An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

Nebraska Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian

Description

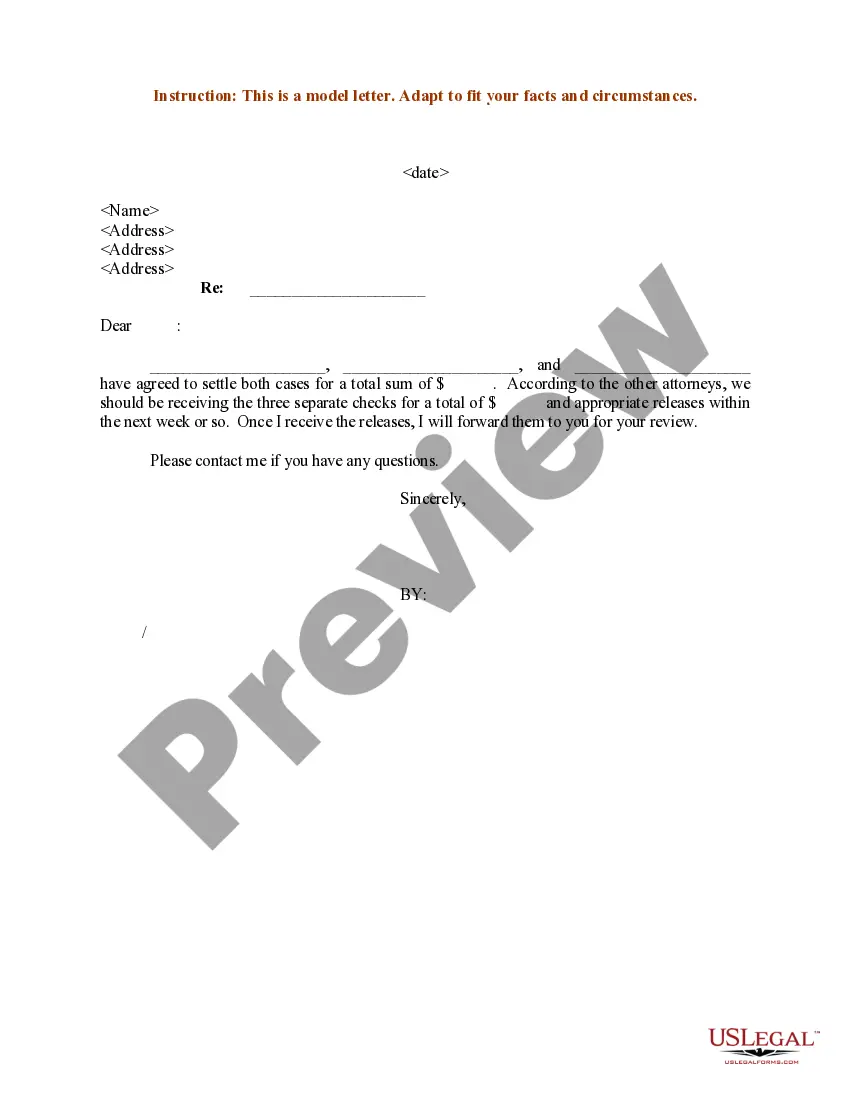

How to fill out Demand For Accounting From A Fiduciary Such As An Executor, Conservator, Trustee Or Legal Guardian?

If you require to summarize, obtain, or produce legal document templates, utilize US Legal Forms, the premier repository of legal forms, available online.

Employ the website's straightforward and user-friendly search to find the documents you need.

Various templates for business and personal purposes are organized by categories and jurisdictions or keywords.

Step 4. Once you have found the form you need, click the Buy Now button. Select your preferred pricing plan and provide your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to acquire the Nebraska Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to access the Nebraska Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian.

- You can also access forms you previously downloaded from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure that you have selected the form for your correct area/state.

- Step 2. Use the Review feature to examine the form's content. Don't forget to read the information.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

The final accounting packet includes a comprehensive breakdown of all financial transactions managed by the fiduciary. This packet typically features detailed account statements, inventory lists, and receipts that document income and expenses. When you issue a Nebraska Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian, you can expect clear and organized documentation. Utilizing uslegalforms can help ensure that your final accounting follows the necessary legal standards and simplifies the entire process.

The final accounting packet usually contains a detailed report of all financial transactions, including income, expenditures, and asset management over the course of the fiduciary relationship. Additionally, it often includes supporting documentation such as receipts and bank statements. When preparing a Nebraska Demand for Accounting from a Fiduciary, it’s crucial to ensure that this packet is thorough and accurate to provide clarity to all parties involved.

A conservator is appointed by the court to manage the financial resources of an individual deemed unable to do so themselves, often due to incapacity. This role can be filled by an individual, agency, or organization, depending on the situation. If you find yourself needing to file a Nebraska Demand for Accounting from a Fiduciary, knowing who qualifies as a conservator can guide you through the legal processes.

Yes, a conservator is a type of fiduciary, tasked with overseeing the financial matters of someone unable to manage their own affairs. While all conservators are fiduciaries, not all fiduciaries are conservators. When dealing with a Nebraska Demand for Accounting from a Fiduciary, understanding this distinction can clarify who is responsible for making financial decisions.

A conservatorship can limit the rights of the individual under care, which may feel restrictive. Additionally, it often involves ongoing court supervision, adding time and costs to managing the estate. If you need to submit a Nebraska Demand for Accounting from a Fiduciary, understanding these disadvantages can help you make informed decisions about the best course of action.

A fiduciary is an individual or organization that manages assets on behalf of another person, always prioritizing that person’s interests. In the context of a Nebraska Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee, or Legal Guardian, fiduciaries hold significant responsibilities. They must manage the finances and affairs of the individual they represent, ensuring transparency and accountability throughout the process.

Typically, a trustee should provide a written accounting at least annually, or more frequently if required by the trust documents. This regular reporting helps beneficiaries stay informed about the financial status of the trust. If you feel that you need a Nebraska Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee, or Legal Guardian, it indicates that transparency is vital to you and the other beneficiaries.

Section 30 2209 of the Nebraska Probate Code outlines the requirements for accounting by a trustee. It specifies that trustees must provide accurate and complete records to the beneficiaries. This section is integral to ensuring transparency and accountability in trust management. Understanding this law aids beneficiaries in making a Nebraska Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee, or Legal Guardian.

Yes, a trustee is legally required to provide an accounting. This accounting should clearly detail all transactions related to the trust assets. When beneficiaries request this information, it is part of the trustee's obligations. If you find yourself needing to issue a Nebraska Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee, or Legal Guardian, it reinforces the importance of this duty.

A trustee cannot refuse or ignore the obligation to provide accounting to beneficiaries. Each beneficiary has the right to seek information about the trust's financial activities. If a trustee fails to comply, beneficiaries may need to issue a Nebraska Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee, or Legal Guardian to ensure compliance.