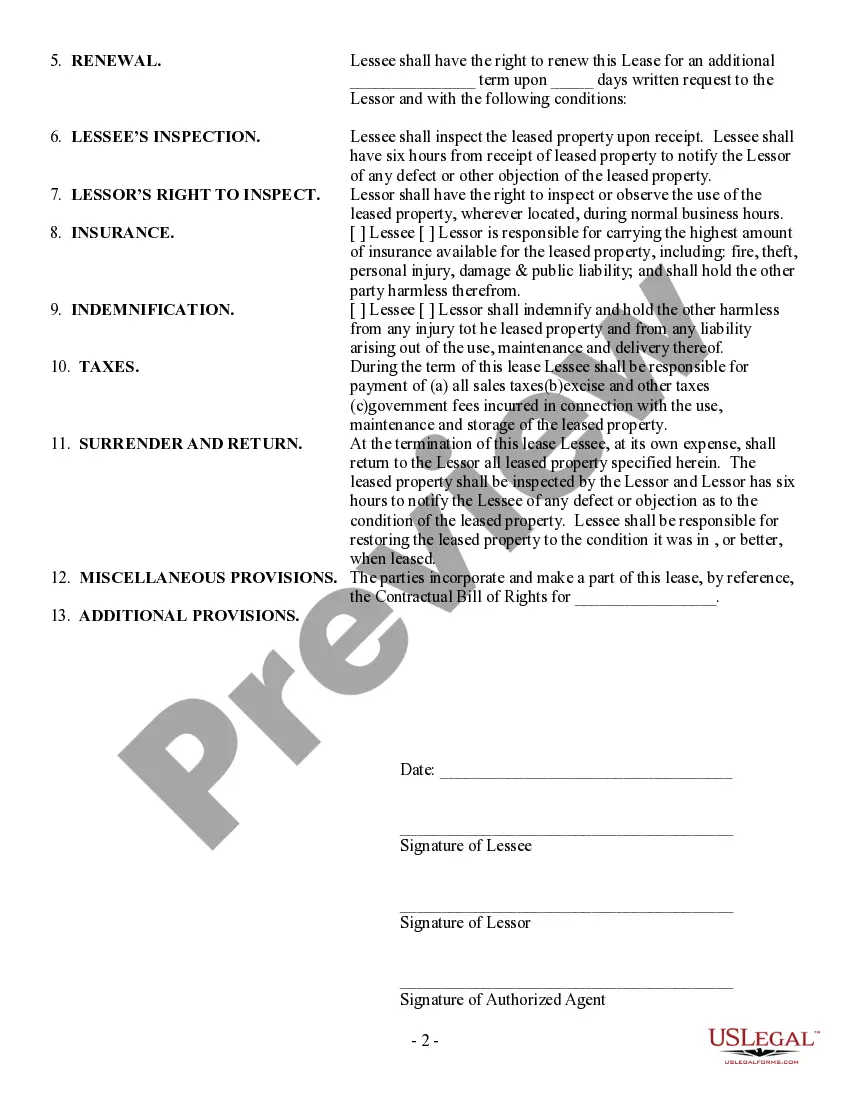

Nebraska Simple Equipment Lease is a contractual agreement between a lessor (the equipment owner) and a lessee (the equipment user) that allows the lessee to rent equipment for a designated period in exchange for regular payments. This type of lease is commonly used by businesses and individuals in Nebraska who require equipment for a specific duration without the need for long-term ownership. Keywords: Nebraska Simple Equipment Lease, contractual agreement, lessor, lessee, rent equipment, designated period, regular payments, businesses, individuals, specific duration, long-term ownership. Nebraska Simple Equipment Lease comes in various types, each catering to different needs and preferences. Some common types are: 1. Construction Equipment Lease: This type of lease is suitable for construction companies or contractors in Nebraska who require heavy machinery, such as excavators, bulldozers, or cranes, for a specific project or duration. 2. Office Equipment Lease: This lease is designed for businesses in Nebraska that require office equipment, including computers, printers, copiers, or fax machines, to optimize their daily operations without the need for the capital investment of ownership. 3. Medical Equipment Lease: Healthcare professionals or facilities in Nebraska can benefit from this lease by leasing medical equipment like imaging machines, surgical equipment, or laboratory instruments, which can be costly to purchase outright. 4. Agricultural Equipment Lease: Farmers or agricultural businesses in Nebraska often opt for this lease to acquire farming machinery like tractors, harvesters, or sprayers, enabling them to increase productivity during peak seasons while avoiding the high costs of equipment ownership. 5. Restaurant Equipment Lease: Restaurants, cafés, or catering businesses in Nebraska can utilize this lease to rent kitchen appliances, refrigeration systems, or specialized cooking equipment, ensuring cost-effectiveness and flexibility in meeting their culinary needs. Keywords: Construction Equipment Lease, Office Equipment Lease, Medical Equipment Lease, Agricultural Equipment Lease, Restaurant Equipment Lease, Nebraska, heavy machinery, office equipment, medical equipment, agricultural machinery, kitchen appliances, flexibility, cost-effectiveness. In summary, Nebraska Simple Equipment Lease is a flexible, short-term agreement that allows individuals and businesses in Nebraska to rent various types of equipment based on their specific requirements. These leases can range from construction, office, medical, agricultural, to restaurant equipment, providing the lessees with the necessary tools and resources without the burden of long-term ownership or heavy upfront costs.

Nebraska Simple Equipment Lease

Description

How to fill out Nebraska Simple Equipment Lease?

Are you currently in a situation where you need documents for either business or personal reasons almost every day.

There are numerous legal document templates available online, but finding forms you can rely on isn’t simple.

US Legal Forms provides a vast array of form templates, similar to the Nebraska Simple Equipment Lease, specifically designed to comply with federal and state regulations.

If you find the correct form, simply click Get now.

Select a convenient document format and download your copy. Access all the document templates you have purchased in the My documents list. You can obtain an additional copy of the Nebraska Simple Equipment Lease at any time if needed. Just click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Nebraska Simple Equipment Lease template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

- Use the Review button to examine the form.

- Read the summary to make sure you have selected the appropriate form.

- If the form isn’t what you’re looking for, use the Research field to find the form that suits your needs and requirements.

Form popularity

FAQ

Yes, you can create your own lease agreement for a Nebraska Simple Equipment Lease. However, it is essential to ensure that your document covers all necessary terms and conditions to protect both parties involved. Using a template from US Legal Forms can simplify this process, providing a clear structure and specific legal language tailored for Nebraska. This approach helps you avoid potential pitfalls and ensures compliance with state regulations.

Filling out a lease renewal requires reviewing the original Nebraska Simple Equipment Lease for its terms and conditions. You will need to specify the renewal period and any changes in payment or terms. Ensure both parties agree to the renewal to avoid misunderstandings, and consider documenting this process using US Legal Forms to maintain clarity.

Equipment leases are typically structured by establishing key terms that safeguard both the lessor and lessee. This includes defining the lease term, payment amounts, and maintenance responsibilities. Each Nebraska Simple Equipment Lease should also clarify liability and insurance requirements to provide complete protection for both parties.

To create a robust equipment rental agreement, begin by detailing the parties involved and the equipment being leased. Include essential terms like the rental period, payment details, and any applicable service agreements. Consider using US Legal Forms for a Nebraska Simple Equipment Lease template to simplify this process and ensure you don’t miss any critical elements.

Structuring a lease involves defining the terms that will guide the agreement. You should cover important aspects such as duration, payment terms, and any terms for renewal or termination. A Nebraska Simple Equipment Lease also benefits from clarity on how the equipment will be used, in order to prevent disputes later on.

To structure a Nebraska Simple Equipment Lease, start by identifying the key parties involved, such as the lessor and lessee. Clearly outline the equipment details, including specifications and condition. Additionally, specify the lease term, payment schedule, and any maintenance responsibilities to ensure both parties understand their obligations.

The typical term of an equipment lease ranges from 1 to 5 years, depending on the type of equipment and business needs. Shorter terms can offer flexibility, while longer terms may provide lower monthly payments. If you are considering a Nebraska Simple Equipment Lease, ensure the term aligns with your operational goals.

The interest rate for an equipment lease usually mirrors financing rates, often ranging from 4% to 15% based on several factors. Personal credit history and the lease term can significantly influence these rates. Therefore, comparing options and understanding your financial position is vital before signing a Nebraska Simple Equipment Lease.

A good lease rate often depends on the asset's depreciation and market conditions. Rates usually start around 4% to 6%, but industry standards vary. Engaging in a Nebraska Simple Equipment Lease can help you determine what a competitive rate looks like for the type of equipment you need.

A good equipment lease rate typically falls in the range of 3% to 10% of the equipment's value annually. This rate can depend on various factors such as the industry and economic conditions. It's essential to compare different offers and consider options like a Nebraska Simple Equipment Lease to find a rate that fits your budget.

Interesting Questions

More info

Power of Attorney Last Will Testament Living Will Health Care Directive Revocable Living Trust Estate Vault Contract Signed by you on the date You signed this Agreement, this Agreement contains conditions as follows: Condition 1) The parties acknowledge that neither person has acquired title to the property in dispute or has an equitable interest therein and that neither person, nor any person with whom the parties have any legal relationship, has any right, authority or claim which either person or any person has in connection with the property in dispute. Condition 2) Neither party has taken, nor is taking, any action as a party to this agreement that either party intends to take against the other party or any person to compel the other party or any person with whom the parties have any legal relationship (whether through contracts, obligations, joint ventures, investments or otherwise) to act at any time with respect to the property in dispute.