A Nebraska Promissory Note in connection with a sale and purchase of a mobile home refers to a legally binding document that outlines the terms and conditions of a loan agreement between the buyer and seller of a mobile home. This document serves as evidence of a loan being granted and the buyer's promise to repay the borrowed amount, typically with interest, over a specified period. The Nebraska Promissory Note is an essential component of the sale and purchase process and ensures that all parties involved are aware of their obligations and rights. It provides a clear framework for the loan agreement, facilitating transparency and minimizing potential disputes. Some key elements typically included in a Nebraska Promissory Note for a sale and purchase of a mobile home may include: 1. Identifying Information: The document includes details of both the buyer and seller involved in the transaction, such as their legal names, contact information, and physical addresses. 2. Loan Amount: The promissory note specifies the total amount of money borrowed by the buyer and being paid by the seller for the purchase of the mobile home. 3. Interest Rate: The document mentions the agreed-upon interest rate that will be applied to the loan amount, determining the additional cost the buyer must pay as interest over the loan term. 4. Repayment Terms: The Nebraska Promissory Note outlines the repayment terms, including the frequency of payments (monthly, quarterly, annual), the due date for each payment, and the total number of payments required to fully repay the loan. 5. Late Fees and Penalties: It is common for the promissory note to include clauses related to late payments, specifying any penalties or fees that the buyer may be liable for if they fail to make payments on time. 6. Security Agreement: In some cases, the promissory note may include a security agreement, where the mobile home itself becomes collateral for the loan. This means that if the buyer defaults on payments, the seller has the right to seize and sell the mobile home to recover the unpaid amount. It is important to note that while the general structure of a Nebraska Promissory Note remains consistent, there can be variations based on individual circumstances. Some examples of different types of Nebraska Promissory Notes in connection with a sale and purchase of a mobile home include: 1. Fixed-Rate Promissory Note: This type of note has a set interest rate that remains unchanged throughout the loan term, providing stability and predictability for the buyer. 2. Adjustable-Rate Promissory Note: In contrast to a fixed-rate note, an adjustable-rate promissory note includes an interest rate that can change periodically based on an index, such as the current market rates. This type of note offers the potential to benefit from lower interest rates but also carries the risk of increasing payments if rates rise. 3. Balloon Promissory Note: A balloon promissory note includes lower monthly payments for a specific period, followed by a lump-sum payment due at the end of the loan term. This type of note may be suitable for buyers who expect increased income in the future or plan to refinance before the balloon payment becomes due. In conclusion, a Nebraska Promissory Note in connection with a sale and purchase of a mobile home outlines the terms and conditions of a loan agreement and facilitates a smooth and legally secure transaction.

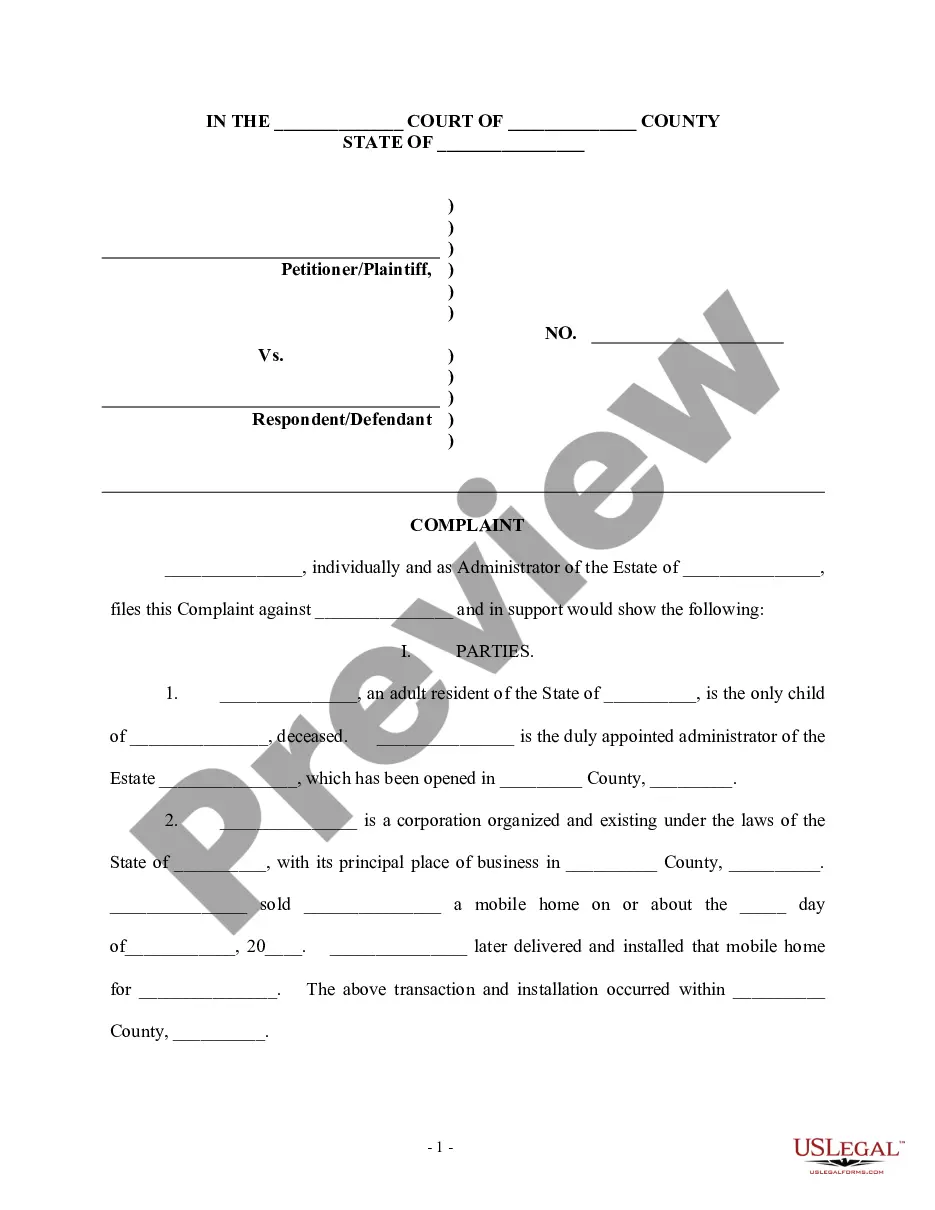

Nebraska Promissory Note in Connection with a Sale and Purchase of a Mobile Home

Description

How to fill out Nebraska Promissory Note In Connection With A Sale And Purchase Of A Mobile Home?

You may spend several hours on the web trying to find the authorized record format that fits the federal and state needs you will need. US Legal Forms supplies 1000s of authorized forms which can be analyzed by specialists. It is simple to down load or print the Nebraska Promissory Note in Connection with a Sale and Purchase of a Mobile Home from my support.

If you currently have a US Legal Forms profile, you can log in and then click the Obtain button. Following that, you can comprehensive, revise, print, or indicator the Nebraska Promissory Note in Connection with a Sale and Purchase of a Mobile Home. Every single authorized record format you buy is the one you have for a long time. To acquire one more copy associated with a purchased kind, proceed to the My Forms tab and then click the related button.

If you are using the US Legal Forms internet site the first time, follow the easy instructions under:

- Very first, make sure that you have chosen the right record format for the state/city that you pick. Look at the kind outline to make sure you have picked out the right kind. If accessible, make use of the Review button to check throughout the record format also.

- If you would like locate one more version of your kind, make use of the Lookup field to obtain the format that fits your needs and needs.

- Once you have identified the format you want, click on Acquire now to carry on.

- Select the costs strategy you want, enter your references, and sign up for your account on US Legal Forms.

- Complete the purchase. You can use your credit card or PayPal profile to cover the authorized kind.

- Select the file format of your record and down load it to the gadget.

- Make changes to the record if possible. You may comprehensive, revise and indicator and print Nebraska Promissory Note in Connection with a Sale and Purchase of a Mobile Home.

Obtain and print 1000s of record web templates while using US Legal Forms website, which provides the biggest assortment of authorized forms. Use skilled and state-certain web templates to deal with your organization or person needs.