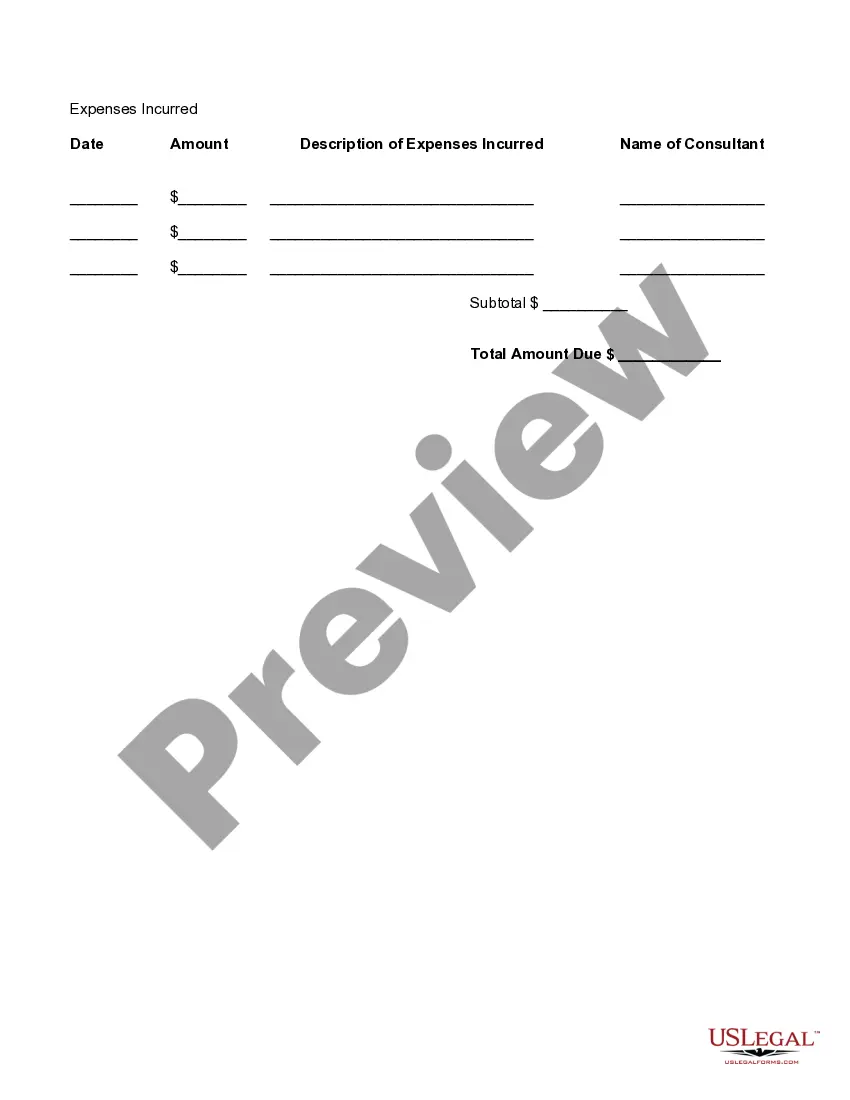

An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Nebraska Detailed Consultant Invoice

Description

How to fill out Detailed Consultant Invoice?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal document templates that you can download or print.

By utilizing the site, you will access a vast assortment of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the Nebraska Detailed Consultant Invoice within minutes.

If you have an account, Log In to obtain the Nebraska Detailed Consultant Invoice from the US Legal Forms repository. The Download button will be available on every form you view. You can access all previously saved forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Choose the format and download the form to your device. Make modifications. Fill out, edit, and print and sign the saved Nebraska Detailed Consultant Invoice. Each template you add to your account has no expiration date and is yours permanently. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you desire.

- Ensure you have selected the correct form for your region/area.

- Click the Preview button to examine the form's content.

- Review the form overview to confirm you have chosen the correct form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, validate your choice by clicking the Purchase now button.

- Next, select your preferred pricing plan and provide your details to register for an account.

Form popularity

FAQ

Writing a detailed invoice involves careful documentation of all services rendered. You should start with your business information, the client's information, and then provide a thorough account of the services offered, including costs and due dates. Using a structured format for your Nebraska Detailed Consultant Invoice ensures clarity and professionalism in your transactions.

To fill out a simple invoice, start by stating your company name, the client's name, and the invoice date. Next, generally list the services provided along with their costs and calculate the total due. Keep it clear and concise so that your Nebraska Detailed Consultant Invoice is easy to read.

Sending a detailed invoice involves compiling all necessary elements in your Nebraska Detailed Consultant Invoice. Utilize electronic formats such as PDF to maintain formatting when sharing via email. Always accompany your invoice with a brief message that emphasizes payment deadlines, ensuring clear communication and fostering a professional relationship.

Filling out invoice details requires attention to specific elements. Start by including your business name, the recipient's name, the invoice date, and an invoice number for record-keeping. Additionally, describe the services or products provided and their associated costs clearly, ensuring your Nebraska Detailed Consultant Invoice is professional and straightforward.

To submit an invoice to an independent contractor, prepare your Nebraska Detailed Consultant Invoice with all relevant details such as your contact information, the contractor's details, and a breakdown of services rendered. Ensure that you include the due date and payment terms. Once your invoice is ready, send it via email or through a secure file-sharing service, creating a digital record for both parties.

Filling out a contractor invoice involves listing your name, contact information, and the client's details at the top. Next, describe the services rendered along with relevant dates and costs. Don't forget to calculate the total amount due and include payment terms. Consider using a Nebraska Detailed Consultant Invoice template from USLegalForms, which makes this task straightforward and ensures you don’t miss any crucial information.

To create a Nebraska Detailed Consultant Invoice, start by including your business's name, address, and contact information at the top. Then, detail the consulting services provided, including dates, hours worked, and hourly rates. Be sure to present a clear total amount due at the bottom. Utilizing platforms like USLegalForms can simplify this process by offering customizable templates that ensure you include all necessary elements.

Consultants typically bill based on hourly rates, project fees, or retainer agreements. Choosing a billing method depends on your services and client agreements. A Nebraska Detailed Consultant Invoice can help standardize your billing process, making it easier for clients to understand their obligations while showcasing your professionalism.

To invoice as a consultant, start by gathering all necessary information about the services you provided. Then, utilize an invoicing platform or template to create your Nebraska Detailed Consultant Invoice. Ensure that you include all essential details, such as your rates, payment instructions, and due date, to facilitate smooth transactions.

Your invoice should be detailed enough to provide clarity without overwhelming the client. Include itemized service descriptions, the hours worked, and any additional charges. A Nebraska Detailed Consultant Invoice strikes the right balance, offering clients a comprehensive view while maintaining a professional appearance.