Nebraska Agreement to Compromise Debt by Returning Secured Property is a legal agreement that allows parties involved in a debt dispute to reach a settlement by returning the secured property in question. This agreement is often used in cases where a debtor has defaulted on a loan and the lender possesses collateral, such as real estate, vehicles, or other valuable assets. Keywords: Nebraska Agreement to Compromise Debt, returning secured property, debt settlement, secured collateral, defaulted loan, legal agreement, debtor, lender, compromise, settlement. Different Types of Nebraska Agreement to Compromise Debt by Returning Secured Property: 1. Residential Property Compromise Agreement: This type of agreement specifically deals with situations where a debtor has defaulted on a residential mortgage loan, and the lender agrees to compromise the debt by accepting the return of the property as full satisfaction of the outstanding amount. 2. Vehicle Collateral Compromise Agreement: This agreement is used when a borrower has fallen behind on loan payments for a vehicle, such as a car, motorcycle, or RV, and the lender agrees to accept the return of the vehicle as a resolution to the outstanding debt. 3. Commercial Property Compromise Agreement: In cases where a business borrower has defaulted on a loan secured by commercial real estate, this type of agreement allows the lender to accept the return of the property as a settlement for the outstanding debt. 4. Equipment Collateral Compromise Agreement: This agreement applies to situations where a debtor has defaulted on a loan secured by equipment or machinery. The lender may agree to compromise the debt by accepting the return of the equipment as resolution for the outstanding amount. 5. Personal Property Compromise Agreement: This type of agreement covers various personal assets, such as jewelry, artwork, or other valuable possessions, that were initially used as collateral for a loan. If the borrower defaults, the lender may choose to enter into a compromise agreement, accepting the return of the personal property as a resolution to the outstanding debt. Nebraska Agreement to Compromise Debt by Returning Secured Property provides a mutually beneficial solution for both debtors and lenders, allowing them to avoid lengthy legal battles and find an alternative resolution to the debt dispute.

Nebraska Agreement to Compromise Debt by Returning Secured Property

Description

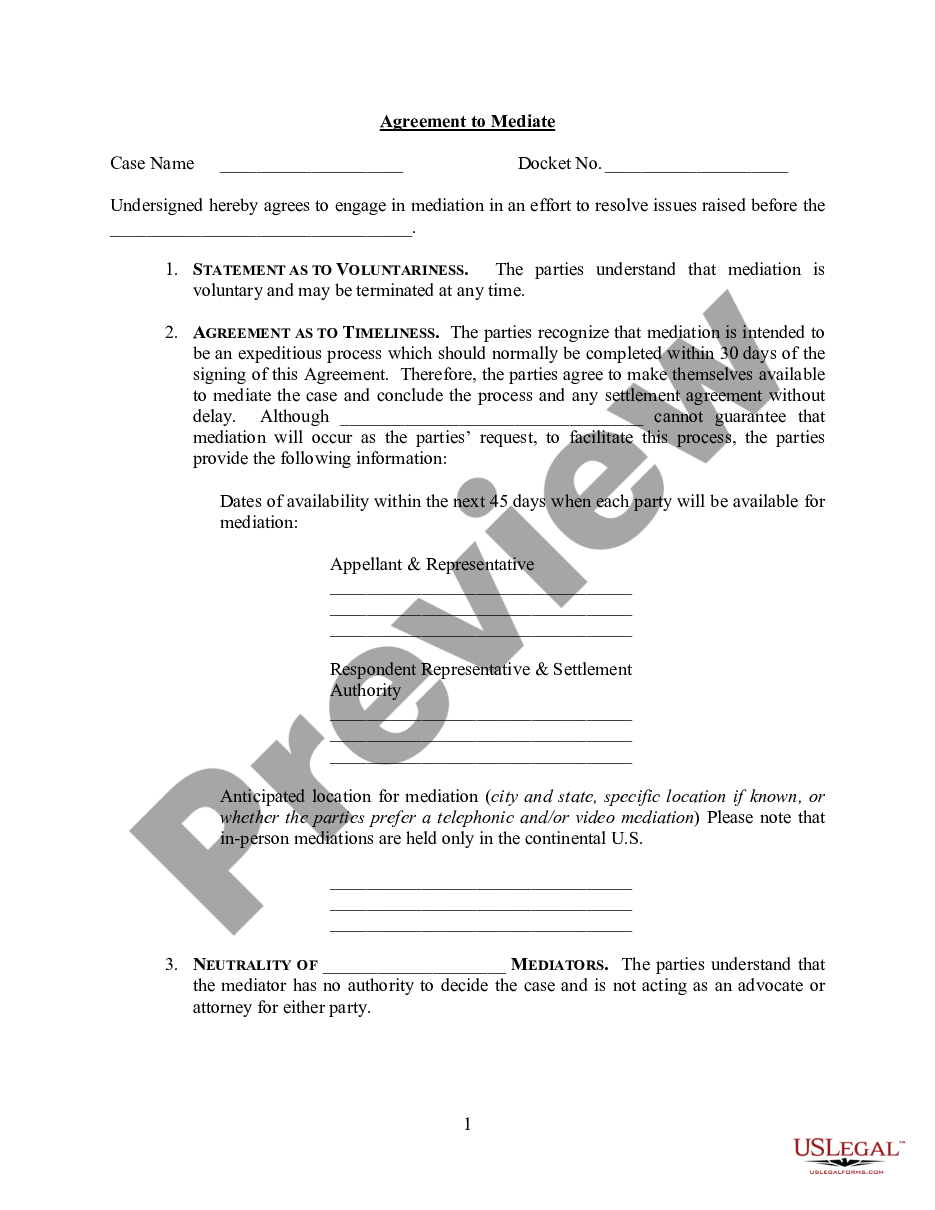

How to fill out Nebraska Agreement To Compromise Debt By Returning Secured Property?

US Legal Forms - one of the biggest libraries of lawful kinds in the United States - provides an array of lawful document layouts you may acquire or printing. While using site, you will get a large number of kinds for enterprise and individual purposes, categorized by categories, suggests, or key phrases.You will discover the most up-to-date variations of kinds such as the Nebraska Agreement to Compromise Debt by Returning Secured Property within minutes.

If you have a monthly subscription, log in and acquire Nebraska Agreement to Compromise Debt by Returning Secured Property from your US Legal Forms catalogue. The Down load key can look on each and every develop you look at. You have access to all in the past acquired kinds inside the My Forms tab of the account.

In order to use US Legal Forms the very first time, listed below are straightforward instructions to help you started:

- Make sure you have selected the right develop for your personal area/region. Click on the Preview key to analyze the form`s content material. See the develop outline to actually have selected the correct develop.

- If the develop doesn`t fit your needs, use the Research industry towards the top of the display to discover the the one that does.

- Should you be happy with the form, affirm your choice by simply clicking the Acquire now key. Then, pick the costs strategy you like and give your credentials to sign up to have an account.

- Approach the deal. Use your bank card or PayPal account to finish the deal.

- Select the format and acquire the form on your product.

- Make modifications. Fill out, revise and printing and sign the acquired Nebraska Agreement to Compromise Debt by Returning Secured Property.

Every format you put into your bank account does not have an expiration date and is also your own property permanently. So, if you want to acquire or printing another backup, just go to the My Forms section and click on on the develop you require.

Obtain access to the Nebraska Agreement to Compromise Debt by Returning Secured Property with US Legal Forms, one of the most considerable catalogue of lawful document layouts. Use a large number of specialist and state-particular layouts that fulfill your small business or individual requirements and needs.