A sales contract is an agreement between a buyer and seller covering the sale and delivery of goods, securities, and other personal property. Goods are classified as equipment if they are used or bought for use primarily in business (including farming or a profession).

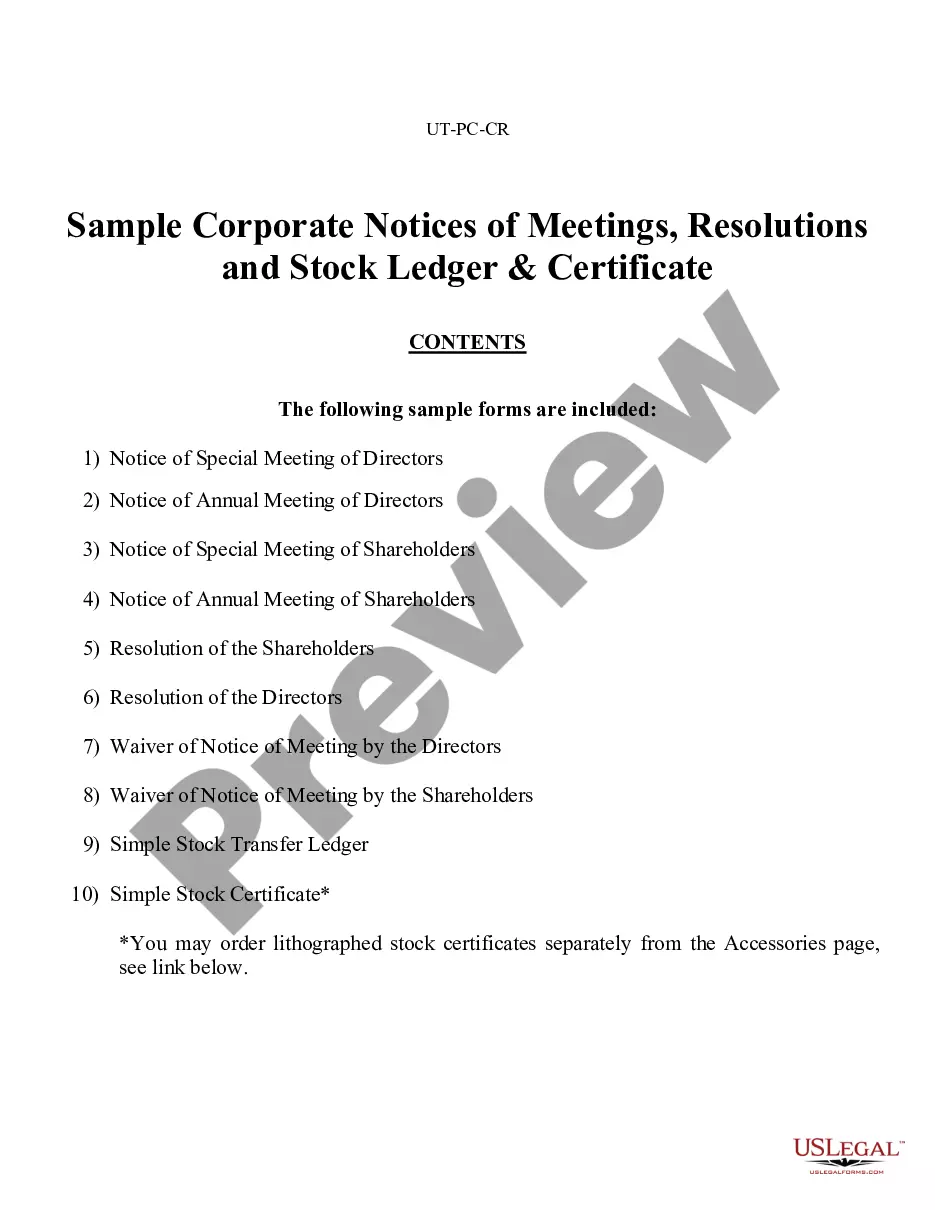

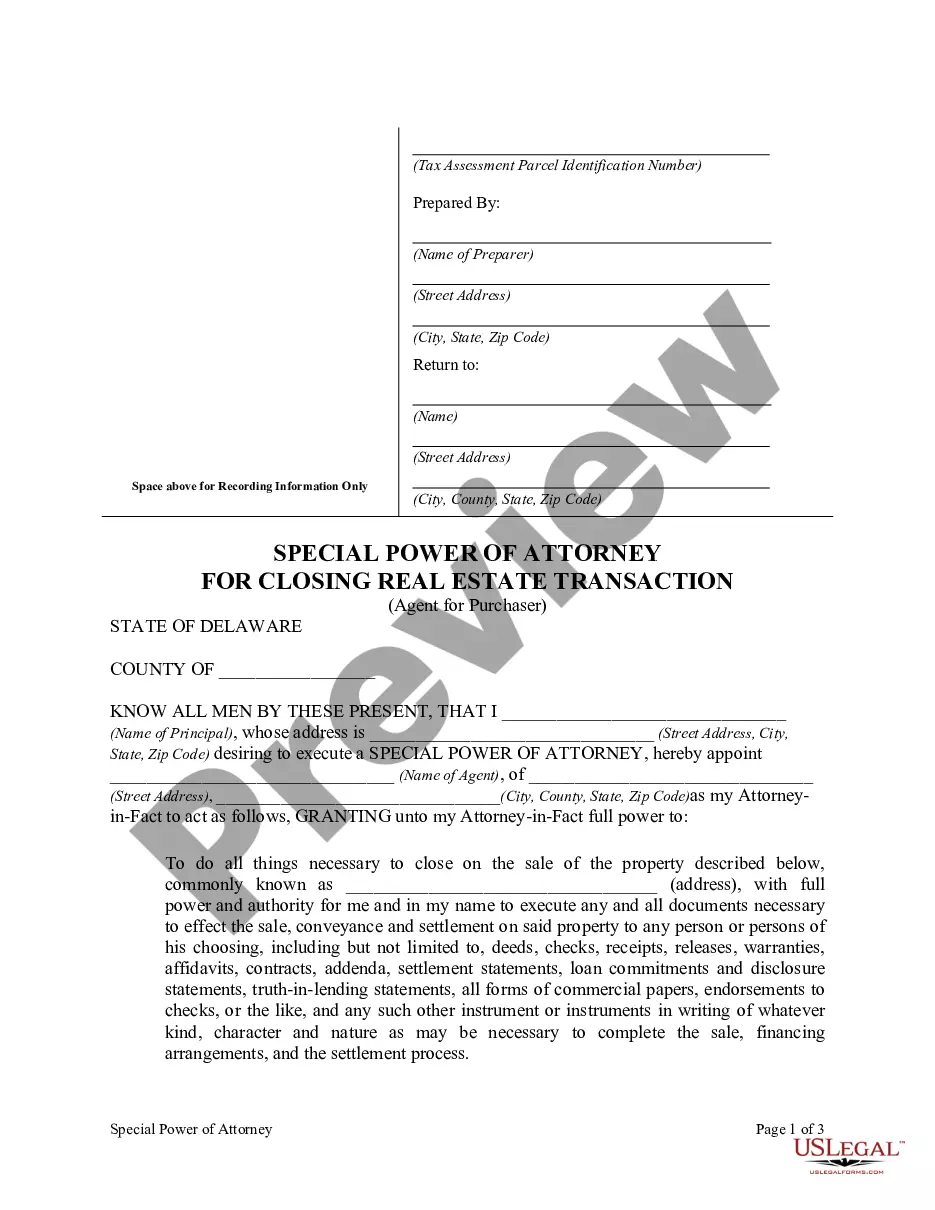

Nebraska Basic Agreement for Sale of Machinery or Equipment

Description

How to fill out Basic Agreement For Sale Of Machinery Or Equipment?

US Legal Forms - one of the largest collections of valid documents in the USA - provides a range of legal document templates you can obtain or create.

By utilizing the website, you can access thousands of documents for both business and personal use, categorized by type, state, or keywords. You can retrieve the latest versions of documents such as the Nebraska Basic Agreement for Sale of Machinery or Equipment within moments.

If you possess a monthly subscription, Log In and obtain the Nebraska Basic Agreement for Sale of Machinery or Equipment from the US Legal Forms repository. The Acquire button will be visible on each template you view.

Select the format and download the form onto your device.

Make modifications. Fill in, edit, print, and sign the saved Nebraska Basic Agreement for Sale of Machinery or Equipment. Every template you have saved in your account has no expiration date and is yours permanently. Thus, if you wish to download or create another copy, simply visit the My documents section and click on the form you need.

- If this is your first time using US Legal Forms, here are simple instructions to get started.

- Ensure you have selected the correct form for your location/region. Click on the Preview button to review the document's content.

- Check the form details to verify you have chosen the appropriate template.

- If the form does not meet your requirements, use the Search area located at the top of the screen to find one that does.

- Once satisfied with the form, confirm your selection by clicking the Purchase now button. Then, choose the payment plan you prefer and provide your information to register for an account.

- Process the transaction. Use your Visa or MasterCard or PayPal account to complete the payment.

Form popularity

FAQ

Yes, selling food in Nebraska usually requires a specific permit based on your business model. If you are selling packaged food, for instance, you may need a sales tax permit, while selling prepared foods may require additional health permits. Understanding these requirements is crucial for any food business when establishing agreements, including those pertaining to the Nebraska Basic Agreement for Sale of Machinery or Equipment.

Yes, if you plan to sell tangible goods and collect sales tax in Nebraska, you need a seller's permit. This permit will help you operate within legal requirements, fostering trust with your customers. The seller's permit is essential when creating a Nebraska Basic Agreement for Sale of Machinery or Equipment, as it allows you to properly document and report sales transactions.

A vendor's license and a seller's permit serve similar purposes in Nebraska, but they are not exactly the same. A vendor's license typically refers to the legal permission to sell goods at specific locations or events, while a seller's permit allows you to collect sales tax on taxable sales. For those dealing with transactions involving machinery or equipment, understanding these distinctions can be critical when drafting a Nebraska Basic Agreement for Sale of Machinery or Equipment.

In Nebraska, businesses must file sales tax returns either monthly, quarterly, or annually, depending on their tax liability. Businesses with higher sales typically file monthly, while those with lower sales may file quarterly or annually. Regular filing helps in maintaining up-to-date records and compliance with state tax laws. Incorporating this into your business practices is beneficial, especially when handling a Nebraska Basic Agreement for Sale of Machinery or Equipment.

The general sales tax rate on equipment in Nebraska is 5.5%. However, local jurisdictions may impose additional taxes, resulting in varying rates depending on the location. Ensuring accurate sales tax calculations is crucial when finalizing any Nebraska Basic Agreement for Sale of Machinery or Equipment. It helps you maintain compliance and avoid any unexpected costs.

In Nebraska, most cleaning services are generally taxable. However, there are exceptions, such as cleaning services for certain types of real property. If you’re a business providing cleaning services, it's essential to understand local tax obligations. Stay informed to optimize your agreements, especially when entering a Nebraska Basic Agreement for Sale of Machinery or Equipment related to cleaning equipment.

Form 20 in Nebraska is used for reporting the sales tax status of certain transactions, including those related to machinery and equipment. This form is important for individuals and businesses engaging in the Nebraska Basic Agreement for Sale of Machinery or Equipment. It ensures that all sales and use tax obligations are met transparently. Utilizing the US Legal Forms platform can simplify the process of filling out Form 20 correctly and efficiently.

Regulation 1 007 pertains to the sales and use tax laws in Nebraska. This regulation outlines the definitions and guidelines for sales tax on transactions involving machinery and equipment, which is directly relevant to the Nebraska Basic Agreement for Sale of Machinery or Equipment. Understanding this regulation is crucial for both buyers and sellers to ensure compliance. The US Legal Forms platform provides resources that can assist in navigating these regulations effectively.

Yes, equipment is taxable in Nebraska. The Nebraska Basic Agreement for Sale of Machinery or Equipment includes provisions that outline the tax implications when selling machinery and equipment. Buyers should understand how these taxes apply to their purchases to avoid any surprises. Consulting with a tax professional or utilizing the US Legal Forms platform can help clarify your obligations.