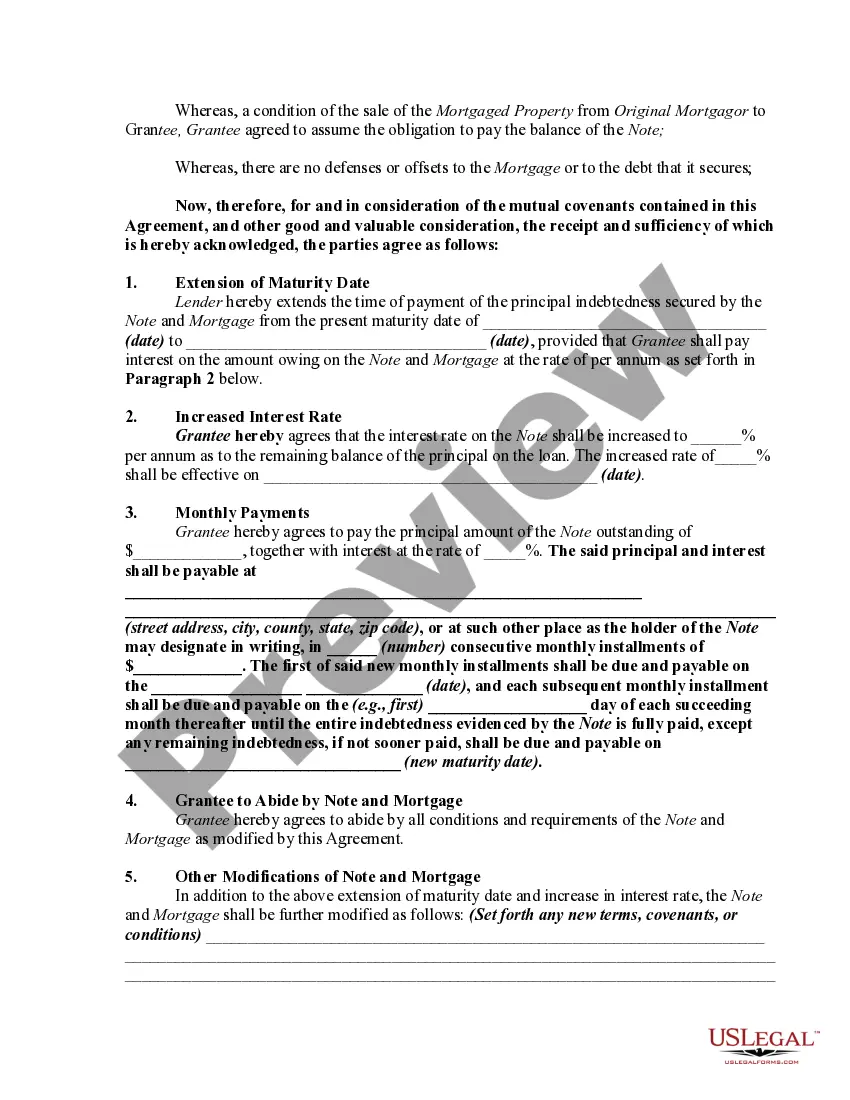

An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. Such a modification or extension is contractual in nature and must be supported by consideration. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Nebraska Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest is a legal document that outlines the terms and conditions when a new owner assumes an existing mortgage on a property in Nebraska while also agreeing to an increased interest rate. This agreement may be required in situations where a property is sold, and the new owner decides to assume the existing mortgage instead of obtaining a new loan. By assuming the debt, the new owner takes responsibility for the remaining balance of the mortgage and agrees to abide by the terms originally established. Keyword: Nebraska Mortgage Extension Agreement, Assumption of Debt, New Owner, Real Property, Mortgage, Increase of Interest. There may be different types of Nebraska Mortgage Extension Agreements with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest, based on specific conditions or parties involved: 1. Standard Nebraska Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest: This document is executed when a new owner buys a property and agrees to assume the existing mortgage while accepting an increase in interest rate. 2. Nebraska Mortgage Extension Agreement with Assumption of Debt and Takeover by a Corporation or LLC: In cases where a corporation or Limited Liability Company (LLC) takes over the ownership of a property and assumes the mortgage, this type of agreement is used to formalize the transaction and specify the new interest rate. 3. Nebraska Mortgage Extension Agreement with Assumption of Debt and Buyout by Family Member: If a property is transferred to a family member, and they agree to assume the mortgage, this agreement is used to clarify the terms, including the increased interest rate. 4. Nebraska Mortgage Extension Agreement with Assumption of Debt and Transfer to a Trust: In situations where a property is transferred to a trust, and the trustee agrees to assume the mortgage, this type of agreement identifies the responsibilities and the new interest rate. Regardless of the specific type of agreement, a Nebraska Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest ensures that both parties involved are fully aware of their obligations regarding the mortgage and the terms of the new interest rate.