Nebraska Sample Letter for Fraudulent Charges against Client's Account

Description

How to fill out Sample Letter For Fraudulent Charges Against Client's Account?

Discovering the right legitimate file template might be a have difficulties. Naturally, there are a lot of templates available online, but how would you obtain the legitimate form you will need? Use the US Legal Forms site. The services delivers a large number of templates, for example the Nebraska Sample Letter for Fraudulent Charges against Client's Account, that you can use for business and private requires. Every one of the kinds are inspected by specialists and fulfill federal and state specifications.

When you are currently signed up, log in to the accounts and then click the Down load switch to have the Nebraska Sample Letter for Fraudulent Charges against Client's Account. Make use of accounts to look from the legitimate kinds you possess acquired in the past. Proceed to the My Forms tab of your accounts and have one more copy of your file you will need.

When you are a brand new end user of US Legal Forms, here are easy recommendations so that you can adhere to:

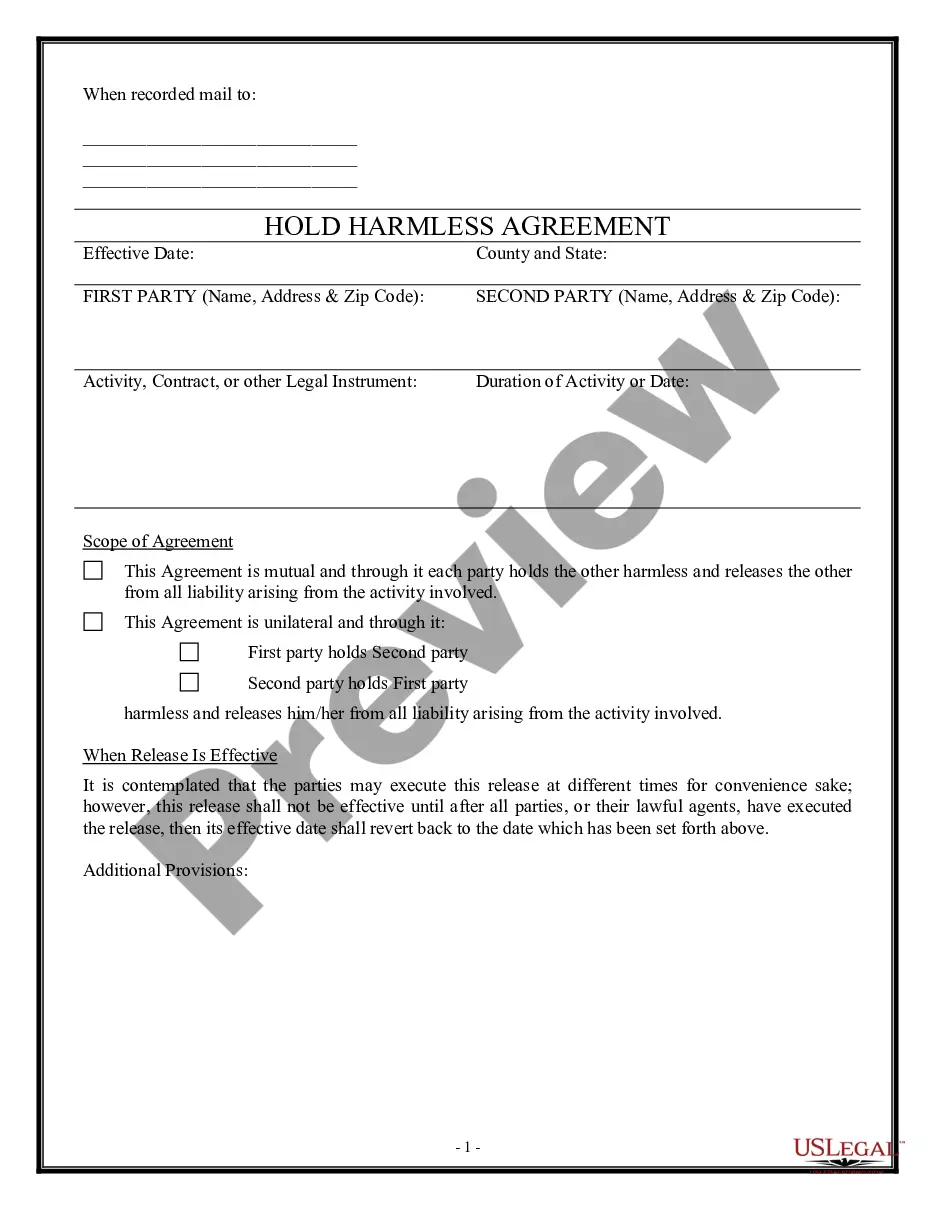

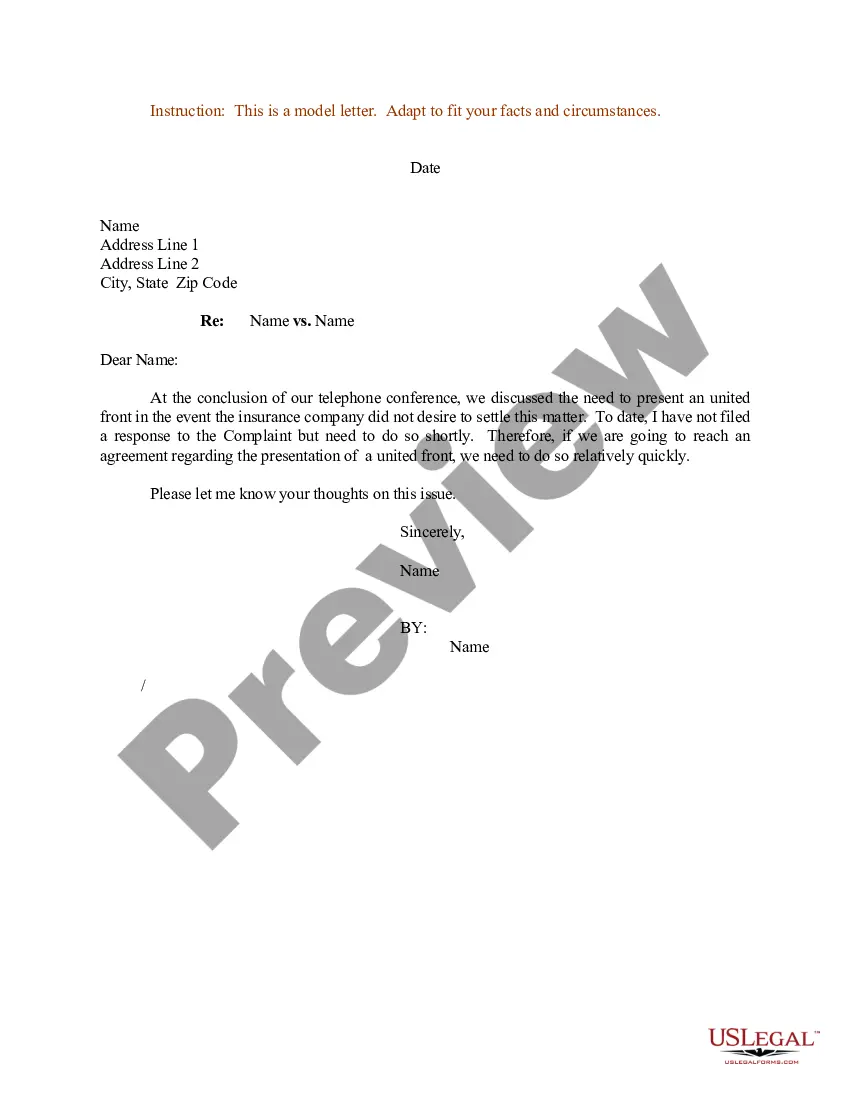

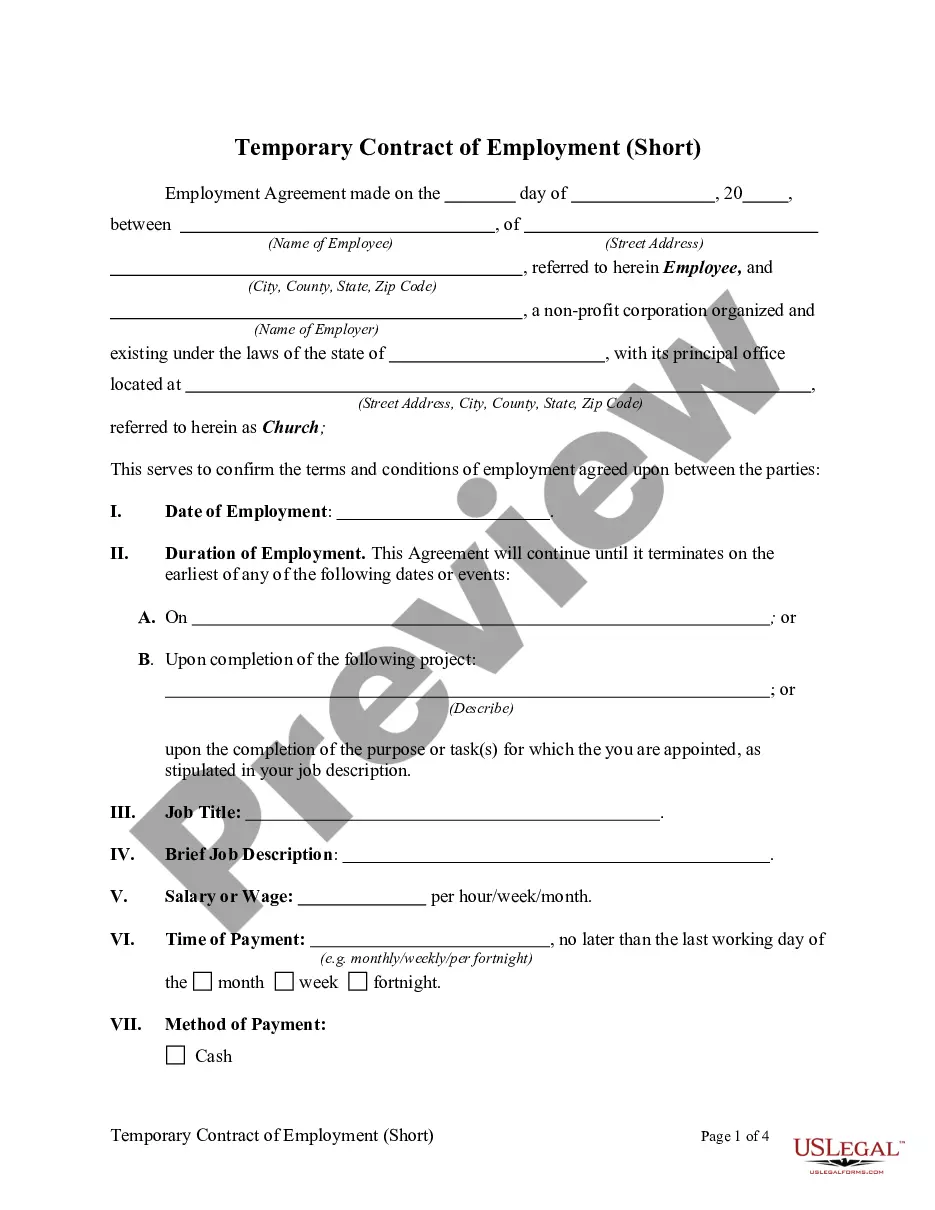

- First, make sure you have selected the correct form to your area/state. It is possible to check out the form while using Preview switch and look at the form information to guarantee it is the right one for you.

- If the form will not fulfill your preferences, make use of the Seach discipline to discover the right form.

- Once you are positive that the form is suitable, click on the Buy now switch to have the form.

- Choose the rates program you would like and enter in the needed details. Design your accounts and purchase your order with your PayPal accounts or bank card.

- Opt for the document file format and acquire the legitimate file template to the gadget.

- Total, change and produce and signal the attained Nebraska Sample Letter for Fraudulent Charges against Client's Account.

US Legal Forms is definitely the biggest collection of legitimate kinds that you can see various file templates. Use the company to acquire professionally-manufactured documents that adhere to status specifications.

Form popularity

FAQ

What should I do if there are unauthorized charges on my credit card account? Contact your bank right away. To limit your liability, it is important to notify the bank promptly upon discovering any unauthorized charge(s). You may notify the bank in person, by telephone, or in writing.

Receiving a dispute denial The issuer may deny the entire disputed amount or a part of it; either way, it should inform you in writing about the denial and how much you owe. You will also be notified about when you need to make your payment, including any interest that accumulated on the amount while it was in dispute.

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

Steps to Disputing a Credit Card Charge Review the Charge. ... Contact the Merchant. ... Contact the Credit Card Company. ... Gather Evidence and Send Dispute Paperwork. ... Continue Making Minimum Payments. ... Wait for a Resolution (And Appeal if Necessary)

Filing a false credit card dispute should never be done; it is credit card fraud and can have consequences like fines, court fees, jail time, blacklisting, and hurt your credit scores.

Gather your evidence When disputing a credit card charge, you'll want to have your receipts, photos and any communication you've made with the merchant to resolve the issue at hand.

What happens if you falsely dispute a credit card charge? Purposely making a false dispute is punishable by law and could lead to fines or imprisonment. You could face legal action by a credit card issuer or the merchant.

In addition to losing the funds from a sale, a business may have to pay its payment processor a chargeback fee to cover administrative costs of resolving the dispute. These fees range from about $15 to $50 per transaction, but they may reach up to $100 or more, depending on the payment processor.