Nebraska Assignment of Property in Attached Schedule

Description

How to fill out Assignment Of Property In Attached Schedule?

Are you currently in a scenario where you require documents for business or specific needs almost every day.

There are numerous legal document formats available online, but obtaining ones you can trust isn’t easy.

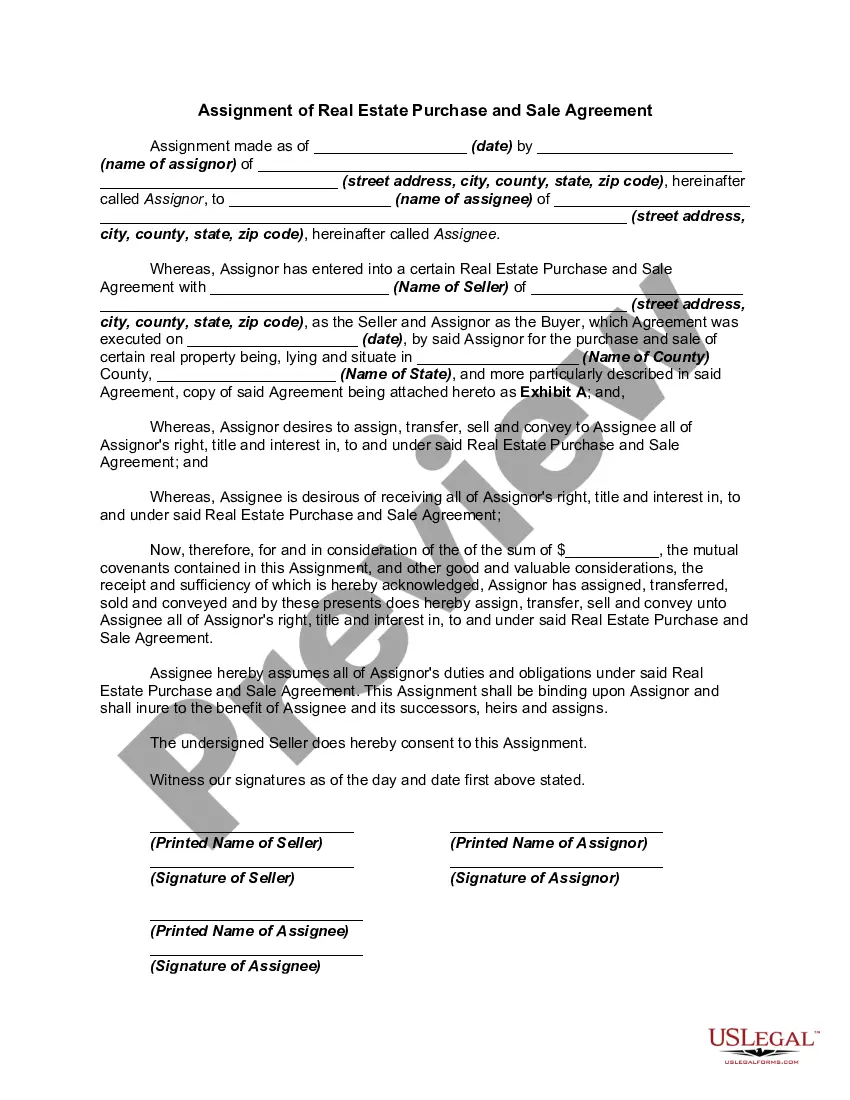

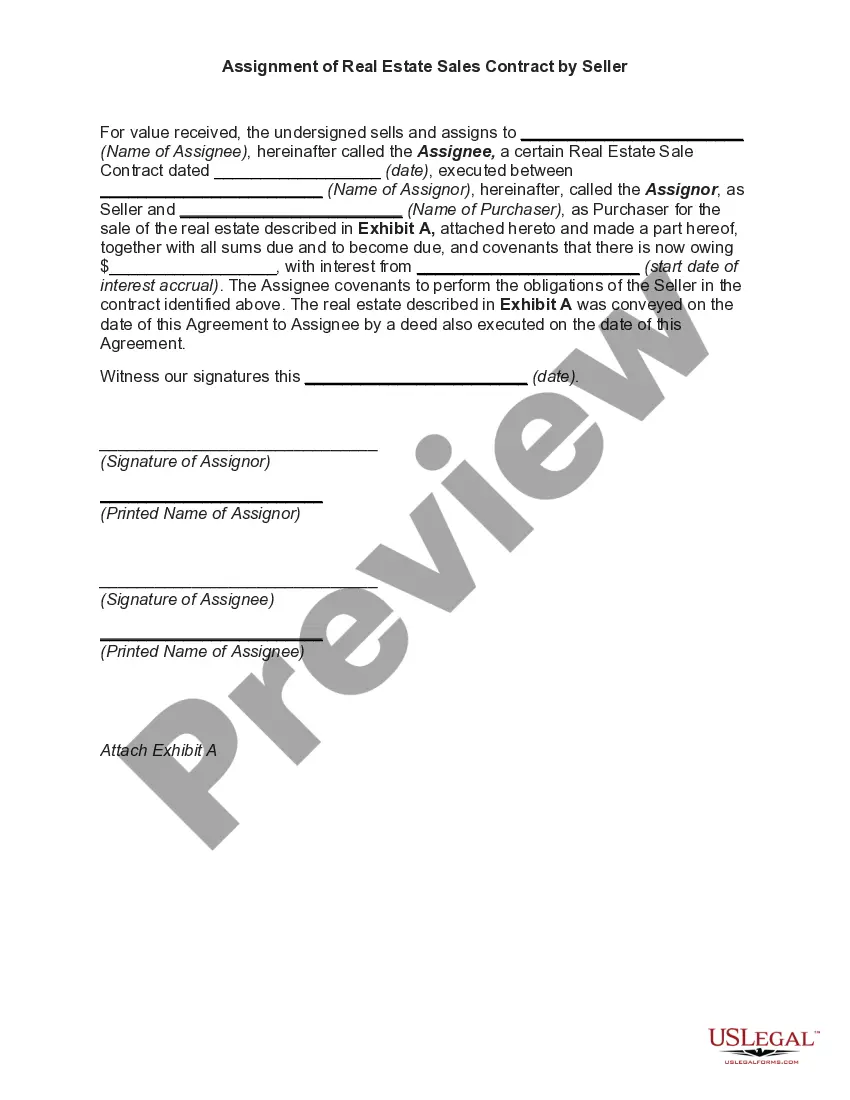

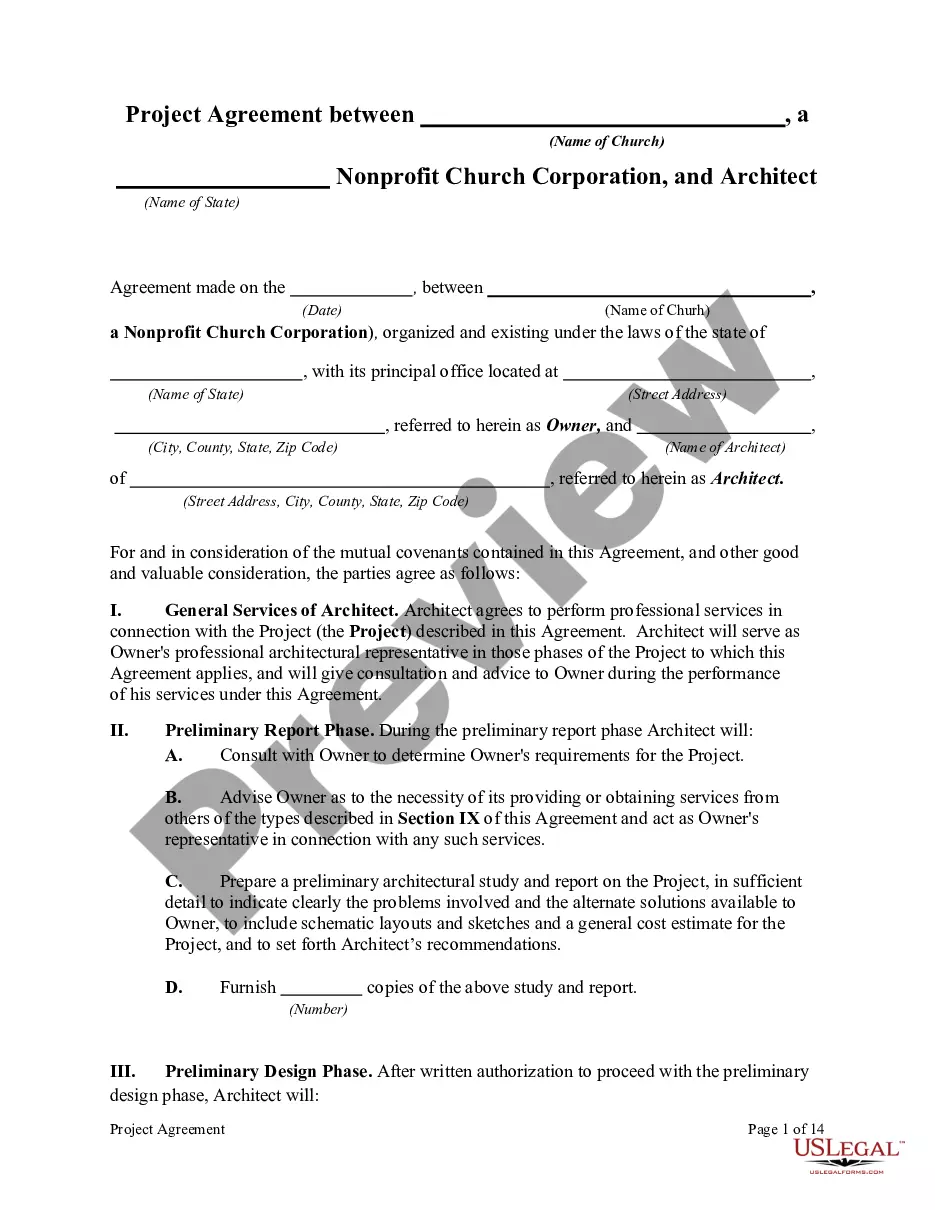

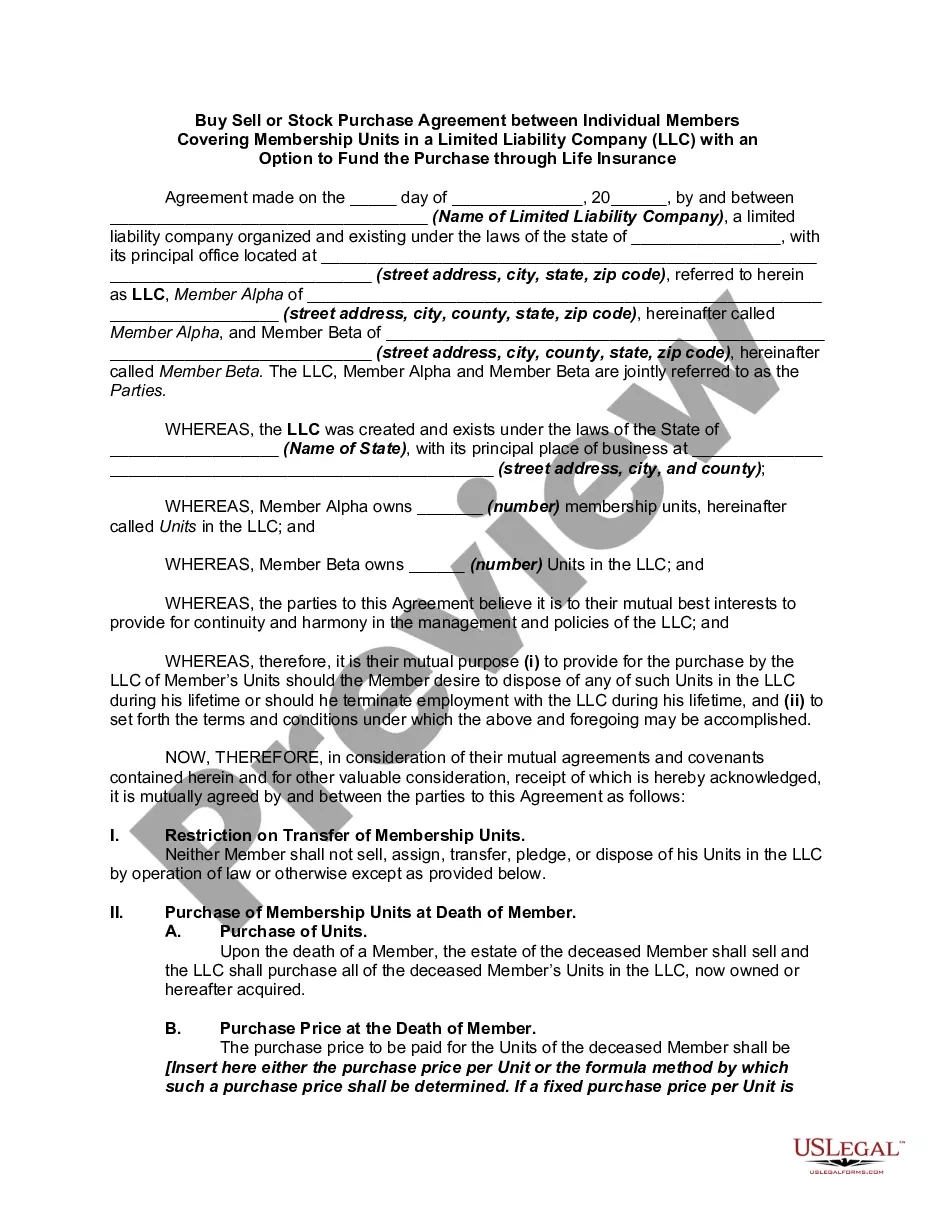

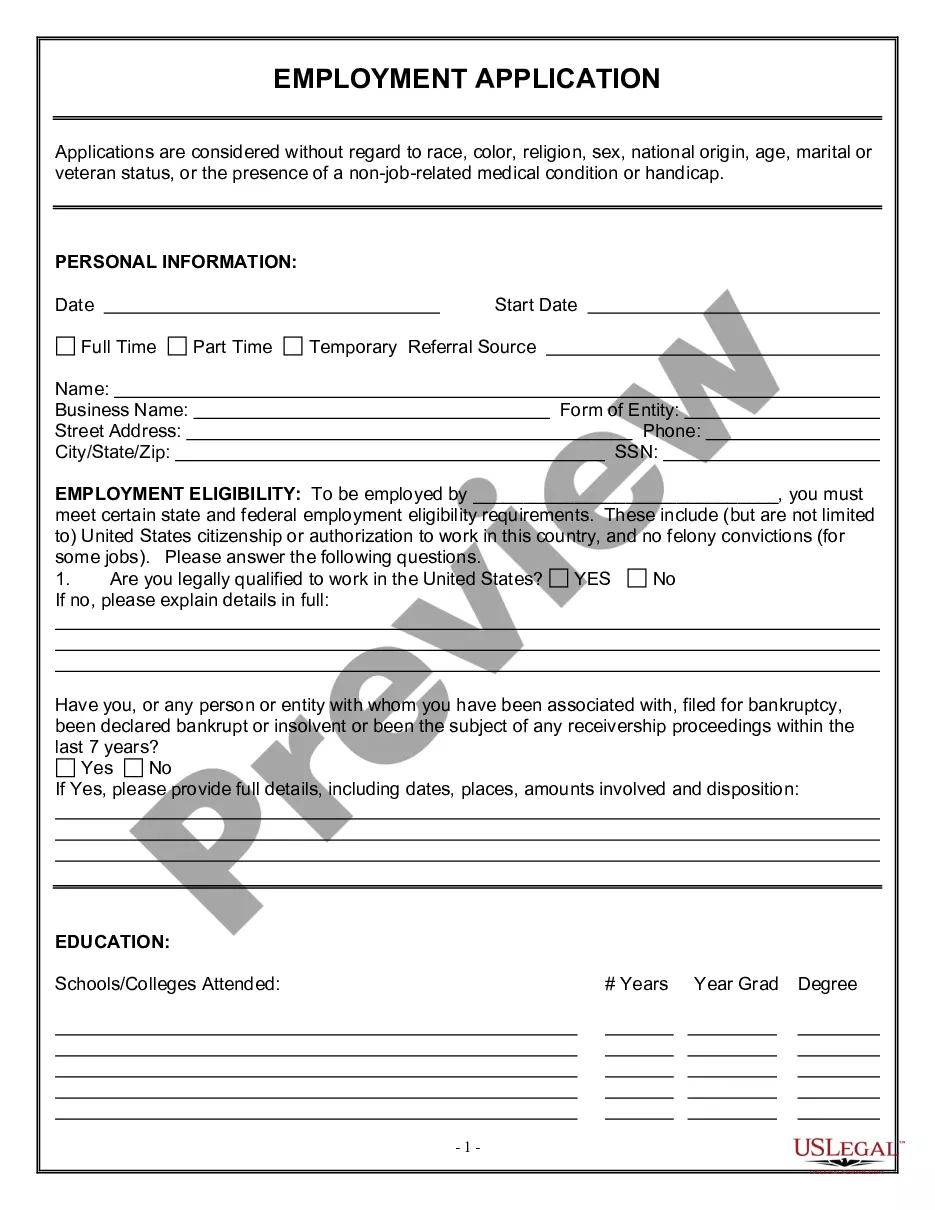

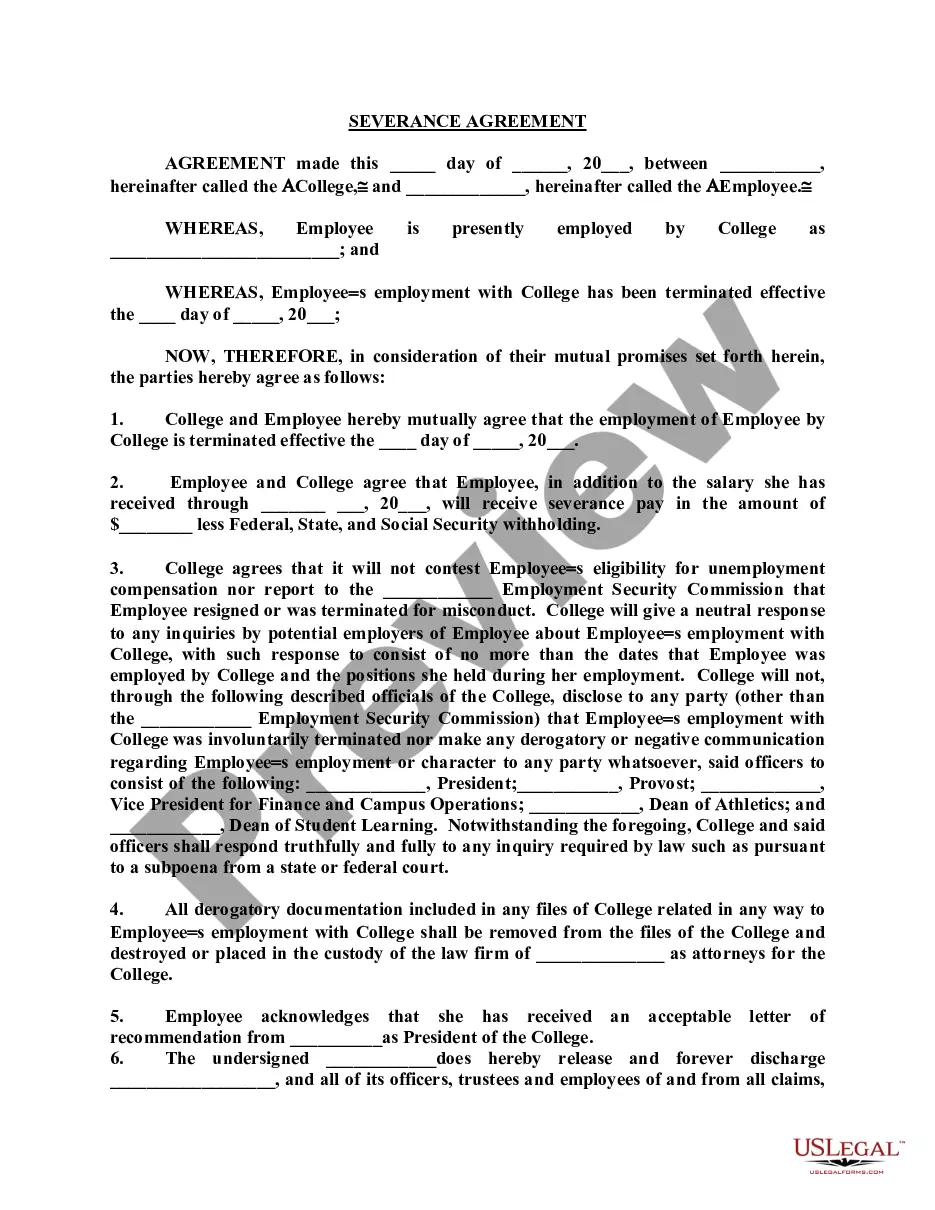

US Legal Forms provides a vast array of form templates, such as the Nebraska Assignment of Property in Attached Schedule, which are designed to comply with state and federal regulations.

Once you find the correct form, click Get now.

Select the pricing plan you prefer, fill in the necessary information to create your account, and make your purchase with your PayPal or credit card. Choose a convenient file format and download your copy. Access all the document formats you have purchased in the My documents section. You can retrieve an additional copy of the Nebraska Assignment of Property in Attached Schedule anytime by clicking the needed form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Nebraska Assignment of Property in Attached Schedule template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Acquire the form you need and ensure it is for the correct state/region.

- Utilize the Preview button to review the form.

- Check the description to ensure you have selected the right form.

- If the form isn’t what you need, use the Lookup field to find the form that fits your requirements.

Form popularity

FAQ

To transfer property in Nebraska, you typically prepare and file a deed with the county register of deeds. The process may involve completing a Nebraska Assignment of Property in Attached Schedule to ensure that the transfer is documented correctly. For detailed guidance on this process, consider consulting resources or services that specialize in Nebraska property transactions.

The Property Tax Request Act in Nebraska governs how local governments can request property tax funding. It establishes procedures for public meetings and transparency regarding proposed tax increases. Understanding this act is crucial, especially when dealing with the Nebraska Assignment of Property in Attached Schedule, as it affects how your property taxes are assessed and communicated.

Property taxes are reported on various forms, but for personal federal tax purposes, they are typically included on Schedule A of Form 1040 if you itemize your deductions. Local forms depend on your county's regulations. When dealing with the Nebraska Assignment of Property in Attached Schedule, ensure that all relevant documentation is properly submitted for accurate reporting.

To file your property taxes in Nebraska, you generally need to complete your local property tax forms, which may vary by county. It's essential to check with your local tax authority to determine the exact forms required. The Nebraska Assignment of Property in Attached Schedule may provide additional guidance to ensure you submit the correct documentation.

To claim a property tax deduction, you typically use Schedule A of Form 1040. This schedule allows you to detail your itemized deductions, which can include local and state property taxes. Utilizing the Nebraska Assignment of Property in Attached Schedule can help optimize your deductions by documenting your property tax contributions precisely.

Personal use of a property refers to the utilization of an asset for personal enjoyment rather than for business or income-generating purposes. This might involve living in a home, using a car for leisure activities, or maintaining personal possessions. Differentiating personal use property in the Nebraska Assignment of Property in Attached Schedule helps maintain clarity in asset documentation.

Personal property in Nebraska encompasses movable assets that individuals or businesses own, distinct from real property. It can include anything from household goods to business inventory. A comprehensive understanding of personal property is crucial when you are preparing the Nebraska Assignment of Property in Attached Schedule.

Personal use property includes items that individuals use for their own enjoyment, like personal vehicles, furniture, or recreational equipment. These assets are typically not used for business purposes. Accurately listing personal use property in the Nebraska Assignment of Property in Attached Schedule can help clarify asset ownership.

To apply for a Nebraska property tax credit, you must complete the necessary forms provided by your local government. Generally, you need to supply financial and property information to demonstrate your eligibility. Using USLegalForms can simplify this process, ensuring you include the required details regarding the Nebraska Assignment of Property in Attached Schedule.

The four types of personal property include tangible personal property, intangible personal property, real property, and personal use property. Tangible property is physical items, while intangible property includes rights and securities. Each type plays a vital role in the Nebraska Assignment of Property in Attached Schedule, helping you categorize and manage your assets effectively.