Nebraska Consumer Loan Application - Personal Loan Agreement

Description

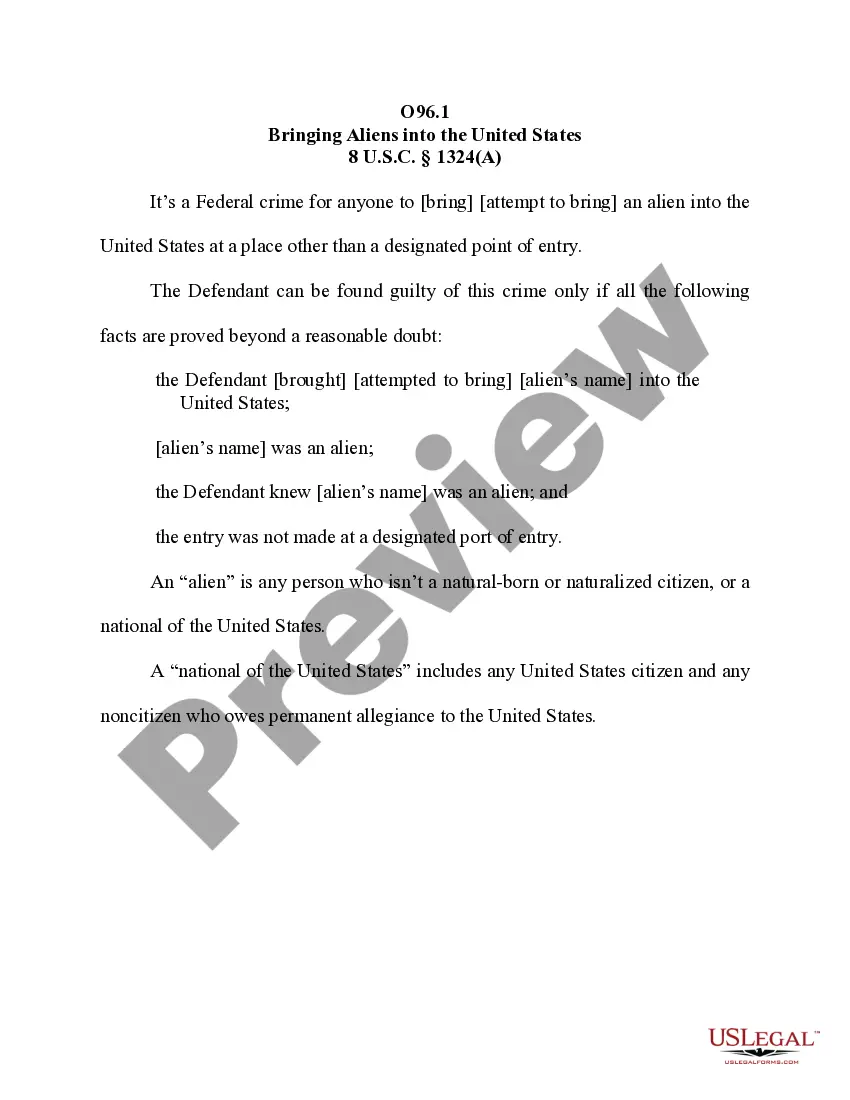

How to fill out Consumer Loan Application - Personal Loan Agreement?

Are you presently in a place the place you will need files for sometimes company or individual functions virtually every working day? There are a lot of legal document layouts available online, but discovering versions you can rely on is not simple. US Legal Forms offers a large number of kind layouts, just like the Nebraska Consumer Loan Application - Personal Loan Agreement, which are published to satisfy federal and state requirements.

Should you be currently familiar with US Legal Forms website and have an account, simply log in. Following that, you are able to acquire the Nebraska Consumer Loan Application - Personal Loan Agreement design.

Unless you offer an bank account and would like to begin to use US Legal Forms, adopt these measures:

- Obtain the kind you want and ensure it is for the appropriate town/county.

- Take advantage of the Preview option to review the form.

- Look at the information to actually have chosen the appropriate kind.

- In case the kind is not what you are looking for, use the Search field to obtain the kind that meets your requirements and requirements.

- Once you find the appropriate kind, click on Acquire now.

- Pick the prices program you would like, submit the specified information and facts to make your bank account, and pay for an order with your PayPal or bank card.

- Decide on a convenient paper format and acquire your duplicate.

Locate each of the document layouts you may have bought in the My Forms food list. You may get a additional duplicate of Nebraska Consumer Loan Application - Personal Loan Agreement whenever, if required. Just click on the essential kind to acquire or print the document design.

Use US Legal Forms, one of the most considerable assortment of legal varieties, to save some time and steer clear of faults. The service offers expertly manufactured legal document layouts which you can use for a variety of functions. Generate an account on US Legal Forms and start generating your life easier.

Form popularity

FAQ

The biggest difference between a consumer loan and a personal loan is that consumer loans can include revolving credit. Personal loans are nonrevolving financial lending products that provide borrowers with a lump sum of money and payment schedule for repaying the loan.

In New York, title loans are not regulated under federal laws. These are granted by third-party direct lenders in New York. Title loans' rates of interest usually depend on the lender's ability to lend. Thus, you can get a short-term loan when you are unable to qualify for conventional loans.

Indiana residents (of legal age) can apply for a car title loan.

The state of Nebraska has specific laws in place to protect borrowers from predatory lending practices. Additionally, a prospective borrower must be at least 18 years of age to apply for a title loan in the Cornhusker State.

A consumer loan is a loan given to consumers to finance specific types of expenditures. In other words, a consumer loan is any type of loan made to a consumer by a creditor. The loan can be secured (backed by the assets of the borrower) or unsecured (not backed by the assets of the borrower).

To reiterate, title loans are not legal in Colorado. If you're considering an alternative, like payday loans, it's important to consider they can be expensive and a short-term solution to your financial situation, so it's worth considering other alternatives before resorting to this type of loan.

Before the Iowa Legislature changed the law in 2007, car title loans were a very expensive way to borrow money. Now the law limits the amount of interest that can be charged to a 21% annual percentage rate. This is still an expensive loan. Also, if you don't pay back the loan, you lose your car.

Q: What is an ?Installment Loan?? A: Under the Nebraska Installment Loan Act, installment loans are personal, consumer loans, whether secured or unsecured, with a maximum amount of $25,000 and a minimum repayment term of six months.