Nebraska Sample Letter for Erroneous Information on Credit Report: [Your Name] [Your Address] [City, State, Zip Code] [Email Address] [Phone Number] [Date] [Credit Reporting Agency Name] [Agency Address] [City, State, Zip Code] Subject: Request for Investigation and Removal of Erroneous Information on Credit Report Dear Sir/Madam, I am writing this letter to inform you about inaccurate information that is listed on my credit report, which I recently obtained from your agency. After carefully reviewing the report, I have noticed several discrepancies that require immediate attention and rectification. Firstly, I would like to bring to your attention the erroneous entry in my credit history stating an unpaid debt to [Creditor's Name]. According to my records, I have never had any financial dealings with this particular creditor, and thus, this information is completely inaccurate. I kindly request you to initiate an investigation promptly to resolve this matter. Additionally, another discrepancy I would like to address is the incorrect listing of late payment for my mortgage account with [Mortgage Company's Name]. I have always made timely payments, and it is crucial to rectify this error as it negatively impacts my creditworthiness. Consequently, I urge you to investigate this matter thoroughly and remove any inaccurate information related to late payments from my credit report. Moreover, I would like to bring your attention to a third erroneous entry, which indicates a bankruptcy filing against my name. This information is entirely inaccurate, as I have never filed for bankruptcy. I request you to investigate this matter urgently and remove this false claim from my credit report. In light of the aforementioned discrepancies on my credit report, I kindly request your immediate action to address these issues. I expect that a comprehensive investigation will be conducted by your agency within the time frame specified by the Fair Credit Reporting Act (FCRA), ensuring that all the inaccuracies are corrected, and my credit report reflects accurate and reliable information. Enclosed with this letter are copies of relevant documents supporting my claims, including payment records, statements, and any other necessary information. I kindly request you to review these documents during your investigation for a more accurate assessment. Furthermore, as per the FCRA, I request you to inform me in writing of the actions taken as a result of this investigation. I would appreciate it if you could provide me with an updated copy of my credit report once the inaccuracies are rectified to verify that the necessary changes have been made. In conclusion, I trust that your agency will handle this matter promptly and efficiently in accordance with the FCRA guidelines. Your cooperation in addressing these erroneous entries on my credit report is highly appreciated. Thank you for your immediate attention to this matter. Please do not hesitate to contact me if you require any further information or need clarification regarding this dispute. Sincerely, [Your Name] -- Note: The above-provided sample letter can be modified and customized as per your specific situation. It is crucial to personalize the letter while focusing on the relevant keywords and accurately describing the erroneous information on your credit report.

Nebraska Sample Letter for Erroneous Information on Credit Report

Description

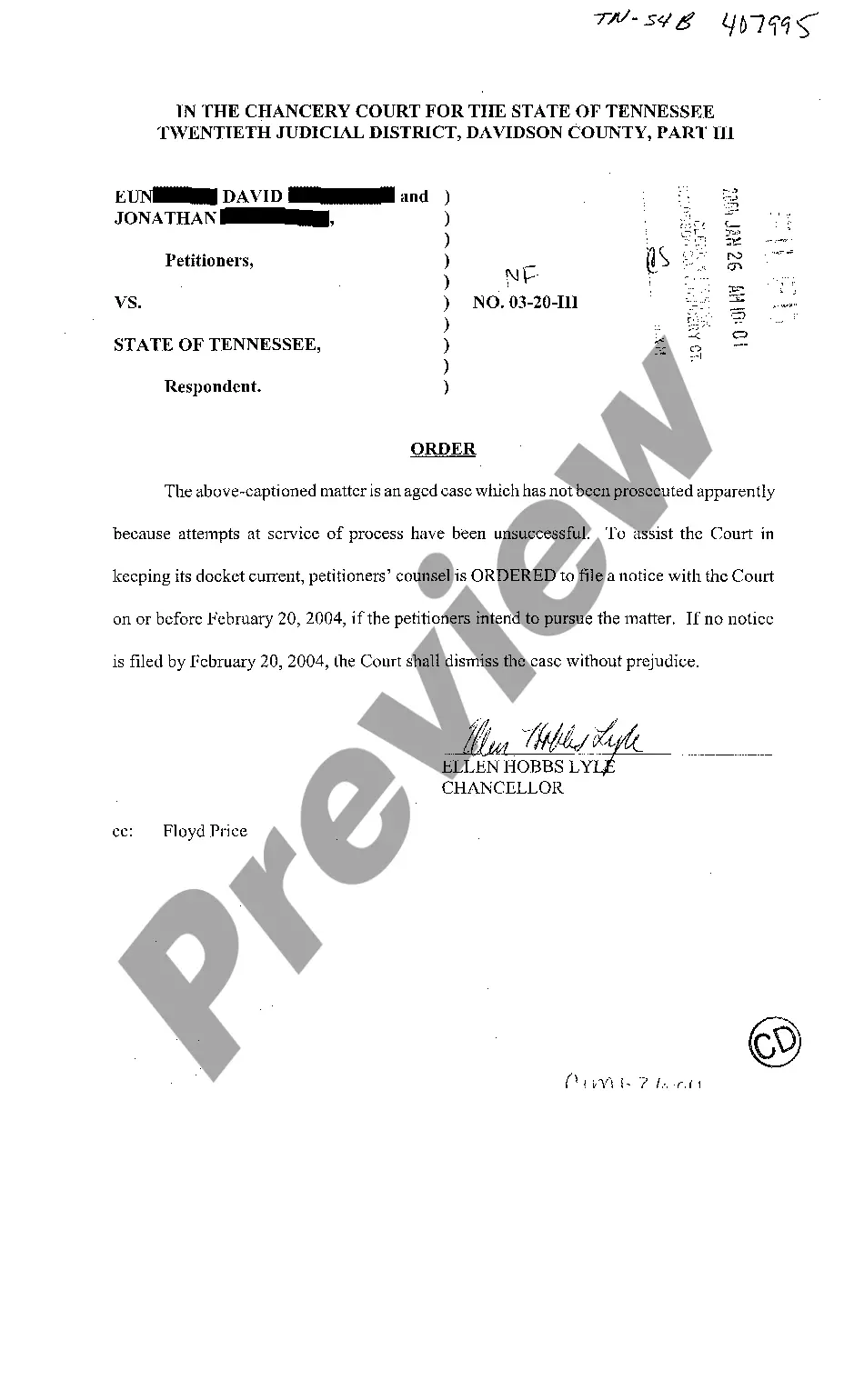

How to fill out Nebraska Sample Letter For Erroneous Information On Credit Report?

If you want to total, download, or print valid document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the site’s straightforward and convenient search to find the documents you require.

Various templates for business and personal purposes are categorized by groups and states, or keywords.

Step 4. After you have found the form you need, select the Purchase now button. Choose the pricing plan you prefer and enter your information to create an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to obtain the Nebraska Sample Letter for Incorrect Information on Credit Report in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Acquire button to locate the Nebraska Sample Letter for Incorrect Information on Credit Report.

- You can also access forms you have previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have chosen the form for the correct region/state.

- Step 2. Use the Preview option to browse through the form’s details. Don’t forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

To remove a false collection from your credit report, start by validating the collection agency's claim against your records. If you find it to be incorrect, you should craft a Nebraska Sample Letter for Erroneous Information on Credit Report and send it to the agency along with any supporting evidence. Taking this formal approach not only helps clarify the situation but also initiates a review process that could lead to the information being removed.

Reporting false information on your credit report involves notifying the credit bureau directly. It's helpful to prepare your evidence and compile a Nebraska Sample Letter for Erroneous Information on Credit Report that highlights your concerns. After submitting your letter, it’s important to follow up to confirm your complaint is being addressed. This ensures that the false information is reviewed and corrected.

If you believe your credit score is wrong, start by comparing it with the details on your credit report. You can then reach out to the credit bureau with the discrepancies noted. Using a Nebraska Sample Letter for Erroneous Information on Credit Report can enhance your complaint, clearly expressing the inaccuracies impacting your score. Prompt action helps resolve the issues more effectively.

To remove incorrect information from your credit report, begin by gathering supporting documents that validate your claim. Utilize a Nebraska Sample Letter for Erroneous Information on Credit Report when you contact the credit reporting agency. This letter will help outline your dispute clearly. Remember that timely follow-up is essential to ensure the corrections are made.

If you find false information on your credit report, it's important to act quickly. Start by reviewing your report thoroughly and identifying the erroneous entries. You can then use a Nebraska Sample Letter for Erroneous Information on Credit Report to formally dispute these inaccuracies with the credit bureau. Additionally, keep records of your communications for future reference.

A 623 letter is a formal request sent to a creditor to dispute inaccurate information reported to the credit bureaus. This letter references Section 623 of the Fair Credit Reporting Act, which outlines your rights as a consumer concerning credit reporting. By utilizing a Nebraska Sample Letter for Erroneous Information on Credit Report, you can effectively structure this correspondence to ensure that it covers all critical details. This can significantly increase the likelihood of resolving your dispute favorably.

A dispute letter for a debt outlines inaccuracies in your credit report that you want corrected. In this letter, you should specify the debt in question, provide any necessary details, and formally request the correction of the erroneous information. You can create a tailored dispute letter using the Nebraska Sample Letter for Erroneous Information on Credit Report to ensure that you address the situation professionally. This letter serves as a key step in asserting your rights as a consumer in the credit reporting process.

A consumer statement is a brief written explanation that you can add to your credit report to clarify an item. This statement is particularly useful if you have challenged information that you believe is incorrect. By using a Nebraska Sample Letter for Erroneous Information on Credit Report, you can provide a clear, concise disclaimer that explains your side of the story. This empowers you to present your perspective to potential lenders or creditors reviewing your credit report.

Removing erroneous information from your credit report begins with a careful examination of your report. Once you've pinpointed any inaccuracies, gather documentation that validates your case. You can use a Nebraska Sample Letter for Erroneous Information on Credit Report to formally notify the credit bureau and expedite the removal process.

To get incorrect information removed from your credit report, you should first check your report for errors. After identifying an issue, gather any evidence that supports your claim. Write a Nebraska Sample Letter for Erroneous Information on Credit Report to the credit bureau, requesting they investigate the error and remove it based on your findings.

Interesting Questions

More info

Free Sample Error Letter Reexpress Categories Topics Tips Articles Business Sales Personal Letters Rhymer Free Rhyming Dictionary Invent Prove Idea Home Tips Error Letters Write Error Letter Made mistake Reduce damage with properly carefully worded letter have made error write your letter soon possible after unfortunate incident focus actions will take have taken rectify situation rather than damage have caused Accompany your apology with promise compensation restitution sincere apology long winning back disgruntled customer tone your letter should very considerate respectful because have probably caused some inconvenience Words such oversight error help keep mistake minor issue When writing this letter concise FREE Error Letter Reexpress Categories Topics Tips Articles Business Sales Personal Letters Rhymer Free Rhyming Dictionary Invent Prove Idea Letter Personal Letters Error Letters Write Error Letter Made mistake Reduce damage with properly carefully worded letter have made error