Nebraska HIPAA Release Form for Insurance: Comprehensive Guide Keywords: Nebraska HIPAA release form, insurance, healthcare providers, protected health information (PHI), authorization, patient consent Introduction: The Nebraska HIPAA Release Form for Insurance is a crucial document that allows healthcare providers to share an individual's protected health information (PHI) with insurance companies for various purposes. It ensures compliance with the Health Insurance Portability and Accountability Act (HIPAA) regulations, which protect the privacy and security of individuals' medical records. This comprehensive guide outlines the importance, purpose, and various types of Nebraska HIPAA Release Forms for Insurance. 1. Basic Information: The Nebraska HIPAA Release Form for Insurance, also known as the Authorization for Release of Protected Health Information form, serves as a legal consent from the patient or their authorized representative to allow healthcare providers to disclose PHI to insurance companies. This disclosure facilitates efficient claims processing, coverage determination, and payment of medical services. 2. Purpose of Nebraska HIPAA Release Form for Insurance: The primary purpose of this form is to ensure that healthcare providers comply with federal HIPAA regulations while sharing the necessary information to process insurance claims. It enables the insurance company to access specific medical records–typically related to diagnosis, treatments, medications, and other relevant details–for claims adjudication, pre-authorization, or utilization review. 3. Elements of Nebraska HIPAA Release Form for Insurance: — Patient Information: The form collects essential patient details, including name, address, date of birth, contact information, and insurance identification specifics. — Healthcare Provider Information: This section requires the healthcare provider's name, address, contact information, and other identifiers necessary for proper identification. — Authorization Details: The form outlines the specific purposes for disclosing PHI, such as claim submission, policy determination, utilization review, and any limitations imposed by the patient. — Expiration Date: A Nebraska HIPAA Release Form for Insurance typically includes an expiration date, after which the release of PHI is no longer authorized. Patients have the option to specify the duration of validity. — Patient Signature: To ensure legal validity, the patient or their authorized representative must sign and date the form. 4. Different Types of Nebraska HIPAA Release Form for Insurance: a) Standard Nebraska HIPAA Release Form for Insurance: This is the most common and straightforward version of the form, providing a general authorization for sharing PHI between healthcare providers and insurance companies. It covers regular claim processing, coverage determination, and pre-authorization requirements. b) Limited Nebraska HIPAA Release Form for Insurance: This type of form limits the scope of PHI disclosure to specific purposes or entities, ensuring that only relevant information is shared. Patients may choose to restrict the release to certain diagnoses, providers, or insurers. c) Temporary Nebraska HIPAA Release Form for Insurance: These forms have a limited duration, typically utilized for time-bound situations, such as short-term insurance coverage or specific treatment purposes. The form specifies the start and end dates for the authorized PHI release. In conclusion, the Nebraska HIPAA Release Form for Insurance is a vital tool for compliance with HIPAA regulations while establishing a seamless flow of medical information between healthcare providers and insurance companies. By using these forms, patients can provide informed consent for the release of their protected health information, ensuring efficient claims processing and healthcare reimbursement.

Nebraska Hippa Release Form for Insurance

Description

How to fill out Nebraska Hippa Release Form For Insurance?

US Legal Forms - among the greatest libraries of legitimate forms in the USA - offers a wide range of legitimate file themes you can obtain or printing. Making use of the site, you can get a large number of forms for company and individual purposes, categorized by groups, claims, or search phrases.You can find the newest variations of forms much like the Nebraska Hippa Release Form for Insurance within minutes.

If you have a subscription, log in and obtain Nebraska Hippa Release Form for Insurance from your US Legal Forms local library. The Obtain button will appear on every develop you see. You get access to all in the past acquired forms within the My Forms tab of your profile.

If you would like use US Legal Forms for the first time, allow me to share simple directions to help you get started out:

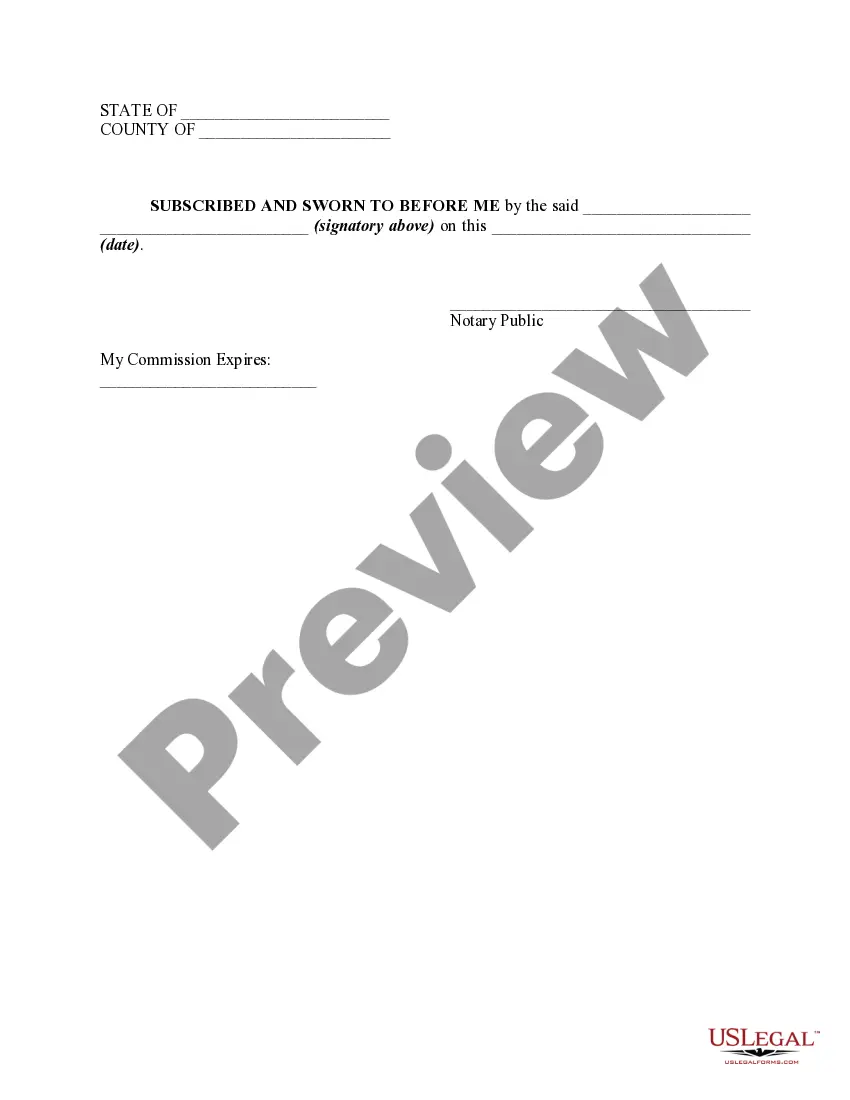

- Ensure you have selected the right develop for your town/region. Go through the Preview button to analyze the form`s information. Read the develop description to ensure that you have chosen the right develop.

- In the event the develop does not suit your requirements, use the Search industry towards the top of the screen to discover the one which does.

- If you are happy with the shape, verify your choice by clicking on the Purchase now button. Then, pick the costs program you prefer and give your credentials to register for the profile.

- Approach the transaction. Use your charge card or PayPal profile to perform the transaction.

- Choose the structure and obtain the shape on the product.

- Make changes. Complete, modify and printing and indicator the acquired Nebraska Hippa Release Form for Insurance.

Every web template you included in your money does not have an expiration time and is also yours forever. So, in order to obtain or printing one more copy, just proceed to the My Forms area and then click in the develop you will need.

Gain access to the Nebraska Hippa Release Form for Insurance with US Legal Forms, probably the most substantial local library of legitimate file themes. Use a large number of professional and express-distinct themes that meet your organization or individual demands and requirements.