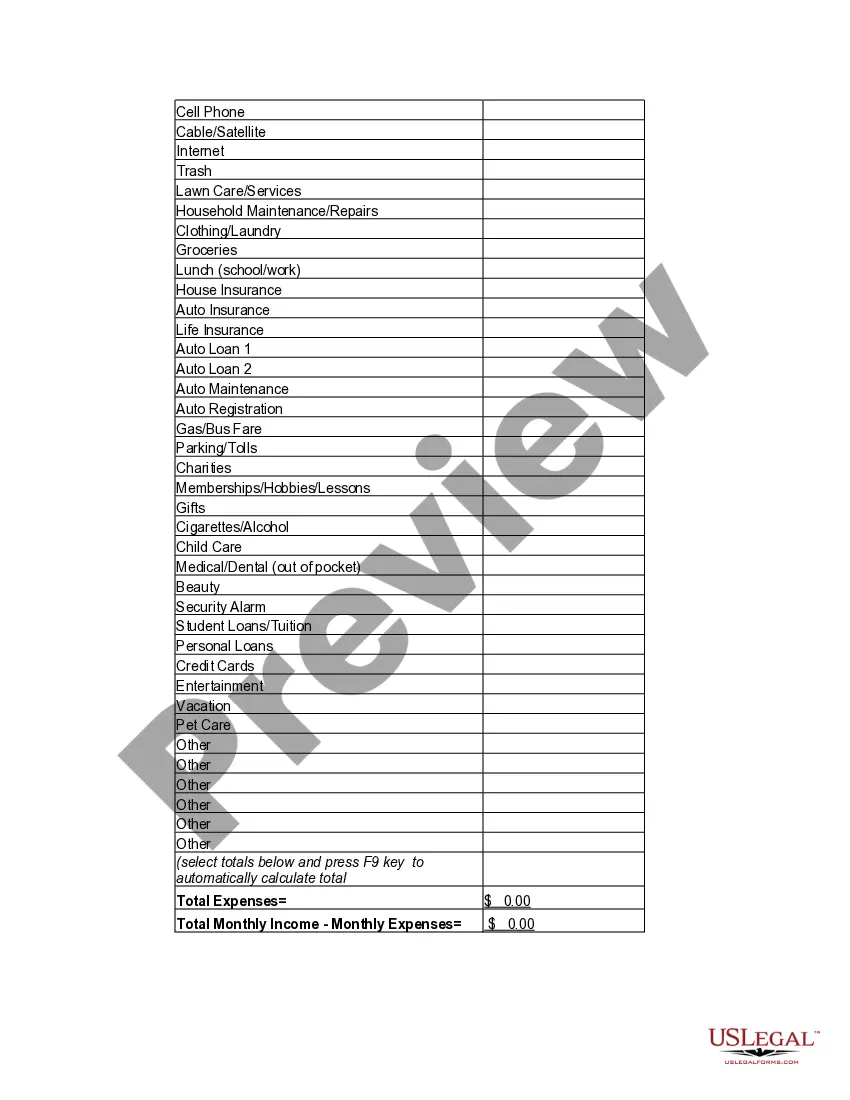

Nebraska Personal Monthly Budget Worksheet is an essential financial tool designed to track income and expenses on a monthly basis, helping individuals gain control over their finances and achieve their financial goals. This worksheet serves as a comprehensive guide to managing personal finances by allowing individuals to monitor their spending habits, identify areas where costs can be minimized, and establish a clear path towards financial stability. Key components of the Nebraska Personal Monthly Budget Worksheet include: 1. Income Tracking: This section helps individuals record and track their various sources of income, such as salary, freelance earnings, investment returns, and any additional income streams. 2. Expense Categorization: It allows users to categorize their expenses into specific groups such as housing, utilities, transportation, groceries, entertainment, debt payments, insurance, and healthcare, among others, providing a clear picture of how money is being allocated each month. 3. Fixed and Variable Expenses: Users can distinguish between fixed expenses (rent/mortgage payments, loan installments, subscriptions) that remain constant each month and variable expenses (groceries, utilities, entertainment) that fluctuate. 4. Savings and Investments: This section encourages individuals to set aside a certain portion of their income for savings, emergency funds, retirement, or any investment plans, aiding in planning for the future and building financial security. 5. Debt Management: This segment helps individuals keep track of their outstanding debts, such as credit card balances, student loans, or car loans, empowering them to make timely payments and avoid unnecessary interest charges. 6. Budgetary Goals: Users are encouraged to set specific financial goals, whether it's paying off debt, saving for a down payment, or funding a dream vacation. This allows individuals to track their progress and make necessary adjustments to their spending habits. Different variations or types of Nebraska Personal Monthly Budget Worksheet may exist based on personal preferences, financial situations, or specialized budgeting needs. Some examples include: 1. Simple Monthly Budget Worksheet: A basic version for beginners, providing a straightforward overview of income and expenses. 2. Advanced Income-Expense Tracker: For individuals with more complex financial portfolios, allowing for more detailed tracking and analysis. 3. Debt-repayment Budget Worksheet: Specifically designed to help individuals tackle debt systematically by prioritizing payments and visualizing progress. 4. Family Budget Worksheet: Tailored to families, this version incorporates additional categories to account for child-related expenses, education costs, and family activities. Regardless of the specific version, a Nebraska Personal Monthly Budget Worksheet is a valuable tool for individuals seeking to gain control over their finances, develop healthy spending habits, and work towards financial freedom.

Nebraska Personal Monthly Budget Worksheet

Description

How to fill out Personal Monthly Budget Worksheet?

You have the ability to dedicate multiple hours online looking for the legal document template that fulfills the state and national requirements you require.

US Legal Forms offers thousands of legal documents that are assessed by experts.

It is easy to download or print the Nebraska Personal Monthly Budget Worksheet from my services.

If available, utilize the Review button to browse through the document template as well. If you wish to obtain another version of your document, use the Search field to find the template that meets your preferences and requirements. Once you have located the template you want, click Get now to continue. Choose the pricing plan you desire, enter your details, and sign up for a free account on US Legal Forms. Complete the payment process. You can use your credit card or PayPal account to pay for the legal document. Select the format of your file and download it to your device. Make modifications to the document if necessary. You can complete, edit, sign, and print the Nebraska Personal Monthly Budget Worksheet. Obtain and print thousands of document templates using the US Legal Forms website, which provides the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and click on the Acquire button.

- After that, you may complete, modify, print, or sign the Nebraska Personal Monthly Budget Worksheet.

- Every legal document template you purchase is your property forever.

- To obtain another copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/area of your choice.

- Review the form details to confirm that you have selected the appropriate document.

Form popularity

FAQ

structured budget sheet should display a clear overview of your income and expenses, organized into sections for easy reading. It typically includes categories for fixed costs, variable expenses, and savings. A neat layout allows for quick updates and adjustments. For a practical example, consider the Nebraska Personal Monthly Budget Worksheet, which offers an effective way to visualize your financial plan.

Filling out a monthly budget sheet requires you to input your income at the top, followed by your various expenses. Clearly categorize essential payments like rent or utilities and track less critical costs as well. The Nebraska Personal Monthly Budget Worksheet makes this task easier by providing a structured format to ensure you stay organized as you fill it out.

Calculating your monthly budget involves gathering all sources of income and estimating your expenses for the upcoming month. Begin by adding up all income sources for a clear total. Next, list your necessary expenses and any discretionary spending. By utilizing the Nebraska Personal Monthly Budget Worksheet, you can streamline this calculation and ensure accuracy.

To write an effective monthly budget example, start by listing your income and all monthly expenses. Then categorize these expenses into fixed and variable costs. Finally, subtract your total expenses from your total income to identify your remaining balance. Using the Nebraska Personal Monthly Budget Worksheet can help you format this process efficiently and clearly.

The 50/30/20 rule of budgeting worksheet is a structured tool that helps you categorize your income into needs, wants, and savings. This worksheet enables you to visualize your financial allocations and make necessary adjustments easily. The Nebraska Personal Monthly Budget Worksheet is an ideal companion for this process, assisting you in creating a tailored budget that meets your individual financial goals. It's designed to simplify budgeting and enhance financial wellness.

Creating a 50/30/20 budget spreadsheet involves outlining your total monthly income and dividing it according to the rule's percentages. You can set up your spreadsheet by adding rows for needs, wants, and savings. With the Nebraska Personal Monthly Budget Worksheet, you can input your expenses and analyze where adjustments may be necessary. This approach can result in a clearer financial picture and effective budget management.

Calculating the 50 30 20 rule in Excel is straightforward. First, input your monthly income in a cell, then create three formulas to calculate 50%, 30%, and 20% of that income. You can easily do this by multiplying your income by 0.50, 0.30, and 0.20 respectively. Using the Nebraska Personal Monthly Budget Worksheet template can help simplify this process and enable better financial tracking.

The 50 30 20 budget rule suggests dividing your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings or debt repayment. For instance, if your monthly income is $4,000, you would allocate $2,000 to needs, $1,200 to wants, and $800 to savings. Using a Nebraska Personal Monthly Budget Worksheet can visualize this distribution, making financial planning easier and more effective.

The 1040N form is Nebraska's individual income tax return used by residents to report their income and calculate their state tax liability. This form helps taxpayers claim deductions and credits applicable to their financial situation. Keeping track of your expenses with a Nebraska Personal Monthly Budget Worksheet can make filling out your 1040N simpler and more accurate. This proactive approach ensures you understand how your income and expenses relate to your tax returns.

Yes, you can file your Nebraska state taxes online, making the process more convenient and efficient. The state offers electronic filing options, including through various tax software programs. Utilizing tools like a Nebraska Personal Monthly Budget Worksheet can enhance your tax preparation by helping you organize your finances before filing. This ensures you capture all deductions and credits available to you.

Interesting Questions

More info

He has written for various print publications, including “Money Magazine” and “The Financial Times.” Williams also writes professionally for consumer education, education consulting and professional services. He frequently provides opinion pieces and reviews of financial products for websites, radio and television networks with an emphasis on technology, social media and privacy. About the Author: Pamela Vines is a Certified Financial Planner, certified Master Financial Planner, CFP®, as well as a Certified Bankruptcy Attorney and the Senior Vice President and General Counsel for the Financial Services Association. Since 2005, she has been passionate about improving the lives of individuals and families through guidance, education and a practical approach. Pam is a lifelong lover of learning, a loving wife of three and the proud mother of three very special little boys who adore the way she makes them laugh.