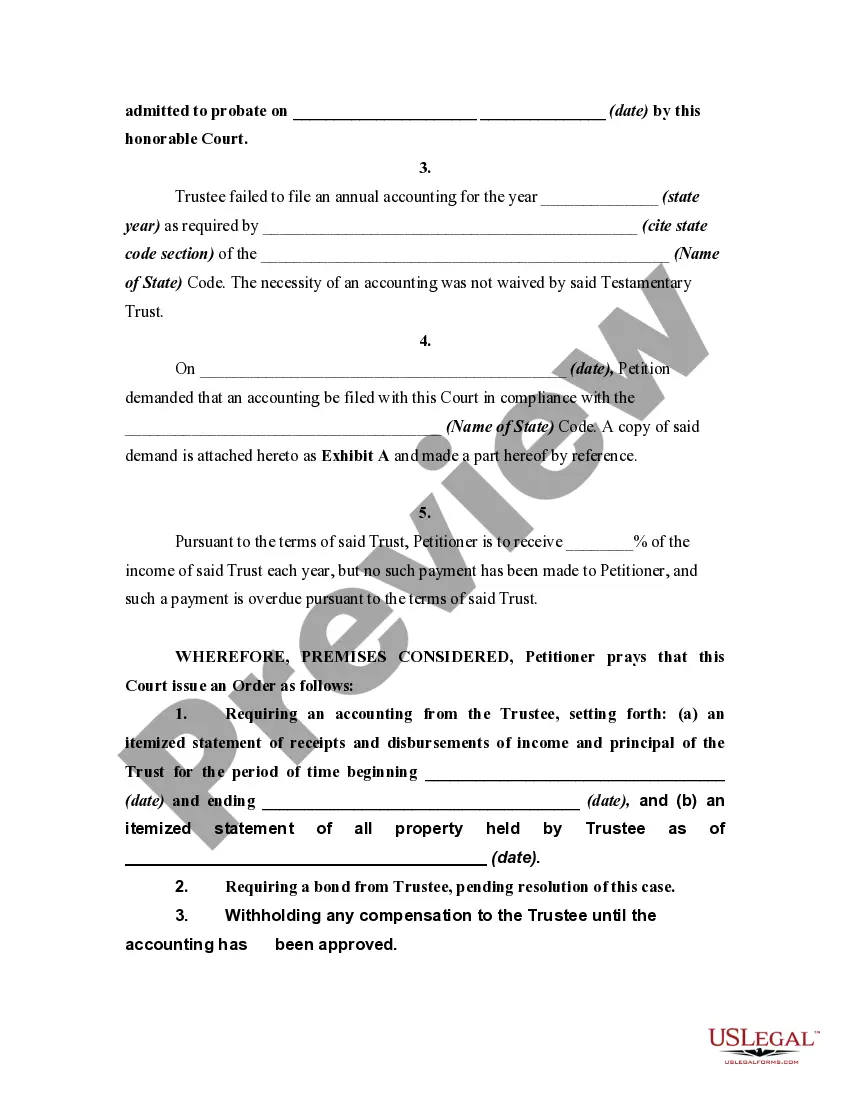

An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

Nebraska Petition to Require Accounting from Testamentary Trustee

Description

How to fill out Petition To Require Accounting From Testamentary Trustee?

Finding the correct legitimate document format can be challenging.

Of course, there are numerous templates available online, but how do you find the appropriate document you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Nebraska Petition to Require Accounting from Testamentary Trustee, suitable for both business and personal needs. All forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Acquire option to download the Nebraska Petition to Require Accounting from Testamentary Trustee.

- Use your account to search through the legal forms you have previously purchased.

- Visit the My documents tab of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the right form for your city/region.

- You can review the form using the Review option and read the form description to ensure it is suitable for you.

- If the form does not meet your requirements, use the Search field to find the correct form.

- Once you are confident the form is appropriate, click the Purchase now option to obtain the form.

- Choose the pricing plan you want and enter the required information.

- Create your account and pay for the transaction using your PayPal account or credit card.

- Select the document format and download the legal document format to your device.

- Complete, edit, print, and sign the received Nebraska Petition to Require Accounting from Testamentary Trustee.

- US Legal Forms is the largest collection of legal forms where you can find a variety of document templates.

- Utilize the service to download professionally crafted paperwork that adhere to state requirements.

Form popularity

FAQ

A testamentary trust is not established until after the person passes away in which the executor or executrix settles the estate as outlined in the will.

30-2209. General definitions. (1) Application means a written request to the registrar for an order of informal probate or appointment under part 3 of Article 24.

Under Pennsylvania law, executors have a duty to provide an accounting to beneficiaries. An accounting is a detailed report that outlines the assets, liabilities, income, and expenses associated with the estate, as well as the executor's actions in managing and distributing the estate.

These elements are: Intention to create a trust; Permissible purpose for the trust; Identification of beneficiaries; and. Existence of trust res.

A testamentary trust is created to manage the assets of the deceased on behalf of the beneficiaries. It is also used to reduce estate tax liabilities and ensure professional management of the assets of the deceased.

The trustee has effective control of the trust, so the trustee should be a person whom you know and trust to act in the best interests of those who are to receive the benefit. If you establish a number of testamentary trusts, you can have different trustees for each of them.

A testamentary trust is a trust established under a valid will, but it's not the same trust as the deceased estate. Depending on who is appointed as the trustee and appointor of the testamentary trust, there may need to be a high level of co-operation between family members.

Consider setting up a trust if you want to: Ensure that your assets are managed for the benefit of your heirs, ing to your wishes. Preserve your assets while potentially minimizing taxes and probate costs associated with transferring assets through a will. Establish a tax-advantaged charitable gift.