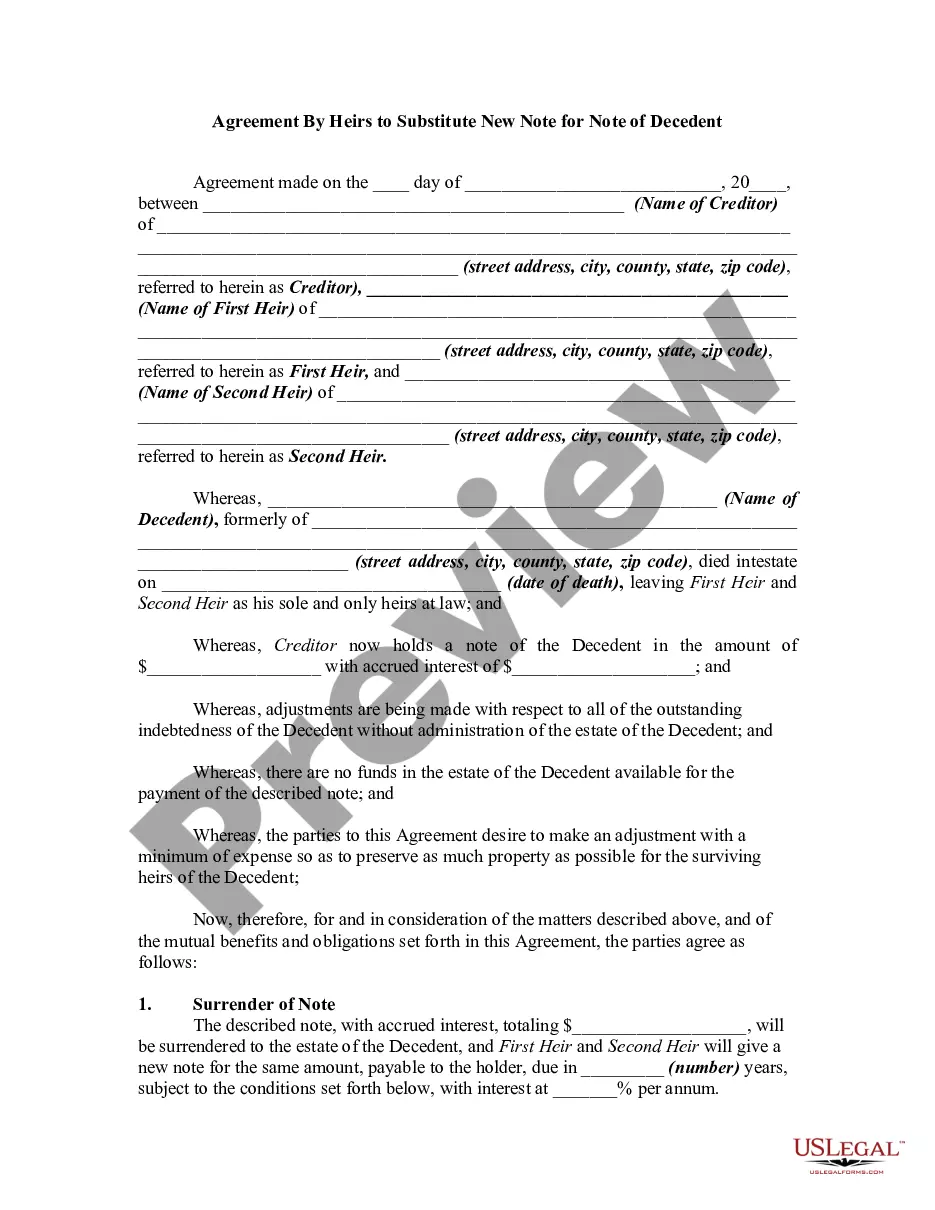

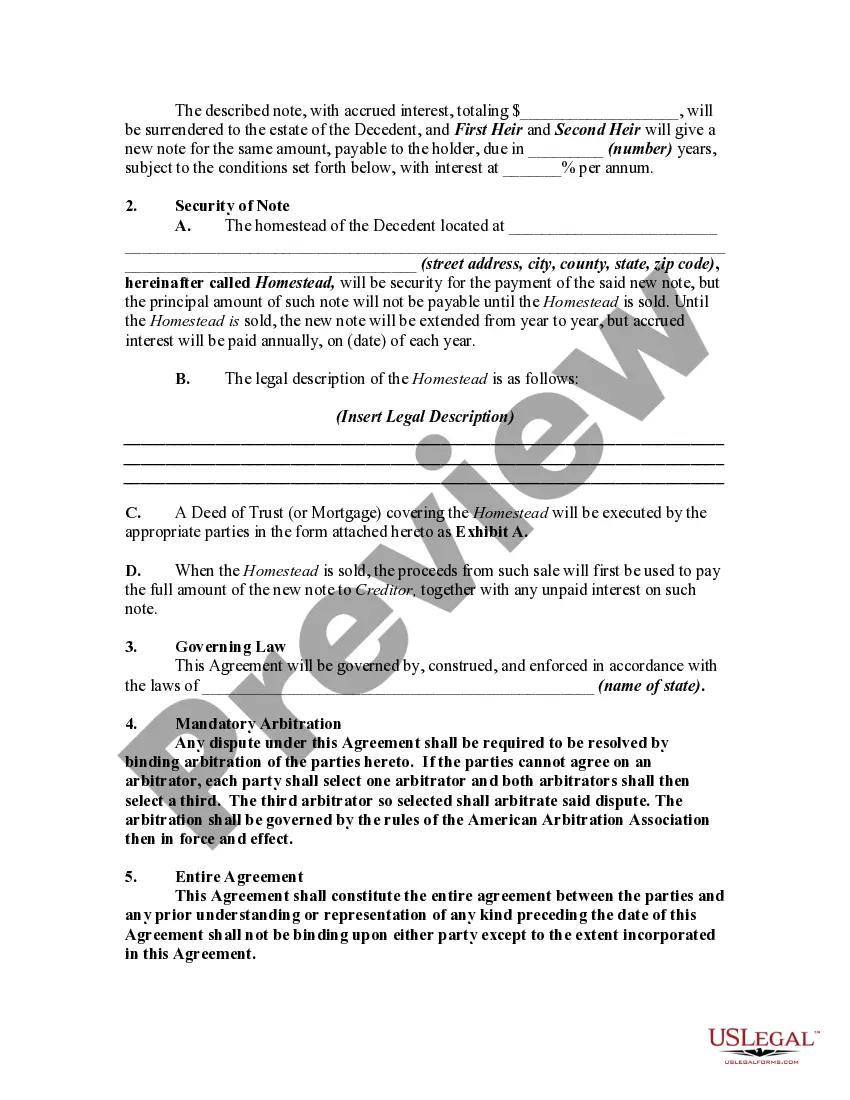

- Take advantage of the Review key to check the shape.

- Read the description to ensure that you have selected the appropriate form.

- If the form isn`t what you are searching for, use the Lookup field to find the form that suits you and requirements.

- If you find the proper form, simply click Acquire now.

- Choose the pricing plan you want, complete the desired information to make your money, and purchase the order utilizing your PayPal or credit card.

- Decide on a practical file formatting and download your version.

Discover all of the record web templates you might have purchased in the My Forms food list. You can aquire a more version of Nebraska Agreement By Heirs to Substitute New Note for Note of Decedent at any time, if needed. Just go through the essential form to download or printing the record template.

Use US Legal Forms, one of the most extensive collection of lawful forms, to save time as well as steer clear of faults. The services provides expertly manufactured lawful record web templates that can be used for an array of reasons. Generate your account on US Legal Forms and start producing your life easier.