Nebraska Revocable Trust for Grandchildren

Description

How to fill out Revocable Trust For Grandchildren?

Selecting the appropriate authorized document template can be a challenge.

Certainly, there is a multitude of templates accessible online, but how can you find the legal form you require.

Utilize the US Legal Forms website. The service offers an extensive array of templates, such as the Nebraska Revocable Trust for Grandchildren, which can be utilized for both business and personal purposes.

If the form does not meet your needs, use the Search field to find the appropriate form. Once you are confident the form is suitable, select the Purchase now button to acquire it. Choose the pricing plan you prefer and enter the required information. Create your account and complete your order using your PayPal account or credit card. Select the document format and download the legal document template to your device. Complete, edit, print, and sign the acquired Nebraska Revocable Trust for Grandchildren. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to download professionally created documents that comply with state requirements.

- All of the forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and then click the Download button to access the Nebraska Revocable Trust for Grandchildren.

- Use your account to browse through the legal forms you have previously purchased.

- Visit the My documents tab in your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions you can follow.

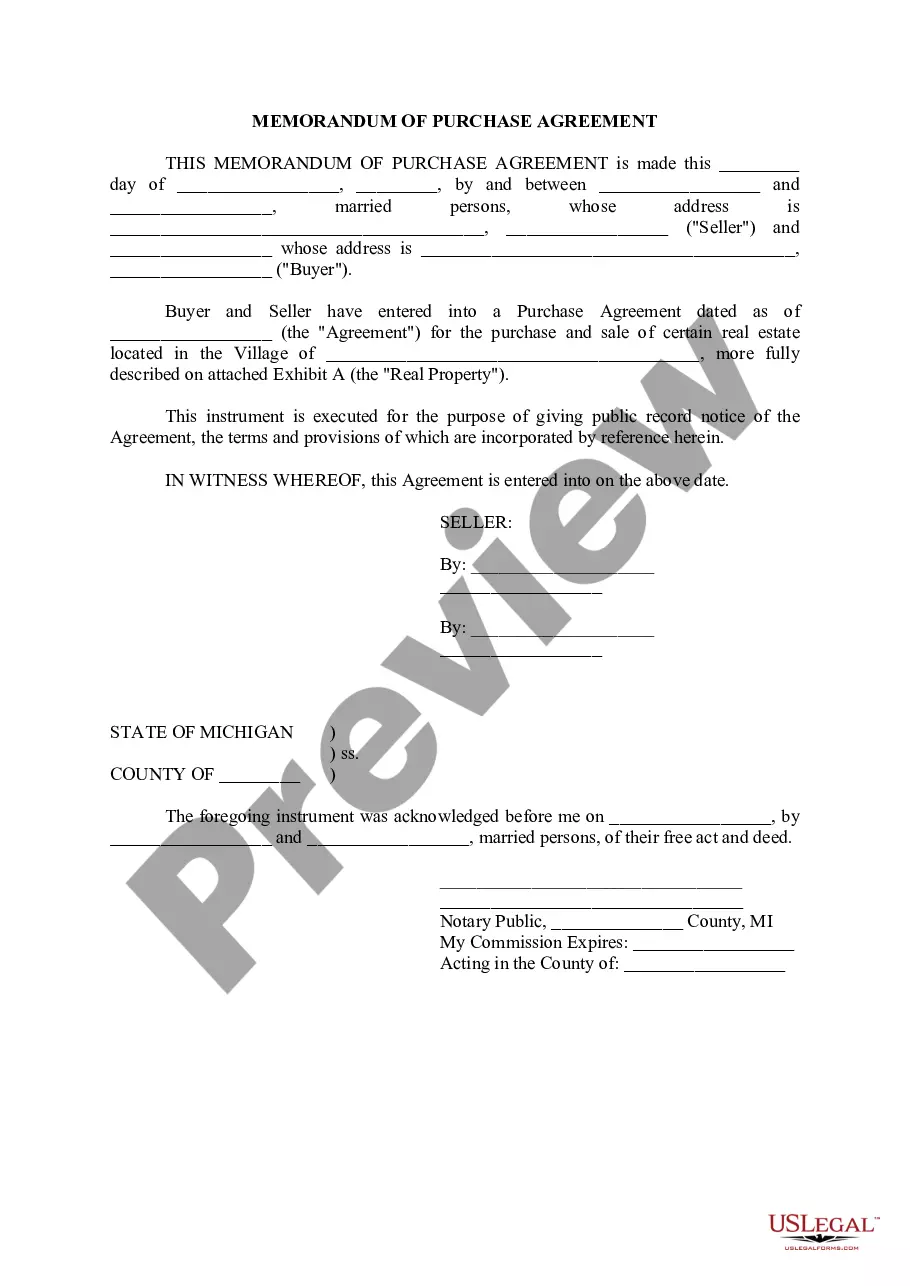

- First, ensure you have selected the correct form for your city/state. You can look at the form using the Preview button and review the form details to ensure this is indeed the correct one for you.

Form popularity

FAQ

In Nebraska, you do not have to register a trust with the state. A Nebraska Revocable Trust for Grandchildren becomes valid as soon as you create and fund it with your assets. While there is no registration requirement, it is important to maintain proper documentation and keep your trust updated. Ensuring that your trust is correctly established helps to safeguard your family's financial future.

Choosing the best state to register a trust often depends on your specific needs and circumstances. However, states like Nevada, Delaware, and South Dakota are popular for their favorable trust laws. If you are considering a Nebraska Revocable Trust for Grandchildren, registering your trust in Nebraska may offer benefits like lower fees and streamlined administration. Always consult with a legal advisor to find the right fit for you.

A revocable trust in Nebraska is a flexible estate planning tool that you can change or dissolve at any time. This type of trust allows you to maintain control over your assets while designating beneficiaries, like your grandchildren. With a Nebraska Revocable Trust for Grandchildren, you can provide for their future education or expenses while avoiding the complications of probate. This arrangement offers peace of mind, as you know your wishes will be honored.

A trust in Nebraska allows you to manage your assets for the benefit of your beneficiaries. When you establish a Nebraska Revocable Trust for Grandchildren, you retain control over the assets, even while they are in the trust. You can change or revoke the trust at any time during your lifetime. Upon your passing, the trust assets are distributed according to your specific instructions, ensuring your grandchildren have what you intended.

In Nebraska, you are not required to file a will unless you are probating it. If your estate plan includes a Nebraska Revocable Trust for Grandchildren, your assets in the trust will avoid probate. This means your grandchildren receive their inheritance without lengthy court proceedings. Filing a will becomes necessary only for assets not included in a trust.

A good account to start for a grandchild is a custodial account or a 529 college savings plan. These accounts allow you to save for their future education or other expenses. Incorporating these accounts into a Nebraska Revocable Trust for Grandchildren adds an extra layer of protection, as the trust can dictate how and when the funds are used. This approach promotes financial responsibility while ensuring your grandchild's interests are prioritized.

The best trust for a grandchild is a Nebraska Revocable Trust for Grandchildren. This trust allows for flexibility, letting you adjust terms as needed while you are still living. It also provides a clear plan for managing and distributing funds at specific milestones, such as education or buying a home. By choosing this route, you ensure your grandchild's financial needs are met according to your wishes.

One of the biggest mistakes parents make when setting up a trust fund is failing to clearly define the distribution terms and the roles of trustees. Without clarity, the intentions can lead to confusion or disputes among family members. Opting for a Nebraska Revocable Trust for Grandchildren allows you to explicitly set guidelines and ensure that your assets are managed properly for their future. Additionally, regularly reviewing the trust will help avoid unintended issues.

The best bond for a grandchild often depends on their age and financial goals. A popular option is a U.S. Savings Bond, which grows over time and offers tax benefits when used for education. Alternatively, you might consider including the bond within a Nebraska Revocable Trust for Grandchildren, ensuring that the proceeds are managed and distributed according to your plans. This strategy can enhance financial security for your grandchildren.

To set up a trust in Nebraska, you can start by drafting a trust document that outlines the terms and beneficiaries. A Nebraska Revocable Trust for Grandchildren is an excellent choice, as it allows you to retain control over the assets during your life. Working with a legal professional ensures that your trust complies with state laws and reflects your intentions clearly. Once established, fund the trust with your chosen assets to make it effective.