A Trust is an entity which owns assets for the benefit of a third person (the beneficiary). A Living Trust is an effective way to provide lifetime and after-death property management and estate planning. When you set up a Living Trust, you are the Grantor. Anyone you name within the Trust who will benefit from the assets in the Trust is a beneficiary. In addition to being the Grantor, you can also serve as your own Trustee. As the Trustee, you can transfer legal ownership of your property to the Trust. A revocable living trust does not constitute a gift, so there are no gift tax consequences in setting it up.

Nebraska Revocable Trust Agreement Regarding Coin Collection

Description

How to fill out Revocable Trust Agreement Regarding Coin Collection?

Are you in a situation where you require documents for potential business or personal reasons regularly.

There are numerous legal document templates accessible online, but locating the trustworthy ones can be challenging.

US Legal Forms offers thousands of form templates, including the Nebraska Revocable Trust Agreement Concerning Coin Collection, designed to comply with state and federal requirements.

Once you find the correct form, click Buy now.

Choose the pricing plan you want, provide the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Nebraska Revocable Trust Agreement Concerning Coin Collection template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct locality/state.

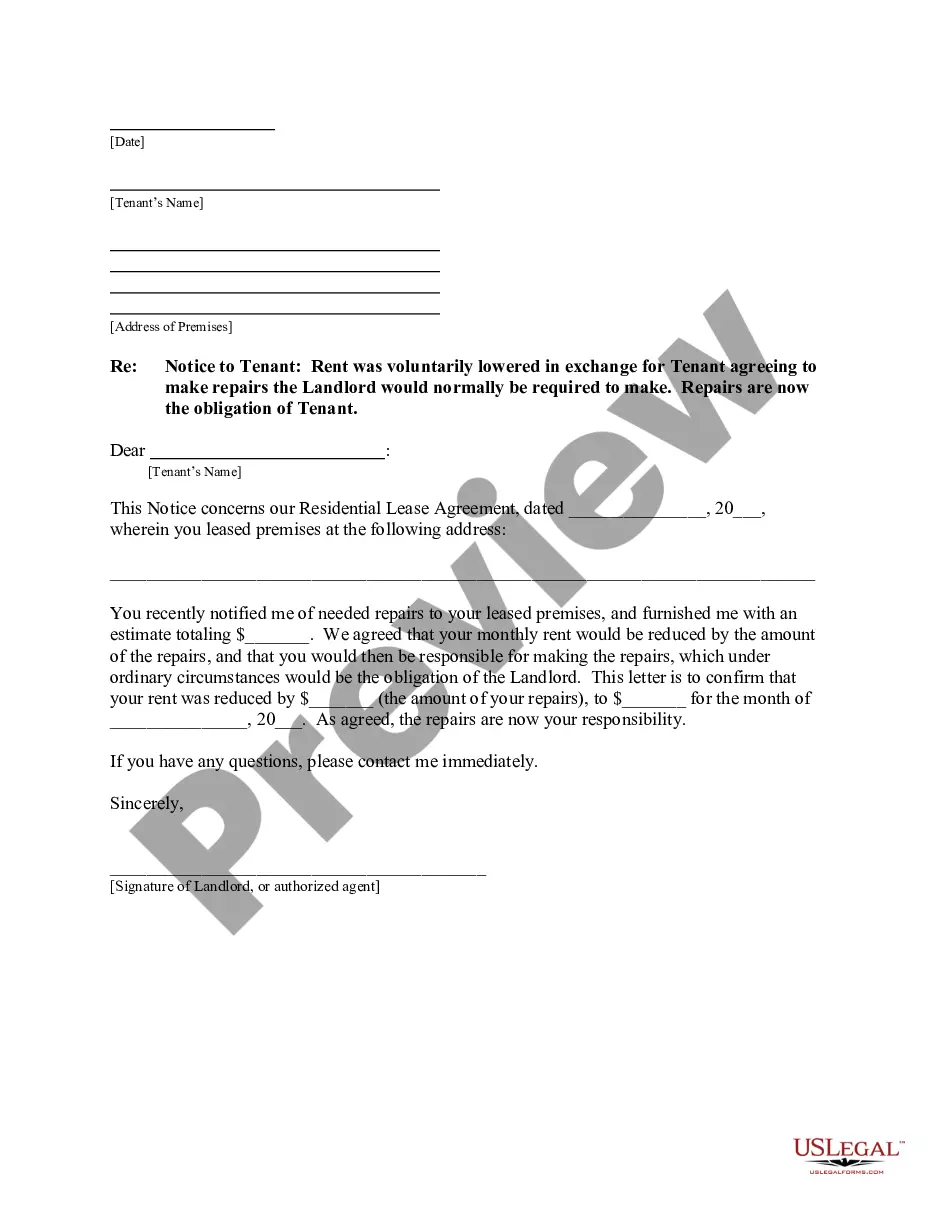

- Utilize the Preview button to review the form.

- Check the description to guarantee you have selected the right form.

- If the form is not what you're looking for, use the Search field to find the form that suits your needs and requirements.

Form popularity

FAQ

Yes, the IRS can seize assets from a trust, including those in a Nebraska Revocable Trust Agreement Regarding Coin Collection, to settle tax debts. Because the trust is revocable and under the creator's control, the IRS treats the assets as part of the creator's estate. It's essential to ensure that your tax filings are accurate and timely to prevent such actions. Seeking assistance from tax professionals can help manage potential risks.

Creditor claims can be made against a revocable trust, including one established via a Nebraska Revocable Trust Agreement Regarding Coin Collection. Since the trust creator maintains control over the trust assets, these assets remain available to creditors if debts arise. However, the trust can still provide a level of organization for your collection while you manage your obligations. Consulting with attorneys experienced in trusts can shed light on ways to structure assets effectively.

Yes, the IRS can seize assets in a revocable trust if taxes are owed. The Nebraska Revocable Trust Agreement Regarding Coin Collection allows the trust creator to maintain control over the assets, which means they remain part of the taxable estate. This means that if there are outstanding tax obligations, the IRS can look to these assets for settlement. It's important to stay current on tax responsibilities to avoid complications.

A Nebraska Revocable Trust Agreement Regarding Coin Collection does not offer full protection from creditors. While the assets within a revocable trust may not go through probate, they can still be claimed by creditors if the trust creator has outstanding debts. It's crucial to understand that because the trust is revocable, the assets are still considered part of the trust creator's estate. Consulting legal professionals can provide proper guidance on protecting assets.

One downside of placing assets in a trust, including the Nebraska Revocable Trust Agreement Regarding Coin Collection, is that it may limit access to those assets during your lifetime. While a trust can provide benefits after passing, it can lead to challenges in modifying or accessing assets if needed. It's essential to consider how this decision affects your financial flexibility and long-term goals.

A notable downside of having a trust, like the Nebraska Revocable Trust Agreement Regarding Coin Collection, is the administrative burden involved. Trusts require careful record-keeping and regular updates to reflect changes in laws or family situations. Additionally, there may be upfront costs associated with creation and ongoing management. Understanding these factors can help in making an informed decision.

One significant mistake parents make is failing to communicate their intentions clearly to their heirs when setting up a trust fund. With the Nebraska Revocable Trust Agreement Regarding Coin Collection, transparency about the purpose and conditions of the trust can help avoid misunderstandings. Equally important is not updating the trust after major life events, such as births, deaths, or changes in financial status, which can lead to complications.

It often makes sense for your parents to consider a trust, particularly the Nebraska Revocable Trust Agreement Regarding Coin Collection. This type of trust allows them to maintain control over their assets while streamlining the transfer process upon their passing. However, they should evaluate their specific needs and consult with a legal advisor to ensure it aligns with their overall estate planning strategy.

One primary disadvantage of a family trust, such as the Nebraska Revocable Trust Agreement Regarding Coin Collection, is the potential for family conflicts. Trusts can sometimes lead to disputes over asset distribution if expectations are not clearly communicated. Additionally, establishing and maintaining a trust requires time and possibly costs in legal fees. Always weigh these factors before proceeding.

Yes, creditors can pursue assets inside a revocable trust, as these assets are still considered part of the grantor's estate. The Nebraska Revocable Trust Agreement Regarding Coin Collection does not shield your collection from creditors. This means that if you face a legal judgment, the assets may be accessible to satisfy those claims. It's crucial to understand the implications when setting up any trust.