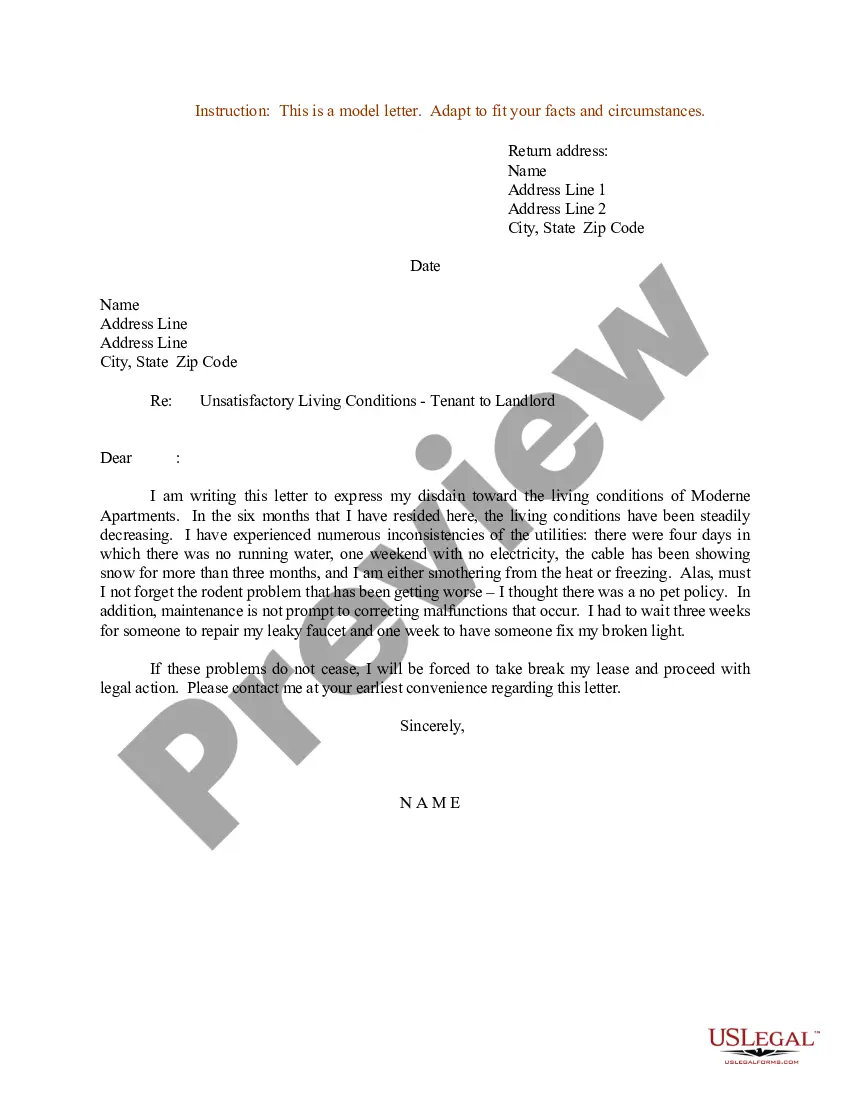

This form is a sample letter requesting the removal of inaccurate information. Always include any copies of proof you may have (e.g., copies of cancelled checks showing timely payments). If the person claims that the information of the bureau is erroneous, the bureau must take steps within a reasonable time to determine the accuracy of the disputed items. If no correction is made, the debtor can write a 100 word statement of clarification which will be included in future credit reports, even it the agency disagrees with clarification.

Nebraska Letter to Credit Bureau Requesting the Removal of Inaccurate Information

Description

How to fill out Letter To Credit Bureau Requesting The Removal Of Inaccurate Information?

Selecting the finest genuine document template can be a challenge. Naturally, there are numerous templates available on the web, but how do you find the authentic version you seek.

Utilize the US Legal Forms website. This service provides a vast array of templates, including the Nebraska Letter to Credit Bureau Requesting the Removal of Incorrect Information, which can be utilized for business and personal purposes. All forms are verified by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Obtain button to acquire the Nebraska Letter to Credit Bureau Requesting the Removal of Incorrect Information. Use your account to search through the legal forms you have previously purchased. Navigate to the My documents tab of your account and obtain another copy of the document you need.

Complete, modify, print, and sign the Nebraska Letter to Credit Bureau Requesting the Removal of Incorrect Information. US Legal Forms is the largest repository of legal forms where you can explore a variety of document templates. Benefit from this service to download well-crafted documents that comply with state requirements.

- If you are a new client of US Legal Forms, follow these simple instructions.

- First, ensure that you have selected the correct form for your jurisdiction/state. Use the Review button to view the form and read the description to confirm it is suitable for you.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

- Once you are convinced that the form is suitable, click the Purchase now button to acquire the form.

- Select the payment plan you desire and enter the necessary information. Create your account and complete your transaction using your PayPal account or Visa or Mastercard.

- Choose the file format and download the legal document template to your device.

Form popularity

FAQ

To remove inaccurate information from your credit report, start by reviewing your report for errors. Once you find inaccuracies, you can draft a Nebraska Letter to Credit Bureau Requesting the Removal of Inaccurate Information. Make sure to include all relevant details about the inaccuracies and any supporting documentation. This structured approach can significantly aid in correcting your credit report.

Yes, you can remove inaccurate information from your credit report. It is essential to identify these errors and take action. By using a Nebraska Letter to Credit Bureau Requesting the Removal of Inaccurate Information, you can formally request corrections. This process helps improve your credit report and can enhance your overall credit score.

You cannot completely erase your credit history, but you can work to improve it by removing inaccuracies and managing your credit responsibly. By using a Nebraska Letter to Credit Bureau Requesting the Removal of Inaccurate Information, you can address errors affecting your credit score. Additionally, maintaining timely payments and managing your debts will gradually enhance your overall credit history.

Yes, you can legally remove inaccuracies from your credit report through the dispute process. Utilizing a Nebraska Letter to Credit Bureau Requesting the Removal of Inaccurate Information ensures you follow the correct procedures required by law. If the disputed information proves to be incorrect, the credit bureau must remove it, enhancing your credit profile.

To get incorrect information removed from your credit report, you should first identify the errors and gather relevant documentation. Then, write a Nebraska Letter to Credit Bureau Requesting the Removal of Inaccurate Information, outlining your request and including evidence to support your claim. Sending this letter prompts the bureau to investigate your case and make necessary corrections.

Yes, you can remove inaccurate information from your credit report by disputing it with the credit bureaus. Using a well-structured Nebraska Letter to Credit Bureau Requesting the Removal of Inaccurate Information increases your chances of success. The bureaus are obligated to investigate and correct any inaccuracies after they receive your request.

To remove an incorrect collection from your credit report, start by obtaining a copy of your report to identify the errors. Craft a Nebraska Letter to Credit Bureau Requesting the Removal of Inaccurate Information, specifying the collection account in question. Attach any documentation that supports your claim, and submit your letter to expedite resolution.

A 609 letter refers to a specific type of request under the Fair Credit Reporting Act, allowing consumers to ask credit bureaus to verify information on their reports. When you utilize a Nebraska Letter to Credit Bureau Requesting the Removal of Inaccurate Information, you may include a 609 request to prompt a thorough review of disputed entries. This tactic helps substantiate your request by pushing for verification of the accuracy of your credit data.

To dispute inaccurate information on your credit report, you should first gather relevant documents and identify the specific inaccuracies. Next, draft a Nebraska Letter to Credit Bureau Requesting the Removal of Inaccurate Information, clearly stating your claim and including supporting evidence. Send the letter to the credit bureau, and they are required by law to investigate your dispute.

To remove inquiries from your credit report, you need to contact the credit bureaus and submit a request for the removal of specific inquiries. Utilize a Nebraska Letter to Credit Bureau Requesting the Removal of Inaccurate Information to clearly outline your request and the reasons for it. This proactive approach allows you to assert your rights and seek an accurate credit report.