This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Nebraska Privacy and Confidentiality Policy for Credit Counseling Services

Description

How to fill out Privacy And Confidentiality Policy For Credit Counseling Services?

You might spend hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal templates that are reviewed by experts.

You can download or print the Nebraska Privacy and Confidentiality Policy for Credit Counseling Services from the service.

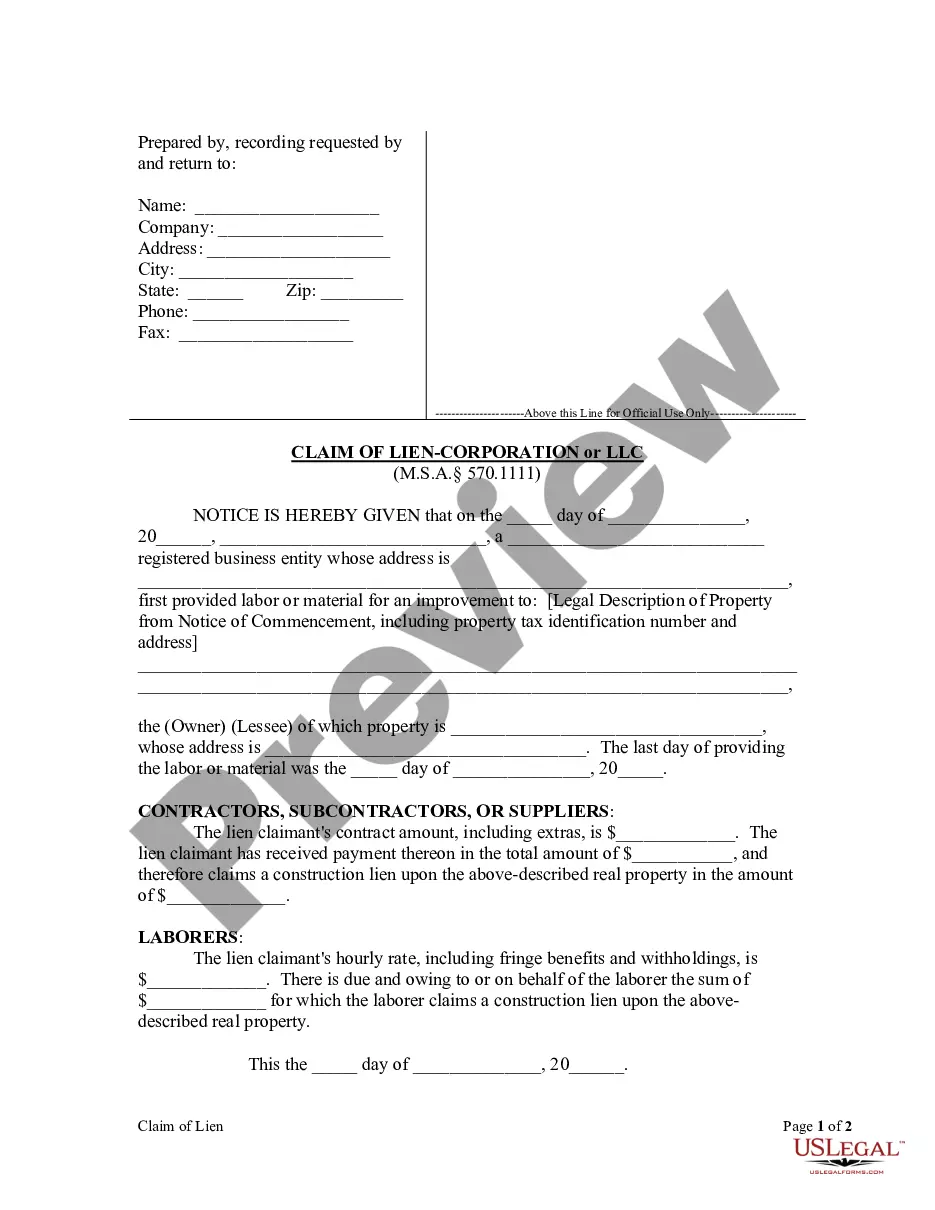

If available, use the Review option to preview the document template as well.

- If you have a US Legal Forms account, you can sign in and click the Obtain button.

- After that, you can complete, modify, print, or sign the Nebraska Privacy and Confidentiality Policy for Credit Counseling Services.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of any purchased form, visit the My documents tab and click the corresponding option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions listed below.

- First, make sure you have selected the correct document template for your state/area of choice.

- Read the form description to ensure you have selected the correct form.

Form popularity

FAQ

The Address Confidentiality Program in Nebraska, as part of the Privacy and Confidentiality Policy for Credit Counseling Services, aims to protect individuals from threats related to their addresses. It provides vital support for survivors of domestic violence and stalking, allowing them to use a designated substitute address. This program not only promotes personal safety but also empowers individuals to engage more freely without fear of exposure.

Address Confidentiality Programs exist in various states to protect residents in dangerous situations, including Nebraska. Each state implements its criteria and application processes, aligning with the broader concept of ensuring privacy for vulnerable individuals. If you want information specific to Nebraska or additional states, you can consult resources that clarify how these programs function across state lines.

The Address Confidentiality Program works by providing participants with a substitute address for official correspondence under the Nebraska Privacy and Confidentiality Policy for Credit Counseling Services. After enrolling, an individual can use this address when interacting with government agencies, banks, and other organizations. This process helps secure the actual address, preventing it from being revealed in public records.

The voluntary disclosure program in Nebraska allows individuals to share their personal information for specific purposes while maintaining confidentiality. Under the Nebraska Privacy and Confidentiality Policy for Credit Counseling Services, this program is designed to support those who need to report their address for various legal purposes. Participants can decide which entities can access their information, ensuring control over their privacy.

A confidential address, as defined by the Nebraska Privacy and Confidentiality Policy for Credit Counseling Services, is an address that is not publicly disclosed to protect the safety of the individual. It allows participants to use a substitute address while maintaining the confidentiality of their actual residence. This measure aims to aid individuals who are vulnerable to threats, ensuring their residential information remains secure.

To make an address confidential in line with the Nebraska Privacy and Confidentiality Policy for Credit Counseling Services, individuals must enroll in the Address Confidentiality Program. This typically involves submitting an application and meeting eligibility criteria. Once approved, the program provides a substitute address that can be used for legal and public records, ensuring your actual location remains private.

To qualify for the Address Confidentiality Program under the Nebraska Privacy and Confidentiality Policy for Credit Counseling Services, citizens must meet specific criteria. Applicants usually need to demonstrate that they are survivors of domestic violence, stalking, or similar threats. Additionally, they should provide proof of their situation along with any necessary documentation. Successful applications help to protect personal information in legal matters.

The ACP credit provides eligible participants with a monthly discount on internet services, typically up to $30 per month. For households on qualifying tribal lands, the credit may increase to $75. Understanding the Nebraska Privacy and Confidentiality Policy for Credit Counseling Services can help you navigate your options smoothly while ensuring your personal details are shared securely.

A confidentiality statement for counselors might state, 'All client information will remain confidential and will only be disclosed with explicit client consent, except as required by law.' Such statements are vital in aligning with the Nebraska Privacy and Confidentiality Policy for Credit Counseling Services, reassuring clients of their rights and the secure handling of their information.

Income for the ACP program includes wages, social security benefits, unemployment benefits, and other sources that contribute to a household’s total earnings. It is essential to report accurate income levels to ensure eligibility without compromising the information's confidentiality. The Nebraska Privacy and Confidentiality Policy for Credit Counseling Services reinforces the importance of safeguarding this sensitive data.