Nebraska Letter Regarding Trust Money: A Comprehensive Guide to Understanding Trust Funds and their Legal Documentation Trust funds play a crucial role in managing and safeguarding assets for beneficiaries, ensuring their financial security and fulfilling the intentions of the trust creator. Understanding the intricacies and legal aspects involved can sometimes be overwhelming, especially when it comes to documentation. One such crucial documentation related to trust funds in Nebraska is the "Nebraska Letter Regarding Trust Money." The Nebraska Letter Regarding Trust Money serves as a detailed explanation of the trust fund's financial aspects, aiming to provide transparency and clarity to all relevant parties. It outlines the trust's purpose, identifies the trust or, trustee, and beneficiaries, and provides essential instructions and guidelines for managing and disbursing trust funds. Different types of Nebraska Letters Regarding Trust Money may exist, depending on the specific nature and conditions of the trust. Here are a few noteworthy examples: 1. Nebraska Revocable Living Trust Letter: This type of letter applies to revocable living trusts, where the trust or retains the right to modify, revoke, or amend the trust during their lifetime. The letter would outline how the trust's funds should be managed, distributed, or invested during the trust or's lifetime and after their passing. 2. Nebraska Irrevocable Trust Letter: In contrast to a revocable living trust, an irrevocable trust cannot be altered or revoked once established. The Nebraska Irrevocable Trust Letter would provide instructions and guidelines on managing trust funds, ensuring compliance with legal requirements and restrictions. 3. Nebraska Testamentary Trust Letter: Testamentary trusts are established through a will and only come into effect after the trust or's death. The Nebraska Testamentary Trust Letter details how the trust funds should be handled, disbursed, and invested for the beneficiaries as per the trust or's will. 4. Nebraska Special Needs Trust Letter: Special needs trusts are designed to benefit individuals with disabilities, providing support without jeopardizing government benefits. The Nebraska Special Needs Trust Letter would outline the specific conditions for using trust funds to enhance the beneficiary's quality of life while preserving eligibility for government assistance programs. 5. Nebraska Charitable Trust Letter: Charitable trusts are established with the intent to benefit charitable organizations or public causes. The Nebraska Charitable Trust Letter would provide guidelines on how the trust funds should be managed, invested, and distributed to fulfill the trust's charitable purposes. These are just a few examples of the various types of Nebraska Letters Regarding Trust Money that may exist, each serving a specific purpose and catering to different trust structures. It is essential to consult with a qualified attorney or legal professional to ensure proper understanding and compliance with Nebraska's laws and regulations governing trust funds.

Nebraska Letter regarding trust money

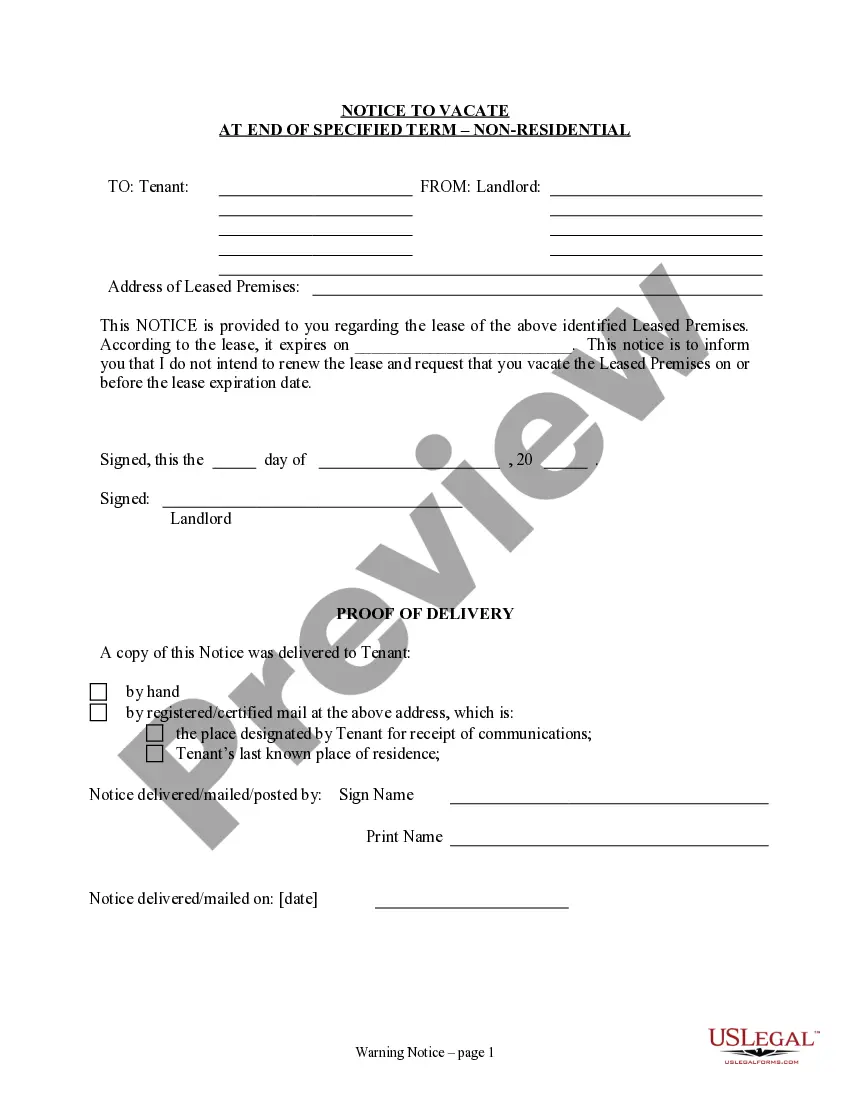

Description

How to fill out Nebraska Letter Regarding Trust Money?

If you need to finalize, download, or print official document templates, utilize US Legal Forms, the largest assortment of official forms available online.

Employ the site’s simple and user-friendly search feature to locate the documents you require.

Various templates for business and personal purposes are categorized by groups and states, or keywords.

Step 4. After you have found the form you need, click the Get now button. Choose your preferred pricing plan and enter your information to create an account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Utilize US Legal Forms to obtain the Nebraska Letter concerning trust funds with just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click the Acquire button to retrieve the Nebraska Letter regarding trust funds.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Confirm you have selected the form for the correct city/state.

- Step 2. Use the Preview function to review the form's details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the document, utilize the Search field at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

For trusts, distributions are taxable to the beneficiary, and the trust must file a Schedule K-1 for each beneficiary paid. The beneficiary will then report the income on their tax return. The trust must also generate a Form 1041 to report the total amount of income the trust earned from the grantor's date of death.

Beneficiaries of a trust typically pay taxes on the distributions they receive from the trust's income, rather than the trust itself paying the tax. However, such beneficiaries are not subject to taxes on distributions from the trust's principal.

Trusts: allocating income to beneficiaries but taxed to trust. The basic rules are as follows: If any of the trust's income is payable in a taxation year to a beneficiary, that amount is deductible in computing the trust's income for year. The amount payable is then included in the beneficiary's income.

There is no California inheritance tax. In short, the beneficiaries and heirs will be able to inherit the property free of taxes. They will not need to pay an income tax on the property, either, because property inherited from someone else is not considered ordinary income.

For trusts, distributions are taxable to the beneficiary, and the trust must file a Schedule K-1 for each beneficiary paid. The beneficiary will then report the income on their tax return. The trust must also generate a Form 1041 to report the total amount of income the trust earned from the grantor's date of death.

Trust beneficiaries must pay taxes on income and other distributions that they receive from the trust. Trust beneficiaries don't have to pay taxes on returned principal from the trust's assets. IRS forms K-1 and 1041 are required for filing tax returns that receive trust disbursements.

What exactly is an inheritance tax? Well, according to Nebraska law (almost) all property that passes by Will or by intestate laws (i.e. if there is no Will) from a Nebraska resident, or a person who had property within the state of Nebraska, is subject to an inheritance tax.

Nebraska is one of a handful of states that collects an inheritance tax. If you are a Nebraska resident, or if you own real estate or other tangible property in Nebraska, the people who inherit your property might have to pay a tax on the amount that they inherit.

In short, if a resident of Nebraska dies and their property goes to their spouse, no inheritance tax is due. If it goes to their parents, grandparents, siblings, children, or a lineal decedent (or their spouse) then the tax is applied to anything over $40,000 at a rate of 1%.

There is no federal inheritance taxthat is, a tax on the sum of assets an individual receives from a deceased person. However, a federal estate tax applies to estates larger than $11.7 million for 2021 and $12.06 million for 2022. The tax is assessed only on the portion of an estate that exceeds those amounts.